Setting Up Deductions

To set up deductions, use the Deduction Table (DEDUCTION_TABLE) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DEDUCTION_TABLE1 |

Specify the deduction priority, subset ID, and other parameters for arrears payments and garnishments. |

|

|

GVT_DEDUCT1_SEC |

(USF) Further define the deduction and the interface in which it will be included. |

|

|

DEDUCTION_TABLE2 |

Specify a deduction classification for deduction codes. You can also define how the deduction code affects special accumulators. (CAN) Specify sales taxes applicable to deduction codes. |

|

|

DEDUCTION_TABLE3 |

Specify U.S. and Canadian tax considerations for the deduction that you are defining. |

|

|

Other Taxable Gross Components |

DEDUCTION_TGCID |

Enter each taxable gross component ID to use for the deduction class. |

|

DEDUCTION_TABLE4 |

Establish parameters for partial deductions and arrears. |

|

|

DEDUCTION_TABLE5 |

Specify which pay periods the deduction should be taken for the pay frequencies that you want to override. |

|

|

Deduction/Frequency Report Page |

PRCSRUNCNTL |

Generate the PAY704 report, which lists information from the Deduction/Deduction Frequency table, which contains deduction priority, tax effect, and frequency of both benefit and nonbenefit deductions. |

|

Deduction Class Report Page |

PRCSRUNCNTL |

Generate the PAY705 report, which lists deduction classification codes from the Deduction table. |

The Deduction Table component defines the tax effect on deduction types and specifies how the system processes arrears and other special deduction considerations during payroll processing. Deductions consist of all payroll deductions and employer contributions to benefit plans—not including taxes. We refer to deductions for taxes simply as taxes.

Deductions on the Deduction Table component are grouped by plan type. The plan type that you select is critical in the deduction process, because it indicates to the system from which component — General Deduction Table or Benefit Program Table—to retrieve the deduction calculation rules. The plan type code for general deductions is always 00. If you want to create your own plan types, use Z0 through ZZ.

When you assign new codes, you must assign a code in the correct range and identical to the one defined in the General Deduction Table component or Benefit Program Table component, otherwise the deduction is not calculated.

Note: Each entry on the General Deduction Table component or the Benefit Program Table component must have a corresponding entry on the Deduction Table component for payroll to process the deduction. Otherwise, you receive an error during pay calculation.

Deduction classifications have a significant effect on how the system calculates tax amounts during payroll processing. Some deductions may have more than one classification. For example, retirement plan deductions, such as 401(k) benefit deductions, can have both before- and after-tax classifications as well as a nontaxable classification for any employer contributions. And certain benefits, such as life insurance, may have a before- or after-tax classification for the employee contribution in addition to a nontaxable or taxable classification for the employer contribution.

For example, suppose your company has a life insurance plan that provides coverage in an amount equal to three times your base salary of 40,000 USD a year. You pay for the after-tax deduction portion of the plan, while your company pays for the nontaxable benefit portion. And because of Internal Revenue Service rules governing employer-paid insurance for coverage over 50,000 USD, there is also a taxable benefit classification for the plan.

Note: Remember that each entry on the General Deduction Table component or the Benefit Program Table component must have a corresponding entry on the Deduction Table component for payroll to process the deduction. Otherwise, you receive an error during payroll calculation.

(USA) U.S. Deduction Classifications

Even though a deduction may have more than one classification, it is still considered only one deduction. For example, a 401(k) plan might consist of a standard before-tax portion, an after-tax portion for those employees who want to contribute more to the plan, and a nontaxable portion relating to the employer's matching contribution.

To define a deduction with multiple classifications, select the Add button in the Tax Classifications scroll area of the Tax Class page to insert another class. Remember that the order in which deductions are calculated is determined by the priority within classification.

If, after taking a before-tax deduction and calculating taxes, the system is unable to take an after-tax deduction with a higher priority number than the before-tax deduction, it returns to the beginning. It then recalculates taxes without taking the before-tax deduction and uses the remaining amount to take the after-tax deduction.

As long as an employee has enough remaining pay for the system to take all deductions, deduction priority, while still part of the calculation, is not particularly important. Priority becomes important when the employee doesn't have enough pay to satisfy all deductions. When this occurs, the system starts with the deductions that have the highest priority (those with the lowest deduction priority numbers) and takes the deductions until it reaches the minimum net pay requirements defined in the Pay Group table. Define deduction priority order on the Deduction Table - Setup page.

(CAN) The Logic Behind Canadian Sales Tax Calculations

When a particular deduction is identified as subject to a sales tax, the sales tax is calculated according to the rates that are specified for each province on the Canadian Tax Table - Tax Rates, Credit and Other page for goods and services tax (GST) and Canadian Tax Table - Provincial Rates page for other sales taxes. For this reason, any deductions that do not have the same sales tax application for all provinces must be set up as separate deduction codes. For example, the same deduction might be represented by two deduction codes:

One subject to provincial sales taxes.

One not subject to provincial sales taxes.

For GST and harmonized sales tax (HST) sales tax processing, the system determines which tax type to apply based on the employee's tax location, providing that the deduction has been set up with both the GST and HST sales tax types specified.

When the system calculates provincial sales tax on insurance (PSTI), it uses the employee's province of residence on the Name/Address page of the Personal Data table for employee-paid portions of a deduction. However, the system uses the employee's tax location on the Payroll page of the Job Data table when calculating PSTI for the employer-paid portions. All other sales tax types use the employee's tax location when calculating the applicable tax.

Canadian deduction classifications are discussed in further detail in the description of the Deduction Table - Tax Effect page.

Note: Depending upon what agreements you have with benefit carriers, a provincial premium tax (PPT) rate may or may not be required at your site.

Payroll for North America sets the taxable gross used for calculation of state and local income tax withholding to the taxable gross for federal withholding. Similarly, the system assumes the taxable gross for state unemployment and disability to be the same as the taxable gross for federal unemployment. However, some states and localities do not follow federal rules for the taxability of all types of benefits. Payroll for North America provides taxable gross definitions as a means of overriding the taxability rules that you specify in the Deduction table.

PeopleSoft maintains state and local taxable grosses that have been adjusted for 401(k), section 125, Thrift Savings Plan (TSP), group-term life plans (GTL), health savings account (HSA), health savings account employer contribution (HSR), and tips. You can add your own entries to the Taxable Gross Definition table for other types of deductions that must be adjusted.

The following are examples of benefit deduction setups and the expected resulting calculations for Ontario and Quebec. To set up these benefit deductions and enter information (such as deduction classification, which sales tax types the deduction is subject to, and effect on taxable grosses), use the Deduction Table - Tax Class and Deduction Table - Tax Effect pages.

Example 1: Ontario—Insurance Other Than Life Insurance (Plan Type 10 and 30)

Define on the Deduction table:

|

Deduction Classification |

Sales Tax Type |

EE or ER |

Effect on Taxable Grosses |

Notes |

|---|---|---|---|---|

|

After-Tax |

None |

EE pays |

None |

|

|

Nontaxable Benefit |

None |

ER pays |

None |

|

Example: Total Premium = 100 CAD per month:

Employer pays 60 CAD

Employee pays 40 CAD

Deduction Class

Sales Tax Type

Amount

Calculation

After-Tax

None

40 CAD

Nontaxable Benefit

None

60 CAD

|

Class |

Premium |

|---|---|

|

EE pays |

40 CAD |

|

ER pays |

60 CAD |

Example 2: Ontario—Life Insurance (Plan Type 20)

PPT = 2% Ontario Provincial Premium Tax

PSTI = 8% Ontario Provincial Sales Tax

PSTI = 9% Quebec Provincial Sales Tax

Province of residence = QC (Quebec)

Province of Employment (Tax Location) = ON

Define on the Deduction table:

|

Deduction Class |

Sales Tax Type |

EE or ER |

Effect on Taxable Grosses |

Notes |

|---|---|---|---|---|

|

After-Tax |

None |

EE pays |

None |

Subject to PPT, PSTI |

|

Taxable Benefit |

None |

ER pays |

Adds to EE taxable grosses |

Subject to PPT, PSTI |

|

After-Tax |

PPT |

EE pays |

None |

|

|

After-Tax |

PSTI |

EE pays |

None |

Calculated on the total of prem + PPT |

|

Taxable Benefit |

PPT |

ER pays |

Adds to EE taxable grosses |

|

|

Taxable Benefit |

PSTI |

ER pays |

Adds to EE taxable grosses |

Calculated on the total of prem + PPT |

Example: coverage priced at 1 CAD per 1000 CAD:

Employer pays 0.60 CAD per 1000 CAD

Employee pays 0.40 CAD per 1000 CAD

For 100,000 CAD coverage: Total Premium = 100 CAD:

Employer pays 60 CAD

Employee pays 40 CAD

Deduction Class

Sales Tax Type

Amount

Calculation

After-Tax

None

40 CAD

100,000 × 0.40 / 1,000

Taxable Benefit

None

60 CAD

100,000 × 0.60 / 1,000

After-Tax

PPT

0.80 CAD

40 CAD × 2 %

After-Tax

PSTI

3.67 CAD

40.80 CAD × 9 %

Taxable Benefit

PPT

1.20 CAD

60 CAD × 2 %

Taxable Benefit

PSTI

4.90 CAD

61.20 CAD × 8 %

Action

Premium

Plus

PPT

PSTI

Equals

Total

EE pays

40 CAD

+

0.80 CAD

+

3.67 CAD

=

44.47 CAD

Adds to EE taxable gross

60 CAD

+

1.20 CAD

+

4.90 CAD

=

66.10 CAD

ER pays

60 CAD

+

1.20 CAD

+

4.90 CAD

=

66.10 CAD

Example 3: Quebec—Health Insurance (Plan Type 10)

PPT = 2.35% Quebec Provincial Premium Tax

PST = 7.5% Quebec Provincial Sales Tax

Define on the Deduction table:

|

Deduction Class |

Sales Tax Type |

EE or ER |

Effect on Taxable Grosses |

Notes |

|---|---|---|---|---|

|

After-Tax |

None |

EE pays |

None |

Subject to PPT, PST |

|

QC Taxable Benefit |

|

ER pays |

Adds to EE QC taxable grosses |

Subject to PPT, PST |

|

After-Tax |

PPT |

EE pays |

None |

|

|

After-Tax |

PST |

EE pays |

None |

|

|

QC Taxable Benefit |

PPT |

ER pays |

Adds to EE QC taxable grosses |

|

|

QC Taxable Benefit |

PST |

ER pays |

Adds to EE QC taxable grosses |

|

Example: Total Premium = 100 CAD per month:

Employer pays 60 CAD

Employee pays 40 CAD

Deduction Class

Sales Tax Type

Amount

Calculation

After-Tax Benefit

None

40 CAD

QC Taxable Benefit

None

60 CAD

After-Tax

PPT

0.94 CAD

40 CAD × 2.35 %

After-Tax

PST

3 CAD

40 CAD × 7.5 %

QC Taxable Benefit

PPT

1.41 CAD

60 CAD × 2.35 %

QC Taxable Benefit

PST

4.50 CAD

60 CAD × 7.5 %

Deduction Class

Premium

PPT

PST

Total

EE pays

40 CAD

0.94 CAD

+

3 CAD

=

43.94 CAD

Adds to EE Fed taxable gross

+

+

=

0 CAD

Adds to EE Quebec taxable gross

60 CAD

+

1.41 CAD

+

4.50 CAD

=

65.91 CAD

ER pays

60 CAD

+

1.41 CAD

+

4.50 CAD

=

65.91 CAD

Example 4: Quebec—Life Insurance (Plan Type 20)

PPT = 2.35 % Quebec Provincial Premium Tax

PSTI = 9 % Quebec Provincial Sales Tax on Insurance

Province of residence = QC

Province of employment (Tax Location) = QC

Define on the Deduction table:

|

Deduction Class |

Sales Tax Type |

EE or ER |

Effect on Taxable Grosses |

Notes |

|---|---|---|---|---|

|

After-Tax |

None |

EE pays |

None |

Subject to PPT, PSTI |

|

Taxable Benefit |

None |

ER pays |

Adds to EE Fed taxable grosses |

Subject to PPT, PSTI |

|

After-Tax |

PPT |

EE pays |

None |

|

|

After-Tax |

PSTI |

EE pays |

None |

Calculated on the total of prem + PPT |

|

Taxable Benefit |

PPT |

ER pays |

Adds to EE Fed taxable grosses |

|

|

Taxable Benefit |

PSTI |

ER pays |

Adds to EE Fed taxable grosses |

Calculated on the total of prem + PPT |

Example: Coverage priced at 1 CAD per 1000 CAD:

Employer pays 0.60 CAD per 1000 CAD

Employee pays 0.40 CAD per 1000 CAD

For 100,000 CAD coverage: Total Premium = 100 CAD:

Employer pays 60 CAD

Employee pays 40 CAD

Deduction Class

Sales Tax Type

Amount

Calculation

After-Tax

None

40 CAD

100,000 × 0.40 / 1,000

Taxable Benefit

60 CAD

100,000 × 0.60 / 1,000

After-Tax

PPT

0.94 CAD

40 CAD × 2.35 %

After-Tax

PSTI

3.68 CAD

40.94 CAD × 9 %

Taxable Benefit

PPT

1.41 CAD

60 CAD × 2.35 %

Taxable Benefit

PSTI

5.53 CAD

61.41 CAD × 9 %

Deduction Class

Premium

PPT

PSTI

Total

EE pays

40 CAD

+

0.94 CAD

+

3.68 CAD

=

44.62 CAD

Adds to EE Fed taxable gross

60 CAD

+

1.41 CAD

+

5.53 CAD

=

66.94 CAD

Adds to EE Quebec taxable gross

+

+

=

0 CAD

ER pays

60 CAD

+

1.41 CAD

+

5.53 CAD

=

66.94 CAD

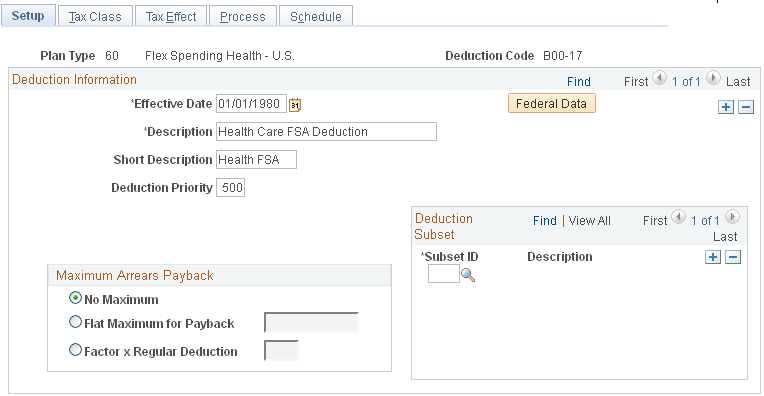

Use the Deduction Table - Setup page (DEDUCTION_TABLE1) to specify the deduction priority, subset ID, and other parameters for arrears payments and garnishments.

Navigation

Image: Deduction Table - Setup page

This example illustrates the fields and controls on the Deduction Table - Setup page.

Deduction Information

|

Field or Control |

Definition |

|---|---|

| Federal Data |

(USF) Select this button to access the Federal Distribution Destinations page where you can further define the deduction and the interface in which it should be included. |

| Short Description |

Enter a short description of the deduction. The short description that you enter here appears on the paycheck stubs by the check printing processes. |

| Deduction Priority |

Enter a deduction priority number for the deduction code. The order in which the system takes deductions during pay calculation is based on the deduction priority number and the deduction classification. You define deduction classifications on the Deduction Table - Tax Class page. The lower the deduction priority number, the higher the priority of that deduction. For example, a deduction with a priority number of 20 is taken before a deduction with a priority number of 40. PeopleSoft recommends that you give each deduction a unique deduction priority number, particularly with before-tax deductions. A possible exception is instances where you may want to establish a set of related deductions with equal deduction priorities. For example, if your company offers a flexible benefits program that requires each employee to choose only one of several health plans, you may want to assign the same deduction priority to all the available health plans. Deductions can be included in special accumulators. If you assign a deduction to a special accumulator and that special accumulator is then used to calculate another deduction, the deduction priority of the first deduction must be less than the deduction priority of the deduction using the special accumulator. |

| Special Processing |

Select a value from this field if the deduction is for a special process: Bond: Select if the deduction is for purchasing Canada Payroll Savings plans. Garnishment: Select if the deduction is for garnishments. This option initiates garnishment processing during payroll calculation. Union Dues: Select if the deduction is for union dues. When you select this option, the system automatically displays the Union Code field. Note: When no special process is applicable, this field should be empty. |

| Union Code |

This field appears only when you select Union Dues in the Special Processing field. Select the union code that is associated with the union for which this deduction applies. Union codes are maintained in the CAN/USA - Union table. |

Maximum Arrears Payback

Use this group box to specify how the system processes the payback of arrears balances. Note that any arrears processing method that you define here can be overridden either at the employee level on the Paysheet One-Time Deductions page, or on the General Ded Code Override (general deduction code override) page for general deductions.

|

Field or Control |

Definition |

|---|---|

| No Maximum |

Select this option if you do not want a maximum amount specified for arrears payback. If you select this field, the system deducts as much money as possible from the employee's paycheck to pay back the arrears balance. |

| Flat Maximum for Payback |

Select this option if you want the maximum arrears payback to be a flat rate. For example, if an employee has an arrears balance of 500 CAD and a flat maximum amount for payback specified at 100 CAD, only 100 CAD is deducted on each paycheck for the arrears balance until the total 500 CAD has been withheld. Note that this amount is in addition to any regular deductions. |

| Factor x Regular Deduction |

Select this option if you want to have a percentage of a regular deduction withheld for the payback of the arrears balance. This is in addition to the withholding of the regular deduction. For example, an employee has a medical deduction of 100 CAD with an arrears balance of 500 CAD. You may want to have the system deduct the normal 100 CAD medical deduction and specify that 50 percent of that amount to apply to the arrears balance. This makes a total deduction of 150 CAD. To do this, you select this field, and enter .5 as the factor. |

Note: For benefit deductions, the maximum arrears payback method that you select applies to all employees with this deduction who are in arrears. To change the arrears processing method for an individual employee, you'll use Benefit Arrears/Frequency Ovrd (benefit arrears/frequency override) page.

Deduction Subset

If you want to include the deduction in any of the deduction subsets that you've defined on the Deduction Subset Table page, select an applicable deduction subset ID. You can include a deduction in any number of deduction subsets.

|

Field or Control |

Definition |

|---|---|

| Subset ID |

Select an applicable deduction subset ID. |

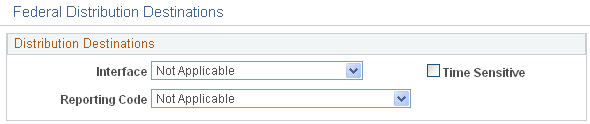

(USF) Use the Federal Distribution Destinations page (GVT_DEDUCT1_SEC) to further define the deduction and the interface in which it will be included.

Navigation

Select the Federal Data button on the Deduction Table - Setup page.

Image: Federal Distribution Destinations page

This example illustrates the fields and controls on the Federal Distribution Destinations page.

|

Field or Control |

Definition |

|---|---|

| Interface |

Select the interface in which the deduction will be included: Not Applicable, OPM/RITS Interface, Thrift Savings Board Interface, or U.S. Department of Treasury. To define a deduction as a military deposit deduction select OPM/RITS Interface. |

| Reporting Code |

Select the reporting code to define the type of deduction. To define a deduction as a military deposit deduction select Military Deposit Deduction. |

| Time Sensitive |

Select if you want the deduction to be eligible for distribution through electronic certification system off-cycle processing. |

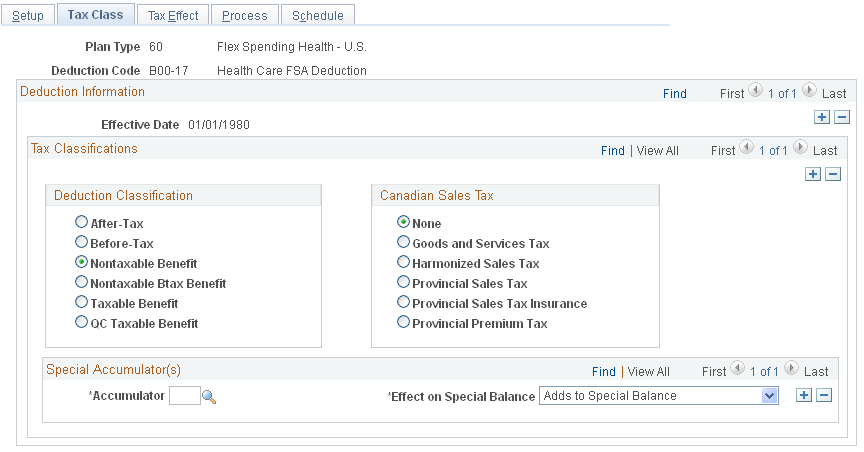

Use the Deduction Table - Tax Class page (DEDUCTION_TABLE2) to specify a deduction classification for deduction codes.

You can also define how the deduction code affects special accumulators.(CAN) Specify sales taxes applicable to deduction codes.

Navigation

Image: Deduction Table - Tax Class page

This example illustrates the fields and controls on the Deduction Table - Tax Class page.

Tax Classifications

Use this group box to assign a deduction classification—and if applicable—Canadian sales taxes to each deduction code. The order in which the system takes deductions during pay calculation is based on the deduction classification and the deduction priority number. Define the deduction priority on the Deduction Table - Setup page. After a deduction code is assigned a classification, (before-tax, after-tax, taxable benefit, and so on) the system uses that classification to decide which deduction takes precedence over the other when a specific deduction has multiple classifications—a 401(k) with both a before-tax and after-tax classification for example.

Deduction Classification

Use this group box to select an appropriate classification for the deduction.

|

Field or Control |

Definition |

|---|---|

| After Tax |

Select to reduce net pay. An example is a monthly parking deduction. |

| Before-Tax |

Select to reduce net pay and taxable gross. One example is an employee contribution to a retirement program, such as a 401(k) plan. |

| Nontaxable Benefit |

Select to represent an employer contribution with no taxable implications (not subject to tax) to an employee benefit plan such as a health plan or retirement plan (U.S. only). This contribution has no direct payroll effect. |

| Nontaxable Btax Benefit (nontaxable before-tax benefit) |

Select to represent an employer contribution for a before-tax deduction (not subject to federal tax) to an employee benefit plan. Currently only used for the before-tax matching contribution to savings plans. Note: (CAN) Before-tax deductions affect federal and provincial taxes. |

| Taxable Benefit |

Select to represent an employer contribution (subject to federal tax, U.S. only) on behalf of an employee, such as life insurance. This contribution increases taxable gross (for tax purposes), but does not increase total gross (for pay purposes). An example of a taxable benefit is the imputed income on employer paid group-term life insurance in excess of fifty thousand dollars. |

| (CAN) QC Taxable Benefit (Quebec taxable benefit) |

Select to represent employer paid items that specifically affect Quebec income tax, such as contributions to employee dental and extended health plan benefits. The contribution increases Quebec provincial gross (for tax purposes), but does not increase total gross (for pay purposes). Unlike the taxable benefit deduction classification (which automatically increases Canadian income taxes [CIT] taxable gross) QC taxable benefit deductions must be defined to add to Quebec income taxes (QIT) taxable gross on the Deduction Table - Tax Effect page. |

Note: Each deduction must have one or more deduction classifications to determine its effect on gross pay and taxable gross.

(CAN) Canadian Sales Tax

Use this group box to specify a sales tax type for each deduction classification that you define. The system then applies the appropriate sales tax percentage against the deduction classification amount calculated and adjusts the taxable gross amounts accordingly.

Note: PeopleSoft maintains the rates for GST, HST, PST, and PSTI on the Canadian Tax tables. The PPT rates are defined and maintained by you on the Canadian Company Tax table.

Note: If a deduction is subject to sales tax, you must insert rows to associate each sales tax type that is required for each applicable deduction classification.

|

Field or Control |

Definition |

|---|---|

| None |

Because you must assign each deduction classification a sales tax type, this is the system default value. |

| Goods and Service Tax |

Select if the deduction code is subject to GST. |

| Harmonized Sales Tax |

Select if the deduction code is subject to HST. |

| Provincial Sales Tax |

Select if the deduction code is subject to PST. |

| Provincial Sales Tax Insurance |

Select if the deduction code is subject to PSTI. |

| Provincial Premium Tax |

Select if the deduction code is subject to PPT. |

Note: To include sales taxes when calculating the value of employee benefits (taxable benefits), you must set up Deduction table entries for those benefit plans.

Special Accumulator(s)

If you want to roll together specific deduction codes to be used later during payroll processing, you enter a special accumulator code here. This code enables you to designate which deductions should add to or subtract from what can best be described as a bucket of earnings. This enables you to specify deductions that will affect the values in the special accumulators during payroll processing.

Deductions are calculated in priority order. If the deduction code has been specified as having an effect on a special accumulator, then the deduction amount is added to or subtracted from the accumulator. If a subsequent deduction is based on that accumulator, then the amount in the accumulator will be a combination of the earnings and the deductions specified.

|

Field or Control |

Definition |

|---|---|

| Accumulator |

Select a special accumulator code. Before you enter the code on this page, you must set up the special accumulator code on the Special Accumulator table. |

| Effect on Special Balance |

Select a value that specifies whether the deduction code adds to or subtracts from the special accumulator balance. |

Note: If you are calculating a deduction that is based on a special accumulator, and that accumulator includes some deductions, then all of the deductions affecting that special accumulator must have a higher priority than the deduction using the accumulator.

Note: (CAN) For Canadian payrolls, all before-tax deductions and taxable benefits are calculated before after-tax deductions and nontaxable benefits. Therefore, you cannot base a before-tax deduction on a special accumulator that is affected by an after-tax deduction and have the after-tax amount used in the before-tax calculation, regardless of the deduction priorities.

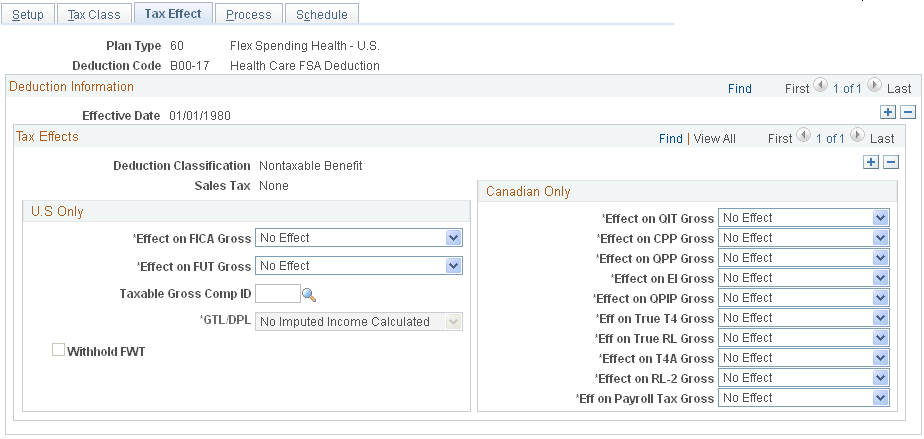

Use the Deduction Table - Tax Effect page (DEDUCTION_TABLE3) to specify U.S. and Canadian tax considerations for the deduction that you are defining.

Navigation

Image: Deduction Table - Tax Effect page

This example illustrates the fields and controls on the Deduction Table - Tax Effect page.

Tax Effects

|

Field or Control |

Definition |

|---|---|

| Deduction Classification |

The deduction classification specified on the Deduction Table - Tax Class page appears here. |

| (CAN) Sales Tax |

The Canadian sales tax that is specified on the Deduction Table - Tax Class page appears here. |

(USA) U.S. Only

Use this group box to indicate whether the deduction adds to, subtracts from, or has no effect on Federal Insurance Contributions Act (FICA) gross and federal unemployment tax (FUT) gross. These fields should be used only on the taxable benefit or before-tax portion of the deduction.

|

Field or Control |

Definition |

|---|---|

| Effect on FICA Gross (effect on Federal Insurance Contributions Act gross) |

Select how the deduction should affect the taxable gross for FICA: Adds To, No Effect, and Subtracts. |

| Effect on FUT Gross (effect on federal unemployment tax gross) |

Select how the deduction should affect the taxable gross for FUT: Adds To, No Effect, and Subtracts. |

| Taxable Gross Comp ID (taxable gross component ID) |

Enter the code for the system to use to define a taxable gross base different from federal when calculating state and local taxes. This code points to information in the Taxable Gross Definition table, which serves two purposes: 1) Indicates which federal taxable gross level (such as federal withholding tax [FWT], FICA, and FUT) is used as a base for state and local taxable gross. 2) Indicates how to adjust (add to or subtract from) the state and local base when it differs from the federal definition. This field is unavailable for entry unless you selected the Taxable Benefit option on the Deduction Table - Tax Class page. Important! The taxable gross component ID that you specify must be unique. If it is not unique, it can cause the taxable grosses to be incorrect. Note: You cannot enter a taxable gross component ID on the Deduction table if you have not yet defined it on the Taxable Gross Definition table. For more information about the Taxable Gross Definition table, see (USA) Updating the Taxable Gross Definition Table in your PeopleSoft Payroll for North America product documentation. Delivered Taxable Gross Comp ID values include: 125: Section 125 cafeteria plan. 401K: 401(k) savings plan. 401R: Employer 401(k) savings plan match. ACT: Adult child taxability (see note below). DPB: Domestic partner benefits GTL: Group-term life. HSA: Health savings account. HSR: Health savings account employer contribution. SSS or SSP: Same-sex spouse (see note below). TIP: Reported tips for an employee. Note: For more information about the ACT Taxable Gross Component ID, see Understanding the Adult Child Benefit Taxability in your PeopleSoft Benefits Administration product documentation. Note: The Taxable Gross Component IDs SSS and SSP can both be used to identify the portion of an employee deduction or employer-paid contribution amount that represents the cost of benefits provided to an employee’s same-sex spouse that are excluded from U.S. federal taxable wages, but which must be included in the definition of taxable wages for state and local tax jurisdictions that do not recognize same-sex marriage. If you are using the PeopleSoft Benefits same-spouse benefit rate functionality, use SSP. If you are not using the Benefits functionally, use SSS. For more information on the Benefits same-spouse benefits rate functionality, see Understanding Benefit Rate Enhancements for U.S. Same-Sex Spouse in your PeopleSoft Human Resources Manage Base Benefits product documentation. For example, Pennsylvania does not consider 401(k) contributions as a reduction in state taxable wages. So the 401(k) deduction would be considered taxable for state withholding tax, but not federal withholding tax. To set this up, you first create a taxable gross component ID, such as 401K, on the Taxable Gross Definition table for Pennsylvania. You then enter 401K in the Taxable Gross Comp ID field on this page when defining the 401(k) deduction. |

| Other Taxable Gross Components |

Click this link to access the Other Taxable Gross Components page where you can enter each taxable gross component ID to use for the deduction class. If you enter IDs on the secondary grid, the parent field can remain blank, or you can enter a value there and enter additional values on the secondary grid. |

| GTL/DPL (group-term life/dependent life) |

Select: Add to GTL (add to group-term life): Select this value if you set up a regular or supplemental employee life plan that qualifies as a group-term plan. Add to DPL (add to dependent life): Select this value if you set up a dependent life plan that qualifies as a group-term plan. No Effect: This value is for other types of plans that do not qualify as group-term life plans. This field is unavailable for entry unless you selected the Taxable Benefit option on the Deduction Table - Tax Class page. If the deduction classification is anything other than taxable benefit this field is unavailable for entry. |

| Withhold FWT (withhold federal withholding tax) |

When you select the Taxable Benefit option on the Deduction Table - Tax Class page, this check box is selected by default, indicating that the taxable benefit portion of the deduction should be withheld. If you do not want the taxable benefit portion withheld, deselect this check box. This field is unavailable for entry unless you selected the Taxable Benefit option on the Deduction Table - Tax Class page. If you want state income tax to be withheld for this earnings type, do not select this check box. Note: A Taxable Gross Definition table entry is always required when you want to stop state or local income tax withholding on a particular taxable benefit deduction, regardless of whether or not the state or locality follows the federal rule for including the amount in taxable income, and regardless of whether or not you have selected this check box for the deduction. |

| Add to FICA Credit (add to Federal Insurance Contributions Act credit) |

(E&G) This field appears if the plan type is Pension Plan (plan 80). By default, this check box is not selected. Select the check box if the corresponding deductions are being classified as part of FICA credit that is used to calculate the Massachusetts state tax. (USF) This field appears if the plan type is Thrift Savings (plan 42) or Retirement (plan 70). |

| Adjust 1042 Gross |

(E&G) This field appears if the Deduction Classification is Before-Tax or Taxable Benefit. By default, this check box is not selected. Select the check box to reduce Form 1042-S reportable earnings or W-2 reportable earnings by the before-tax deduction amount or increase them by the taxable benefit deduction amount. If the employee receives both Form 1042-S and W-2 reportable earnings, the taxable benefit or before-tax deduction amount is prorated to adjust taxable wages associated with both types of earnings. |

| Add to FICA Credit (add to Federal Insurance Contributions Act credit) |

(E&G) This field appears if the plan type is Pension Plan (plan 80). By default, this check box is not selected. Select the check box if the corresponding deductions are being classified as part of FICA credit that is used to calculate the Massachusetts state tax. (USF) This field appears if the plan type is Thrift Savings (plan 42) or Retirement (plan 70). |

| Adjust 1042 Gross |

(E&G) This field appears if the Deduction Classification is Before-Tax or Taxable Benefit.By default, this check box is not selected. Select the check box to reduce Form 1042-S reportable earnings or W-2 reportable earnings by the before-tax deduction amount or increase them by the taxable benefit deduction amount. If the employee receives both Form 1042-S and W-2 reportable earnings, the taxable benefit or before-tax deduction amount is prorated to adjust taxable wages associated with both types of earnings. |

| Add to FICA Credit (add to Federal Insurance Contributions Act credit) |

(E&G) This field appears if the plan type is Pension Plan (plan 80). By default, this check box is not selected. Select the check box if the corresponding deductions are being classified as part of FICA credit that is used to calculate the Massachusetts state tax. (USF) This field appears if the plan type is Thrift Savings (plan 42) or Retirement (plan 70). |

| Adjust 1042 Gross |

(E&G) This field appears if the Deduction Classification is Before-Tax or Taxable Benefit. By default, this check box is not selected. Select the check box to reduce Form 1042-S reportable earnings or W-2 reportable earnings by the before-tax deduction amount or increase them by the taxable benefit deduction amount. If the employee receives both Form 1042-S and W-2 reportable earnings, the taxable benefit or before-tax deduction amount is prorated to adjust taxable wages associated with both types of earnings. |

(CAN) Canadian Only

In this group box (with the exception of CIT gross), you specify how the deduction should affect the taxable gross amounts for each of these accumulators. You can specify whether a deduction adds to, has no effect on, or subtracts from the taxable gross amounts.

Important! This setup is a requirement for Canadian processing. It is imperative that you define deductions that affect T4A and RL-2 withholdings before they are processed. To ensure that all amounts are allocated to the proper accumulators for year-end processing, complete this setup prior to running the first payroll of the new tax year. Be aware that the corresponding deduction codes must be defined to the appropriate tax form definitions through the Tax Form Definitions table prior to running the year-end process.

|

Field or Control |

Definition |

|---|---|

| Effect on QIT Gross (effect on Quebec income taxes gross) |

Select Adds To if the deduction affects Quebec taxable gross. If the deduction is not subject to QIT, select No Effect. If the deduction is eligible for reducing Quebec taxable gross, select Subtracts. |

| Effect on CPP Gross (effect on Canada Pension Plan gross) |

Select Adds To when deductions are subject to CPP contributions. If the deduction does not impact CPP contributions, select No Effect. If the deduction is eligible to reduce CPP contributions, select Subtracts. Note: Although CPP contributions are affected, these deductions are adding to or subtracting from the grosses. |

| Effect on QPP Gross (effect on Quebec Pension Plan gross) |

Select Adds To when deductions are subject to QPP contributions. If the deduction does not impact QPP contributions, select No Effect. If the deduction is eligible to reduce QPP contributions, select Subtracts. Note: Although QPP contributions are affected, these deductions are adding to or subtracting from the grosses. |

| Effect on EI Gross (effect on Employment Insurance gross) |

Select Adds To when deductions are subject to EI premiums. If the deduction does not impact EI premiums, select No Effect. If the deduction is eligible to reduce EI premiums, select Subtracts. Note: Although EI premiums are affected, these deductions are adding to or subtracting from the grosses. |

| Effect on QPIP Gross (effect on Quebec Parental Insurance Plan gross) |

Select Adds To when deductions are subject to QPIP premiums. If the deduction does not impact QPIP premiums, select No Effect. If the deduction is eligible to reduce QPIP premiums, select Subtracts. Note: Although QPIP premiums are affected, these deductions are adding to or subtracting from the grosses. |

| Eff on True T4 Gross (effect on true T4 gross) |

Taxable benefits should be defined as Adds To. Before-tax deductions should be defined as having No Effect. This field affects accumulated total employment income amounts, which are used for reporting, purposes. The Health Insurance Premium report (TAX102CN) is an example. |

| Eff on True RL Gross (effect on true RL gross) |

Affects accumulated total employment income amounts that are used for reporting purposes. The Health Insurance Premium report (TAX102CN) is an example. Define taxable benefits as Adds To. Define before-tax deductions as having No Effect. Values are Adds To, No Effect, and Subtracts. |

| Effect on T4A Gross |

Affects the accumulated taxable gross amount to establish separate income taxes to be reported on a T4A slip. Values are Adds To, No Effect, and Subtracts. |

| Effect on RL-2 Gross |

Affects the accumulated taxable gross amount to establish separate QIT to be reported on an RL-2 slip. When Effect on RL-2 Gross is set to Adds To or Subtracts, the system automatically sets Effect on QIT Gross to Adds To or Subtracts, respectively. Values are Adds To, No Effect, and Subtracts. |

| Eff on Payroll Tax Gross (effect on payroll tax gross) |

Affects an accumulated gross amount that is subject to Northwest Territories and Nunavut payroll tax. Values are Adds To, No Effect, and Subtracts. |

Use the Deduction Table - Process page (DEDUCTION_TABLE4) to establish parameters for partial deductions and arrears.

Navigation

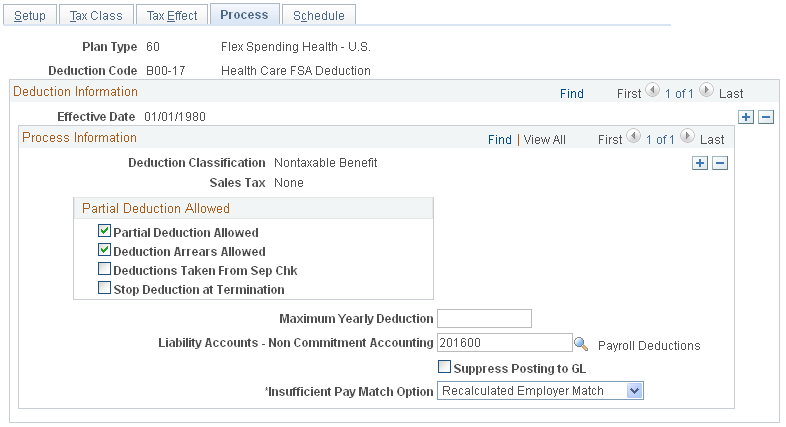

Image: Deduction Table - Process page

This example illustrates the fields and controls on the Deduction Table - Process page.

Partial Deduction Allowed

Use this group box to define parameters for deductions during deduction processing and arrears.

|

Field or Control |

Definition |

|---|---|

| Partial Deduction Allowed |

Select this check box if you want a partial deduction to be taken during deduction processing when there is insufficient pay to take the entire amount. Do not select this option for garnishment deductions. |

| Deduction Arrears Allowed |

Select this check box to have the system transfer any uncollected amount for a deduction into an arrears balance. During subsequent payroll runs the system attempts to recover the balance in arrears from an employee's paycheck—up to the maximum controlled by the arrears payback amount on this table. If you set up an arrears payback deduction (such as a company loan or a vacation advance) on the Earnings Table - Taxes page, this check box must be selected. Important! If an employee is not paid during a regularly scheduled payroll and there are deductions scheduled to be withheld, those deductions are put into arrears if the Deduction Arrears Allowed check box is selected. Important! Do not select the Deduction Arrears Allowed check box for garnishments. Late or unpaid garnishments cannot be held in arrears—these are managed by the court system and are prohibited from being placed in arrears by garnishment regulations. If you select this check box for garnishments, unexpected or incorrect pay results may occur for both U.S. and Canadian customers. |

| Deductions Taken From Sep Chk (deductions taken from separate check) |

Select to take the deduction from any additional check that an employee might get in a single pay period. You may want to select this check box for deductions for savings plan contributions. |

| Stop Deduction at Termination |

Select to indicate not to take the deduction from the paycheck of a terminated employee. If an employee's termination date is equal or prior to the pay period end date, the deduction will not be taken. For example, most health insurance plans are prepaid—premiums deducted for this month are used to provide coverage for next month. If employees no longer have health benefits after they are terminated, the deduction shouldn't be taken. |

| Maximum Yearly Deduction |

Enter an amount for any deductions that have a yearly limit. For example, there is a limit on the amount of before-tax portion 401(k) contributions an employee can make. For that deduction classification, enter the maximum contribution here, so the system will automatically stop after the deduction limit has been reached. The value that you enter here remains valid for one calendar year. It resets to zero at the start of the new year. |

| Liability Accounts - Non Commitment Accounting |

Enter the general ledger liability account to which this deduction should be charged. At least one general ledger account must be entered for a deduction and a general ledger account is required for every deduction classification. Note: (E&G) The Expense Accounts - Non Commitment Accounting and Liability Accounts - Non Commitment Accounting fields are not applicable to education and government users. |

| Suppress Posting to GL |

This check box appears only when the deduction class is an employer expense: Nontaxable Benefit, Nontaxable Btax Benefit (before tax), Taxable Benefit, and QC Taxable Benefit. Select this check box to prevent the accounting entry from being generated from the GL Interface processes for the specified deduction/deduction class combination. Note: This check box must be selected for the Adult Child deduction code/Non-taxable before tax benefit class. The Commitment Accounting Actuals Distribution process and PAYGL02.SQR, and the Commercial PAYGL01.SQR look at this check box, and when the check box is selected, suppresses accounting data. The PAY705A SQR Deduction Classes report, reports the Suppress Posting to GL value for every deduction code/deduction. |

| Insufficient Pay Match Option |

This field appears for 4x Savings and 6x FSA plans when the deduction class is Nontaxable Benefit, Nontaxable Btax Benefit (before tax), and QC Taxable Benefit. Note: The insufficient match pay options only work with the Service Step table and Percent of Employee Investment options. Specify how the employer matching/nonmatching contribution should be paid in situations of insufficient net pay:

|

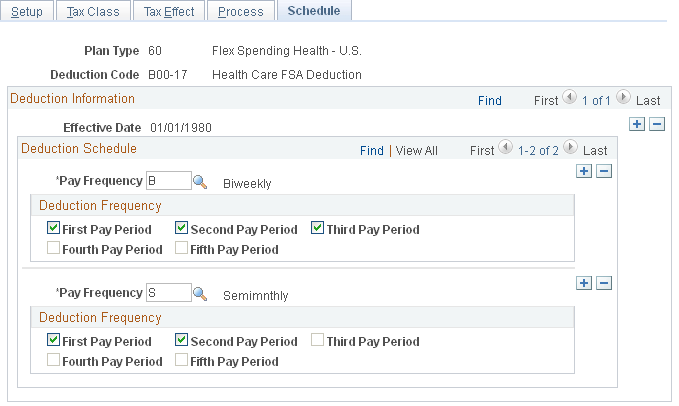

Use the Deduction Table - Schedule page (DEDUCTION_TABLE5) to specify which pay periods the deduction should be taken for the pay frequencies that you want to override.

Navigation

Image: Deduction Table - Schedule page

This example illustrates the fields and controls on the Deduction Table - Schedule page.

By default, each deduction comes out every pay period regardless of pay frequency. If you want a deduction to be taken out on a schedule other than every pay period, you must complete the Deduction Table - Schedule page.

Deduction Schedule

|

Field or Control |

Definition |

|---|---|

| Pay Frequency |

Specify the pay frequency that you want to override for those deductions that are not deducted every pay period. Values prompt from the Frequency table: Annual, Biweekly, Daily, Monthly, Quarterly, Semimonthly, and Weekly. If you select a Weekly frequency, you can select the Fifth Pay Period option only if you have also selected the first, second, third, and fourth periods. Likewise, for a Biweekly frequency you can only select the Third Pay Period option if you have also selected the first and second. Because a deduction with a monthly frequency is always taken once a month, there is no override for that pay frequency on this page. Suppose that you have a semimonthly payroll, but health deductions should only come out of the last paycheck of the month. In this case, you would select a pay frequency of Semimonthly and take a deduction in the second pay period. |

Deduction Frequency

Use this group box to specify which appropriate pay periods to take the deduction for the pay frequency selected. You must insert a new row for every pay frequency for which you have a pay group defined.

|

Field or Control |

Definition |

|---|---|

| First Pay Period through Fifth Pay Period |

Select the appropriate period check boxes that you want the deduction to be taken in. |

Note: If you want the deduction code to be taken each pay period, do not alter this page when you initially create the deduction code. The default for this page is every pay period for every pay frequency.