Setting Up for FLSA Calculation

To set up FLSA period definitions, use the FLSA Period Table (FLSA_PERIOD_TBL) component.

Note: The FLSA and Alternative Overtime Calculations appendix provides examples of calculations. Use the examples as a guide while setting up FLSA calculations.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

FLSA_PERIOD_TBL |

View all delivered FLSA periods and create or maintain user-defined FLSA periods. |

|

|

Default Settings Page |

COMPANY_TABLE2_GBL |

Set up default company information; including FLSA settings. |

|

FLSA Calendar Table Page |

FLSA_CALENDAR |

Set up FLSA calendars. |

|

Calc Parameters Page |

PAYGROUP_TBL3 |

Define payroll processing parameters for pay groups |

|

FLSA Period Definition Page |

FLSA_PERIOD_SBPNL |

(USA) Specify FLSA period definition and other parameters for the pay group's FLSA calculation. |

|

Earnings Table - General Page |

EARNINGS_TABLE1 |

Define parameters and rules for calculating earnings. Also specify the effects on Fair Labor Standards Act (FLSA) regular rate calculations, and define retro pay processing options. Note: In the Earnings Table component (EARNINGS_TABLE), only the General page and the Calculation page affect FLSA payment. Use them to specify the earnings codes in the company that are affected by FLSA regulations, and assign the earnings codes to FLSA categories. See (USA) Setting Up the Earnings Table for FLSA Calculations. |

|

Earnings Table - Calculation Page |

EARNINGS_TABLE3 |

Specify special earnings calculation formats that control how the pay calculation handles the earnings code and what results the earnings code produces. Note: In the Earnings Table component (EARNINGS_TABLE), only the General page and the Calculation page affect FLSA payment. Use them to specify the earnings codes in the company that are affected by FLSA regulations, and assign the earnings codes to FLSA categories. See (USA) Setting Up the Earnings Table for FLSA Calculations. |

|

JOB_DATA_JOBCODE |

Enter information about a person's job, including status, employee class, shift, or standard hours. |

FLSA calculations apply only to the U.S. The Fair Labor Standards Act of 1937 requires that you pay overtime to nonexempt employees who work more than 40 hours in a week.

Government regulations require employers to pay overtime at a rate that is at least equal to the rate calculated according to FLSA regulations. Additionally, you must prorate nondiscretionary bonuses over all applicable FLSA periods and use them to calculate the FLSA regular rate. When an employee has multiple nonexempt jobs in the same organization, the system applies the overtime rule to the total hours for all jobs.

A premium rate is the extra amount of the contractual rate paid for overtime and is stated by percentage. The contractual rate is the hourly rate of pay that an employer promises an employee in exchange for performing a job. The premium amount paid for overtime can be paid either at contractual rate or FLSA rate.

For example, if you compute overtime at 1.5 times the contractual rate, then the overtime premium rate is 50 percent. A contractual rate of 10 USD per hour yields overtime earnings of 15 USD per hour, with 5 USD as the overtime premium paid at contractual rate. Per FLSA regulation, when bonus is factored into the overtime calculation, this premium overtime pay can be higher at FLSA rate.

The Company table enables you to specify what rate to use for overtime premium as follows:

Always at the FLSA premium.

At the greater of the FLSA or contractual premium rates.

The employee always receives at least the FLSA premium.

Note: Salaried employees with unspecified hours are always calculated at the FLSA rate, even if it is lower than the contractual rate. Also, the Rate Code and Frequency fields on the Job Data, Compensation page (JOB_DATA3), must either be the pay period or Annual for salaried employees. A frequency value of Hourly for a salaried employee can adversely impact calculations for FLSA and retro pay. See Adding Organizational Instances for Employees, Contingent Workers, and POIs

You can calculate overtime pay:

According to FLSA rules.

According to a calculation of:

overtime hours × percentage of the contractual rate that you have agreed to pay for overtime work

How you calculate overtime, prorate bonuses, and handle other earnings (such as shift differentials and tips) depends on whether the employees are subject to FLSA standards or exempt from them.

FLSA calculation is affected by the pay frequency. Supported pay frequencies are weekly, biweekly, monthly and semimonthly. Frequency factors that are defined on the Frequency table may be required in converting the amounts from pay period to FLSA period frequency.

Note: Some FLSA calculations use constant values for standard hours or work day hours from Job for an entire period. Changing standard hours or work day hours in the middle of an FLSA period causes inaccurate calculations. Make changes at the end or beginning of the FLSA period.

PeopleSoft delivers and maintains three FLSA period definitions:

Fixed FLSA Period

Law Enforcement

Fire Protection

The delivered period definitions are based on data published by the U.S. Department of Labor, Wage and Hour Division. Your organization's requirements might vary slightly from the delivered values if, for example, a union contract overrides the threshold hours established by the U.S. Department of Labor.

If the delivered FLSA period definitions are not adequate for your organization, define new FLSA periods on the FLSA Period Table page.

Use the FLSA Period Table page (FLSA_PERIOD_TBL) to view all delivered FLSA periods and create or maintain user-defined FLSA periods.

Navigation

Image: FLSA Period Table page

This example illustrates the fields and controls on the FLSA Period Table page.

FLSA Period

These values cannot be changed for delivered FLSA periods. The fields can be edited for user-defined periods.

|

Field or Control |

Definition |

|---|---|

| FLSA Period in Days |

Enter the length of the FLSA pay period, or the days from the FLSA begin date to the FLSA end date. |

| FLSA Threshold Hours |

Enter the number of hours worked in the corresponding period length before the FLSA rate applies to fire protection and law enforcement employees. |

To set up foundation tables for FLSA calculations:

Select FLSA settings in the USA section on the Company - Default Settings page.

Select the FLSA Required check box if any pay groups in the company require FLSA compliance.

If you don't select this check box, FLSA functionality is not available in Payroll for North America. After you select the FLSA Required check box, the FLSA Rule (Fair Labor Standards Act rule) group box becomes available for entry.

Select an option in the FLSA Rule group box.

Designate whether the system should always use the FLSA premium rate (even when the FLSA rate is less than the contractual rate) or the higher of the FLSA and contractual rates (this is the default).

Set up the FLSA calendar on the FLSA Calendar Table (Fair Labor Standards Act Calendar table) page.

Define the FLSA period days and start dates on the FLSA Calendar Table page. This step is not required when you use the Basic Rate Formula for fixed, salaried hours in a fixed FLSA period.

Review the FLSA Period Definition table and add additional period definitions if necessary.

PeopleSoft delivers the standard period definitions as defined by the U.S. Department of Labor. You cannot modify the delivered period definitions. Define additional period definitions only if the delivered definitions are not adequate for your needs.

Select the FLSA Required check box on the Pay Group Table - Calc Parameters page.

If FLSA functionality applies to this pay group, select this check box to enable the display of the FLSA Period Definition (Fair Labor Standards Act period definition) button. You must consider whether FLSA applies when creating pay groups.

Note: When setting up pay groups, do not use the same pay group ID in two separate companies if the companies use different overtime earnings codes.

Specify the FLSA period definition and other parameters for the pay group's FLSA calculation on the FLSA Period Definition page.

To access the FLSA Period Definition page, select the FLSA Period Definition button on the Pay Group Table - Calc Parameters page.

Note: Unless you enable FLSA functionality at every level in the previous steps, you don't see FLSA functionality at the next lower level. In other words, if you do not select the FLSA Required check box in the Company table, you don't see FLSA functionality on the Pay Group Table - Calc Parameters page. After you select the FLSA Required check box in the Pay Group table, the FLSA Period Definition button becomes available. The country for the pay group must also be USA for FLSA processing. To be included in the FLSA calculation, an employee must have nonexempt status in job data and belong to a pay group that is set up with FLSA required.

Use the Job Information page (JOB_DATA_JOBCODE) to enter information about a person's job, including status, employee class, shift, or standard hours.

Navigation

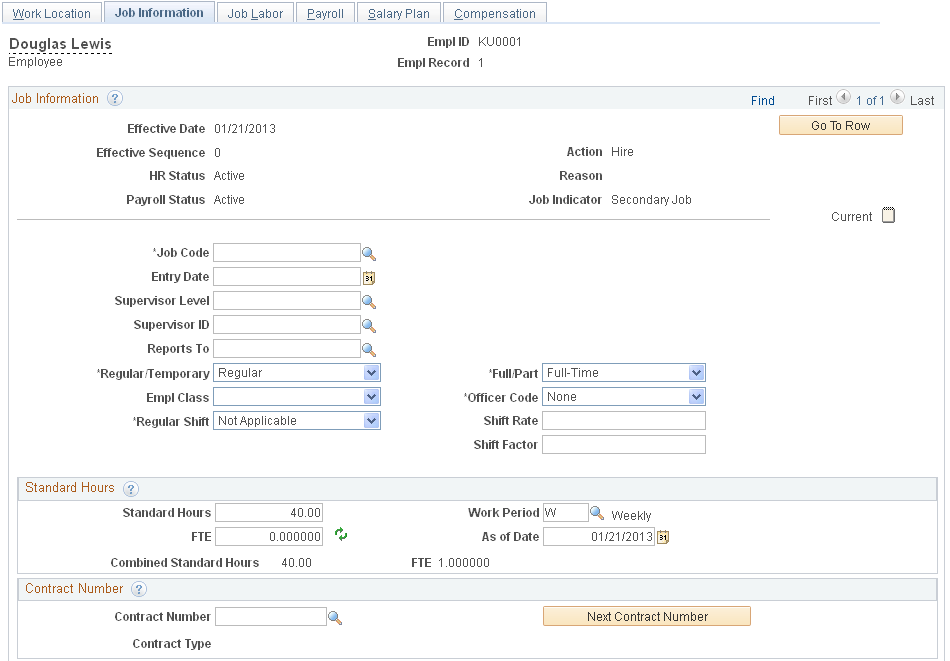

Image: Job Information page (1 of 2)

This example illustrates the fields and controls on the Job Information page (1 of 2).

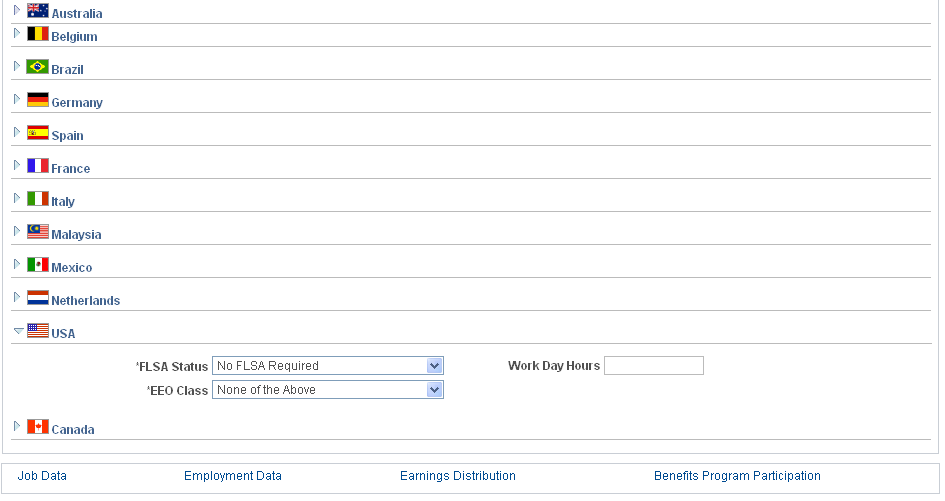

Image: Job Information page (2 of 2)

This example illustrates the fields and controls on the Job Information page (2 of 2).

Note: This step is employee-specific. Complete the USA section of the Job Information page when you hire an employee.

|

Field or Control |

Definition |

|---|---|

| FLSA Status (Fair Labor Standards Act status) |

Only nonexempt employees are entitled to FLSA calculation. |

| Work Day Hours |

Displays the number of hours an employee is scheduled to work on a normal day, which the system uses to calculate the FLSA Basic Rate Formula. |

Note: Do not enter a salaried employee's compensation rate as an hourly rate (hourly frequency) in the Compensation Rate field on the Job Data - Compensation page. Under some conditions, doing so causes the system to pay minimum wage in place of the FLSA rate.