Setting Up Pay Groups

To set up pay groups, use the Pay Group Table component (PAYGROUP_TABLE).

These topics provide an overview of and how to set up pay groups.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PAYGROUP_TABLE1 |

Set up and describe pay groups. |

|

|

PAYGROUP_TABLE2 |

Establish employee type options for a particular pay group. |

|

|

PAYGROUP_TABLE3 |

Define further payroll processing parameters for pay groups. |

|

|

FLSA_PERIOD_SBPNL |

(USA) Specify FLSA period definition and other parameters for the pay group's FLSA calculation. |

|

|

(E&G) Education and Government Additional Earnings Codes Page |

PAYGRP_TBL3_HP_SEC |

(E&G) Add earnings codes for education and government. |

When implementing a payroll system for use with HCM, one of your major tasks is to set up pay groups. For example, you might create different pay groups for employees with different sets of benefits or earnings.

While pay groups may seem specific to payroll processing, you also need this information for Human Resources, to set up job records and benefit programs. Many of the default field values on the Administer Workforce pages are based on the pay group values that you specify on the Pay Group Table component (PAYGROUP_TABLE). Set up at least one pay group for each company that you established in the Company component (COMPANY_TABLE) or the Agency USF component (AGENCY_TABLE) for U.S. federal users.

See Entering Company Information.

See (USF) Entering Agency Information.

Setting Up Your Pay Group

Where you set up your pay group depends on which payroll application you use:

PeopleSoft Payroll for North America.

If you use PeopleSoft Payroll for North America, use the Pay Group table pages discussed in this topic as well as additional pages of the Pay Group table that are documented in the PeopleSoft Payroll for North America.

PeopleSoft Payroll Interface

If you use PeopleSoft Payroll Interface, use the Pay Group Table pages discussed in this topic as well as additional pages of the Pay Group table that are documented in the PeopleSoft Payroll Interface.

PeopleSoft Global Payroll.

If you use PeopleSoft Global Payroll, use the Pay Group component in that application.

See Defining Pay Groups.

Pay system other than a PeopleSoft payroll application.

If you are not using a PeopleSoft payroll application, use the Pay Group table pages discussed in this topic.

PeopleSoft Pension Administration.

If you use PeopleSoft Pension Administration, also set up pay groups for your pension payee companies. Pension Administration doesn't use pay groups for paying pension benefits.

See PeopleSoft Pension Administration.

Note: If you use more than one payroll application (for example, Payroll for North America and Global Payroll), set up the pay groups required for both applications. Otherwise, set up only the pay groups required for the application you are using. The company and pay group keys must be unique to the payroll application; do not use the same combination of keys for multiple payroll applications.

Using the Pay Group Table

The Pay Group Table component consists of nine pages. For Human Resources, enter information only on the first three pages of the component, because that information is used across all HCM applications. The last six pages in the component are used with Payroll for North America, and to a lesser extent, with Payroll Interface.

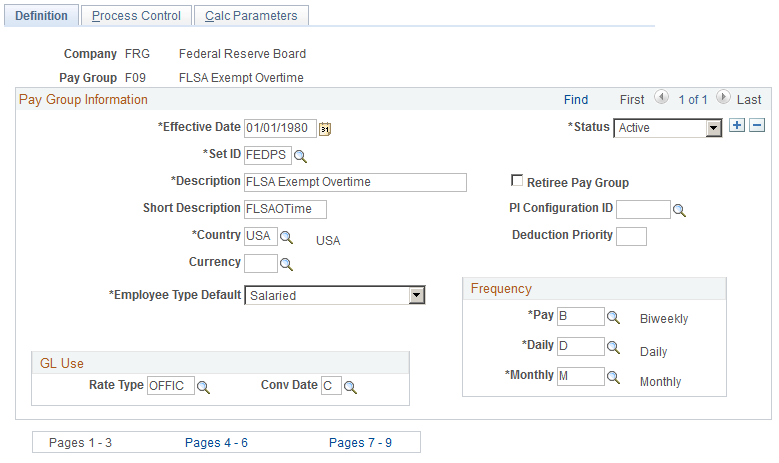

Use the Pay Group Table - Definition page (PAYGROUP_TABLE1) to set up and describe pay groups.

Navigation

Image: Pay Group Table - Definition page

This example illustrates the fields and controls on the Pay Group Table - Definition page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Pay Group |

The Pay Group value that you specified in the entry dialog box is displayed. Note: On employee job records, the Pay Group default is from the company level. |

| Set ID |

Select a set ID for the shift table used by the employees in this pay group. For pay groups that don't use a shift table, use a generic set ID. |

| Retiree Pay Group |

Select for a separate retiree pay group. PeopleSoft recommends keeping retirees in their own pay group. There is no processing associated with this check box. |

| PI Configuration ID (Payroll Interface configuration ID) |

Select, if appropriate. The PI Configuration ID is set up using the Configuration Table component (INTRFC_CONFIG) in Payroll Interface. You must set up that component first, or leave this field blank for now. Note: You must enter a value for Payroll Interface. If the PI Configuration ID is not set up correctly, payroll processing in Payroll Interface will not function properly. Refer to the PeopleSoft Payroll Interface for more information. |

| Deduction Priority |

Enter a deduction priority number for your pay group. The deduction priority is used for multiple job employees when the single check option is not selected for a company. |

| Employee Type Default |

Select the most common employee type within the pay group. The system uses this value as the default for the pay group's employee job records. The default you enter on this page is edited against the Benefit Program table. You need either to set up that table first or leave this field blank for now. Values are as follows:

|

| (CAN) Wage Loss Plan Default |

Specify a wage loss plan default value for the pay group. This default value assigns employees the appropriate wage loss plan on the Canadian Income Tax Data page whenever the system automatically creates employee tax data records. |

Frequency

|

Field or Control |

Definition |

|---|---|

| Pay |

Select the pay period frequency. Note: If the employee's compensation rate on the Compensation page is quoted with the same frequency type as the pay period (for example a monthly frequency), you must use the same frequency ID (same annualization factor) for both the pay frequency and the compensation frequency. |

| Daily |

Select the frequency used by Payroll for North America to calculate the daily pay rate. Only frequencies on the Frequency table with a frequency type of daily are available for selection. |

| Monthly |

Select the frequency used by Payroll for North America to calculate a monthly pay rate. Only frequencies on the Frequency table with a frequency type of monthly are available for selection. |

General Ledger Use

PeopleSoft General Ledger uses these fields.

|

Field or Control |

Definition |

|---|---|

| Rate Type |

Select the appropriate value from the list provided. |

| Conv Date (conversion date) |

Values are Check Date, Pay End Date, and Today's Date. |

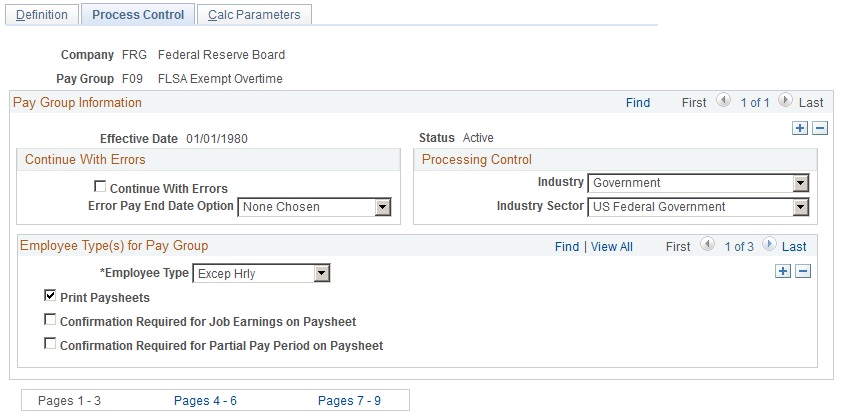

Use the Process Control page (PAYGROUP_TABLE2) to establish employee type options for a particular pay group.

Navigation

Image: Process Control page

This example illustrates the fields and controls on the Process Control page. You can find definitions for the fields and controls later on this page.

You establish options on this page before you assign employee types on employee records. For example, you might want to group only salaried employees in your monthly pay group and group hourly and exception hourly employees in a biweekly pay group.

Continue With Errors

|

Field or Control |

Definition |

|---|---|

| Continue With Errors |

Select to enable the Pay Confirmation process to proceed even if the Pay Calculation process encounters nonfatal calculation errors. The system moves the paysheets in error to a designated off-cycle calendar to be corrected in a separate off-cycle run. Note: All pay groups attached to a single pay run ID must have the same setting in the Continue With Errors option on this page. If this condition is not met, the system cannot transfer any errored paysheets for the pay run ID. |

| Error Pay End Date Option |

This value is used by the Pay Calendar build process to set up the pay calendar. Select the date of the off-cycle calendar to which erred paysheets are moved. If you select Next Day, the Pay Calendar Creation process creates one cycle pay calendar for each on-cycle pay calendar that is created. The pay end date for the off-cycle calendar is one day after the pay end date for the on-cycle pay calendar. For example, if the pay end date for the on-cycle calendar is May 31st, the pay end date for the off-cycle calendar is June 1st. Warning! If you enter your own end date, you must ensure that a pay calendar has been built for that date before attempting to calculate transferred pay lines. |

Processing Control

|

Field or Control |

Definition |

|---|---|

| Industry |

Select your organization's primary business industry, such as Core, Education, Government, Retail, and so on. |

| Industry Sector |

Select None, Core, Public Sct (public sector), or US Federal. |

Employee Type(s) for Paygroup

|

Field or Control |

Definition |

|---|---|

| Employee Type |

Select the options—Hourly, Exception Hourly, or Salaried—that are valid for this pay group. If you use PeopleSoft Payroll for North America, you also need to designate payroll processing parameters. Otherwise, for employees being paid with PeopleSoft Payroll for North America, leave Print Paysheets selected as the default. Note: If a specific employee type is not defined on a pay group, a user can't set up that type of employee. For example, if a pay group does not have an employee type of salaried, when an employee is hired, the user can't enter S as the employee type on job. |

| Print Paysheets |

If you are using PeopleSoft Payroll for North America, select this check box if the employees in this employee type should always be included when printing paysheets. Employee types for which this check box is deselected still appear on the paysheet pages. Note: You must check this box if either of the confirmation required check boxes is selected. |

| Confirmation Required for Job Earnings on Paysheet |

If you are using PeopleSoft Payroll for North America, select this box to deselect the OK to Pay field on the paysheets by default. OK to Pay tells the system whether to pay an employee or place the record on hold until you review it. Pay Calculation, in turn, processes only those employees who have OK to Pay selected. If you select this option, Print Paysheets must also be selected. Typically, hourly employees require some sort of positive time input to get paid. For this reason, you might say that confirmation is required. Once you enter their time on the paysheets, you manually select OK to Pay to permit them to be paid. For exception hourly and salaried employees, you usually enter exception time only as required. Therefore, you might indicate that confirmation is not required. These employees automatically get paid their regular salary or hours each pay cycle, because the paysheets are created with the OK to Pay check box selected. |

| Confirmation Required for Partial Pay Period on Paysheet |

If you are using PeopleSoft Payroll for North America, select this box to control the OK to Pay check box on the paysheet. Whenever there is a mid-period change on the Job record—an employee is hired, is terminated, or changed jobs or pay rates—the system creates partial pay period records due to proration. Typically, if you prorate pay, you should deselect this check box to tell the system that confirmation is not required and to select OK to Pay on the paysheet. If, on the other hand, you want to manually verify the proration for employees, select this option. You can adjust the pay on the paysheets and click the OK to Pay check box. If you select this option, Print Paysheets must also be selected. |

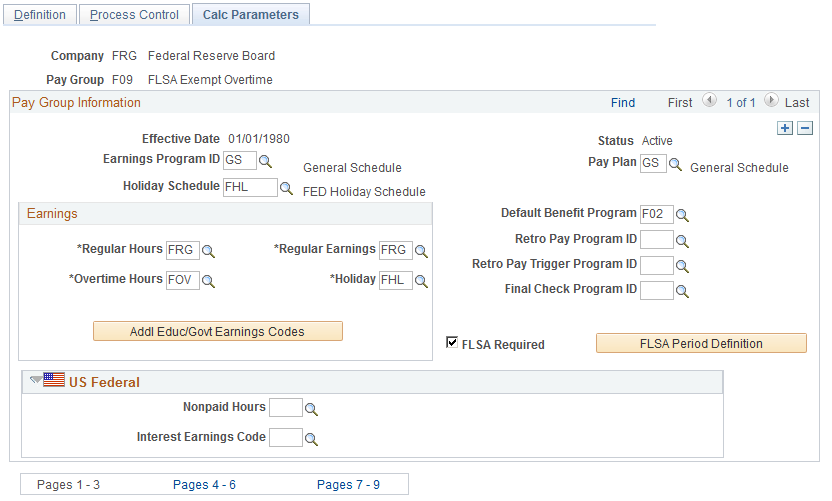

Use the Calc Parameters page (PAYGROUP_TABLE3) to define further payroll processing parameters for pay groups.

Navigation

Image: Pay Group Table - Calc Parameters page

This example illustrates the fields and controls on the Pay Group Table - Calc Parameters page. You can find definitions for the fields and controls later on this page.

Pay Group Information

|

Field or Control |

Definition |

|---|---|

| Earnings Program ID |

Select a default value for the employee records in this pay group. Earnings Program IDs are set up using the Earnings Program Table component (EARNS_PROGRAM_TBL) in either Payroll for North American or Payroll Interface. You must set up that component first or leave this field blank for now. |

| Pay Plan |

(USF) Select the pay plan to assign to this pay group. |

| Holiday Schedule |

Select the holiday schedule for the pay group. If you left the Holiday Schedule field blank on the Location Profile page, the system uses the holiday schedule you specify on this page as the default for the worker's job record. You must set up the Holiday Schedule table before making a selection or leave this field blank for now. Note: In Payroll Interface, if you want the third-party payroll system to process holiday pay, on the Holiday Schedule component set up a holiday schedule called NONE. |

| Default Benefit Program |

Select the default benefit/deduction program for the pay group. The system uses this default benefit/deduction program as the default for the employee's job record. The default you enter on this page is edited against the Benefit/Deduction Program Table in the Benefits menu. You must set up that table first, or leave this field blank for now. |

| Retro Pay Program ID |

Select a retro pay program to associate with the pay group. The retro pay program identifies the earnings codes used in retro pay calculations. In each retro pay program, you list earnings codes that are eligible for retro pay, and for each of these earnings codes, you specify the earnings code to be used for paying the retro pay earnings. You define retro pay programs in the Retro Pay Program component. See Program Table Page. |

| Retro Pay Trigger Program ID |

Select a retro pay trigger program to associate with the pay group. The retro pay trigger program controls which record and field changes (on the job record and the additional pay data record) create retro pay requests. The retro pay calculation process then processes these requests to determine how much, if any, retro pay is to be paid because of the changes. You define retro pay trigger programs in the Retro Pay Trigger Program component. See Retro Pay Trigger Program Page. Note: Releases before PeopleSoft Payroll for North America 9.1 generated retro requests using PeopleCode rather than retro pay trigger programs. When you upgrade from one of these earlier releases, use correction mode to enter retro pay trigger programs for the current and history rows on this page. You cannot save changes to this component if there are any rows that have a retro pay program but no retro pay trigger program. |

| Final Check Program ID |

To specify a default final check program for the pay group, select the final check program ID that identifies the earnings, deductions, and accruals to be used in final check processing for the pay group. |

| FLSA Required |

(USA) Select this check box if FLSA regulations are to be applied to this pay group. When you select this check box, the FLSA Period Definition button appears. If you do not select this check box, the button does not appear and you cannot define FLSA pay periods. FLSA is for U.S. Payroll only; this check box appears on the page if you have enabled FLSA processing on the FICA/Tax Details page (access through the Company Table − Default Settings page) and on every pay group when applicable. Note: If FLSA is not selected for a company, it cannot be selected for a pay group within that company. After it has been selected at the company level, it does not have to be selected at the pay group level. However, if FLSA is required for a pay group, it must be selected at both the company and pay group levels. Note: (USF) If FLSA is required for a whole agency or for most pay groups in an agency, you should deselect the FLSA Required check box and define FLSA requirements on the Agency Table. Remember that if the FLSA Required check box isn't selected on the Agency Table, the FLSA Rule for a pay group is set by default to Higher of FLSA Contractual. Note: To be included in FLSA calculation, an employee must have non-exempt status and belong to an FLSA pay group. Note: When setting up pay groups, do not use the same pay group ID in two separate companies if the companies use different overtime earnings codes for FLSA. |

| FLSA Period Definition |

(USA) Click to access the FLSA Period Definition page. |

Earnings

Use this group box to define earnings codes for each earnings type.

|

Field or Control |

Definition |

|---|---|

| Regular Hours |

Select the appropriate earnings code for the regular hours earnings type. |

| Overtime Hours (overtime hours earnings type) |

Select the appropriate earnings code for the overtime hours earnings type. |

| Regular Earnings |

Select the appropriate earnings code for the regular earnings type. |

| Holiday |

When the system creates paysheets and detects that a holiday falls within the pay period, it uses the earnings code associated with this field. If Holiday Type on the Holiday Schedule Table is Canadian, the system uses this earnings code to set up the statutory holiday earnings on the paysheet. Note: (USF) The system does not enter the holiday earnings code on the paysheet if the employee is in a nonpay status for the entire pay period. |

| Refund |

Enter the earnings code used to refund money to employees who cancel U.S. Savings Bond elections or whose purchases are suspended due to the annual purchase limit. Important! The refund earnings code must be configured appropriately. On the Earnings Table - Taxes page, the Add to Gross and Maintain Earnings Balances check boxes must be selected, and the earnings code must not be subject to any taxes. |

(USF) US Federal

Specify additional earnings codes.

|

Field or Control |

Definition |

|---|---|

| Nonpay Hours |

Enter the earnings code to be entered on the paysheets when the system detects that an employee is on leave without pay or short or long-term disability for an entire pay period. Note: Nonpay hours are included on paysheets only if the employee is in nonpay status for the entire pay period. |

| Interest Earnings Code |

Enter the earnings code used to pay interest on retroactive payments that are over 30 calendar days late. |

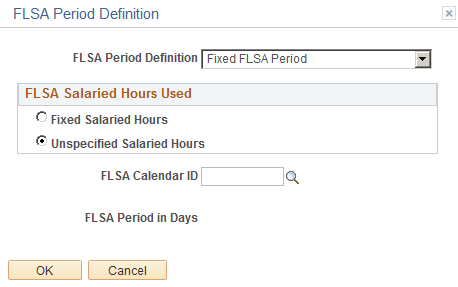

Use the FLSA Period Definition page (FLSA_PERIOD_SBPNL) to specify FLSA period definition and other parameters for the pay group's FLSA calculation.

Navigation

Click FLSA Period Definition on the Calc Parameters page.

Image: FLSA Period Definition page

This example illustrates the fields and controls on the FLSA Period Definition page. You can find definitions for the fields and controls later on this page.

The FLSA Period Definition page changes, depending on which options you select. The following table shows which fields are visible on the page, depending on the FLSA Period Definition you select:

|

FLSA Period Definition |

FLSA Salaried HRS Use: Unspecified or Fixed |

Use Basic Formula |

FLSA Calendar ID |

FLSA Period in Days |

FLSA Threshold Hours |

|---|---|---|---|---|---|

|

Fixed FLSA Period with Fixed Salaried Hrs selected and Use Basic Formula clear |

X |

X |

X |

X |

|

|

Fixed FLSA Period with Fixed Salaried Hrs selected and Use Basic Formula selected |

X |

X |

|

|

|

|

Fixed FLSA Period with Unspecified Salaried Hrs selected |

X |

|

X |

X |

|

|

Law Enforcement |

|

|

X |

X |

X |

|

Fire Protection |

|

|

X |

X |

X |

|

Field or Control |

Definition |

|---|---|

| FLSA Period Definition |

Select the appropriate FLSA period definition:

If you select Fixed FLSA Period, the period can only be for 7 or 14 days. There are no FLSA Threshold Hours for employees in the Fixed FLSA Period, because threshold hours only apply to law enforcement and fire protection employees. |

FLSA Salaried Hours Used

|

Field or Control |

Definition |

|---|---|

| Fixed Salaried Hours |

Select this option to use the standard hours you entered on the employee's Job record. If you select this option, the Use Basic Formula check box appears. |

| Use Basic Formula |

If you select this check box, the FLSA Calendar ID and FLSA Period in Days check boxes disappear. Basic formulas are used only for monthly and semi-monthly pay periods. The FLSA period is assumed to be the same as the Pay Calendar period; hence, no FLSA Calendar ID is required. If you select this check box, you must enter information into the Work Day Hours field on the Job Information page. |

| Unspecified Salaried Hours |

Select this option to use the actual number of hours worked per week by salaried employees to determine their FLSA rate. |

| FLSA Calendar ID |

Select a FLSA calendar ID. The FLSA calendar ID is linked to the FLSA Start Date and FLSA Period in Days fields on the FLSA Calendar Table page, which are used to define the FLSA begin and end dates. Hence, the pay group uses the FLSA Calendar ID to define the FLSA periods. This field is not applicable if you select Basic Rate Formula. If you select Fixed FLSA Period, the prompt list contains only FLSA Calendar IDs with 7 or 14 FLSA Periods in Days. For Fire Protection or Law Enforcement, the prompt list contains FLSA Calendar IDs from 7 to 28 days. |

| FLSA Period in Days |

The length of the FLSA pay period, or the days from the FLSA Begin Date to the FLSA End Date. The system displays it automatically. It is based on the FLSA Period in Days you define on the FLSA Calendar Table. This field is display-only. |

| FLSA Threshold Hours |

The number of hours worked before the FLSA rate applies to Fire Protection and Law Enforcement employees. Both of these types of jobs have different threshold hours defined by FLSA regulations. Both threshold hour schedules are delivered by PeopleSoft and are defined in the FLSA Period Table. You can create user-defined FLSA period definitions with different threshold hour schedules if necessary. See Overview of FLSA Calculations and Multiplication Factors in FLSA Calculations. |

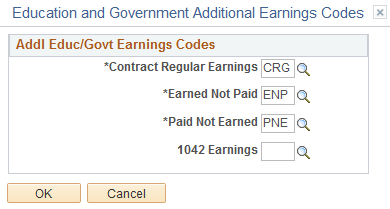

Use the Education and Government Additional Earnings Codes page (PAYGRP_TBL3_HP_SEC) to add earnings codes for education and government.

Navigation

Click Addl Educ/Govt Earnings Codes on the Calc Parameters page

Image: Education and Government Additional Earnings Codes page

This example illustrates the fields and controls on the Education and Government Additional Earnings Codes page. You can find definitions for the fields and controls later on this page.

Select the appropriate earnings code for each field.