Defining Pay Groups

To define pay groups, use the Pay Groups (GP_PYGRP) component.

Note: This topic discusses the first two pages of the Pay Group component. The other page in the Pay Group component is the Supporting Element Overrides page which is discussed elsewhere in this product documentation.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_PYGRP_NAME |

Define pay group parameters. |

|

|

GP_PYGRP_DFLT |

Define default rounding, proration, and frequency conditions for a pay group. |

A pay group is a logical grouping of qualifying individuals for payment and contains payees who share pay characteristics. All payees in a pay group must have the same pay frequency (begin, end, and payment dates) and payroll calculation process and belong to the same pay entity.

When you set up a pay group, you define a number of default settings, such as eligibility group and work schedules, that apply to payees associated with the pay group.

However, you can set up pay group rule overrides for earnings and deductions, which is useful when certain rules don't apply to specific groups of payees.

Group together payees who typically receive the same type of earnings and deductions. This enables you to define elements that apply to most members of a pay group. You can create any exceptions through payee-level overrides or override the default pay group.

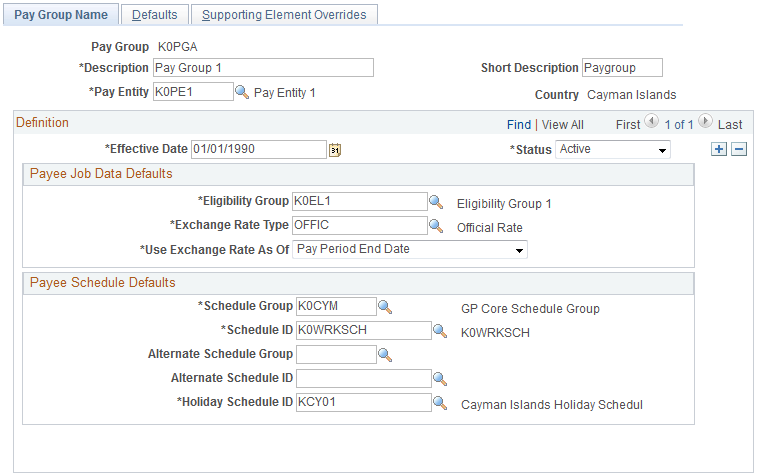

Use the Pay Group Name page (GP_PYGRP_NAME) to define pay group parameters.

Navigation

Image: Pay Group Name page

This example illustrates the fields and controls on the Pay Group Name page.

|

Field or Control |

Definition |

|---|---|

| Pay Entity |

Select the pay entity to associate with this pay group. You can link each pay group with only one pay entity. |

Warning! Once you've processed a payroll, never change the pay entity. Doing so can corrupt your data.

Payee Job Data Defaults

In this group box, you can define numerous default settings for a pay group. The effective date applies to the entire group box; therefore, you can change these options simultaneously if you have schedule, business process, or rule changes.

Note: Not every payee in a pay group has the same eligibility group, exchange rate type, or holiday schedule. You can override any default for an individual on the Job Data - Payroll page. Defaults can be overridden for certain periods of time through effective-dating. On the Job Data - Payroll page, the Global Payroll group box that includes eligibility group, exchange rate type, and holiday schedule information appears only if you set the Payroll System field to Global Payroll.

See Understanding Payee Data, Understanding Job Data.

|

Field or Control |

Definition |

|---|---|

| Eligibility Group |

Select the default eligibility group to associate with this pay group. Apply elements to payees in pay groups through eligibility groups. An eligibility group must be associated with a pay group. A payee is assigned to an eligibility group through the default defined at the pay group level. This default value can be overridden at the payee level. Note: Payees in an eligibility group are eligible for elements at the payee level, but if a payee isn't in an eligibility group for which an element is valid, that payee cannot be eligible for that element. |

|

Field or Control |

Definition |

|---|---|

| Exchange Rate Type |

Select the default exchange rate type that's used for currency conversions for this pay group during processing. You can specify an element in a currency other than the processing currency. During processing, it is converted to the processing currency, using this exchange rate information. Define exchange rate types on the Market Rate Type Page. |

| Use Exchange Rate As Of |

Select the effective date for use in retrieving the exchange rate. The options correspond to the dates that you associate with this pay group. Values are Pay Period Begin Date, Pay Period End Date, and Payment Date. |

Payee Schedule Defaults

Define scheduling defaults for a pay group. Payees can be assigned a work schedule and an alternate work schedule based on the scheduling defaults defined for the payee's pay group.

|

Field or Control |

Definition |

|---|---|

| Schedule Group |

Select the schedule group for the pay group. Schedule groups enable you to categorize schedules into specific groups. |

| Schedule ID |

Select the schedule ID for the pay group. |

| Rotation ID |

Select the rotation ID for the selected the schedule ID. Rotation IDs are used with rotating schedules. Rotating schedules can be assigned to several payees with different schedule begin days. Note: The Rotation ID field only appears if you select a rotating schedule. |

| Alternate Schedule Group |

(Optional) Select an alternate schedule group for the pay group. |

| Alternate Work Schedule |

(Optional) Select an alternate work schedule. A payee can be associated with an alternate work schedule for some absences. |

| Alternate Rotation ID |

(Optional) Select an alternate rotation ID for the pay group. Note: The Alternate Rotation ID field only appears if you select a rotating schedule. |

| Holiday Schedule |

Select the holiday schedule for the pay group. The pay group's holiday schedule is used in processing if you do not select a different holiday schedule for the payee on the Job Data - Payroll page. However, the pay group holiday schedule is not entered as a default on the payee's Job record. |

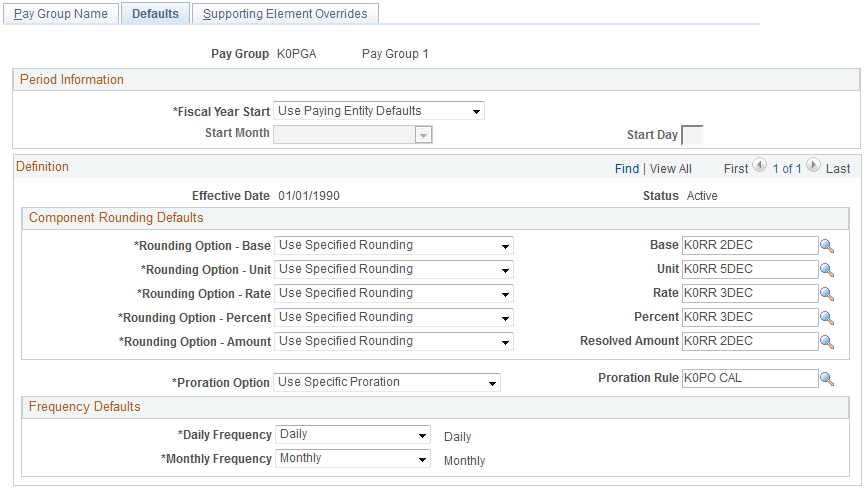

Use the Defaults page (GP_PYGRP_DFLT) to define default rounding, proration, and frequency conditions for a pay group.

Navigation

Image: Defaults page

This example illustrates the fields and controls on the Defaults page.

Period Information

Define dates for your pay group's fiscal year.

|

Field or Control |

Definition |

|---|---|

| Fiscal Year Start |

Define the start date of your organization's fiscal year for this pay group. Values are: Use Paying Entity Defaults: The next two fields become unavailable. Use Specified Start Date: Complete the next two fields. |

| Start Month and Start Day |

Enter the first month and the first day of the start month in your organization's fiscal year. |

Component Rounding Defaults

Specify default rounding rules for earnings and deductions at the pay group level. You can specify rounding for individual earnings and deductions when those elements are defined or direct the system to follow the pay group default settings.

|

Field or Control |

Definition |

|---|---|

| Rounding Option - Base, Rounding Option - Unit, Rounding Option - Rate, Rounding Option - Percent and Rounding Option - Amount |

Select an option to determine whether these components of an earning, deduction, or entitlement element can be rounded before calculation. Values are: No Rounding: Prevents rounding of the component. Use Specified Rounding: Enter a rounding rule in the corresponding field on the right. |

| Resolved Amount |

Select the rounding rule to apply to the resolved amount for earnings and deductions. Rounding occurs after the system resolves the element's calculation rule. Also applies to an earning or deduction element for which the calculation rule is defined as Amount. Values are: No Rounding: Prevents rounding of the amount. Use Specified Rounding: Enter a rounding rule in the field on the right. |

| Proration Option |

Select either No Proration or Use Specific Proration. |

| Proration Rule |

If you selected Use Specific Proration in the Proration Option field, enter the proration rule that is to be used as the default proration rule for elements being used to process this pay group. In defining an earning or deduction element, you can have the system use the pay group default value or have it specify a unique rule for a certain earning or deduction element. |

Frequency Defaults

Use this group box to define the frequency defaults used in multiple pay calculation components.

Note: The system calculates the daily and monthly pay rates that appear on the Job Data - Compensation page based on the frequency factors associated with the pay group assigned to each payee (on the Job Data - Payroll page). As a result, if you use these corresponding daily and monthly rate system elements directly within your Global Payroll rules, you will need to ensure that the frequency factors associated with the pay group coincide with the values to which you expect these values to resolve. Otherwise, rates may not be in sync (because the system retrieves daily and monthly rates directly from Job Data.)