Understanding Segmentation Setup

Segmentation refers to the process of calculating all or a subset of elements in a process list in separate slices or segments. You can segment components of pay based on events such as changes in compensation or employee status during a pay period. For example, if an individual changes jobs during a pay period and your organization separates earnings by job, you can set up the system to trigger segmentation of earning results on the payslip when there's a change to the job change action/reason field in PeopleSoft HR.

This topic discusses:

Types of segmentation.

Relationship of period, segment, and slice dates.

Basic rules of element resolution.

Effective-dated element definitions.

Rules for slicing accumulators and accumulator members.

Rules for parent and child element resolutions.

Segmentation and payee overrides.

Proration and segmentation.

Retroactive processing and segmentation.

Positive input with segmentation.

Segmentation system elements.

This topic discusses:

Types of segmentation.

Selecting elements to segment.

Types of Segmentation

Global Payroll offers two types of segmentation:

Period segmentation

This type of segmentation occurs when data that changes in mid period, such as a compensation rate, requires all elements in the process list to be calculated repeatedly on either side of the change date. The system divides the pay period into two or more distinct segments and treats each segment as a complete and separate payroll calculation. It calculates each element in the process list for each segment, resulting in multiple gross-to-net processes, payslips, and Payee Process Stat records. The system calculates each element using components that were effective during the different time slices.

Element segmentation

This type of segmentation occurs when data that changes in midperiod requires the affected element (and perhaps a subset of other elements) to be calculated repeatedly on either side of the change date. (Each sub-period is called a slice.) The system segments only the elements that you select and it creates separate result rows only for the specified elements. In element segmentation, there is only one gross-to-net result set.

Selecting Elements to Segment

With period segmentation, the system segments all elements on the process list automatically. With element segmentation, you must specify which elements in the process list to slice. To do this, you add the elements to be segmented to an element list that you define using the Segmentation Event Definition page.

For every pay period, the system generates begin and end dates for:

Periods

Pay periods—monthly, biweekly, or weekly—are used to group and calculate a payee's earnings. Each period has a begin and end date and can be sliced or segmented.

Segments

A sub-period of time within the normal pay period that is created due to period segmentation. Each segment represents a separate gross-to-net calculation of every element in the period and has begin and end dates. Individual elements can be sliced within a sub-period.

Slices

The span of time into which an element is segmented due to element segmentation. Unlike a segment or period, it does not represent a separate gross-to-net process, because it affects only a limited set of elements in a period or segment. Like a segment, a slice has begin and end dates.

All three sets of dates (period, segment, and slice) are generated every time a payroll is processed, regardless of whether a period is sliced or segmented. The begin and end dates for periods, segments, and slices, are stored in the output result tables for the period and made available as system-computed elements for use in other calculations.

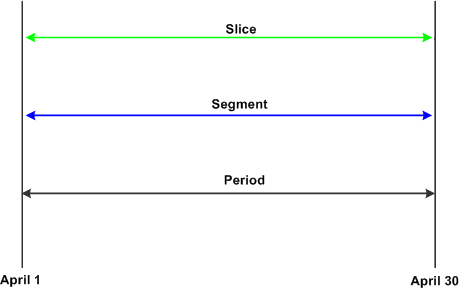

Example 1: Unsegmented Period

In an unsegmented period the number of periods equals the number of segments, which equals the number of slices. All three have identical begin and end dates.

Image: An unsegmented period

This diagram illustrates the relationship between period, segment, and slice begin and end dates in an unsegmented period.

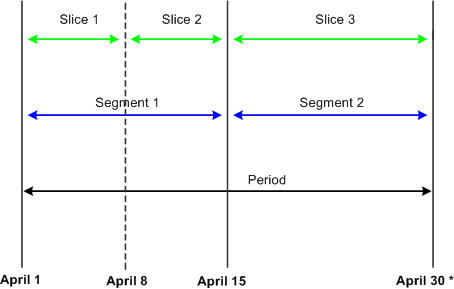

Example 2: Segmented Period

Image: A segmented period

This diagram shows a period with two segments; segment 1 contains a sliced element.

This topic discusses the basic rules of element resolution for period and element segmentation.

Using Period Segmentation

When using period segmentation, all elements are resolved once in each segment.

Using Element Segmentation

When using element segmentation:

Primary elements are resolved once in each slice if they are set up to be sliced.

Supporting elements are resolved once in each slice if they are set up to be sliced.

A supporting element is also resolved in each slice if it is a component of an element that's defined to be sliced. Suppose that an earning element E1 is sliced. If this element uses a duration element (a supporting element) that measures years of service, and the value of earning E1 is based on the years returned by the duration element, the duration element is resolved whenever E1 is resolved, because it's a component of E1.

Note: To define the elements to be sliced, use the Segmentation Event Definition page.

Example of Period Segmentation

In period segmentation, all elements are calculated once for each segment and there are multiple gross-to-net result sets.

This table lists examples of elements, their calculation rules, and the associated period segmentation rules:

|

Element |

Calc Rule |

Base |

% |

Prorate |

|---|---|---|---|---|

|

E1 (Base Pay) |

Amount |

N/A |

N/A |

Yes |

|

E2 |

Base × Percent |

E1 |

10% |

No |

|

D1 (Deduction) |

Base × Percent |

A1 |

10% |

No |

|

A1 (Accum) |

E1 + E2 |

N/A |

N/A |

N/A |

Assume that E1 represents base pay and that the value of E1 increases from 10,000 to 20,000 on September 16, triggering the segmentation of the September pay period into two equal parts. This scenario is represented in the following table:

|

Element |

Segment 1: September 1– September 15 |

Segment 2: September 16– September 30 |

|---|---|---|

|

E1 (Base Pay) |

10,000 × ½ = 5,000 |

20,000× ½ = 10,000 |

|

E2 |

E1, Segment 1 × 10% = (5,000 × 10%) = 500 |

E1, Segment 2 × 10% = (10,000 × 10%) = 1,000 |

|

A1 |

Sum of E1 and E2 for Segment 1 = (5,000 + 500) = 5,500 |

Sum of E1 and E2 for Segment 2 = (10,000 + 1,000) = 11,000 |

|

D1 (Deduction) |

A1 for Segment 1 × 10% = 550 |

A1 for Segment 2 × 10% = 1,100 |

|

Net Pay |

Net Pay for Segment 1 = 4,950 |

Net Pay for Segment 2 = 9,900 |

In this example, all the elements on the process list are segmented and there are two separate gross-to-net calculations.

Example of Element Segmentation

When performing element segmentation, the system slices only those elements that are included in the Element List. The system produces only one gross-to-net result set and includes the sliced elements within a segment or period.

This table lists examples of elements, their calculation rules, and the associated element segmentation rules:

|

Element |

Calc Rule |

Base |

% |

On Element List for Segmentation? |

Prorate |

|---|---|---|---|---|---|

|

E1 (Base Pay) |

Amount |

N/A |

N/A |

Yes |

Yes |

|

E2 |

Base × Percent |

E1 |

10% |

No |

No |

|

D1 (Deduction) |

Base × Percent |

A1 |

10% |

No |

No |

|

A1 (Accum) |

E1 + E2 |

N/A |

N/A |

No |

N/A |

Assume that E1 represents base pay and that the value of E1 increases from 10,000 to 20,000 on September 16, triggering the slicing of element E1 into two equal parts. (The only element defined to be sliced is E1.) This scenario is represented in the following table:

|

Element |

Slice 1: September 1 – September 15 |

Slice 2: September 16 – September 30 |

|---|---|---|

|

E1 (Base Pay) |

10,000 × ½ = 5,000 |

20,000 × ½ = 10,000 |

|

E2 |

Sum of E1 × 10% = (5,000 + 10,000) × 10% = 1,500 |

|

|

A1 (Accumulator) |

Sum of E1 and E2 = (15,000 + 1,500) = 16,500 |

|

|

D1 (Deduction) |

A1 × 10% = (16,500 × 10%) = 1, 650 |

|

|

Net Pay |

14,850 |

E1 is sliced once on September 16, resulting in two separate calculations for E1 — one for each slice. There is only one gross-to-net process, and the Net Pay element represents the sum of E1 in each slice and E2 in each slice minus D1 (deduction 1).

All effective-dated elements contain a Definition as of Date field that tells the system which effective-dated row to use when retrieving the definition of an element. Options include calendar period begin date, calendar period end date, and payment date.

The same Definition As Of Date definition is used for all segments and slices within the period.

This topic describes the rules for slicing accumulators and accumulator members.

Using Period Segmentation

With period segmentation, every element and supporting element is segmented—a situation cannot exist in which an element is segmented but the accumulator to which it belongs isn't segmented.

Using Element Segmentation

The slicing of a member of an accumulator does not cause slicing of the accumulator, but the slicing of an accumulator causes all member elements to be sliced.

Rules for slicing an accumulator that is used as a driver are covered in the topic that discusses multiple resolutions of earnings and deductions.

When an element is composed of (or based on) other elements, the system defines those other elements as child elements and the elements that are based on them as parent elements. Elements and supporting elements can be parents or children.

Say Tax A is a percentage of earning E1 and earning E2 (Tax A = 10% × ( E1 + E2)). In this example, Tax A is the parent and earning E1 and earning E2 are the children. The concept of child and parent elements is central to understanding how an element that is based on other elements is resolved.

Matching and Mismatching Slices and Segments

During period segmentation, all elements are segmented equally, and parent and child elements always match.

During element segmentation, parent and child elements can be sliced equally, or one may be sliced more than the other. For example, the parent might be included in the list of elements to segment, while the child is not. If the parent and child slices are identical, the parent and child are said to match; if they are not identical, they are referred to as mismatching.

Global Payroll follows specific rules for processing matching and mismatched elements. These rules are illustrated in the following examples.

Examples 1–7: Parent Element Is a Primary Element or a Supporting Element

The following cases use these elements:

Earning E1 = Percent of F1 (supporting element).

Earning E3 = Percent of E2 (primary element).

F1 = 100 (supporting element).

E2 = 100 (primary element).

This table summarizes the examples that follow in this topic. The child and parent slices in these examples do not always match, as indicated in the Match/No Match column.

|

Case Number |

Parent Action |

Child Action |

Child Type |

Match/No Match |

Process Rule |

|---|---|---|---|---|---|

|

1 |

Sliced |

Not Sliced |

Primary Element (E2) |

No Match |

Use the value of the child for each slice of the parent. |

|

2 |

Sliced |

Sliced |

Primary Element (E2) |

Match |

Use the slice value of the child for each slice of the parent. |

|

3 |

Sliced |

Sliced |

Primary Element (E2) |

Partial Match Child Sliced More |

Sum the value for each child slice that matches the parent slice. |

|

4 |

Sliced |

Sliced |

Primary Element (E2) |

Partial Match Child Sliced Less |

Use the Slice value of the child where dates match. If they don't match, sum the value of all child slices. May return incorrect values. |

|

5 |

Sliced |

Sliced |

Primary Element (E2) |

No Match |

Sum the value of all child slices. May return incorrect values. |

|

6 |

Not Sliced |

Sliced |

Primary Element (E2) |

No Match |

Sum of the child values. |

|

7 |

Sliced |

Not Sliced |

Supporting Element (F1) |

Not applicable. Matching does not matter when the child is a supporting element. |

Resolve the value of the child for each slice of the parent. (See note following case details.) |

Note: The following examples show the results with and without proration. Prorated amounts are in parentheses.

Case 1

Assumptions:

E2 (primary element) = 100

E3 (primary element) = 10% of E2

Proration on E3

Scenario: Parent is sliced; child is not sliced. Child is a primary element.

For E3 (parent), there are two slices:

Slice 1: 10% of 100 (50)

Slice 2: 10% of 100 (50)

For E2 (child), there is one slice with a value of 100.

Each slice of E3 uses the full value of the child (E2). This causes a warning message to be displayed in the Payee Messages component.

Case 2

Assumptions:

E2 (primary element) = 100

E3 (primary element) = 10% of E2

Proration on E2

Scenario: Parent is sliced; child is sliced. Child is a primary element.

For E3 (parent), there are two slices:

Slice 1: 10% of 100 (50)

Slice 2: 10% of 100 (50)

For E2 (child), there are two slices:

Slice 1: 100 (50)

Slice 2: 100 (50)

When the parent's slice dates equal the child's slice dates, the parent uses the child's value. Although the slice dates match, without proration on the child, the results may be incorrect.

Case 3

Assumptions:

E2 (primary element) = 100

E3 (primary element) = 10% of E2

Proration on E2

Scenario: Parent is sliced; child is sliced more. Slices partially match. Child is a primary element.

For E3 (parent), there are two slices:

Slice 1: 10% of 100 (33.33)

Slice 2: 10% of 200 (33.33 + 33.34)

For E2 (child), there are three slices:

Slice 1: 100 (33.33)

Slice 2: 100 (33.33)

Slice 3: 100 (33.34)

Slice 1 of the parent and child match, so the system sums the child slices (slice 1, in this example). For the second slice of E3 (the parent), the system sums slice 2 and slice 3 of E2 (the child), because the begin date of slice 2 and end date of slice 3 match slice 2 of E3 (the parent). This scenario causes a warning message to be displayed in the Payee Messages component.

Case 4

Assumptions:

E2 (primary element) = 100

E3 (primary element) = 10% of E2

Proration on E2

Scenario: Parent is sliced; child is sliced less. Slices partially match. Child is a primary element.

For E3 (parent), there are three slices:

Slice 1: 10% of 100 (33.33)

Slice 2: 10% of 200 (66.67)

Slice 3: 10% of 200 (66.67)

For E2 (child), there are two slices:

Slice 1: 100 (33.33)

Slice 2: 100 (66.67)

Generally, if the child is a primary element, it should be on the same list of elements to be sliced as the parent element. This ensures that both the child and parent have matching slices. Otherwise, the above scenario could occur and should be avoided.

The resolution is twofold. When there are exact matches (as in slice 1 of the parent and the child), the system uses the child's value. If the parent or the child has proration turned on, the result is correct. The second resolution of the parent sums all resolutions of the child (200, in this example), resulting in an over calculated amount. This is because the system cannot get a match on the slice dates for the parent and the child. Even with proration turned on, the amount of the child is overstated (see the amounts in parentheses).

Case 5

Assumptions:

E2 (primary element) = 100

E3 (primary element) = 10% of E2

Proration on E2

Parent is sliced. Child is sliced. No match on slice dates. Child is a primary element.

For E3 (parent), there are two slices:

Slice 1: 10% of 300 (100)

Slice 2: 10% of 300 (100)

For E2 (child), there are three slices:

Slice 1: 300 (100)

Slice 2: 300 (100)

Slice 3: (100)

Generally, if the child is a primary element, it should be on the same list of elements to be sliced as the parent element. This ensures that both the child and parent have matching slices. Otherwise, the above scenario could occur and should be avoided.

When the parent's slice dates do not match any of the child's slice dates—as in the second resolution in Case 5 — the system sums the value of all child slices for each resolution of the parent. This causes a warning message to be displayed in the Payee Messages component.

Case 6

Assumptions:

E2 (primary element) = 100

E3 (primary element) = 10% of E2

Proration on E2

Parent is not sliced. Child is sliced. No match on slice dates. (Slice dates are not applicable to the parent.) Child is a primary element.

For E3 (parent), there is one slice with a value of 10% of 200 (100)

For E2 (child), there are two slices:

Slice 1: 200 (100)

Slice 2: 200 (100)

When the parent isn't sliced, and the child is—and the child is a primary element—the resolution of the parent element sums the values of all resolutions of the child. This causes a warning message to be displayed in the Payee Messages component.

Case 7

Assumptions:

E1 (primary element) = 10% of F1

F1 (supporting element) = 100

Proration on E1

Parent is sliced. Child is not sliced. Child is a supporting element.

For E1 (parent), there are two slices:

Slice 1: 10% of 100 (50)

Slice 2: 10% of 100 (50)

For F1 (child), there are two slices:

Slice 1: 100

Slice 2: 100

Slice 1 of E1 resolves the child for the slice 1 time period. F1 is sliced because, as a supporting element child, it resolves for each parent's slice.

Note: If a supporting element is populated through an array, bracket, or a formula, then that array, bracket or formula element must be on the same list of elements to slice as the parent. (Define the list of elements to slice using the Element List grid on the Segmentation Event Definition page described in this topic.)

System Generated Warning Messages

During the pay calculation, the system issues a warning message in the following situations if the child element is a primary element and its slice dates don't match the parent's slice dates:

Parent is sliced. Child isn't sliced (see Case 1).

Parent is sliced. Child is sliced. The slice dates of the parent don't match the slice dates of the child (see Cases 3, 4, and 5).

Parent isn't sliced. Child is sliced (see Case 6).

If the child element is an accumulator, a warning message is issued whenever the accumulator's slice dates don't match the parent's slice dates.

Messages are displayed in the Payee Messages component.

You can define two types of overrides at the payee level:

Primary element overrides.

Supporting element overrides.

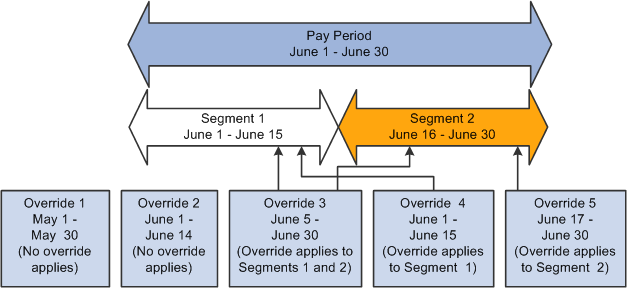

Both type of overrides are called payee level overrides, and the system follows the same basic rules for applying these overrides to segmented and unsegmented periods. Generally, when a pay period has period or element segmentation, payee overrides are applied to a segment based on the segment end date and the end date of the override, following the rules below. The rules are the same for primary and supporting element overrides at the payee level; only primary element overrides are discussed here. Any minor differences in these two types of overrides are clarified in the following examples.

The rules for applying overrides at the payee level are:

Primary element overrides apply to earning, deduction, absence entitlement, and absence take elements, and the overrides must have begin dates. End dates are not required.

Supporting element overrides apply to elements such as variables, formulas, arrays, and brackets.

If an override is to apply to a segment, the end date of the override must equal or be greater (or blank) than the end date of the segment or slice (see @ Overrides 3 and 4 in the diagram that follows)

An override can apply to more than one segment if the end date of the override is greater than one segment's or slice’s end date and greater than or equal to the subsequent segment's or slice’s end date(or blank) (see Override 3 in the diagram that follows).

If the end date of the override is less than the end date of the segment or slice, the override doesn't apply to that segment (see Overrides 1 and 2 in the diagram that follows).

Primary element overrides are prorated if the element is defined to be prorated.

With supporting element overrides, the supporting element is prorated if it's a component of an element that's defined to be prorated and that element is segmented.

Payee overrides must be Active as of the segment or slice end date.

Image: A primary element override

This diagram shows an example of a primary element override.

Overrides 1 and 2 apply to neither segment, because their end dates come before the end dates of Segments 1 and 2.

Override 3 applies to Segments 1 and 2 equally, because its end date is greater than the first segment's end date and greater than or equal to the second segment's end date.

Override 4 applies to Segment 1 because its end date is greater than or equal to the end date of Segment 1 and less than the end date of Segment 2.

Override 5 applies to Segment 2, because its end date is equal to the end date of Segment 2 and its begin date is after the end date of Segment 1.

The following examples offer a more detailed view of how payee overrides are applied to segmented and unsegmented periods:

Scenario: Two payees are eligible to receive an earning element (E1) whose value is 100. Assume that Payee 1 has no segmentation and that Payee 2 has period segmentation in the January pay period. The segment dates for Payee 2 are January 1, 2005−January 15, 2005 and January 16, 2005 – January 31, 2005. The payees have identical supporting element overrides, and the pay period being processed is January 1, 2005 – January 31, 2005. This table lists cases that show how the system applies primary element overrides:

Note: In this example, override is abbreviated Over.

|

Case |

Over. Begin Dt |

Over. End Dt |

Over. Value |

Payee 1 Results |

Payee 2 Results |

Reasons |

|---|---|---|---|---|---|---|

|

1 |

Jan. 1, 2000 |

Dec. 31, 2004 |

200 |

100 |

100 |

End date is less than period/segment end date. |

|

2 |

Jan. 1, 2000 |

Jan. 5, 2005 |

200 |

100 |

100 |

End date is less than period/segment end date. |

|

3 |

Jan. 1, 2005 |

Jan. 5, 2005 |

200 |

100 |

100 |

End date is less than period/segment end date. |

|

5 |

Jan. 5, 2005 |

Jan. 20, 2005 |

200 |

100 |

S1=200 S2=100 |

For Payee 2, Segment 1 uses the override because the end date is greater than Segment 1's end date. |

|

6 |

Jan. 20, 2005 |

Jan. 25, 2005 |

200 |

100 |

100 |

The override's begin date is greater than Segment 1's end date and its end date is less than Segment 2's end date, so the override doesn't apply to either segment of Payee 2. For Payee 1, the override's end date is less than the end date of the period, so no override applies. |

|

7 |

Jan. 5, 2005 |

Jan. 31, 2005 |

200 |

200 |

S1=200 S2=200 |

The override's begin date is before the end date of Segment 1, and its end date is greater than or equal to the end dates of both segments, so it applies to both segments. |

|

8 |

Jan. 20, 2005 |

Feb. 1, 2005 |

200 |

200 |

S1=100 S2=200 |

For Payee 2, Segment 1 doesn't use the override, because the override's begin date is greater than Segment 1's end date. |

Note: Although these examples refer to period segmentation, the same basic rules apply to element segmentation: if a sliced element is overridden at the payee level, the override applies to the slices just as it applies to segments with period segmentation.

When you set up the Global Payroll system up to segment earnings, deductions, or absence entitlement elements in a pay run, you can also instruct the system to generate prorated calculation results for these elements based on such factors as the number of work hours or days in each slice/segment relative to the total number of work hours or days in the pay period. To do this, you must associate each earning, deduction, or absence entitlement element you want to prorate with a proration rule on the element definition pages. Then, when segmentation or slicing occurs, the element automatically calls the appropriate proration factor.

This topic discusses:

Segmentation with proration.

Segmentation without proration.

Segmentation and proration of earning and deduction assignments.

Segmentation with Proration

To have the system prorate a segmented earning, deduction, or frequency-based entitlement element, specify proration as part of the element's definition.

You must define the proration rule to use in segmentation processing, because the rule is not hard-coded. Generally, a proration rule that you define consists of a numerator, representing the slice or segment, and a denominator, representing the entire pay period.

You can determine how to define the numerator and denominator that constitute the proration factor. The numerator and denominator can be any of these elements:

Accumulator

Count

Duration

Formula

Variable

Note: When you define a proration element, the Always Recalculate check box on the Proration Name page is automatically selected. This is to ensure that the system correctly calculates the proration factor when there is element segmentation.

Note: You can also use the PRORATE system element to invoke proration for an earning or deduction element, even when there's no segmentation.

See Defining Proration Rules, Earnings - Rounding/Prorations Page.

Segmentation without Proration

To apply segmentation without proration, select the No Proration option on the Rounding/Proration page of the Earning/Deduction Definition component or the Absence Entitlement component.

This table provides an example of segmentation without proration:

|

Element |

Calc Rule |

Base |

% |

On Element List for Segmentation? |

Prorate |

|---|---|---|---|---|---|

|

E1 (Base Pay) |

Amount = 20,000 |

N/A |

N/A |

Yes |

No |

|

E2 |

Base × Percent |

E1 |

10% |

No |

No |

|

A1 (Accum) |

E1 + E2 |

N/A |

N/A |

No |

N/A |

|

E3 |

Base × Percent |

A1 |

10% |

No |

No |

Note: You can slice or segment a period without applying proration, but an element cannot be prorated unless there is segmentation.

Assume that E1 represents base pay and that E1 is sliced on September 16, halfway through the pay period. None of the interrelated elements are defined to be prorated. This scenario is represented in this table:

|

Element |

Slice 1: September 1– September 15 |

Slice 2: September 16– September 30 |

|---|---|---|

|

E1 (Base Pay) |

20,000 |

20,000 |

|

E2 |

(E1, Slice 1 + E1, Slice 2) × 10% = (20,000 + 20,000) × 10% = 4,000 |

|

|

A1 (Accumulator) |

Sum of E1 (Slice 1 + 2) and E2 = (40,000 + 4,000) = 44, 000 |

|

|

E3 |

A1 × 10% = (44,000 × 10%) = 4,400 |

Because E1 is not defined to be prorated, the system incorrectly calculates the value of E1 in each slice (slices 1 and 2) as 20,000 (the true value in each slice should be 20,000 × ½). This leads to additional errors: When E2 is calculated, the system sums up E1 in each slice, to yield a value of 40,000 × 10% (the correct amount is 20,000 × 10%). Similarly, A1 resolves to 44,000 instead of 22,000. And E3, defined as A1 × 10%, resolves to 44,000 × 10%, yielding 4,400 (the correct result is 2,200).

It's important to understand why segmentation does not automatically result in proration. For example, if E2 is a percentage of E1 and both are sliced, E1, but not E2, is prorated.

Segmentation and Proration of Earning and Deduction Assignments

In Global Payroll you can define segmentation triggers only for effective dated records, with one exception: you can define segmentation triggers for the begin and end dated earning and deduction assignment record GP_PYE_OVRD. The purpose of this exception is to enable you to assign an earning or deduction to a payee on the Element Assignment by Payee (GP_ED_PYE) or Payee Assignment by Element (GP_ED_ELEM) components and have the system segment—and prorate— the element when the assignment begin date comes after the pay period begin date, and/or the assignment end date comes before the period end date. If you want the system to prorate the calculation results, you must specify proration as part of the element's definition.

Note: The steps for configuring the system to slice a pay period based on the begin and end dates of the overrides assigned to a payee on the Element Assignment by Payee (GP_ED_PYE) and Payee Assignment by Element components (GP_ED_ELEM) are almost identical to those used for standard segmentation setup, and are discussed in detail in the topic on setting up triggers.

When a retroactive trigger is generated in response to an event, the system writes the effective date of the change to trigger tables in Global Payroll. The system uses this date to determine how far back in time to recalculate closed periods, using this logic:

Without backward limits, the system takes the effective date of the change that triggers retroactive processing, returns to the first calendar period in which the effective date falls, and calculates the entire period and everything going forward.

If the effective date of the retroactive change falls in mid period, the system doesn't automatically segment the period or use proration when recalculating original pay items (because it tries to recalculate the entire period).

Segmentation triggers remain active and available to the system because they may be needed for future retroactive processing.

Like payee level overrides, positive input enables you to override the value of an element in a pay period. And like payee overrides, positive input uses begin and end dates (the begin and end dates are optional with positive input). Thus, when a calendar pay period has period or element segmentation, positive input is assigned to a segment or slice based on the end date of the instance. Unlike payee overrides, positive input is applied only to a single element or slice and is never prorated. Other rules that affect the assignment of positive input are:

If the begin and end dates of the instance precede the calendar begin date, positive input is assigned to the first segment or slice.

When no begin or end date is specified for the instance, the system assigns the instance to the last segment or slice in the pay period.

It's assumed that the end dates for the instance and calendar are the same.

This table lists the system elements that are delivered for segmentation:

|

System Element |

Description |

|---|---|

|

FIRST ACT SEGMENT |

First Active Segment (Y/N) Indicates whether the segment that is being processed is the first active segment within the calendar period. |

|

FIRST SEGMENT |

First Segment (Y/N) Indicates whether the segment that is being processed is the first segment within the calendar period. |

|

LAST ACT SEGMENT |

Last Active Segment (Y/N) Indicates whether the segment that is being processed is the last active segment within the calendar period. |

|

LAST SEGMENT |

Last Segment (Y/N) Indicates whether the segment that is being processed is the last segment within the calendar period. |

|

SEGMENTATION-PRD |

SEGMENTATION-PRD indicates whether the segment being processed is the same as the calendar period (it indicates whether period segmentation has occurred) by returning the following values: 1 (true) if the segment being processed does not match the calendar period and 0 (false) if this segment does match the calendar period. |

|

SEGMENTATION-ELEM |

SEGMENTATION-ELEM indicates whether the slice being processed is the same as the calendar period (it indicates whether element segmentation has occurred) by returning the following values: 1 (true) if the slice being processed does not match the calendar period and 0 (false) if this slice does match the calendar period. |