Recording One-Time Deductions

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PAY_SHEET_ADD_D |

Enter a one-time deduction to take in the current pay period only, override an existing deduction, increase an existing deduction, refund a deduction amount, or increase or decrease an arrears payback. |

|

|

By Payline - One-Time Deductions Page Payline One-Time Deductions Page |

PAY_SHEET_LINE_D |

Enter a one-time deduction to take in the current pay period only, override an existing deduction, increase an existing deduction, refund a deduction amount, or increase or decrease an arrears payback. |

|

By Payline Security - One-Time Deductions Page |

PAY_SHEET_LN_D |

Enter a one-time deduction to take in the current pay period only, override an existing deduction, increase an existing deduction, refund a deduction amount, or increase or decrease an arrears payback. |

The system computes regular deductions based on deduction data at the company level and the employee level. You can make permanent or one-time changes to deduction data.

One-Time Deduction Overrides

While each One-Time Deduction record corresponds to a Pay Earnings record, the one-time deduction is based on all the pay earnings that are associated with the employee. The only exception is when you associate the one-time deduction with a pay earnings that you pay on a separate check.

For example, Jan has two Pay Earnings records:

One for her regular salary of 1,000 USD.

One for a bonus of 500 USD.

Assume Jan received the bonus for her work in the Controller's department and you don't want to charge it to her regular department, the Office of the President. Jan also decided to take an additional 10 percent from her regular pay for this pay period to apply to her loan payback.

To accommodate Jan's request:

Access her payline, using the Payline Earnings page.

In her regular Pay Earnings record, select the By Paysheet - One-Time Deductions page.

Enter the 10 percent loan payback.

Create a second Pay Earnings record for the 500 USD bonus.

Because you don't want the loan payback to affect her bonus check, enter a separate check number of 1 and a Bonus reason code.

Otherwise, the one-time deduction applies to all her Pay Earnings records.

Note: When an employee transfers mid-period, the system creates two paysheets and takes all deductions on both paysheets. To prevent the system from taking deductions on both paychecks, use the one-time deduction override option for one of the paysheets and set the deductions to None.

Permanent Deduction Overrides

To make a permanent change to deduction data, use:

The Deduction Table pages to change the basic attributes of a deduction.

One of the Benefits Table pages or the General Deduction Table page to change how the system calculates a deduction.

The General Ded Code Override page (for nonbenefit deductions) or the Override Benefits Deductions page (for benefit deductions) to override processing parameters at the employee level that are normally controlled by the Deduction table.

The Create General Deductions page to change employee-specific deduction data not governed by the Deduction table.

(CAN) Canadian One-Time Before Tax Deductions

Consultation with the Canada Revenue Agency (CRA) has prompted PeopleSoft to revise our treatment of one-time before-tax deductions associated with specific taxation methodologies.

PeopleSoft's basic methodology is to derive Pay Period Taxable Gross as: Taxable Earnings plus Taxable Benefits less Before-Tax Deductions.

The calculation methodology the system uses to derive Annual Taxable Income depends on the tax method that is used (annualized, bonus, or both annualized and bonus on a single cheque).

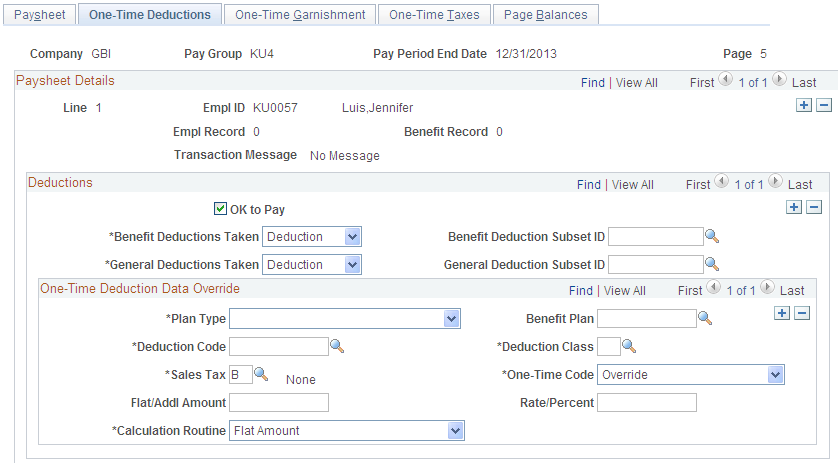

Use the By Paysheet - One-Time Deductions page (PAY_SHEET_ADD_D) to enter a one-time deduction to take in the current pay period only, override an existing deduction, increase an existing deduction, refund a deduction amount, or increase or decrease an arrears payback.

Navigation

Image: By Paysheet - One-Time Deductions page

This example illustrates the fields and controls on the By Paysheet - One-Time Deductions page.

Deductions

|

Field or Control |

Definition |

|---|---|

| OK to Pay |

The default comes from the paysheet. |

| Benefit Deductions Taken |

During the Create Paysheet process, the initial value comes from the deduction override evaluation processing. When a paysheet is manually entered, the initial value comes from the pay calendar. You can override it after the paysheet is created. Values include:

|

| General Deductions Taken |

During the Create Paysheet process, the initial value comes from the deduction override evaluation processing. When a paysheet is manually entered, the initial value comes from the pay calendar. You can override it after the paysheet is created. Values include:

|

One-Time Deduction Data Override

|

Field or Control |

Definition |

|---|---|

| Deduction Code and Deduction Class |

The deduction code must match the code for the deduction type that you are adjusting. To create a one-time override for both the 401(k) before-tax and after-tax deductions, create two entries: one for a deduction classification of after-tax, the other for before-tax. |

| (CAN) Sales Tax |

For one-time deductions that attract sales tax (provincial sales tax on insurance, provincial sales tax, provincial premium tax, Quebec sales tax on insurance, Quebec sales tax, Quebec provincial tax, goods and services tax, or harmonized sales tax), you do not need to enter the sales tax classification here. The Pay Calculation process generates the sales tax amounts. If you enter a one-time sales tax deduction only, the system processes it accordingly. |

| One-Time Code |

Select from the following:

|

| Calculation Routine, Flat/Addl Amt (flat or additional amount) and Rate/Percent |

Define how to calculate the deduction. The available options include Calculated by Salary System, Default to Deduction Table, Flat Amount, Percentage of Federal Gross, Percent of Net Pay, Percent of Special Earnings, Percent of Total Gross, Percentage, Rate x Hours Worked, Rate x Special Hours, Rate x Total Hours, or Special Deduction Calculation. If you select Flat Amount, enter the amount in the Flat/Addl Amt field. If you select any of the options that use a percentage or a rate, enter the percentage or rate in the Rate/Percent field. If you select a calculation routine that uses a rate or percent, you can enter an additional flat dollar amount to deduct. |