Setting Up Group-Term Life Insurance in Canada

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DEDUCTION_TABLE2 |

(CAN) Specify deduction classifications and sales taxes applicable to deduction codes that are used for group-term life insurance. |

Group-term life insurance that employers provide to employees and their dependents is a special type of benefit subject to taxation and reporting requirements. In Canada, the value of all employer-paid premiums for group-term life insurance on employees and their dependents constitutes a taxable benefit.

To calculate the taxable benefit for all group-term life plans, the system performs the following processes when you run the Pay Calculation COBOL SQL process (PSPPYRUN):

Determines an employee's total life insurance coverage (all plans that have a taxable benefit component defined), including both employer- and employee-paid coverage.

For example, an employee might belong to several group-term life plans, such as basic life, supplemental life, and dependent life coverage. In this case, the system combines the calculated coverage of all the plans to determine the employee's total life insurance coverage. (Any plans that are completely employee-paid should not have a taxable benefit defined).

Determines the percentage of the total for each plan.

Calculates the taxable benefit based on the actual cost to the employer.

For example, if the employer pays 1 CAD for every 1,000 CAD of coverage, and the employee has 50,000 CAD of coverage, the system multiplies 1 CAD by 50 to arrive at 50 CAD, which it uses in the following step.

Subtracts employee-paid, after-tax contributions to the coverage.

The law stipulates that if an employee contributes to the total cost of coverage, then you must subtract the amount of the employee contribution from the total cost of coverage. The resulting amount is considered the taxable benefit—the amount that is included in the employee's taxable gross. The system uses only after-tax deduction classifications; it ignores before-tax deductions. The system does not take into account one-time paysheet adjustments, but rather recalculates these at the end of the year.

The system adds the resulting amount added to the employee's taxable gross in the Paycheque record. View this amount using the Paycheque Deductions page. It appears as the taxable benefit under the appropriate group-term plan type and deduction code.

Example

Suppose a Canadian employee has three plans:

|

Plan Type |

Benefit Plan |

Coverage Amount |

Premium |

|---|---|---|---|

|

20 |

Life |

100,000 CAD |

Employer-paid premium: 50 CAD Employee-paid premium: 50 CAD 1 CAD per 1,000 CAD |

|

21 |

Supp Life (supplemental life) |

150,000 CAD |

Employer-paid premium: 50 CAD Employee-paid premium: 100 CAD 1 CAD per 1,000 CAD |

|

25 |

Dep Life |

50,000 CAD |

Employee-paid premium: 50 CAD (All employee-paid—no taxable benefit) |

The system calculates imputed income as follows:

Determine total life insurance coverage for plans subject to taxable benefits:

Life: 100,000 CAD.

Supplemental Life: 150,000 CAD.

Determine the percentage of total for each plan:

Life: 40 percent.

Supplemental Life: 60 percent.

Calculate the taxable benefit based on the actual cost to the employer:

Life: 60 CAD x frequency factor / number of days in contract.

Supplemental Life: 300,000 CAD / 1,000 CAD x 1.17 CAD = 351.00 CAD.

Subtract employee-paid, after-tax contributions to the coverage:

20 Life: 100 CAD − 50 CAD = 50 CAD.

21 Supplemental Life: 150 CAD − 100 CAD = 50 CAD.

The employee's Paycheque Deduction record displays:

|

Plan Type |

Benefit Plan |

Deduction Classification |

Premium |

|---|---|---|---|

|

20 |

Life |

After-Tax |

50 CAD |

|

20 |

Life |

Taxable Benefit |

50 CAD |

|

21 |

Sup (supplemental) |

After-Tax |

100 CAD |

|

21 |

Sup |

Taxable Benefit |

50 CAD |

|

25 |

Dep |

After-Tax |

50 CAD |

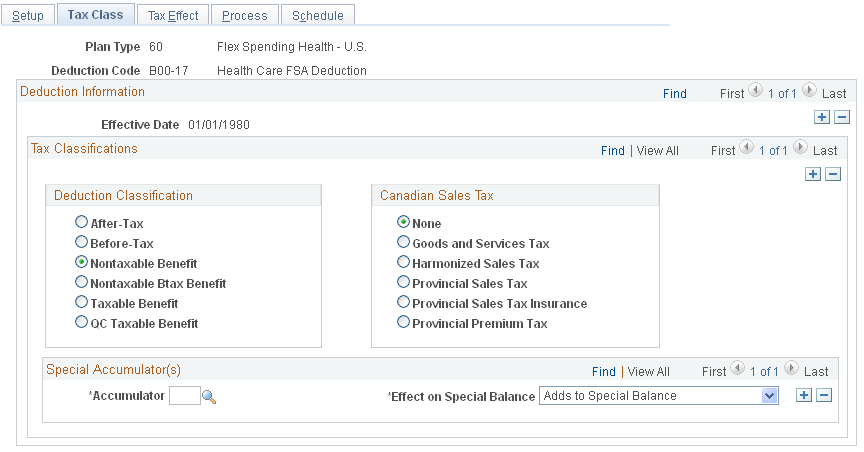

(CAN) Use the Deduction Table - Tax Class page (DEDUCTION_TABLE2) to specify deduction classifications and sales taxes applicable to deduction codes that are used for group-term life insurance.

Navigation

Image: Deduction Table - Tax Class

This example illustrates the fields and controls on the Deduction Table - Tax Class.

When you enter the page, select a life insurance plan type.

Deduction Classification

After-Tax and Taxable Benefit are the deduction classification options. All group-term life plans must have a taxable benefit deduction classification when employer paid for the system to calculate imputed income amounts and consider them income eligible for federal and provincial tax purposes:

For employee contributions to the group-term life insurance, define an after-tax deduction classification.

For employer contributions to the group-term life insurance, define a taxable benefit deduction classification.

Canadian Sales Tax

In Ontario and Quebec, premium contributions are subject to provincial sales tax on insurance (PSTI). For these provinces, define a sales tax type of PSTI, which is associated with both after-tax and taxable benefit deduction classifications.

The employee's province of residence on the Contact Information page in the Personal Data component (PERSONAL_DATA) determines the provincial rate that the system uses when calculating the employee portion of a deduction that is subject to PSTI. The system uses the province in which the employee works to determine and calculate the provincial rate for the employer portion. All other sales tax types use the employee's work location to determine the provincial rate.