Defining Stock Details

To define stock details, use the Stock Details (STOCK_DTL) component.

Use this component to define the attributes of your stock that can change over time, such as the transfer agent, rounding rules, and earnings codes. You can change a stock's attributes, such as when a stock changes from private to publicly traded, and maintain consistency of the other features of the stock.

Generate the Stock Detail report (STSU019) to view stock detail information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

STOCK_DTL1 |

Define general characteristics of the stock, such as public/private status, SEC registration, and escrow and transfer agents. |

|

|

STOCK_DTL2 |

Define rules common to stock option and stock purchase plans, including fractional share, stock price, and non-trading day rules. |

|

|

STOCK_DTL3 |

Define rules specific to stock option plans, such as earnings codes, company share limit, ISO limit rule, captive broker, and agreement details. |

|

|

STOCK_DTL_SEC1 |

Define stock option earnings codes. |

|

|

STOCK_DTL4 |

Define rules specific to stock purchase plans, such as earnings codes, purchase value limit, and captive broker. |

|

|

STOCK_DTL_SEC2 |

Define the stock purchase earnings codes for disqualified and qualified dispositions. |

|

|

Stock Details - Contact Page |

STOCK_DTL5 |

Add the name, phone number, email address, and fax number of the stock administrator. |

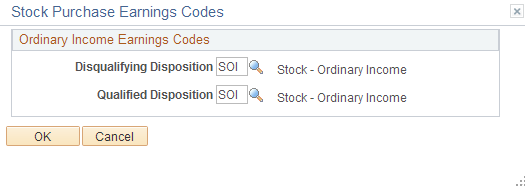

Use the Stock Details - General page (STOCK_DTL1) to define general characteristics of the stock, such as public/private status, SEC registration, and escrow and transfer agents.

Navigation

Image: Stock Details - General page

This example illustrates the Stock Details - General page.

|

Field or Control |

Definition |

|---|---|

| Public/Private |

Selecting Private indicates that the stock is not publicly traded on an exchange and the Maintain Daily Prices page displays only Private. The default is Public. |

| SEC Registered |

Select if your company's stock is registered with the SEC. |

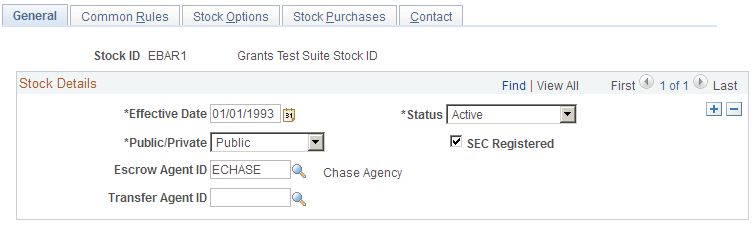

Use the Stock Details - Common Rules page (STOCK_DTL2) to define rules common to stock option and stock purchase plans, including fractional share, stock price, and non-trading day rules.

Navigation

Image: Stock Details - Common Rules page

This example illustrates the Stock Details - Common Rules page.

|

Field or Control |

Definition |

|---|---|

| FMV Method |

Select the method to determine fair market value. FMV methods are defined on the FMV Method Table page. |

| Net Earnings Code |

Select the earnings code that is used to net out the taxes sent to Payroll for North America so that a check is not generated. |

| Decimal Places |

Specify how many decimal places to use for fractional shares and stock prices. Enter a number from 1 to 6. |

| Rounding Rule |

Specify how to round the fractional shares and stock prices. |

| Holiday |

Determine which day's price to use when an FMV calculation includes a holiday. Values are Previous Trading Day and Next Trading Day. |

| Weekend |

Specify the combination of day's prices to use when an FMV calculation includes a weekend. Values are:

|

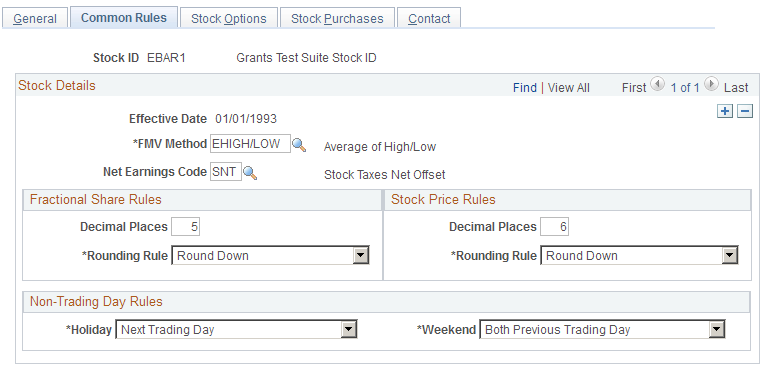

Use the Stock Details - Stock Options page (STOCK_DTL3) to define rules specific to stock option plans, such as earnings codes, company share limit, ISO limit rule, captive broker, and agreement details.

Navigation

Image: Stock Details - Stock Options page

This example illustrates the Stock Details - Stock Options page.

|

Field or Control |

Definition |

|---|---|

| Stock Option Earnings Codes |

Click to access the Stock Option Earnings Code page, where you can define stock option earnings codes. |

| Year Rule |

Select either Calendar Year or Fiscal Year to indicate how your company calculates any company-mandated annual share limits on stock option grants to optionees. Select Calendar Year if your company does not impose a share limit. If you select Fiscal Year, use the Stock Fiscal Year page to define the fiscal year. |

| Limit Rule |

Select Stock Limit if your company limits the number of shares granted to each optionee for this stock ID. Select Plan Limit if your company limits the number of shares granted to each optionee by stock plan. |

| Optionee Limit |

Enter the number of shares each optionee is limited to. This field is available if you select Stock Limit as the limit rule. |

| Vesting Rule |

Specify the rule to use for handling the amount over the ISO limit. Select Even Distribution of ISO to use the same percentage over the limit to determine the total non-qualifying (NQ) shares. Select Maximum ISO limit each year to use the actual percentage over the limit to determine the total NQ shares. |

| Repricing Rule |

Select the rule for determining how repriced grants contribute to the ISO limit. Select First Exercisable All Years to look at the shares first exercisable in all years. Select First Exercisable as of Reprice to look at the shares first exercisable the year of the reprice up to the reprice date. |

| Use Captive Broker |

Select to require that participants use a captive broker for options transactions that require a broker. |

| Prompt Option Agreement |

Select to have the system display a warning message for exercise transactions that do not have a related agreement on file. |

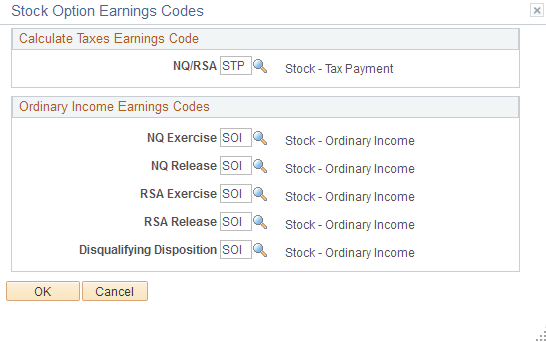

Use the Stock Option Earnings Codes page (STOCK_DTL_SEC1) to define stock option earnings codes.

Navigation

Click the Stock Option Earnings Codes link on the Stock Details - Stock Options page.

Image: Stock Option Earnings Codes page

This example illustrates the Stock Option Earnings Codes page.

Select the earnings codes for sending option income and taxes to Payroll for North America. The payroll system can then include these amounts in the employee's year-to-date earnings totals and taxes.

Calculate Taxes Earnings Code

Select the tax earnings code to use for stock option transactions.

Ordinary Income Earnings Codes

Select the ordinary income earnings code to use for each type of stock option transactions.

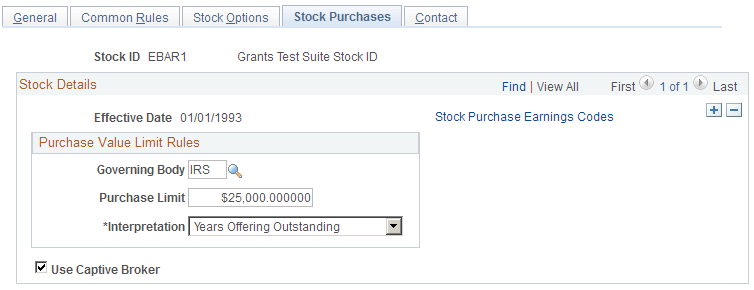

Use the Stock Details - Stock Purchases page (STOCK_DTL4) to define rules specific to stock purchase plans, such as earnings codes, purchase value limit, and captive broker.

Navigation

Image: Stock Details - Stock Purchases page

This example illustrates the Stock Details - Stock Purchases page.

|

Field or Control |

Definition |

|---|---|

| Stock Purchase Earnings Codes |

Click to access the Stock Purchase Earnings Codes page, where you can define ordinary income earnings codes for disqualifying and qualifying dispositions. |

| Governing Body |

The regulatory body that governs equity compensation plans. |

| Purchase Limit |

By default, this field displays the purchase value limit defined on the Governing Body Rules- Stock Purchase Rules page. You can change the value. |

| Interpretation |

Select Calendar Year if the purchase limit spans a calendar year. Select Years Offering Outstanding if the purchase limit spans an offering period greater than a calendar year. |

| Use Captive Broker |

Select to require that participants use a captive broker for stock purchase transactions that require a broker. |

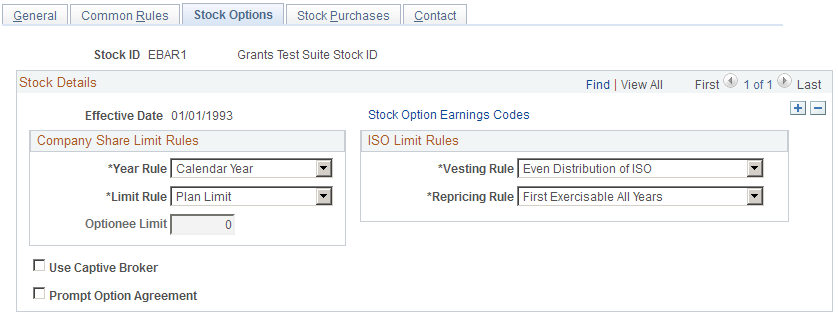

Use the Stock Purchase Earnings Codes page (STOCK_DTL_SEC2) to define the stock purchase earnings codes for disqualified and qualified dispositions.

Navigation

Click Stock Purchase Earnings Codes on the Stock Details - Stock Purchases page.

Image: Stock Purchase Earnings Codes page

This example illustrates the Stock Purchase Earnings Codes page.