Defining Stock Purchase Plan Rules

To define stock purchase plan rules, use the Stock Purchase Plan Rules (ST_ESPP_PLAN) component.

The Stock Purchase Plan Rules component defines the details of the stock purchase plan that can change over time. Use the effective-dated table to define plan level details for each stock purchase plan that you offer.

Generate the Stock Purchase Plan Rules report (STSU022) to view stock purchase plan rules information.

Note: Before you define your plan rules, you must define a stock plan ID using the Stock Plan page and a stock plan in the Stock Plan Table component. You must also have the benefits administrator define a benefit plan ID.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ST_ESPP_PLAN1 |

Define basic rules for a stock purchase plan and link the stock plan to a benefit plan. Define plan details, such as the governing body, offering type, and when participants can enroll. |

|

|

Plan Comments Page |

ST_ESPP_PLAN7 |

Add comments about the stock purchase plan. |

|

ST_ESPP_PLAN2 |

Select FMV methods and specify rules for nontrading days. |

|

|

ST_ESPP_PLAN3 |

Define limits for the offering period and the purchase period, including period lengths and applicable company limits. |

|

|

ST_ESPP_PLAN4 |

Define the purchase rules of your plan, such as purchase price calculation and share and price rounding rules. |

|

|

ST_ESPP_PLAN5 |

Define the contribution rules. |

|

|

ST_ESPP_PLAN6 |

Define the holding period for dispositions, that is, the number of months participants must hold the stock before they can sell it. This holding period is independent of the IRS holding requirements for qualified Section 423 plans. |

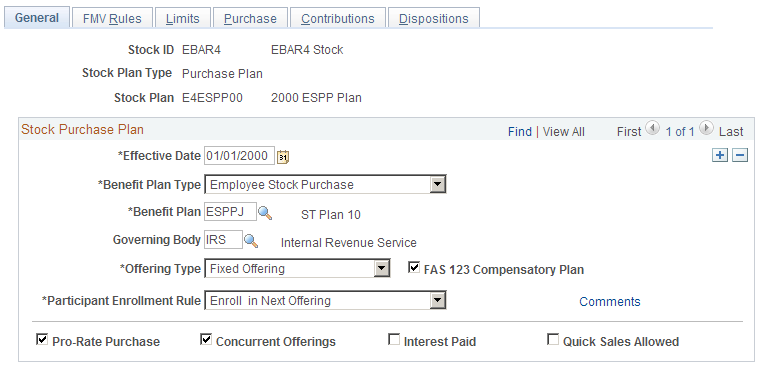

Use the Stock Purchase Plan Rules - General page (ST_ESPP_PLAN1) to define basic rules for a stock purchase plan and link the stock plan to a benefit plan.

Define plan details, such as the governing body, offering type, and when participants can enroll.

Navigation

Image: Stock Purchase Plan Rules - General page

This example illustrates the Stock Purchase Plan Rules - General page.

|

Field or Control |

Definition |

|---|---|

| Benefit Plan |

Select a benefit plan that matches the stock plan you selected. This is where you link the two plan codes. |

| Governing Body |

The default is IRS. |

| Offering Type |

If you select Fixed, the offering end date for all the participants is the same no matter when they enrolled in the offering. If you select Rolling, the offering end date is measured from the date on which the participants enroll with multiple offerings outstanding. For both offering types, the offering begin date of a subsequent offering can't be earlier than the offering end date of the previous offering. |

| FAS 123 Compensatory Plan |

Select if your plan is compensatory as defined by FAS 123. |

| Participant Enrollment Rule |

Select one of the following rules that governs when new participants enroll in a stock purchase plan: Enroll in Next Purchase Period: Enrolls the participant in the first purchase period for which the period begin date for the purchase period is greater than or equal to the coverage begin date, regardless of the offering. After you've identified the purchase period, the system assigns the offering of that purchase period and the first grant date before the purchase period begin date of the offering. Enroll in Next Offering: Enrolls the participant in the first offering period for which the period begin date for the offering period is greater than or equal to the coverage begin date. After you've identified the offering period, the system assigns the first purchase period within the offering and the first grant date within the offering period. Enroll in Current Offer/Pur Pd: Enrolls the participant in the current offering and purchase period. The system determines the current offering and purchase period by finding the first grant date greater than or equal to the coverage begin date. It assigns the offering based on the grant date and then the purchase period within the offering by selecting the first purchase period for which the purchase period begin date greater than or equal to the grant date. User Defined: Does not enroll participants. Use this to import enrollments, modify the update participants process, or manually enter the enrollments. |

| Comments |

Select to access the Plan Comments page, where you add comments. |

| Pro-Rate Purchase |

Select to prorate purchases. If you select this, you can enter a prorate factor on the Stock Purchase - General page. |

| Concurrent Offerings |

Select if your plan allows more than one active offering at a given time. |

| Interest Paid |

Select if you pay interest on contributions. This field is informational only. |

| Quick Sales Allowed |

Select to enable quick sales at the individual issuance level. This field is informational only. |

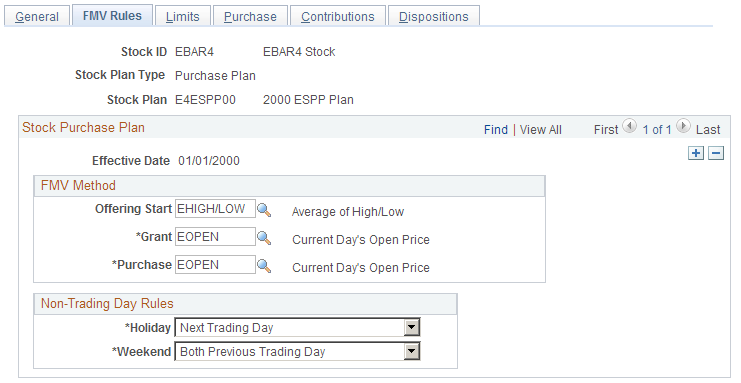

Use the Stock Purchase Plan Rules - FMV Rules page (ST_ESPP_PLAN2) to select FMV methods and specify rules for nontrading days.

Navigation

Image: Stock Purchase Plan Rules - FMV Rules page

This example illustrates the Stock Purchase Plan Rules - FMV Rules page.

You define which method to use for calculating the stock FMV. You may chose to use different methods for different types of transactions.

FMV Method

Define a method to determine the stock values at various points in the stock purchase process. You define the FMV methods using the FMV Method Table page. These methods supersede the FMV defined in the Stock Details component for these specific events.

|

Field or Control |

Definition |

|---|---|

| Offering Start |

Select an FMV method. This field is informational only. |

| Grant |

Select an FMV method. This field represents the grant FMV based on a participant's grant date. It might be used to determine the purchase price. |

| Purchase |

Select an FMV method. This field is used to calculate the ordinary income for dispositions. Depending on your purchase plan rules, it may be used to determine the purchase price. |

Non-Trading Day Rules

The system accounts for all days in a calendar year. The days that are not market trading days must be identified as such. Therefore, define a method to account for these nontrading days. The methods below supersede the holiday and weekend FMV rules defined in the Stock Details component.

|

Field or Control |

Definition |

|---|---|

| Holiday |

When a FMV calculation includes a holiday, select Previous Trading Day to use the previous trading day's price, or Next Trading Day to use the next trading day's price. |

| Weekend |

When a FMV calculation includes a weekend, select one of the following: Both Previous Trading Day: Uses the previous trading day's price for both weekend days. Both Next Trading Day: Uses the next trading day's price for both weekend days. Saturday Previous - Sunday Next: Uses the previous trading day's price for Saturday and the next trading day's price for Sunday. Saturday Next - Sunday Previous: Uses the next trading day's price for Saturday and the previous trading day's price for Sunday. |

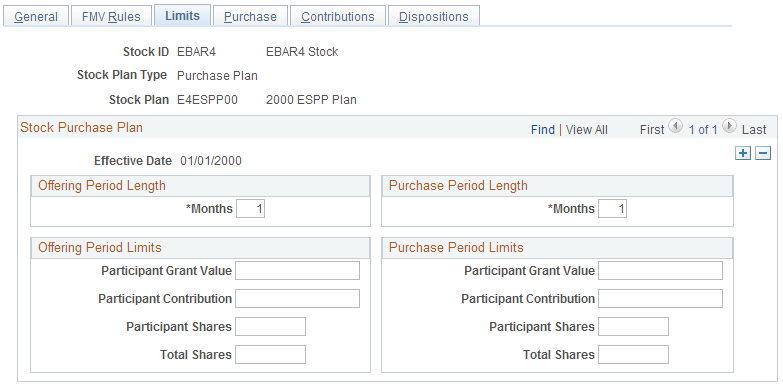

Use the Stock Purchase Plan Rules - Limits page (ST_ESPP_PLAN3) to define limits for the offering period and the purchase period, including period lengths and applicable company limits.

Navigation

Image: Stock Purchase Plan Rules - Limits page

This example illustrates the Stock Purchase Plan Rules - Limits page.

You define the offering and purchase period length as well as various share and value limits. The system defaults are the limits specified on the Governing Body Rules component, but you can make them more restrictive. If your purchase periods overlap different calendar years, check with your payroll administrator to make sure that your payroll system doesn't deduct contributions over the limit.

|

Field or Control |

Definition |

|---|---|

| Offering Period Length |

Enter the number of months in the offering period. You cannot exceed the governing body rules. This value is used to calculate the default offering period end date. |

| Purchase Period Length |

Enter the number of months in the purchase period. This cannot be longer than the offering period. You cannot exceed the governing body rules. |

Offering Period Limits

(Optional) You can make the offering period limits more restrictive than the purchase value limit defined on the Governing Body Rules - Stock Purchase Rules page. You cannot make the limits more permissive.

|

Field or Control |

Definition |

|---|---|

| Participant Grant Value |

Enter the maximum grant value that a participant can purchase during an offering period. The grant value is the number of shares purchased multiplied by the grant FMV. |

| Participant Contribution |

Enter the maximum contribution that an individual participant can make in an offering period. |

| Participant Shares |

Enter the maximum number of shares that a participant can purchase in an offering period. |

| Total Shares |

Enter the total number of shares for all participants that can be issued in an offering period. |

Purchase Period Limits

Use these fields to make the purchase period limits more restrictive than those defined on the Governing Body Rules - Stock Purchase Rules page. Field descriptions are the same as those for the offering period limits, except that they pertain to different periods of time.

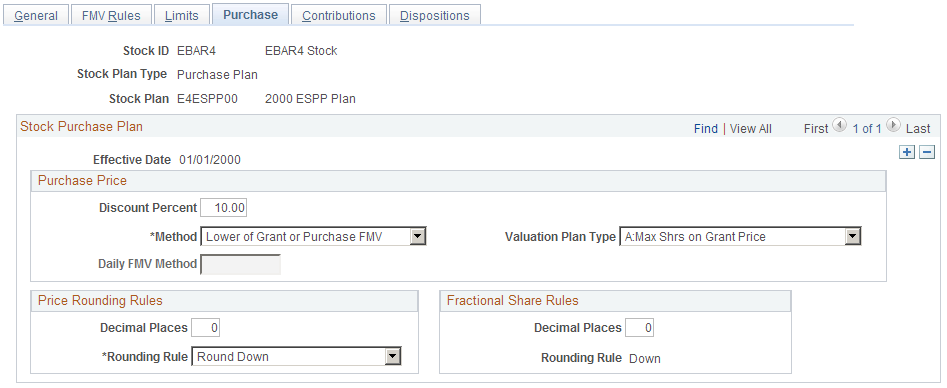

Use the Stock Purchase Plan Rules - Purchase page (ST_ESPP_PLAN4) to define the purchase rules of your plan, such as purchase price calculation and share and price rounding rules.

Navigation

Image: Stock Purchase Plan Rules - Purchase page

This example illustrates the Stock Purchase Plan Rules - Purchase page.

Purchase Price

|

Field or Control |

Definition |

|---|---|

| Discount Percent |

Enter the discount percent the Calculate Prices process is to use when calculating the purchase price for the stock. |

| Method |

Select how the Calculate Prices process should calculate the participants' purchase price: Average Daily FMV in Purch PD: Averages the daily FMV throughout the purchase period. Grant FMV: Uses the FMV on the day of the grant. Lower of Grant or Purchase FMV: Uses the lower of the grant or purchase FMV. This is the default. Purchase FMV: Uses the stock FMV on the day of the purchase. User Defined: Uses some other method. The Calculate Prices process must be manually entered. |

| Valuation Plan Type |

Select the appropriate valuation plan type, as defined in FAS 123. Valid values range from Type A to Type I. |

| Daily FMV Method |

If you selected a purchase price method of Average Daily FMV in Purch PD, this field is available for entry. Select a method to determine what type of price is used for each day. Valid values are defined in the FMV Method Table. |

Price Rounding Rules

The price rounding rules defined on the Stock Details - Common Rules page is the default. You can make them more restrictive.

|

Field or Control |

Definition |

|---|---|

| Decimal Places |

Enter a number between 0 and 6 to determine the number of decimal places when calculating a price or FMV in the Calculate Prices process. |

| Rounding Rule |

Select a rounding rule to use when calculating a price or FMV in the Calculate Prices process: Standard, Up, and Down. |

Fractional Share Rules

These fields become available for entry if fractional shares are allowed at the stock detail level. The fractional share rules defined on the Stock Details - Common Rules page are the default. You can make them more restrictive. If fractional shares are not allowed, The Decimal Places field is 0 and the Rounding Rule field is Down.

|

Field or Control |

Definition |

|---|---|

| Decimal Places |

Enter a number between 0 and 6 to determine the number of decimal places to round when calculating the number of shares purchased. |

| Rounding Rule |

Displays Down, which is the method of rounding when calculating the number of shares to purchase. |

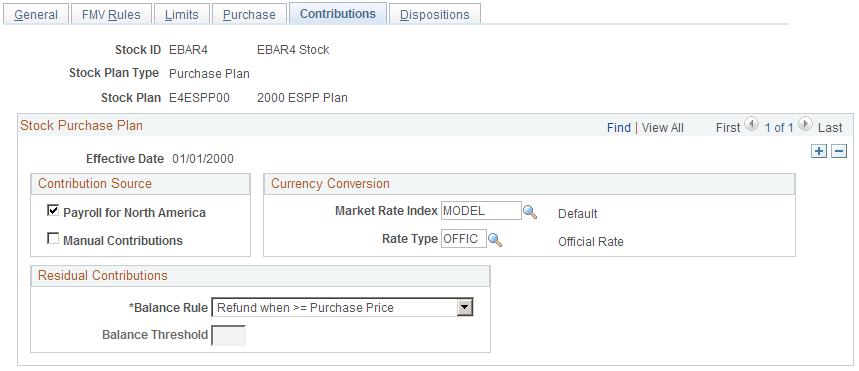

Use the Purchase Plan Rules - Contributions page (ST_ESPP_PLAN5) to define the contribution rules.

Navigation

Image: Stock Purchase Plan Rules - Contributions page

This example illustrates the Stock Purchase Plan Rules - Contributions page.

You define the contribution source, currency conversion, and what happens to residual contributions for a stock purchase plan. The system gathers the contributions in the local currency based on the participant's pay group. It converts the contributions to the stock currency for the purchase, then back to the current local currency for refunds.

Contribution Source

Select Payroll for North America if you receive stock purchase contributions from Payroll for North America. If Payroll for North America is not installed, this option is not available. Select Manual Contributions if you receive stock purchase contributions from any other source. If you use Payroll for North America as your primary contribution source, you might also select Manual Contributions to allow for adjustments. This field determines what contributions are processed in the Gather Contributions process.

Currency Conversion

If you use the system to convert local currency to the currency defined at the stock ID level, select the currency conversion parameters for the Currency Conversion process.

|

Field or Control |

Definition |

|---|---|

| Market Rate Index |

Select a market rate index for the Convert Currencies process to use to convert participant contributions from a local currency to the stock currency. The Market Rate Index is defined in Define General Options is the default. |

| Rate Type |

Select a currency conversion rate type to indicate the type of rate used to convert the local currency to the stock ID currency. |

Residual Contributions

After a stock purchase is processed and confirmed, some of the participants' contributions may be left over. The balance may be less than the purchase price of the stock or the participant may have reached an offering period, or purchase period limit, which left more than the purchase price unused. Indicate a method of handling these residual contributions.

|

Field or Control |

Definition |

|---|---|

| Balance Rule |

Select Carry Forward Balance and no balance threshold amount to carry forward any amount. Select this option and enter a balance threshold amount to carry forward any amount less than or equal to the threshold amount and refund the rest. Select Carry Fwd when <= Purchase Price to carry forward any amount less than or equal to the participant's purchase price. If the amount is greater than the purchase price, it is refunded. Select Refund Balance and no balance threshold amount to refund any amount. Select this option and enter a balance threshold amount to refund any amount greater than or equal to the threshold amount. If the amount is less than the threshold amount, it is carried forward to the next purchase. Select Refund when >= Purchase Price to refund any amount greater than or equal to the participant's purchase price after a purchase. If the amount is less than the purchase price, it is carried forward to the next purchase. This is the default. |

| Balance Threshold |

If you selected a balance rule of Carry Forward Balance or Refund Balance, this field becomes available for entry. Enter the minimum amount needed to carry forward or refund. |

Use the Stock Purchase Plan Rules - Dispositions page (ST_ESPP_PLAN6) to define the holding period for dispositions, that is, the number of months participants must hold the stock before they can sell it.

This holding period is independent of the IRS holding requirements for qualified Section 423 plans.

Navigation

|

Field or Control |

Definition |

|---|---|

| Holding Period Months |

(Optional.) Enter the number of months after the purchase date during which a participant must hold the stock before selling the shares. If you enter a disposition for less than the holding months you specify here, you receive a warning. Note: This period is independent of the IRS holding requirements. |