Home | Book List | Contents | Master Index | Contact Us |

Go to main content

|

|

Navigate: From the Tasks menu, select Foundation > GL Cross Reference. The GL Cross Reference window opens.

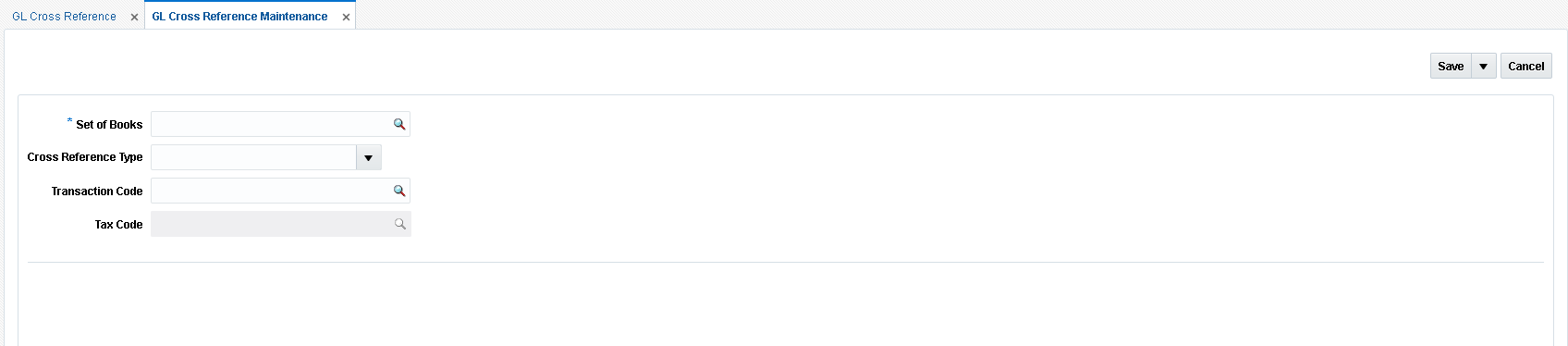

From the Search Results pane of the GL Cross Reference window, select Create from the Action menu. The GL Cross Reference Maintenance window opens.

Figure 3-2 GL Cross Reference Maintenance Window

In the Set of Books ID field, enter the identifier that applies to this cross reference.

Note:

If there is only one Set of Books set up in RMS, this field is populated automatically.

In the Cross Reference Type field, select the account category. Valid values include:

Basic Transactions

Non-merchandise Codes

Reason Code Actions

In the Transaction Code field, enter the transaction code for the new GL cross reference. Valid values for basic transactions include:

TAP – Trade Accounts Payable

TAX – Tax

UNR – Unmatched Receipt

VWT – Variance Within Tolerance

DWO – Discrepancy Write Off

RWO – Receipt Write Off

PPA – Pre-Paid Asset

DIRAR – Complex Deal Income Receivable

DIRAF – Fixed Deal Income Receivable

VCT – Variance Calc Tolerance

VCCT – Varance Calc Tax Tolerance

CRN – Credit Note

TAPNDI – Trade Accounts Payable Non-dynamic item

CRNNDI – Credit Note Non-dynamic item

TAXNDI – Tax Non-dynamic item

TAXRVC – Tax Reverse Charge

TAXRVO – Tax Reverse Offset

TAXACQ – Tax-Acquisition

TAXACO – Tax-Acquisition Offset

For non-merchandise cross reference type use the RMS non-merchandise codes as valid values.

For Reason Code Action cross reference type :

The Transaction Code can be sequentially assigned and disabled when in add mode. That is, the sequence number is incremented to assign the next available Transaction Code for Reason Code Actions.

This transaction code is then used on the 'Reason Code' Maintenance to assign specific accounting entries to a Reason Code. The structure allows for one Reason Code Action Transaction Code to be used by multiple Reason Codes, thereby reducing setup time.

In the Tax Code field, enter the tax code associated with the GL cross reference.

Note:

This field is disabled except when a transaction code of 'TAX', 'TAXNDI', 'TAXACQ', 'TAXACO', 'TAXRVC', or 'TAXRVO' is being created.

Click Save to save your changes. Alternatively, from the drop down menu, select Save and Close to save your changes and close the window or Save and Add Another to save your changes and add an additional GL cross reference.