7. Underwriting

7.1 Introduction

Underwriting is the next step after application entry in Lease origination cycle. At the beginning of underwriting process, the application has been entered into Oracle Financial Services Lending and Leasing, receiving an application number. The application, then passes through the initial prescreening checks, and receives a credit bureau report. (Credit bureau pulls are based upon zip code setup.) The system assigns it a custom credit score and based on this, the application automatically updates its status and sent to the appropriate queue. In doing so, one of three things happen to the application:

- The application passes all the prescreening requirements and is automatically approved based on the auto-decisioning process. The system, then, automatically notifies the producer with a decision fax. You can use the Underwriting screen to view the application and decision information and proceed to funding.

- The application fails the prescreening requirements and is automatically rejected based on the auto-decisioning process. Again, the system notifies the producer with a decision fax. You can use the Underwriting screen to view application and decision information. Also, you can rehash the application.

- The application receives a status requiring a manual review and is sent to the underwriting queue. It is now up to the underwriter to verify data and manually change the status of application using Underwriting screen.

This chapter explains how to use the Underwriting screen to complete the following tasks:

- Loading an application on the Underwriting screen

- Verifying the applicant information

- Verifying the credit bureau data

- Calculating and validate the debt-to-income ratios

- Requesting a credit bureau report manually

- Adding comments and tracking attributes

- Making a decision about an application

- Verifying the edits

- Rehashing an application

- Ageing an application.

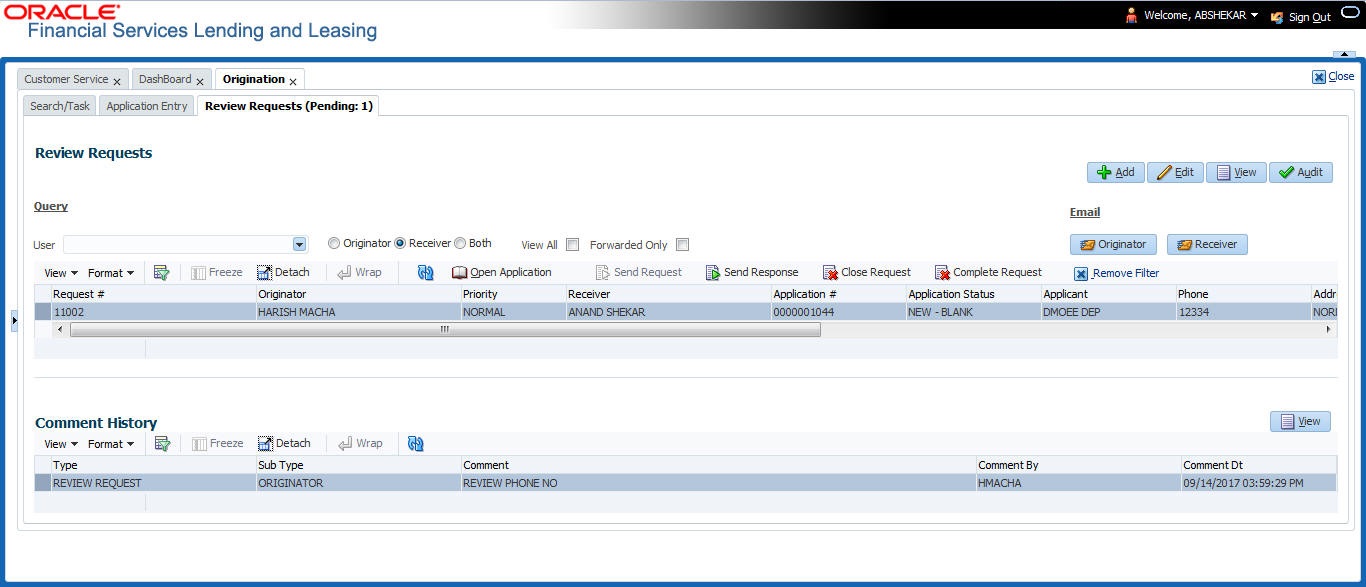

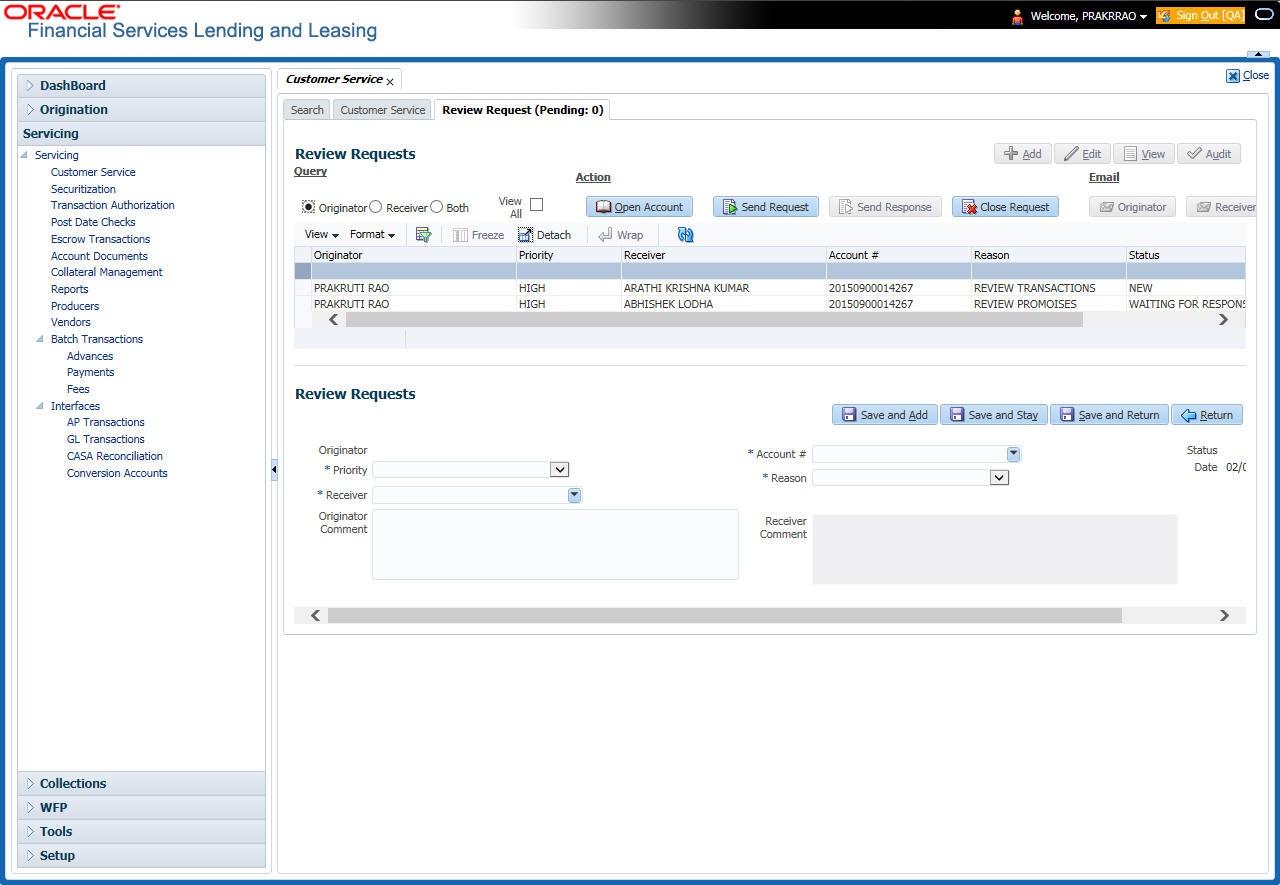

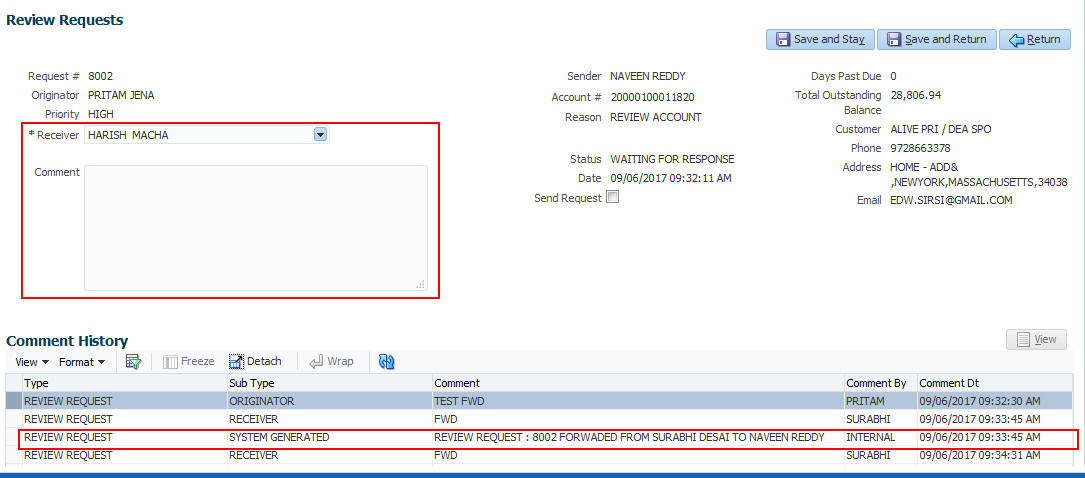

- Review Requests

7.2 Underwriting Screen - an overview

The underwriting process follows these basic steps:

- Opening the Underwriting screen and loading the application you want to work with.

- Viewing and verifying information about the applicant supplied during application entry.

- Viewing information from the credit bureau report.

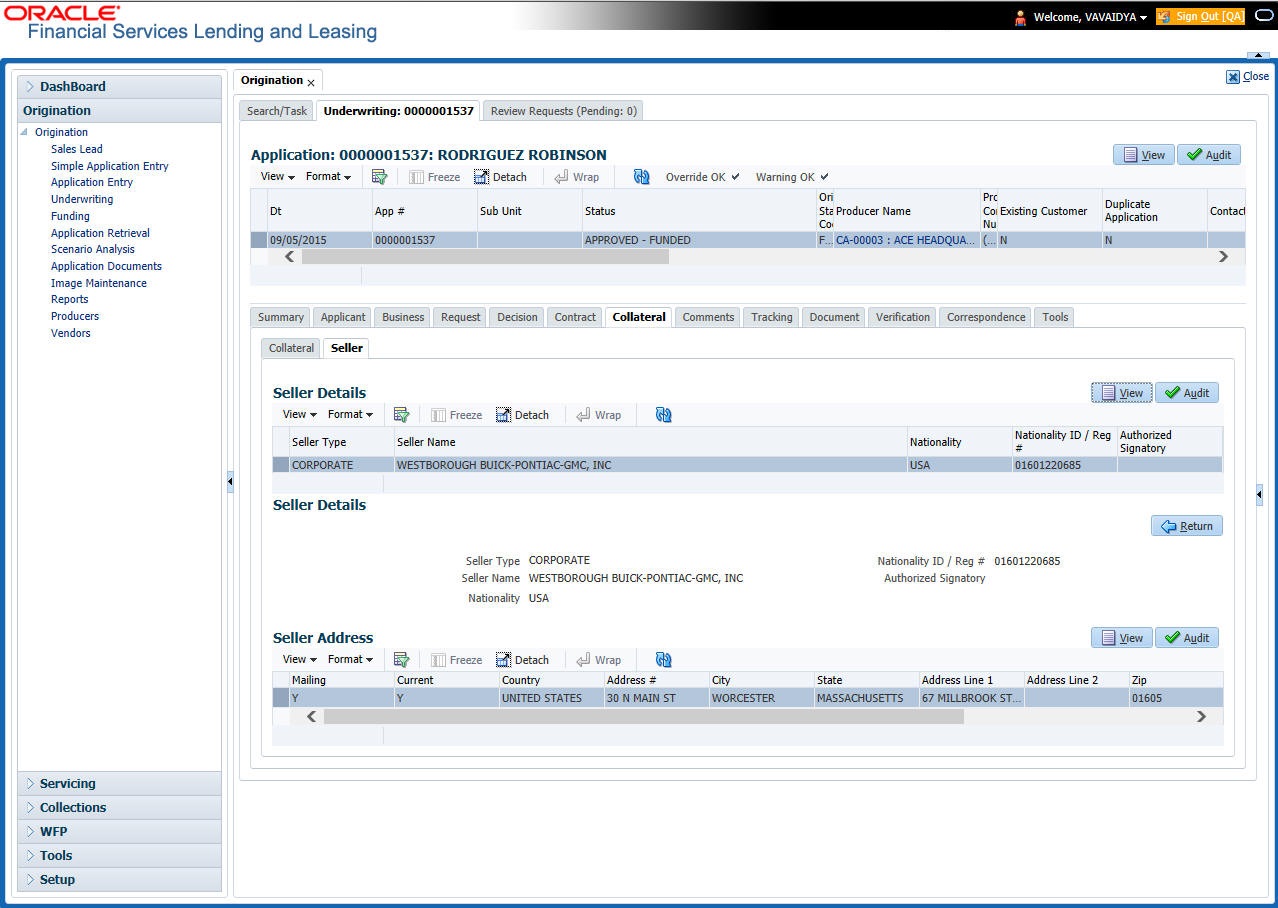

- Viewing and verifying information regarding the collateral, if present.

- Viewing and verifying information regarding the trade-ins, if present.

- Calculating and validating the debt-to-income ratios.

- Selecting the pricing for the application.

- Specifying information regarding stipulations, itemizations, check lists, and rate schedules (variable rate Lease only), if required. (The checklist can be configured to display a list of tasks to follow when using the Underwriting screen.)

- Making a decision on the Lease (approve, reject, or condition).

- Performing an edits check to verify the information on Underwriting screen.

- Viewing errors and warnings from the edits check and make the required corrections to the data.

- Changing the status of the application.

7.3 Loading an Application on the Underwriting screen

The first step in the underwriting process is to load the application you want to work with. For details about using the Loading an application, refer Searching for an Application in the chapter Search Function.

7.3.1 Applications

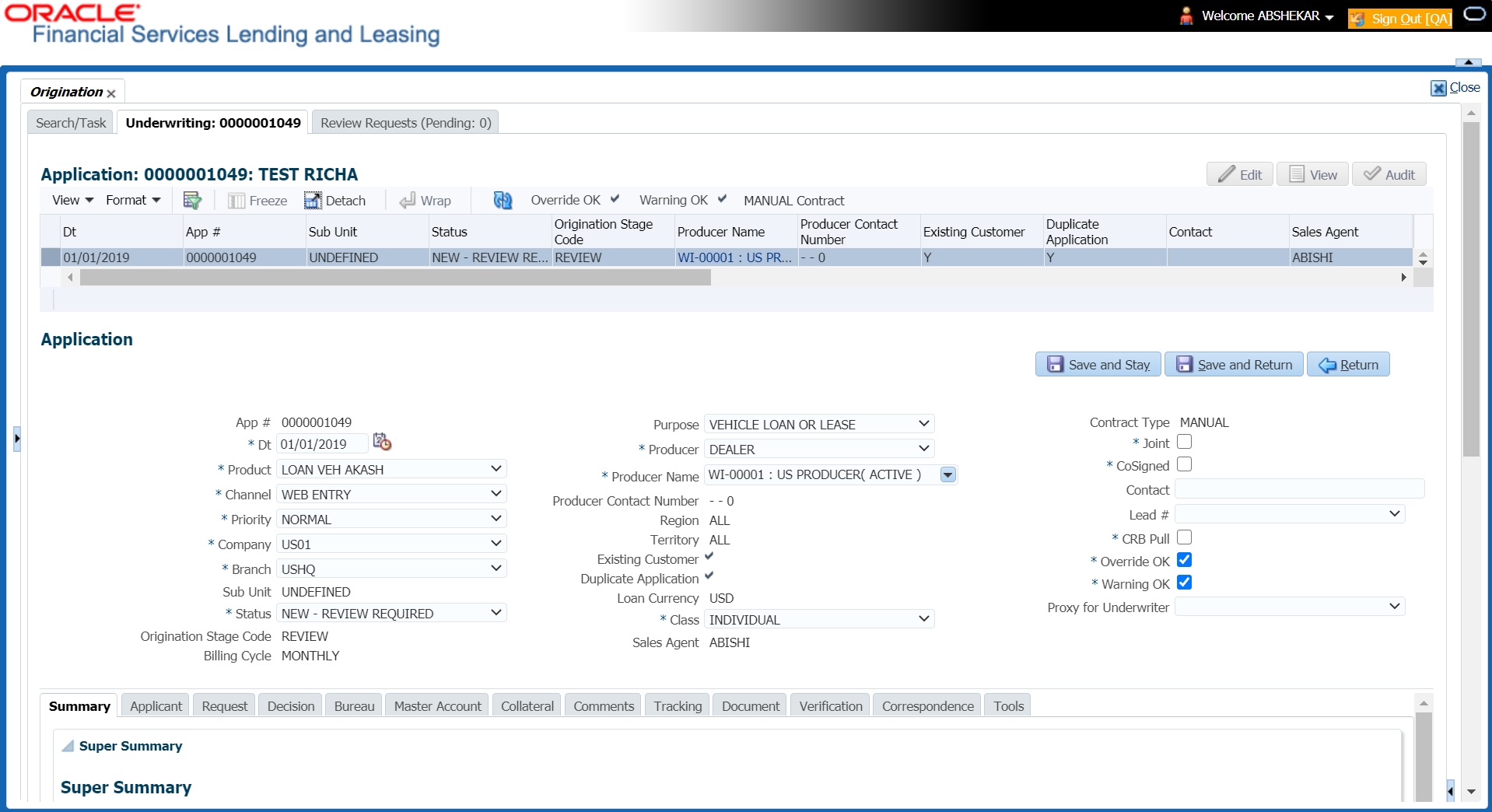

The Underwriting screen’s Applications section appears at the top of the screen opened from Underwriting master tab. The screen displays the application number and name on the header and contains information such as application purpose, product and producer.

In this section, you can perform any of the Basic Operations mentioned in Navigation chapter

A brief description of the fields is given below:

Field: |

View this: |

App # |

The application number |

Dt |

The application date |

Product |

The Lease product of the application. |

Channel |

How the application information was received. |

Priority |

The priority of the application. |

Company |

The company of the application. |

Branch |

The branch of the company. |

Status |

The status of the application. |

Origination Stage Code |

The origination stage code of the application. |

Billing Cycle |

The billing cycle of the application. System displays the applicable billing cycle by default based on the product and the calculation method defined at Setup > Products screen. The editable nature of billing cycle is controlled by the system parameter UIX_BILL_CYCLE_ALLOWED_IND. However, for Rent Factor type of lease calculation, only ‘Monthly’ is applicable and system displays an error on save if any other value is selected. |

Purpose |

The purpose of the application. |

Producer |

The producer type and producer of the application. The Producer drop-down list displays all the Producers maintained in lookup code PRO_TYPE_CD (PRODUCER TYPE CODES). Since the Company and Branch of the account and Producer need not be the same, you can select any Producer across all branches of the company to which the account belongs. This implies that a common Producer belonging to a company can be specified to accounts which belong to different branches but the same company. |

Producer Name |

The name of the producer of the application. The Producer Name is displayed as a hyperlink and clicking on the same will open ‘Producers’ page with details of the producer. |

Producer Contact Number |

The system displays the contact number of the producer. |

Region |

The region of the producer. |

Territory |

The territory of the producer. |

Existing Customer |

Indicates if the customer is an existing customer. |

Duplicate Application |

Indicates if the application is a duplicate application. |

Lease Currency |

The Lease currency of the application. |

Class |

The class of the application. |

Sales Agent |

The sales agent of the application. |

Contract Type |

The type of application. ‘Manual’ indicates OFSLL generated application, where as ‘eContract/Dealer’ indicates that application is generated from external system. |

Joint |

If selected, indicates this is a joint application. |

Cosigned |

If selected, indicates this is a co-signed application. |

Contact |

The contact of the application. |

Lead # |

The lead number will appear in the list only if a lead is already created using the Sales Lead link. |

CRB Pull |

Check this box to pull an initial credit bureau report, after the application passes the pre screen edits. Uncheck the box, if you want to enter an application without pulling a credit report. To use a previously pulled credit bureau report, uncheck this box and specify the Bureau and Bureau Reorder # fields on the Primary Applicant screen. |

Override Ok |

Check this box to ignore the overrides. If the application has been marked as ‘Override OK’ then the system would allow you to change the application status even when override condition exists. |

Warning Ok |

Check this box to ignore the warnings. If the application has been marked as ‘Warning OK’ then the system would allow you to change the application status even when warning exists. |

Proxy for Underwriter |

If you are acting as a proxy for an Underwriter, then you can select the Underwriter’s name from the adjoining options list. The list displays all the associated Underwriters, Underwriting Supervisors, and Underwriting Managers. However, this is not mandatory and can be used while auctioning an application on behalf of another underwriter. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

7.3.2 Changing the Status of the Application

You can use underwriting screen’s Applications master screen to change the status and sub status of the application.

To change the status of the application

- On the Underwriting form’s Application master screen, change the status of application to either Approved, conditioned, or Rejected in the Status field and click Save.

The system checks the information on the Underwriting form using guidelines established during implementation.

The system finds an error based on these guidelines, a Warning message appears stating “Validation Error exist, Unable to Change the status. Please check the Edits.”

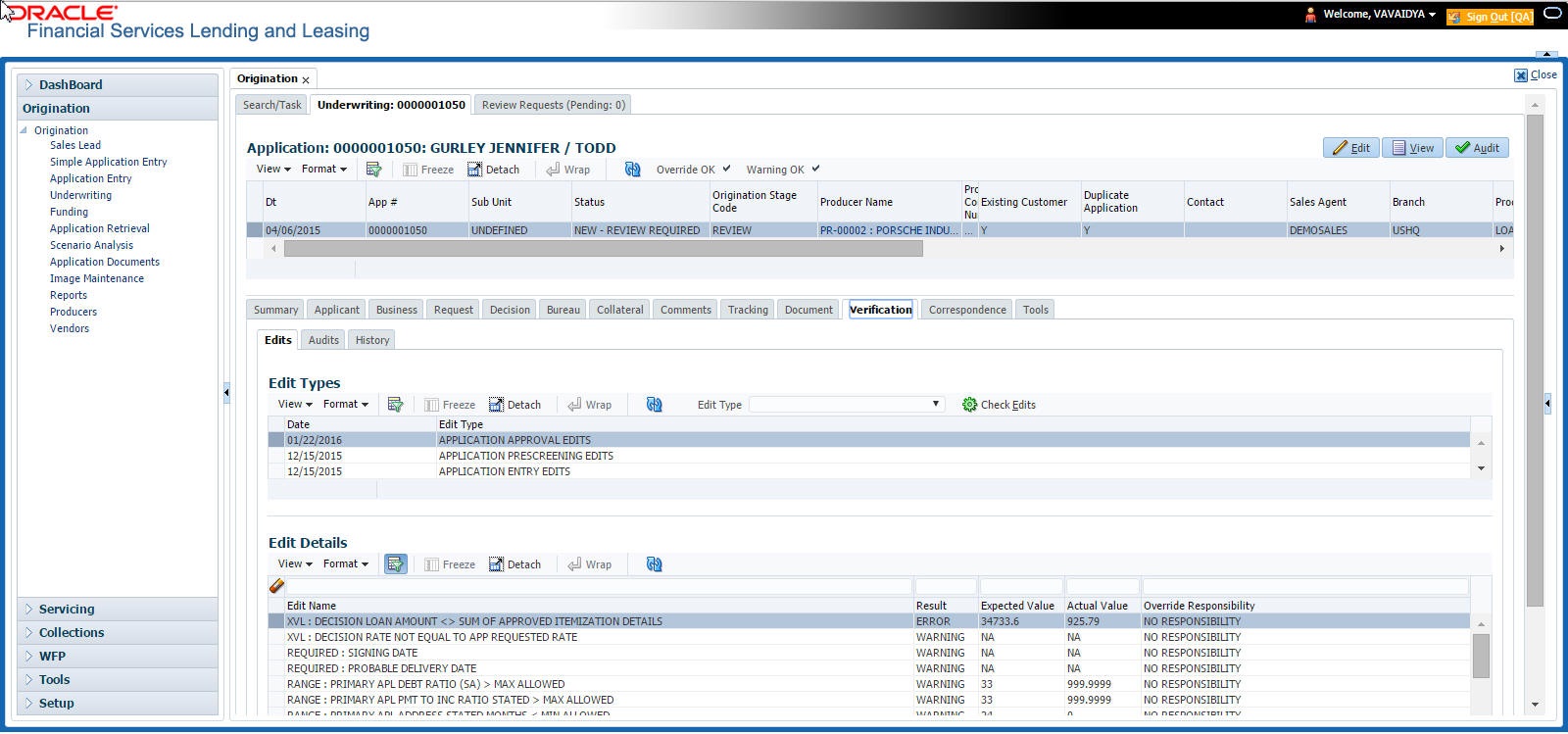

- Click the Verification link and begin verifying edits on the Edits screen (For more information, see the Verification link section in this chapter.)

During status change:

- If there is an error in the edit, system displays an error message as ‘Errors exist. Cannot change status. Please Verify Edits.’ and previous status is retained.

- If there is an edit which requires override, the system displays an override message as ‘Override Required. Do you want to continue?’

- If you select ‘Yes’, the system will continue with OVERRIDE_REQUIRED processing by changing the status.

- If you select ‘No’, the system will change the status back to old status.

During status change, if there is a warning in the edit, the system displays an error message as ‘Warning Exists. Do you want to continue?’.

- If you select ‘Yes’, the system will continue processing by changing the status.

- If you select ‘No’, the system will change the status back to old status.

7.3.3 Rehashing an Application

Once the application moves to status of Approved, Rejected, or conditioned status, you cannot amend the information. However, you can amend the application, by changing the sub status of the application to Rehashing.

To Rehash the Application

- Open the Underwriting screen and load the application you want to change with the Approved, Rejected, or conditioned status.

- In the Applications master section, select Rehashing in the Sub Status field and click Save.

After you enter the information required in the application, you can change the status to Approved, Rejected, conditioned, or Withdrawn. (For more information, refer Decision Tab section in this chapter.)

Once the status is changed to Approved, Rejected, conditioned, or Withdrawn, you cannot make further changes to the information on the Decision tab.

7.3.4 Aging an Application

The Underwriting screen can be configured so that applications will be moved to a separate queue after a certain amount of time. (This time frame is determined in setup). This applications receive a sub status of Aged Application. This housekeeping function allows you to keep your system free of stagnant application by moving them into an archive.

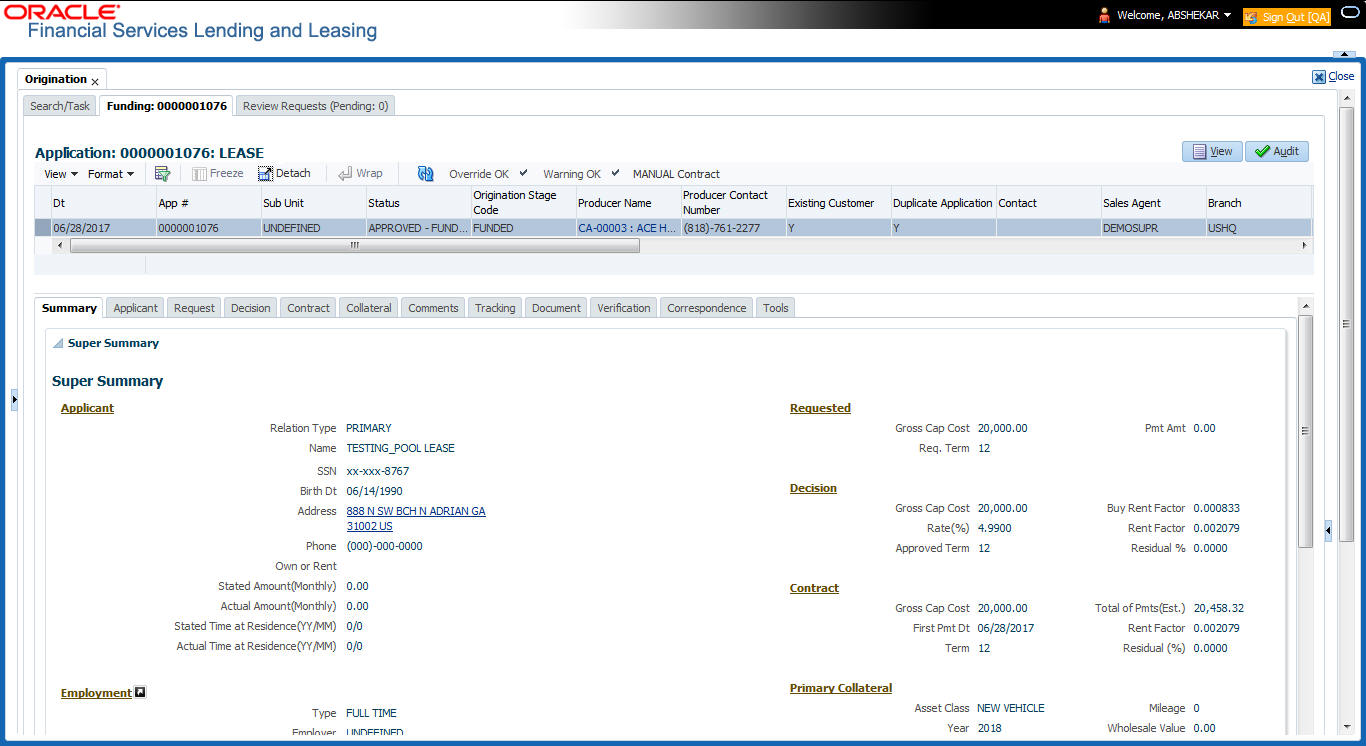

7.4 Summary Tab

The summary screen provides a unified view of the application details without navigating to the respective screens/ sub-tabs.

Using this screen, you can view the following details in their respective sections:

- Super Summary

- Applicant

- Ratios

- Bureau

- Checklist

- Collateral

- Trade-In

- Requested

- Approved

- Decision Itemizations

- Decision History

- Comments

- Stipulations/Adverse Actions

To view the Super Summary

- Open the Underwriting screen and load the application you want to work with.

- Click Summary tab. By default the system opens the summary tab. Expand the Super Summary section.

The Super Summary tab provides a snapshot of all relevant details in a single screen and contains details of Applicant, Employment, Ratios, Bureau, Requested financials, Decision updates, Contract updates and Primary Collateral details. You need not have to navigate to each of these tabs for specific information on the application. Also clicking on the hyperlinks of Address, Employment, Ratios, and Trade-In helps you to directly navigate to respective tab(s),

During the Underwriting and Funding stages, 'verified' button is displayed just below the address and employment details for each of the applicants. This would be enabled only when the Verified by and Verified Dt in the respective tabs are blank. You can verify the details from the Super Summary tab. Clicking on Verified will do the following:

- System will copy the stated values to Actual values.

- System will stamp the “Verified By” as 'User Name' and 'Verified Date' as 'Current GL Date' for the respective applicant.

- If 'Verified Details' are already updated in tab or if the details are stamped, this button will be disabled.

- 'Verified' button will be available when 'Actual Amount' equal to ZERO or 'Verified By' or 'Verified Date' is NULL.

You need not navigate to Address and Employment tab for verifying applicant details.

Decision details will be displayed when application has Origination Stage as “Review, Decisioned, Contract or Funded”. In case an application is Rehashed, only Decision information will be displayed and Contract information will not be displayed. Contract details will be displayed when application has Origination Stage as “Contract or Funded”.

The system displays the collateral details maintained in the collateral tab on click of navigation button under the headings Primary Collateral and Secondary Collateral. Collateral details for Unsecured loan also will be displayed if they are maintained.

All the trade-in details, if any, maintained in the application would be displayed on click of Navigation button.

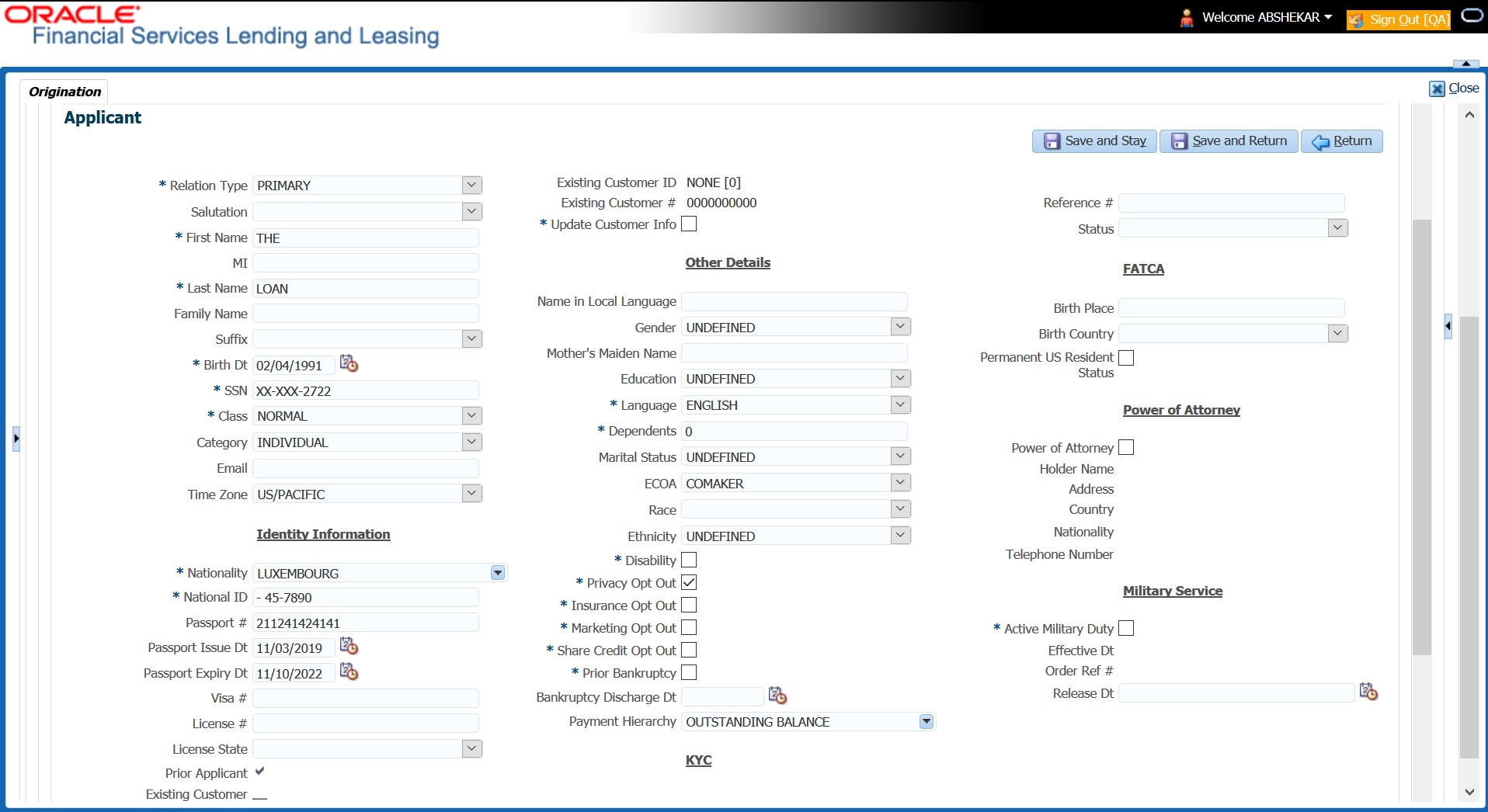

7.5 Applicant Tab

Having selected and loaded an application, you can view the information about applicant in the Applicants tab. This is information that was recorded on the Application Entry screen or gathered during the credit pull. You can edit data from the Application Entry screen at anytime in the following steps. Remember to save your work with each change. Information from the credit bureau pull is available to view only.

Using the information supplied on the application, complete the Applicants tab details and the following sub tab details:

- Address

- Employments

- Telecoms

- Summary

- Credit Scores

- Duplicate Applicant

- Existing Accounts.

- Tracking Attributes

Primary Applicant details are required for SME applications also. The system uses information on the Financial and Liabilities sub tabs in determining the applicant’s net worth. The system uses information on the Employments screen and Other Incomes sub screen to calculate the applicant’s debt-to-income ratio.

To verify applicant information on the Underwriting screen

- Open the Underwriting screen and load the underwriting application you want to work with.

- Click Applicants tab.

- In this section, you can perform any of the Basic Operations mentioned in Navigation chapter

A brief description of the fields is given below:

Field |

Do this |

Relation Type |

Select the relationship type from the adjoining drop-down list. For example, primary, spouse, secondary, or cosigner. |

Salutation |

Select the salutation from the adjoining drop-down list. |

First Name |

Specify the applicant’s first name. |

MI |

Specify the applicant’s middle name. |

Last Name |

Specify the applicant’s last name. |

Family Name |

Specify the applicant’s family name. |

Suffix |

Select the name suffix/generation from the adjoining drop-down list. |

Birth Dt |

Specify the applicant’s date of birth. |

SSN |

Specify the applicant’s social security number. |

Class |

Select the classification of the applicant from the adjoining drop-down list. For example, normal or employee. The system uses this information to restrict access to the database by recognizing employees as ‘secured applications’. You can create a SME (Small Medium Enterprise) application by selecting Small business. When you select small business and save your entry, the Business Applicants link on the Applicants link is available. (required). |

Specify the personal Email ID of the applicant. |

|

Time Zone |

Specify the time zone to which the applicant belongs. This information appears when you enter and save the zip code for the primary applicant’s current home address on the Address sub screen. You can also manually complete this field. |

Identity Information Section |

|

Nationality |

Select the applicant’s nationality from the adjoining drop-down list. |

National ID |

Specify the national identification number. |

Passport # |

Specify the passport number. |

Passport Issue Dt |

Select the date on which passport was issued. |

Passport Expiry Dt |

Select the passport’s expiration date. |

Visa # |

Specify the applicant’s visa number. |

License # |

Specify the applicant’s license number. |

License State |

Select the state where the license was issued, from the adjoining drop-down list. |

Prior Applicant |

Check this box to indicate that the customer is an existing customer. |

Existing Customer |

Check this box to indicate that this applicant has a previous account. |

Existing Customer ID |

Specify the customer ID if the applicant is an existing customer. |

Existing Customer # |

Specify the customer number if the applicant is an existing customer. On saving the applicant details, the data in ‘Existing Customer #’ is displayed as a link in ‘Applicant’ section header and clicking on the same will display the customer details in Search Results section of Servicing module. |

Update Customer Info |

Check this box to indicate if system can override the existing customer information and create the record with latest address and communication details of the customer. |

Other Details section |

|

Name in Local Language |

Specify the applicant’s name in local language. |

Gender |

Select the gender of the applicant from the adjoining drop-down list. |

Mother’s Maiden Name |

Specify the mother’s maiden name. |

Education |

Select the education of the applicant from the adjoining drop-down list. |

Language |

Select the applicant’s native language from the adjoining drop-down list. |

Dependents |

Specify the number of dependents. |

Marital Status |

Select the marital status of the applicant from the adjoining drop-down list. |

ECOA |

Select the ECOA (Equal Credit Opportunity Act) code, from the adjoining drop-down list. This defines the various possibilities on who is liable; individual, joint, cosigner and so on. |

Race |

Select the applicant’s race from the adjoining drop-down list. |

Ethnicity |

Select the applicant’s ethnicity from the adjoining drop-down list. This is the information the Home Mortgage Disclosure Act requires to be reported. |

Disability |

Check this box if the application has a disability. |

Privacy Opt Out |

Check this box to indicate that the applicant has elected to refrain from the non-public sharing of information. |

Insurance Opt Out |

Check this box to indicate that the applicant has elected to refrain from insurance related inquiries. |

Marketing Opt Out |

Check this box to indicate that the applicant has elected to refrain from marketing related inquiries. |

Share Credit Opt Out |

Check this box to indicate that the applicant has elected to refrain from financial information and share credit related inquiries. |

Prior Bankruptcy |

Check this box if prior bankruptcy exists. |

Bankruptcy Discharge Dt |

Enter the discharge date of prior bankruptcy (if one exists). |

Payment Hierarchy |

Select the required Hierarchy Definition to be used for payment appropriation from the drop-down list. The list is populated with all the pre-defined and enabled hierarchy definitions maintained Setup > Administration > Users > Payment Hierarchy screen. The Hierarchy Definition selected here is propagated to Servicing > Customer/Business details. If an existing hierarchy is modified and the ‘Update Customer/Business info’ option is enabled, then the Payment Hierarchy in Servicing > Customer / Business details are also updated. |

KYC Section |

|

Reference # |

Specify the reference number. |

Status |

Select the status of the applicant from the adjoining drop-down list. |

FATCA Section |

|

Birth Place |

Specify the birth place of the applicant. |

Birth Country |

Select the country of birth of the applicant. |

Permanent US Resident Status |

Check this box if the applicant has permanent US resident status. |

Power of Attorney Section |

|

Power of Attorney |

Check this box if you hold a power of attorney. |

Holder Name |

Specify the holder name of the power of attorney. |

Address |

Specify the address of the holder. |

Country |

Specify the country of the power of attorney holder. |

Nationality |

Specify the nationality of the power of attorney holder. |

Telephone Number |

Specify the telephone number of the power of attorney holder. |

Military Service - this section can be used to capture applicant’s Active Military Duty details and can be validated with applicant Bureau Details. |

|

Active Military Duty |

Check this box to indicate if applicant is on Active Military Duty. |

Effective Dt |

Select the date from when the applicant is on Active Military duty using adjoining calendar. |

Order Ref # |

Specify the Order Reference number which indicates the applicant’s Active Military duty service. |

Release Dt |

Select the date from when the applicant was released from Active Military duty using adjoining calendar. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- You can verify the personal information about the applicant. Two check boxes indicate if this is an existing customer or a prior applicant. The Existing Customer field enables you to select the existing customer.

7.5.1 Address Sub Tab

You can specify more than one address for each applicant, such as a home address, second home address, and vacation home address. However, at least one must be marked as current. Also, only one address can be selected as the mailing address, and that address must be marked as current. Finally, while you can have more than one Home type address, only one can be marked as current.

To complete the Address sub tab

- Click Address sub tab.

- In this section, you can perform any of the Basic Operations mentioned in Navigation chapter.

Based on the country chosen in the address tab, the fields for capturing the address will vary.

A brief description of the fields is given below:

Field |

Do this |

Address Type |

Select the type of address from the adjoining option list. |

Current |

Check this box if this is a current address. The mailing address must be marked as current. |

Confirmed |

Check this box if the address is the confirmed one |

Mailing |

Check this box if this is the mailing address. Only one address entry can be marked as the mailing address. |

Permission to Call |

Check this box if customer has provided permission to contact through the specified phone number. Atleast one phone number per application should have the permission to call (flagged as 'Y') for the successful pre-qualification of the application. Else, an error message is displayed. |

Permission to Text |

Check this box if customer has provided permission to contact through text message. |

Country |

Select the country of mailing address from the adjoining drop-down list. |

Address Details section |

|

Postal Type |

Select the postal address type from the adjoining drop-down list. |

Address # |

Specify the address number of the mailing address |

Street Pre |

Select the street prefix (directional) from the adjoining drop-down list. |

Street Name |

Specify street name. |

Street Type |

Select the street type from the adjoining drop-down list. |

Street Post |

Select the street postfix (directional) from the adjoining drop-down list. |

Apt # |

Specify the apartment number. |

Address Line 1 |

Specify the first address line. |

Address Line 2 |

Specify the second address line. |

Address Line 3 |

Specify the third address line. |

Zip |

Select the zip code from the adjoining drop-down list. For non US country, you have to enter zip code. |

Zip Extn |

Specify the extension of the zip code. |

City |

Specify the city of the mailing address. |

State |

Select the state of the mailing address, from the adjoining drop-down list. |

Phone |

Specify the phone number. |

Additional Information section |

|

Own / Rent |

Select the ownership type from the adjoining drop-down list. |

Landlord |

Specify the landlord’s name. |

Landlord Phone |

Specify the landlord’s phone number. |

Contact |

Specify the person contacted on behalf of landlord. |

Contact Title |

Specify title of the person contacted on behalf of landlord. |

Contact Phone |

Specify phone number of the person contacted on behalf of landlord. |

Extn |

Specify the extension of the phone of the person contacted on behalf of landlord. |

Census Tract/BNA code |

Specify census tract/BNA (block numbering area). These are defined by the US Census Bureau code. |

MSA Code |

Specify the metropolitan statistical area (MSA) code. These are similar in concept to a zip code, but used mostly on government reports. |

Comment |

Specify a comment. |

Address Rent Mortgage Stated section |

|

Years |

Specify the stated number of years at residence. |

Months |

Specify the stated number of months at residence. |

Currency |

Select the currency code of payment amount, from the adjoining drop-down list. |

Pmt Amount |

Specify the stated payment amount. |

Frequency |

Specify the stated payment frequency. |

Rent/Mortgage |

The system displays the rent or mortgage amount. |

Address Rent Mortgage Actual section |

|

Years |

Specify the Actual number of years at residence. |

Months |

Specify the Actual number of months at residence. |

Pmt Amount |

Specify the Actual payment amount. |

Frequency |

Specify the Actual payment frequency. |

Rent/Mortgage |

The system displays the rent or mortgage amount. |

Verified Section |

|

Verified By |

The name of the verifier. |

Verified Dt |

The date of verification. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- If there are more than one addresses associated with the applicant, click Save And Add on the Address sub screen and add address details.

7.5.2 Employments Sub Tab

Use the Employment sub screen to record employment information about the applicant. You can have more than one entry.

To complete the Employments sub tab

- Click Employments sub tab

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Current |

Check this box if this is the current employment. |

Permission to Call |

Check this box if customer has provided permission to contact through the specified phone number. Atleast one phone number per application should have the permission to call (flagged as 'Y') for the successful pre-qualification of the application. Else, an error message is displayed. |

Permission to Text |

Check this box if customer has provided permission to contact through text message. |

Type |

Select the address type from the adjoining drop-down list. |

Employer |

Specify the employer’s name. |

Occupation |

Select the occupation from the adjoining drop-down list. |

Title |

Specify the title. |

Department |

Specify the department of the employer. |

Employee ID |

Specify the employee identification. |

Employer Address section |

|

Country |

Select the country from the adjoining drop-down list. |

Address # |

Specify the building number. |

Address Line 1 |

Specify the first address line. |

Address Line 2 |

Specify the second address line. |

Zip |

Select the zip code from the adjoining drop-down list. For non US country, you have to enter zip code. |

Zip Extn |

Specify the zip code extension. |

City |

Specify the city. |

State |

Select the state from the adjoining drop-down list. |

Additional Information section |

|

Phone |

Specify the work phone number. |

Extn |

Specify phone extension. |

Contact |

Specify the person contacted on behalf of the employer. |

Contact Title |

Specify title of the person contacted on behalf of the employer. |

Contact Phone |

Specify phone number of the person contacted on behalf of the employer. |

Contact Extn |

Specify the extension of the phone of the person contacted on behalf of the employer. |

Comment |

Specify a comment. |

Employment Details Stated section |

|

Years |

Specify the stated number of years with the employer. |

Months |

Specify the stated number of months with the employer. |

Pay Day |

Select the stated payment day of the month using the adjoining calendar. Ensure that the date selected is greater than or equal to current system date. |

Frequency |

Select the stated payment frequency from the adjoining drop-down list. |

Currency |

Select the currency code from the adjoining drop-down list |

Income Amt |

Specify the stated income. |

Salary |

View the salary of the customer. |

Employment Details Actual section |

|

Years |

Specify the Actual number of years with the employer. |

Months |

Specify the Actual number of months with the employer. |

Pay Day |

Select the Actual payment day of the month using the adjoining calendar. Ensure that the date selected is greater than or equal to current system date. |

Frequency |

Select the Actual payment frequency from the adjoining drop-down list. |

Income Amt |

Specify the Actual income. |

Salary |

View the salary of the customer. |

Verified Section |

|

Verified By |

The name of the verifier. |

Verified Dt |

The date of verification. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

7.5.3 Telecoms Sub Tab

The Telecoms sub screen only needs to be completed if additional phone numbers exist. If not, this sub screen can be left blank.

To complete the Telecoms sub tab

- Click the Telecoms sub tab

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field |

Do this |

Type |

Select the telecommunication type from the drop-down list. |

Phone |

Specify the phone number. |

Extn |

Specify the phone extension. |

Current |

Check this box if this Telecom number is current. |

Permission to Call |

Check this box if customer has provided permission to contact through the specified phone number. Atleast one phone number per application should have the permission to call (flagged as 'Y') for the successful pre-qualification of the application. Else, an error message is displayed. |

Permission to Text |

Check this box if customer has provided permission to contact through text message. |

Time Zone |

Select the applicant’s time zone from the drop-down list. |

Start Time |

Specify the best time to start the call. |

Period |

Select the time period for the best time to call start time, am or pm, from the drop-down list. |

Best day to call |

Select the preferred day of the week to contact the customer from the drop-down list. |

End Time |

Specify the best time to end the call. |

Period |

Select the time period for the best time to call end time, am or pm, from the drop-down list. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

7.5.4 Summary Sub Tab

The system calculates debt ratios in the Ratios section on the Summary sub screen (Applicants link) using the data in the Incomes and Liabilities sections. Information in the Incomes section comes from the Employments sub screen and the Other Incomes sub screen during application entry. The information in the Liabilities section comes from the Address sub screen, the Liabilities sub screen during application entry, and the credit bureau pull.

To View Summary sub tab

- Click the Summary sub tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field |

Do this |

What if Pmt Amt |

Specify the payment amount you want to use in the ratios. |

Score |

View the credit score for the application |

Grade |

View the credit grade for the application |

Totals |

|

Monthly Income- Stated Amt |

The stated monthly income. |

Monthly Debt- Stated Amt |

The stated monthly liability. |

Monthly Income- Actual Amt |

The actual monthly income. |

Monthly Debt- Actual Amt |

The actual monthly liability. |

Assets Amt - Liabilities Amt |

The net worth amount. |

Ratios |

|

Debt - Stated Before (%) |

The debt amount stated before. |

Debt - Stated After (%) |

The debt amount stated after. |

Debt - Actual Before (%) |

The actual debt amount before. |

Debt - Actual After (%) |

The actual debt amount after. |

Disposable Inc - Stated Before (%) |

The disposable income stated before. |

Disposable Inc - Stated After (%) |

The disposable income stated after. |

Disposable Inc - Actual Before (%) |

The actual disposable income before. |

Disposable Inc - Actual After (%) |

The actual disposable income after. |

Revolving Debt - Stated Before (%) |

The stated revolving debt before. |

Revolving Debt -Stated After (%) |

The stated revolving debt after. |

Revolving Debt - Actual Before (%) |

The actual revolving debt before. |

Revolving Debt - Actual After (%) |

The actual revolving debt after. |

Pmt to Income - Stated Before (%) |

The stated income payment before. |

Pmt to Income - Stated After (%) |

The stated income payment after. |

Pmt to Income - Actual Before (%) |

The actual income payment before. |

Pmt to Income - Actual After (%) |

The actual income payment after. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

Once the payment amount is approved in Decision screen, it will be copied and displayed in the What if Payment field in Summary sub screen.

Calculating Debt Ratios

The system offers powerful tools to the underwriter for analyzing an applicant’s debt-to-income ratios (total of an applicant’s debt obligation divided by that person’s regular income). The system calculates debt ratios in the Ratios section on the Summary sub screen (Applicants link) using the data in the Incomes and Liabilities sections. Information in the Incomes section comes from the Employments sub screen and the Other Incomes sub screen during application entry. The information in the Liabilities section comes from the Address sub screen, the Liabilities sub screen during application entry, and the credit bureau pull.

An underwriter may also add information to the Incomes and Liabilities sections on the Summary sub screen during the underwriting process.

The debt-to-income ratios in the Ratios section can be recalculated by including or excluding information from the Incomes section, Liabilities section and Financials sub screen.

To calculate debt ratios

- Open the Underwriting screen and load the application you want to work with.

- In the Underwriting link bar, click Applicants.

- On the Applicants Details screen, select the applicant you want to work with and click Show in the Details column.

- Click Summary sub tab.

- On the Summary sub screen, view the display only data in the Totals section.

Field:

View this:

Monthly Income (Stated)

The stated monthly income.

Monthly Income (Actual)

The actual monthly income.

Monthly Debt (Stated)

The stated monthly liability.

Monthly Debt (Actual)

The actual monthly liability.

Assets

The assets.

Liabilities

The liabilities.

Net-Worth

The net-worth.

- In the What if Pmt Amt field, enter the payment amount you want to use in the ratios. Once the payment amount is approved in Decision screen, it will be copied in the What if Payment field and the ratios are updated accordingly.

Whenever you modify the ‘What If pmt Amt’ field, system automatically calculates the below ratio's:

- Stated Before DTI - if liabilities, stated income or applicant financials are updated.

- Stated After DTI - if decision payment amount, liabilities, stated income or applicant financials are updated.

- Actual Before DTI - if liabilities, actual income or applicant financials are updated.

- Actual After DTI - if decision payment amount, liabilities, actual income or applicant financials are updated.

- Stated PTI - if decision payment amount, stated income or applicant financials are updated.

- Actual PTI - if decision payment amount, liabilities, actual income or applicant financials are updated.

7.5.4.1 Financials Sub Tab

The Financials sub screen only needs to be completed if financial assets exist on the application. If not, this sub screen can be left blank.

To complete the Financials sub tab

The Financials sub screen only needs to be completed if financial assets exist on the application. If not, this sub screen can be left blank.

- Click Financials sub tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field |

Do this |

Type |

Select financial type from the drop-down list. For example, liquid assets, retirement assets, and so on. |

Source |

Specify source; for example, stocks, 401K, rent received, and so on. |

Account # |

Specify the account number. |

Currency |

Select the currency code from the drop-down list. |

Lease Currency Amount |

View the Lease currency amount. |

Amount |

Specify amount. |

Include |

Check this box to indicate that the Asset is included. |

Comment |

Specify comment, if any. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

7.5.4.2 Liabilities Sub Tab

All the liabilities of the applicant that are entered during application entry are displayed in this tab. For example: Rent. In addition, if you need to record additional liabilities for an applicant the same can be done in this tab. Also any liability information of the applicant received through credit pull will be displayed under 'Credit Bureau Data' in Liabilities sub tab.

To complete the Liabilities sub tab

- Click Liabilities sub tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field |

Do this |

Include |

Check this box to indicate that the liability is included. |

Liability Type |

Select the liability type from the adjoining drop-down list. |

Currency |

Select the currency code from the adjoining drop-down list. |

Amount |

Specify the liability amount. |

Lease Currency Amount |

View the Lease currency amount. |

Frequency |

Select the frequency from the adjoining drop-down list. |

Account Type |

Specify the account type. |

Account Balance |

Specify the account balance. |

Lease Account Balance |

View the Lease currency amount. |

Comment |

Specify a comment, if any. |

Credit Bureau Data |

|

Bureau |

View the name of credit Bureau. |

Open Dt |

View the opening date of credit account. |

Pmt Manner |

View the mode of payment. |

Account # |

View the account number. |

Status |

View the current status of credit account. |

Account Type |

View the type of account maintained. |

Creditor's Name |

View the name of the Creditor. |

Subscriber # |

View the Subscriber number. |

ECOA |

View the ECOA (Equal Credit Opportunity Act) code. |

Term |

View the term of credit. |

Credit Limit |

View the total credit limit amount. |

High Balance |

View the high balance amount if any. |

Past Due Amt |

View the total past due amount if any. |

30 |

View the number of delinquency days. |

60 |

View the number of delinquency days. |

90 |

View the number of delinquency days. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- The Dedupe Liabilities button removes duplicate (“de-dupes”) liabilities that may be present from subsequent (manual) credit bureau pulls for nonspousal joint applications

7.5.4.3 Other Incomes Sub Tab

The Other Incomes sub tab only needs to be completed if other incomes exist on the application. If not, this sub screen can be left blank.

To complete the Other Incomes sub tab

- Click the Other Incomes sub tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field |

Do this |

Type |

Select the income type from the adjoining drop-down list. Note: In case, the other income of the applicant is from Employment, then the details of Actual Amount specified in the Employments Sub Tab is auto populated. Also if the income is verified in the Employments Sub Tab, then Verified By and Verified Dt details are auto populated. You can also verify the details here using the current system date. |

Currency |

Select the currency from the adjoining drop-down list. |

Stated Amount |

Specify the monthly stated income. |

Frequency |

Select the income frequency from the adjoining drop-down list. |

Lease Currency Amount Stated |

View the Lease currency amount stated. |

Comment |

Specify a comment, if any. |

Include |

By default the include check box is selected indicating that the other income details are included. You can deselect the same if not required. When Include check box is selected system automatically adds the ‘Loan Currency Amount Stated’ and ‘Loan Currency Amount Actual’ details to Applicant > Summary Tab. Also system calculates the DTI and PTI ratio's based on ‘Actual Amount’ specified. |

Actual Amount |

Specify the actual monthly income amount. |

Lease Currency Amount Actual |

View the actual Lease currency amount. |

Verified By |

The Verified By field is auto populated with the logged in user name only after the record has been verified and saved. |

Verified Dt |

You can verify the record by selecting the current system date from the adjoining calendar icon. Note: System displays an error message if any other dates is selected apart from current system date. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

7.5.4.4 Rescoring a Credit Bureau Report Manually

Any manually pulled credit bureau reports can be used to rescore an application.

To manually rescore a credit bureau report

- Open Underwriting screen and load the underwriting application you want to work with.

- Click Applicants.

- On the Applicants Details screen, select the applicant you want to work with and click View.

- Click the Credit Scores sub tab.

- In the Rescore Applicant section, select in the Credit Report ID field, the bureau report you want to use to rescore the applicant.

- Click Rescore.

The system displays the new information in the Credit Scores and Parameters sections. This new score automatically appears in the System Recommendation section on the Decision link.

7.5.5 Credit Score Sub Tab

You can view the credit score based on the system’s internal scoring models in Credit Scores sub tab.

To View Credit Scores sub tab

- Click the Credit Scores sub tab.

You can view the following details:

- Credit Score

- Model

- Bureau

- Credit Report ID

- Credit Grade

- Score

- Current

- Parameters

- Parameters

- Value

- Score

Note

If you select No Bureau in the Credit Bureau Report ID field and click Rescore, the best match internal scoring is used for rescoring the applicant without credit bureau report.

7.5.6 Duplicate Applicant Sub Tab

Click De-dupe Applicants to display the existing customer details of the applicant. While reviewing the de-dupe results, if the current applicant's credentials are exactly matching with an existing customer record, you can attach the current application to the existing customer. The same can be done by just keying in the customer ID in the applicants tab and clicking save.

In case a particular customer has more than one account, on clicking De-dupe Applicants the system displays only one account in ‘Duplicate’ sub tab. However, you can view all the accounts held by customer in 'Existing accounts' sub tab.

To View duplicate applicant’s details, click Duplicate Applicant sub tab. In this section you can view the duplicate applicant’s details.

A brief description of the fields is given below:

Field |

Do this |

Source Type |

View the source type of the duplicate applicant |

Applicant Id/ Cus Id |

View the applicant ID if the source type is applicant and the customer ID if the source type is customer. |

Application # |

View the application number of the existing applicant details for the respective records. |

Days since last application |

View the total number of days elapsed since the last application date. System auto calculates this value as ‘Current system date (minus) Last application date’. |

ID |

View the applicant ID |

First Name |

View the first name of the duplicate applicant |

Middle Name |

View the middle name of the duplicate applicant |

Last Name |

View the last name of the duplicate applicant |

Date of Birth |

View the date of birth of the duplicate applicant |

CIF |

View the CIF no of the duplicate applicant |

SSN # / National ID |

View the national ID or SSN number of the duplicate applicant |

Driving License # |

View the driving license number of the duplicate applicant |

City |

View the city of the duplicate applicant |

State |

View the state of the duplicate applicant |

Zip |

View the zip of the duplicate applicant |

7.5.7 Existing Account Sub Tab

The Existing Account Sub Tab displays the applicant's details, if it has been previously maintained in the system. Also along with the applicant's details, the account number of the applicant is displayed as a hyperlink. Clicking on the hyperlink will display the respective account details through the Customer Service screen of Servicing module.

In case you do not see a hyperlink associated with the account number, then you might have restricted access to the Servicing module. You can request your system administrator to navigate to Setup > User > Access screen, and enable the ‘ACCESS TO SERCOLL UCS CUSTOMER SERVICE TAB’ option in Security Access Definition section available in the 'Screen' tab. For more information, on defining user privileges, refer to ‘3.3.2 Screen’ section in Setup guide.

View the following details:

Field: |

View this: |

Account # |

The account number. |

Title |

The account title. |

Relation |

The customer relationship. |

Product |

The Lease product. |

Payoff Amount |

The payoff amount. |

Amount Due |

The delinquent amount due. |

Oldest Due Dt |

The due date. |

Status |

The account status. |

Company |

The company. |

Branch |

The branch. |

Total Pay Off Amt |

The payoff amount. |

Total Amt Due |

The total due amount. |

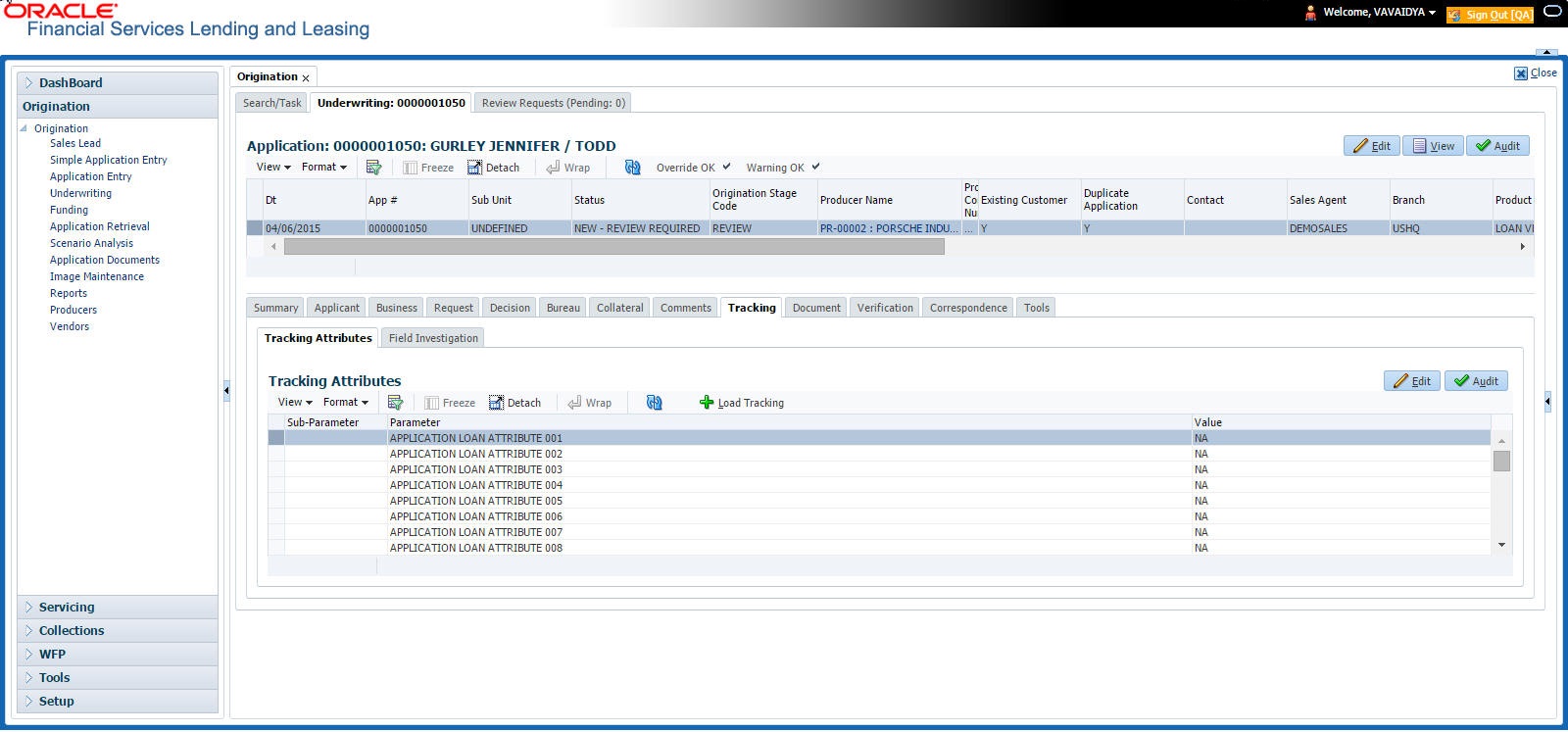

7.5.8 Tracking Attributes Sub Tab

You can add tracking attribute information to an application at any time in the underwriting process by using the Tracking Attribute tab.

The Tracking tab enables you to record further information associated with the application. What items you choose to track are setup during implementation.

To track attributes

- Click Tracking Attributes sub tab.

- Select the item you want to track.

- Click Edit to edit the following information:

Field

Do this

Sub-Parameter

View the sub-parameter

Parameter

View the parameter.

Value

Specify the information about the corresponding Value field.

- Save changes you made to the account.

7.5.8.1 Create Tracking

- Click Create Tracking, the system loads the tracking parameters.

- If you want to reduce the list of parameters, select a sub-attribute in the Sub Attribute box.

- If your system has been configured to use the Sub Code field, only attributes in a particular group appear in the Parameter display.

- Specify the requested parameter in the Value field and click Save.

7.5.9 Customer Search Tab

While creating an application for an existing customer, you can retrieve and copy the customer details into the new application by using the Customer Search section of the Simple Application Entry screen.

You can modify only the address, employment, financial details and not the demographic and identification details.

To copy the Customer Details

- On the Underwriting screen, click Applicants tab.

- Click Customer Search tab.

- In the Search Criteria screen, use the Comparison Operator and Values columns to create the search criteria you want to use to find a customer.

- Click the Search button.

The system locates and displays all the customer details that meet your search criteria in the Search Results section.

Select Reset Criteria at any time to clear the Comparison Operator and Values columns on the Criteria screen.

- In the Search Results section, select a customer you want to load.

- Select the relation type and click Copy Customer Details.

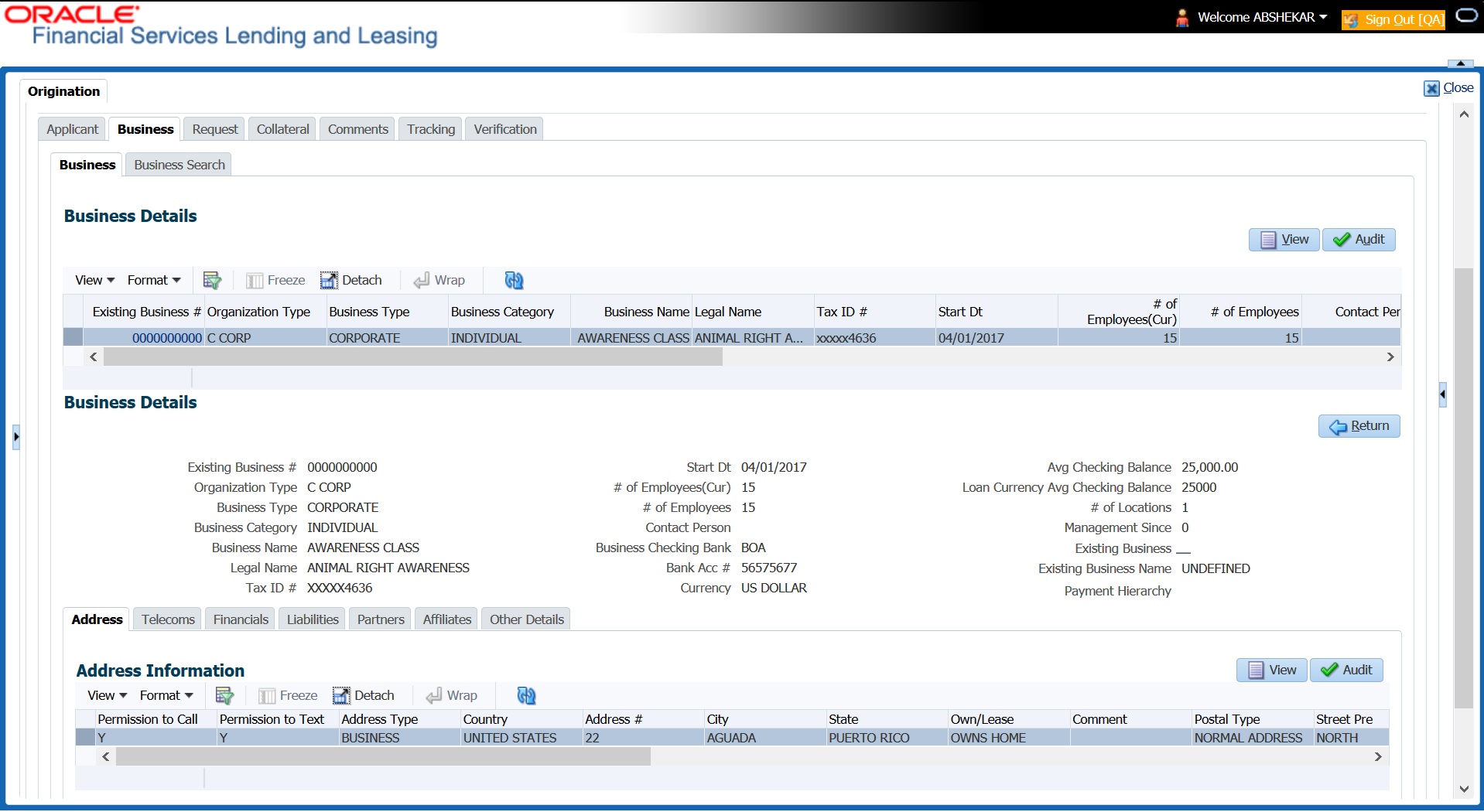

7.6 Business Tab

Oracle Financial Services Lending and Leasing can record SME business related financial information and business partners on the Business section to assist in approving the Lease application during underwriting. The Business Applicant screen is available and contains the following sub screens:

- Address

- Telecoms

- Financials

- Liabilities

- Partners

- Affiliates

- Other details

If there are no business information associated with the application, the Business Applicant tab is unavailable.

To complete the Business tab

- If SME business information is included on the application, select small business in the Class field on the Applications section and click Save.

The Business tab appears on the Underwriting screen.

- Click BusinessTab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Organization Type |

Select the organization type. |

Business Type |

Select the type of the business. |

Business Name |

Specify the name of the business. |

Legal Name |

Specify the legal name of the business. |

Tax ID |

Specify the tax identification. |

Start Date |

Specify the business start date. |

# of Employees (Cur) |

Specify the current number of employees at the business. |

# of Employees |

Specify the number of employees at the business after financing. |

Contact Person |

Specify the contact person at the business. |

Business Checking Bank |

Specify the bank name of the business’s checking account. |

Bank Acc # |

Specify the bank account number. |

Avg Checking Balance |

Specify the average checking balance. |

# of Locations |

Specify the number of locations of the business. |

Management Since |

Specify the year the current management was established. |

Existing Business |

Check this box if it is an existing Business. |

Existing Business Name |

Specify the name of Business entity. If this is not an existing Business, the field is displayed as UNDEFINED. |

Payment Hierarchy |

Select the required Hierarchy Definition to be used for payment appropriation from the drop-down list. The list is populated with all the pre-defined and enabled hierarchy definitions maintained Setup > Administration > Users > Payment Hierarchy screen. The Hierarchy Definition selected here is propagated to Servicing > Customer/Business details. If an existing hierarchy is modified and the ‘Update Customer/Business info’ option is enabled, then the Payment Hierarchy in Servicing > Customer / Business details are also updated. |

- Perform any of the Basic Actions mentioned in Navigation chapter

7.6.1 Address Sub Tab

You can enter more than one address for the business.

To complete the Address Sub Tab

- Click Address Sub Tab

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Current |

Check this box if this is a current address. The mailing address must be marked as current. |

Permission to Call |

Check this box if customer has provided permission to contact through the specified phone number. Atleast one phone number per application should have the permission to call (flagged as 'Y') for the successful pre-qualification of the application. Else, an error message is displayed. |

Permission to Text |

Check this box if customer has provided permission to contact through text message. |

Mailing |

Check this box if this is the mailing address. Only one address entry can be marked as the mailing address. |

Address Type |

Select the address type. |

Country |

Select the country. |

Address # |

Specify the building number. |

Own /Lease |

Select the ownership type. |

Comment |

Specify a comment. |

Postal Type |

Select the address type. |

Street Pre |

Select the street prefix (directional). |

Street Name |

Specify street name |

Street Type |

Select the street type. |

Street Post |

Select the street postfix (directional). |

Apt # |

Specify the apartment number. |

Address Line 1 |

Specify the first address line. |

Address Line 2 |

Specify the second address line. |

Zip |

Select the zip code. For non US country, you have to enter zip code. |

Zip Extn |

Specify the zip extension. |

City |

Specify the city. |

State |

Select the state. |

Phone |

Specify the phone number. |

- Perform any of the Basic Actions mentioned in Navigation chapter

- If there are more than one addresses associated with business, click Save And Add and add the address details.

7.6.2 Telecoms Sub Tab

The Business tab’s Telecoms sub tab needs to be completed, if additional phone numbers for the business exist. If not, this sub tab can be ignored.

To complete the Telecoms sub tab

- Click Telecoms sub tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Permission to Call |

Check this box if customer has provided permission to contact through the specified phone number. Atleast one phone number per application should have the permission to call (flagged as 'Y') for the successful pre-qualification of the application. Else, an error message is displayed. |

Permission to Text |

Check this box if customer has provided permission to contact through text message. |

Type |

Select the telecommunication type. |

Phone |

Specify the phone number. |

Extn |

Specify the phone extension. |

Current |

If selected, indicates that this is a current telecom. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

7.6.3 Financials Sub Tab

The Business tab’s Financials sub screen only needs to be completed if financial assets exist on the application for the business. If not, this sub screen can be left blank.

To complete the Financials sub tab

- Click the Financials sub tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Type |

Select financial type; for example, liquid assets, retirement assets, and so on. |

Source |

Specify source; for example, stocks, 401K, rent received, and so on. |

Currency |

Select the currency of the asset. |

Amount |

Specify amount. |

Lease Currency Amount |

The system displays the Lease currency amount |

Comment |

Specify comment, if any. |

Include |

Check this box to include this record in calculations on the Other Details sub section. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

7.6.4 Liabilities Sub Tab

The Business Applicant link’s Liabilities sub screen only needs to be completed if financial liabilities exist on the application for the business. If not, this sub screen can be left blank.

To complete the Liabilities sub tab

- Click Liabilities sub tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Type |

Select the liability type. |

Currency |

Select the currency. |

Lease Currency Amount |

The system displays the Lease currency amount |

Amount |

Specify the liability amount. |

Frequency |

Select the frequency. |

Account Type |

Specify the account type. |

Lease Currency Account Balances |

The system displays available Lease currency account balance. |

Account Balance |

Specify the account balance. |

Comment |

Specify comments, if any. |

Include |

Check this box to include this record in calculations on the Other Details sub screen. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

7.6.5 Partners Sub Tab

You can enter more than one partner for the business.

To complete the Partners sub tab

- Click Partners sub tab

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Permission to Call |

Check this box if customer has provided permission to contact through the specified phone number. Atleast one phone number per application should have the permission to call (flagged as 'Y') for the successful pre-qualification of the application. Else, an error message is displayed. |

Permission to Text |

Check this box if customer has provided permission to contact through text message. |

First Name |

Specify the partner’s first name. |

MI |

Select the partner’s middle name. |

Last Name |

Specify the partner’s last name. |

Suffix |

Specify the partner’s suffix. |

SSN # |

Specify the partner’s social security number. |

Birth Dt |

Specify the partner’s birth date. |

Birth Place |

Specify the partner’s birth place. |

Title |

Select the partner’s title. |

Ownership (%) |

Specify the percentage of ownership held by the customer. |

Net worth |

Specify the partner’s net worth. |

Gross Income |

Specify the partner’s gross income. |

Language |

Specify the partner’s language. |

Nationality |

Specify the partner’s nationality. |

Country |

Select the partner’s country code. |

Address # |

Specify the partner’s address number. |

Address Line 1 |

Specify the partner’s first address. |

Address Line 2 |

Specify the partner’s second address line. |

Zip |

Select the partner’s zip code. For non-US country, you have to enter zip code. |

Zip Extn |

Specify the partner’s zip extension. |

City |

Specify the partner’s city. |

State |

Select the partner’s state. |

Phone |

Specify the partner’s phone number. |

Extn |

Specify the partner’s phone extension. |

Specify the partner’s email. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

7.6.6 Affiliates Sub Tab

You can enter more than one affiliate for the business.

To complete the Affiliates sub tab

- Choose Affiliates sub tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Organization Type |

Select the affiliate’s organization type |

Legal Name |

Specify the affiliate’s legal name |

Business Name |

Specify the affiliate’s business name |

Tax ID |

Specify the affiliate’s tax identification |

Ownership (%) |

Specify the affiliate’s percentage of ownership |

# of Employees |

Specify the affiliate’s number of employees |

NAICS CODE |

Specify the affiliate’s North American Industry Classification System code. |

Country |

Select the affiliate’s country code. |

Address # |

Specify the affiliate’s address number. |

Address Line 1 |

Specify the affiliate’s first address line. |

Address Line 2 |

Specify the affiliate’s second address line. |

Zip |

Select the affiliate’s zip code. For non US country, you have to enter zip code. |

Zip Extension |

Specify the affiliate’s zip extension. |

City |

Specify the affiliate’s city. |

State |

Select the affiliate’s state. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

7.6.7 Other Details Sub Tab

The Other Details sub screen records information regarding monetary amounts associated with the business such as profits, sales, and expenses.

To complete the Other Details sub tab

- Click Other Details sub tab.

- Click Edit.

- Verify financial details as well as assets and liabilities linked to the business.

A brief description of the fields is given below:

Field: |

Do this: |

Other Details section |

|

Currency |

Select the currency. |

Business Type |

Select the type of business. |

Analysis Frequency |

Select the analysis frequency. |

Lease Currency Gross Margin Factor |

The system displays the Lease currency business’s gross margin factor |

Gross Margin Factor |

Specify the business’s gross margin. |

Organization Type |

Select the type of organization. |

Lease Currency Income |

The system displays the Lease currency business income amount. |

Income |

Specify the business’s income amount. |

Lease Currency Collection Average |

Specify the Lease currency collection average. |

Collection Average |

Specify the collection average. |

Lease Currency Proj Coll Avg Annual |

Specify the Lease currency annual projected collection average. |

Proj. Coll.Avg.Annual |

Specify the annual projected collection average. |

Lease Currency Book List |

Specify the Lease currency business booklist. |

Book List |

Specify the business booklist. |

Lease Currency Turn Over |

Specify the Lease currency turnover amount. |

Turn Over |

Specify the turnover amount. |

Lease Currency Capital Amount |

Specify the Lease currency capital amount. |

Capital Amt |

Specify the capital amount. |

Lease Currency Earned Surplus |

Specify the Lease currency earned surplus amount. |

Earned Surplus |

Specify the earned surplus amount. |

Lease Currency Gross Profit |

Specify the Lease currency gross profit amount. |

Gross Profit |

Specify the gross profit amount. |

Lease Currency Net Profit |

Specify the Lease currency net profit amount. |

Net Profit |

Specify the net profit amount. |

Lease Currency Working Capital |

Specify the Lease currency working capital amount. |

Working Capital |

Specify the working capital amount. |

Lease Currency Annual Sales |

Specify the Lease currency annual sales amount. |

Annual Sales |

Specify the annual sales amount. |

Lease Currency Projected Sales |

Specify the Lease currency projected sales amount. |

Projected Sales |

Specify the projected sales amount. |

Lease Currency Equity |

Specify the Lease currency equity amount. |

Equity |

Specify the equity amount. |

Open Delq |

Specify the open delinquency amount. |

Lease Currency Business Expenses |

Specify the Lease currency business expenses amount. |

Business Expenses |

Specify the business expenses amount. |

Lease Currency Personal Expenses |

Specify the Lease currency personal expenses amount. |

Personal Expenses |

Specify the personal expenses amount. |

Lease Currency Total Expenses |

View the Lease currency total expenses amount. |

Total Expenses |

View the total expenses amount. |

Lease Currency Annual Proj Sales Amt |

View the Lease currency annual projected collection amount. |

Annual Proj Sales Amt |

View the annual projected collection amount. |

Lease Currency Annual Proj Exp Amt |

View the Lease currency annual projected expenses amount. |

Annual Proj Exp Amt |

View the annual projected expenses amount. |

Lease Currency Current Assets |

Lease currency current assets. |

Current Assets/Liability ratio |

View the current asset to liability ratio. |

Lease Currency Fixed Assets |

View the Lease currency fixed assets. |

Fixed Assets |

View the fixed assets. |

Lease Currency Intangible Assets |

View the Lease currency intangible assets. |

Intangible Assets |

View the intangible assets. |

Lease Currency Current Liabilities |

View the Lease currency current liabilities |

Current Liabilities |

View the current liabilities. |

Lease Currency Long Term Liabilities |

View the Lease currency long term liabilities. |

Long Term Liabilities |

View the long term liabilities. |

Lease Currency Total Assets |

View the Lease currency total assets |

Total Assets |

View the total asset amount. |

Lease Currency Total Networth |

View the Lease currency total net worth amount. |

Total Net worth |

View the total net worth amount. |

Lease Currency Total Liability |

Lease currency total liability amount. |

Total Liability |

View the total liability amount. |

Debt Net worth Ratio |

View the debt to net worth ratio. |

Current Assets/Liability ratio |

View the current asset to liability ratio. |

Signatures |

|

Title 1-4 |

Specify the title. |

Signature1-4 |

Specify the signature. |

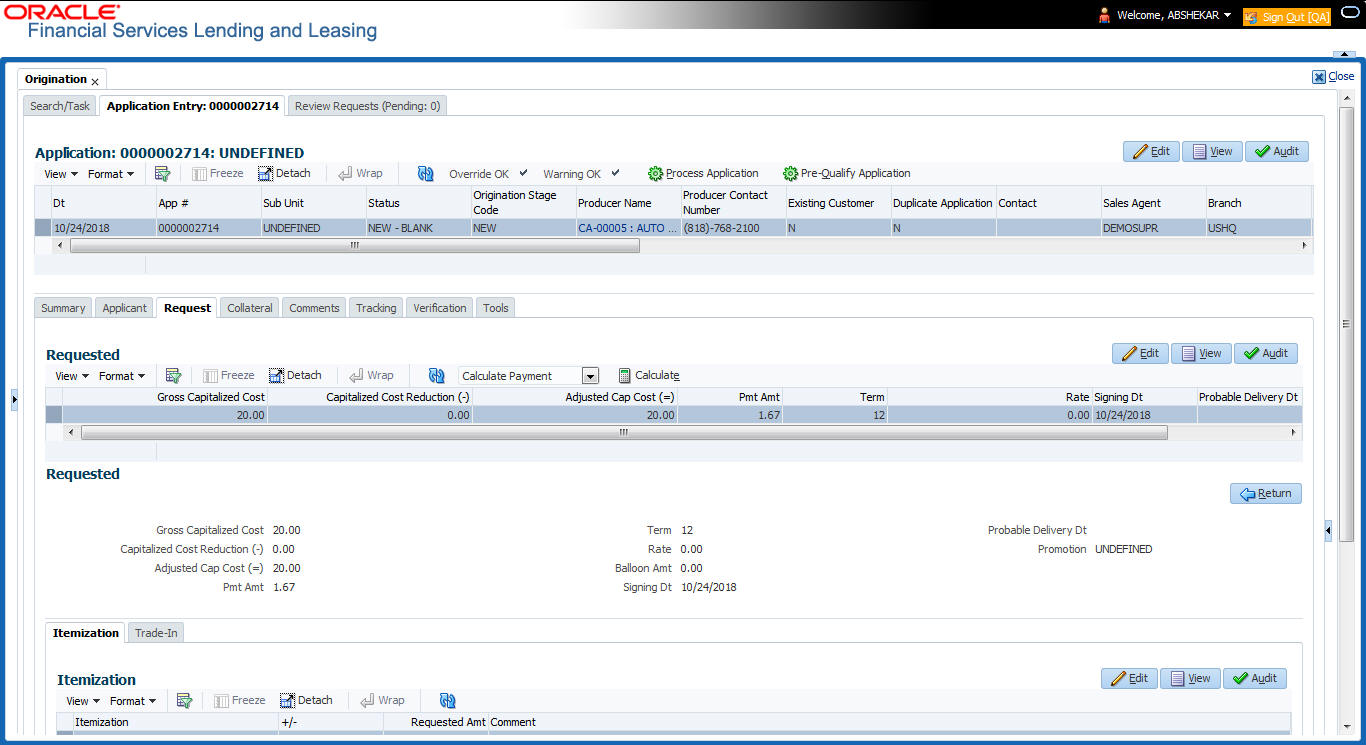

7.7 Request Tab

In the Request tab you can define the required Lease parameters and calculate Payment, Interest Rate, Term and Lease Amount using the quick calculator. By default, system calculates for monthly repayment term basis. The payment frequency can be changed only in the Underwriting tab during decisioning.

To complete Request section:

- On the Application Entry tab, click Request tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields are given below:

Field |

Do this |

Gross Capitalized Cost |

Specify the value of gross capitalized cost. |

Capitalized Cost Reduction (-) |

Specify the value of capitalized cost reduction which is the advance amount. |

Adjusted Cap Cost (=) |

View the adjusted capitalized cost which is calculated as Gross Capitalized Cost - Capitalized Cost Reduction. |

Pmt Amt |

Specify the requested payment amount. |

Term |

Specify the requested term (number of payments). |

Rate |

Specify the requested Rate. |

Balloon Amt |

Specify the balloon amount (if exist). Note: This field is displayed only if the lease calculation method is ‘Interest Rate’. |

Signing Dt |

Specify the signing date |

Probable Delivery Dt |

Specify the probable delivery date. |

Promotion |

Select the promotion type from the drop-down list. Note: This field is displayed only if the lease calculation method is ‘Interest Rate’. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- In the ‘Requested’ section, there is a drop-down list adjacent to the ‘Calculate’ button with following options to auto calculate different Lease parameters based on the data provided. Select the record you want to work with and from the drop-down option, select the option you want system to calculate:

Lease Type

Calculate Option

Rent Factor

Calculate Payment

Calculate Gross Capitalized Cost

Interest Rate

Calculate Payment

Calculate Interest Rate

Calculate Term

Calculate Lease Amount

- Click Calculate. The system displays the requested calculation in the respective field.

7.7.1 Itemization Sub Tab

The Itemizations sub tab enables you to add or verify any itemized amounts associated with the application. The list of itemizations is determined by the product you select in the master screen during the application entry process. The Itemizations sub screen displays an itemization record of the amount financed, such as the cash price, cash down payment, trade-in, unpaid cash price balance and so on. Information that was entered on the Itemization sub screen during the application entry process will appear in the Requested Amt column. Information that you enter as an underwriter in the Approved Amt column will appear in the Itemizations sub tab on the Underwriting screen.

Application request details need to be essentially entered in the itemization sub tab for pre-screening to be successful. Else, the system displays error and application would not proceed to the next level in work flow. The details of down payment, trade-in, insurance, fees etc. and the total sale price are recorded under itemization.

To add or view itemizations

- Open the Underwriting screen and load the underwriting application you want to work with.

- Click Request > Itemizations sub tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Itemization |

View the itemization. |

+/- |

View whether the itemized amount is added or subtracted from the Lease amount. |

Requested Amt |

Specify the requested amount. |

Comment |

Specify a comment. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

7.7.2 Trade-In Sub Tab

The Trade-In sub screen enables you to add or verify any trade-ins associated with the application. If there is any information regarding an itemized trade-in, use the Trade-In sub screen to enter the details in the system. (This sub screen might already contain information supplied during the application entry process.)

To complete the Trade-In sub screen

- Open the Underwriting screen and load the underwriting application you want to work with.

- Click Request > Trade-In.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Trade-In |

|

Asset Type |

Select the asset type. |

Asset Sub Type |

Select the asset sub-type. |

Year |

Specify the year of the asset. |

Make |

Specify the make of the asset. |

Model |

Specify the model of the asset. |

Body |

Specify the body of the asset. |

Identification # |

Specify the identification number. |

Description |

View the asset description. |

Valuation |

|

Wholesale Amt |

Specify the wholesale value. |

Base Retail Amt |

Specify the retail value. |

Addons Amt (+) |

Specify the add ons value. |

Pay Off Amt (-) |

Specify the payoff amount. |

Total Amt = |

View the total value. |

Valuation Dt |

Specify the valuation date. |

Source |

Select the valuation source. |

Valuation Supplement |

Specify the valuation supplement. |

Edition |

Specify the valuation edition. |

- Perform any of the Basic Actions mentioned in Navigation chapter

7.7.3 Subvention Sub Tab

With the Subvention sub tab, available only for Lease, you can review the subvention information from the application entry and calculate the subvention amount, as well as override the calculated subvention amount. The participant’s information is automatically populated based on the selected subvention plan.

To complete the Subvention sub screen

- Open the Underwriting screen and load the underwriting application you want to work with.

- Click Request > Subvention sub tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Subvention Plan section: |

|

Plan |

Select the subvention plan. |

Description |

View the subvention plan description. |

Sub Plan |

Select the sub plan. |

Sub Plan Description |

View the subvention sub plan description. |

Subvention Type |

View the subvention type. |

Include |

Check this box to include this record in calculations on the Other Details sub section |

- Perform any of the Basic Actions mentioned in Navigation chapter.

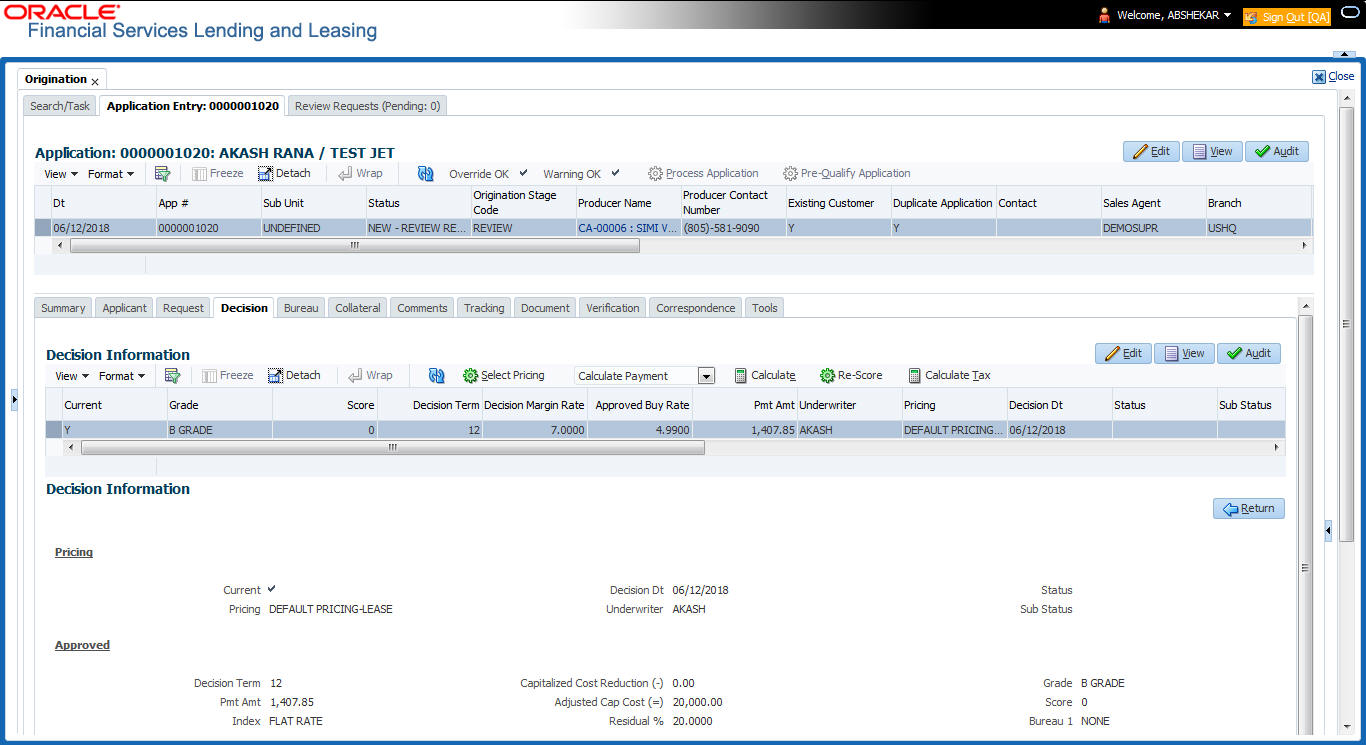

7.8 Decision Tab

If the application was initially approved automatically, the system displays its recommendations on the Decision tab’s Approved section.

If the application was initially rejected automatically, the system displays its reasons on the Decision link’s Stipulation sub tab.

If you choose to approve or reject the Lease manually, you must manually select the pricing (rule) set by the portfolio company for a specific product. The system validates this pricing against the information in the System Recommendation sections. The information in the Requested section comes from the application entry process and can be edited.

- If the data meets your approval, change the status of the application to either Approved or Rejected and enter any stipulations.

- If you reject the application, change the status to Rejected and enter the reasons for the adverse action on the Stipulations sub screen.

You can use the quick calculator provided with the drop-down list adjacent to the ‘Calculate’ button to calculate the required Lease parameters. You can also use the calculator available in Tools section for completing this step. For detailed information on using the Calculator tools, refer “Tools” chapter in the document.

To verify the application decision data

- Open the Underwriting screen and load the underwriting application you want to work with.

- Click Decision tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

- A brief description of the fields is given below:

Field:

Do this:

Pricing section

Current

Check this box to indicate that this is the current decision.

Pricing

View the pricing.

Decision Dt

View the decision date.

Underwriter

View the underwriter id.

Status

View the application status.

Sub Status

View the application sub-status.

Approved section

Decision Term

Specify the approved decision term.

Pmt Amt