Setting Up Life Insurance and Accidental Death Plans

To set up life and accidental death plans, use the Coverage Formula Table (BN_FORMULA) and Life and AD/D Plan Table (LIFE_ADD_TABLE) components.

This section provides an overview of coverage calculation formulas.

You can create simple formulas to define how coverage should be calculated. These formulas are used by both life and disability insurance plans. You can specify how the benefits compensation base is determined, a formula to apply against that base to derive a coverage amount, and limits on the coverage amount. You can also define whether the coverage is subject to reduction based on attained age. The examples illustrate calculation possibilities with as of rates:

Example: Employer Pays Increased Premium

An employee belongs to a life insurance plan that uses the premium as of January 1, current year and coverage as of the current date. The system uses the benefit base for the calculation.

|

Employee |

Effective Date |

Salary |

Benefit Base |

|---|---|---|---|

|

Ann Jeffrey |

January 1, 2008 |

10,000 |

12,000 |

|

Ann Jeffrey |

April 1, 2008 |

15,000 |

15,000 |

|

Ann Jeffrey |

January 1, 2009 |

17,500 |

18,000 |

|

Table |

Effective Date |

Rate |

Per |

|---|---|---|---|

|

Life (employee) |

January 1, 2008 |

1.00 |

Thousand |

|

Life (employer) |

January 1, 2008 |

2.00 |

Thousand |

The employee gets a raise, so coverage increases during the year; however, until the next January 1, the system calculates the employee premium as if the coverage did not increase. The employer pays the difference between the employee deduction and the actual cost. This affects imputed income.

|

Pay End Date |

Coverage |

Employee Amount |

Employer amount |

|---|---|---|---|

|

January 31, 2008 |

12,000 |

12.00 |

24.00 |

|

February 28, 2008 |

12,000 |

12.00 |

24.00 |

|

March 31, 2008 |

12,000 |

12.00 |

24.00 |

|

April 30, 2008 |

15,000 |

12.00 |

33.00 |

|

May 31, 2008 |

15,000 |

12.00 |

33.00 |

Example: Coverage and Premium Remain the Same

Another employee belongs to a life insurance plan that uses the premium as of January 1, current year and coverage as of January 1, current year.

|

Employee |

Effective Date |

Salary |

Benefit Base |

|---|---|---|---|

|

Jim Henry |

January 1, 2008 |

10,000 |

12,000 |

|

Jim Henry |

April 1, 2008 |

15,000 |

15,000 |

|

Jim Henry |

January 1, 2009 |

17,500 |

18,000 |

|

Table |

Effective Date |

Rate |

Per |

|---|---|---|---|

|

Life (employee) |

January 1, 2008 |

1.00 |

Thousand |

|

Life (employer) |

January 1, 2008 |

2.00 |

Thousand |

No change is made in Jim Henry's coverage or premium until the new year.

|

Pay End Date |

Coverage |

Employee Amount |

Employer Amount |

|---|---|---|---|

|

January 31, 2008 |

12,000 |

12.00 |

24,00 |

|

February 28, 2008 |

12,000 |

12.00 |

24,00 |

|

March 31, 2008 |

12,000 |

12.00 |

24,00 |

|

April 30, 2008 |

15,000 |

12.00 |

24,00 |

|

May 31, 2008 |

15,000 |

12.00 |

24,00 |

Use the Coverage Formula Table page (BN_FORMULA) to create coverage calculation formulas.

Navigation:

You can select from existing formulas to calculate life insurance coverage or create your own coverage calculation formulas, both from the Coverage Formula Table page.

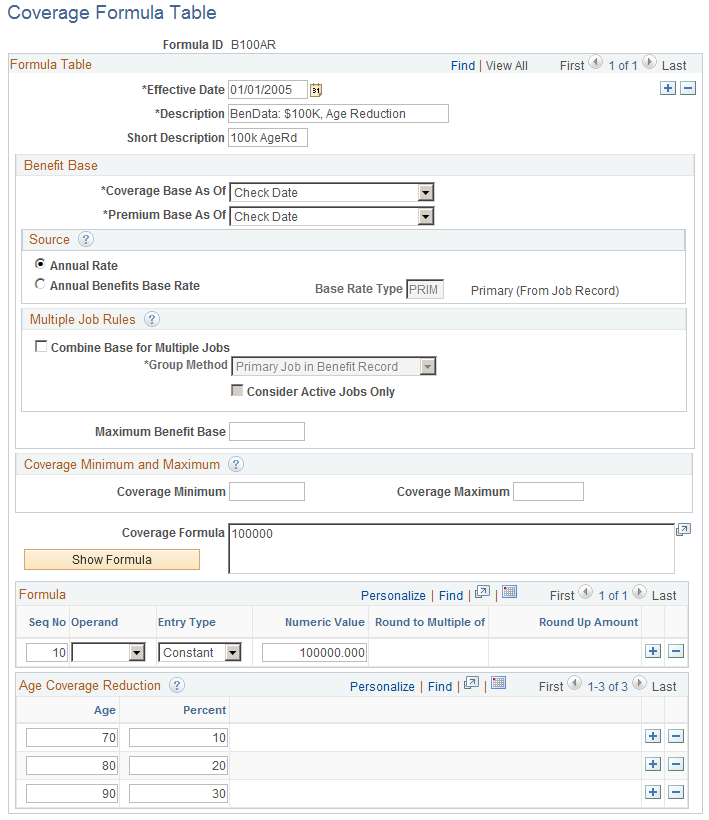

This example illustrates the fields and controls on the Coverage Formula Table page. You can find definitions for the fields and controls later on this page.

Benefit Base

Field or Control |

Description |

|---|---|

Coverage Base As Of |

Select the employee's salary that the system will use for coverage calculation. Values are:

|

Premium Base As Of |

Select the employee's salary that the system will use for premium calculation. The options are:

|

Source

Field or Control |

Description |

|---|---|

Annual Rate |

Select this field for the system to use the regular compensation base entered on the Job Data - Compensation page in Workforce Administration. |

Annual Benefits Base Rate |

Enter a rate from the drop-down menu. The system uses the rates defined in the Annl Benef Base Rt Type Tbl page. |

Multiple Job Rules

Field or Control |

Description |

|---|---|

Combine Base for Multiple Jobs |

Select this option if you want to aggregate salary from multiple jobs as a basis for a coverage determination. |

Group Method |

This field is available if you selected the Combine Base for Multiple Jobs option. Select the grouping method for the system to use when selecting jobs to contribute to the total benefit base. Values are:

|

Consider Active Jobs Only |

Select to have the system consider only jobs with an active status. |

Maximum Benefit Base |

Enter the maximum amount of benefit base that can be used in the coverage formula calculation. Note: This is most often used in disability plans to limit the amount of salary subject to replacement. |

Coverage Minimum and Maximum

Field or Control |

Description |

|---|---|

Coverage Minimum |

Enter the minimum amount of coverage that an employee can receive. If the calculated coverage falls below this amount, this amount will be covered as a default. |

Coverage Maximum |

Enter the maximum amount of coverage that an employee can receive. If the calculated coverage exceeds this amount the coverage is capped. |

Coverage Formula

Field or Control |

Description |

|---|---|

Coverage Formula |

Displays the formula in an algebraic format. |

Show Formula |

Click to refresh the Coverage Formula field. |

Formula

Field or Control |

Description |

|---|---|

Operand |

Select from these mathematical options to build your formula. |

Entry Type |

Select an entry type. Values are:

|

Numeric Value |

This field is available if you select Constant in the Entry Type field. Enter a numeric value. |

Round to Multiple of |

Enter a numeric value to designate the precision of the rounded number. Typical multiples are 100 and 1000. |

Round Up Amount |

Enter a numeric value to designate when a number gets rounded. |

Age Coverage Reduction

Field or Control |

Description |

|---|---|

Age |

Enter the age of employee. The system determines the age by the pay period end date. |

Percent |

Enter a percentage that the system will deduct from the employee's coverage. |

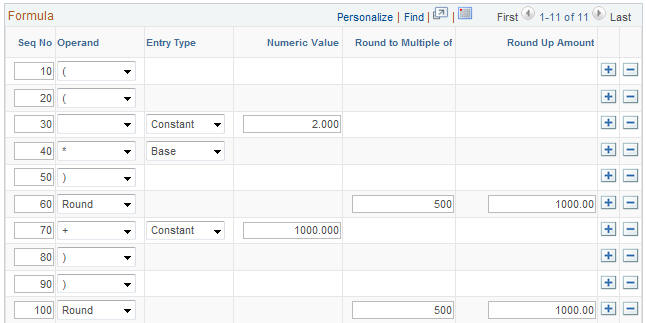

An Example for Creating a Formula

Here is an example for setting up the formula for ((2 X BASE) ROUND + 1000)) ROUND

For Seq No field 10, select the ( symbol in the Operand field.

Add a row.

For Seq No field 20, select the ( symbol in the Operand field.

Add a row.

For Seq No field 30, select Constant in the Entry Type field and enter 2 in the Numeric Value field.

Add a row.

For Seq No field 40, select the * symbol in the Operand field and select Base in the Entry Type field.

Add a row.

For Seq No field 50, select the ) symbol in the Operand field.

Add a row.

For Seq No field 60, select Round in the Operand field, enter 1000 in the Round to Multiple of field, and enter 500.00 in the Round Up Amount field.

Add a row.

For Seq No field 70, select + in the Operand field, select Constant in the Entry Type field, and enter 1000.00 in the Numeric field.

Add a row.

For Seq No field 80, select the ) symbol in the Operand field.

Add a row.

For Seq No field 90, select the ) symbol in the Operand field.

Add a row.

For Seq No field 100, select Round in the Operand field, enter 500.00 in the Round to Multiple of field, and enter 1000 in the Round Up Amount field.

The formula creation area should look like this:

This example illustrates the fields and controls on the Formula creation area. You can find definitions for the fields and controls later on this page.

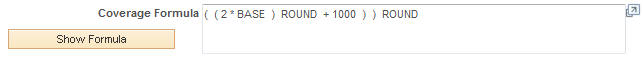

When you are done and have clicked Save Formula or Save, the formula that you created appears in the Coverage Formula Scroll area.

This example illustrates the fields and controls on the Completed customized formula. You can find definitions for the fields and controls later on this page.

Other examples of formulas you may want to create are:

Flat Amount

2 x Base

(2 x Base) Round

(2 x Base) Round + Flat Amount

((2 x Base) + Flat Amount) Round

(Base + Flat Amount) Round

((2 x Base) Round + Flat Amount) Round

Use the Life and AD/D Plan Table page (LIFE_ADD_TABLE) to enter life or AD/D plan details.

Navigation:

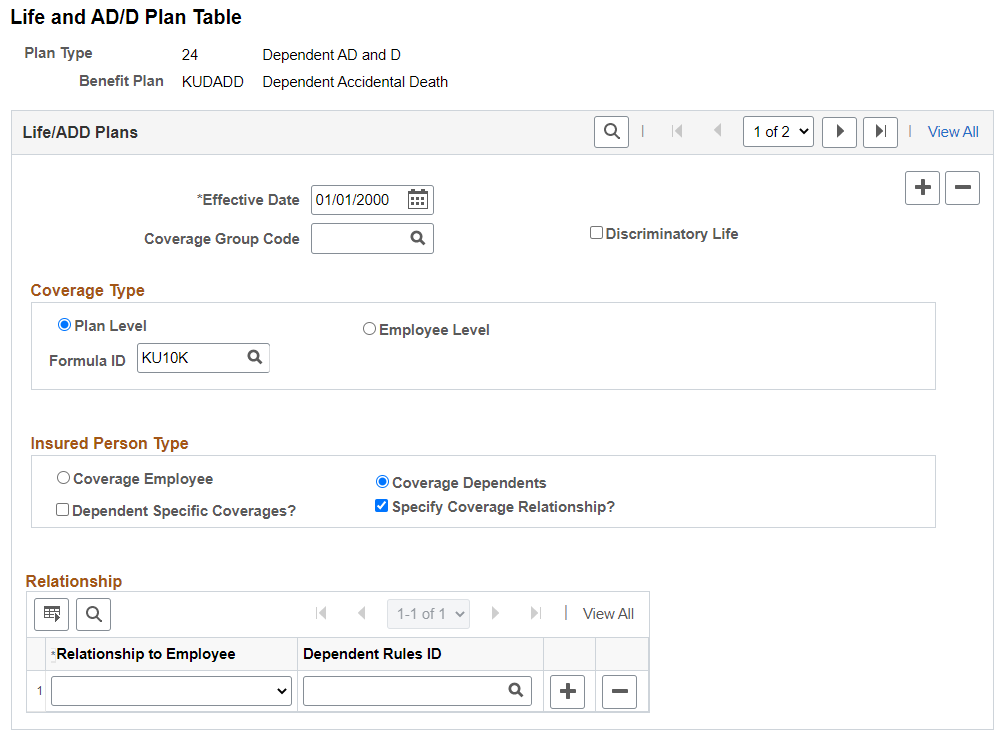

This example illustrates the fields and controls on the Life and AD/D Plan Table page. You can find definitions for the fields and controls later on this page.

Life/ADD Plans

Field or Control |

Description |

|---|---|

Coverage Group Code |

(Optional) Enables you to define a maximum benefit amount for a group of life and AD/D plan types. Coverage group codes are defined on the Life and AD/D Coverage Groups page. You might do this if employees can choose more than one life plan type—perhaps life and AD/D—but the total benefit for the combined plans cannot exceed a specific amount. The coverage group code maximum applies to all the life and AD/D benefit plans that you associate with a coverage group code and one benefit program. |

Discriminatory Life |

Select this field for the system not to deduct any coverage amounts from the U.S. imputed income calculation. |

Coverage Type

Field or Control |

Description |

|---|---|

Plan Level |

Select to indicate that coverage for this plan is determined by a specific formula ID. |

Employee Level |

Select to indicate that coverage for this plan is specified by the flat amount on the enrollment page. |

Formula ID |

Select from the available coverage formula IDs. |

Insured Person Type

Field or Control |

Description |

|---|---|

Employee |

Select to indicate that the person insured by this plan is the employee. On the enrollment page, this directs the system to collect beneficiary allocations. |

Dependents |

Select to indicate that the persons insured by this plan are the employee's dependents and not the employee. On the enrollment page, this directs the system to collect a list of covered individuals. |

Dependent Specific Coverages? |

Select the check box to indicate that each covered dependent will have an individual coverage amount entered for him or her on the enrollment page. If this check box is not selected, then a single coverage amount is specified and each covered person receives this same amount of coverage. |

|

Specify Coverage Relationship? |

Select the check box to specify if the coverage should be based on the dependent's age, and relationship with the employee. If this check box is selected, then a Relationship grid displays below. If this check box is not selected, then all the dependents are eligible for coverage. |

|

Relationship to Employee |

Select the relationship of the covered dependents with the employee. |

|

Dependent Rules ID |

Select the dependent rule for validating the dependents during the enrollment to this plan type. You can enter different dependent rules for your relationships. For more information on defining dependent rules, see Setting Up Dependent Rules for Health Plans. The dependent validation also depends on the event rules defined in Event Rules Table- Event Rules Page. |

Restricting Insurance Coverage

You can associate coverage formulas that include coverage minimum and maximum amounts with a life benefit program and benefit plan combination. When you do this, the system verifies that coverage for participants doesn't exceed those minimums and maximums, regardless of the coverage that you enter on the Life and AD/D Plan table. This enables you to restrict the amount of coverage for an individual life plan.

You can use the Coverage Group Code page to also restrict the amount of coverage across all life insurance plans in which the employee enrolls. For example, you define a coverage group code with a 500,000 USD maximum, then enter that coverage group code for a supplemental life plan and a group life plan, and associate both benefit plans with a benefit program. If you enrolled an employee in both of these plans, the system would ensure that the employee's total coverage by both plans does not exceed 500,000 USD.

If the maximum is exceeded, the system reduces the total coverage to meet the coverage maximum. When the system processes deductions, it accumulates the coverage amounts and begins reducing coverage when the coverage group maximum is reached. The system processes plans in order of deduction priority. If more than one plan has the same priority, it processes in increasing plan type order.

PeopleSoft Payroll for North America calculates coverage and premiums for the Option A - Standard FEGLI optional life plan in accordance with federal regulations. The Option A - Standard plan provides at least 10,000 USD in additional coverage, depending upon the employee's rate of pay.

When an employee's annual rate of pay is more than the sum of the annual rate of basic pay for Level II Executive Schedule positions under 5 U.S.C. 5313, plus 10,000 USD, Option A coverage automatically increases. The amount then becomes the difference between the employee's annual rate of pay and the maximum allowable Basic Insurance Amount (BIA). Calculations are included in the Calculation Rules Table for calculation rule ID OPTA.

The maximum allowable BIA appears in the Maximum Benefits Base field on the Calculation Rules Table page. PeopleSoft Payroll for North America uses this information to calculate coverage and premium amounts.