Setting Up Retirement Plans

To set up a retirement plan for PERS (the California Public Employees Retirement System) or the U.S. federal government, use the Retirement Plan Table (RTRMNT_PLAN_TABLE) component.

This section discusses how to enter retirement plan details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RTRMNT_PLAN_TABLE |

Set up California PERS or U.S. federal government retirement plans. |

Use the Retirement Plan Table page (RTRMNT_PLAN_TABLE) to set up California PERS or U.S. federal government retirement plans.

Navigation:

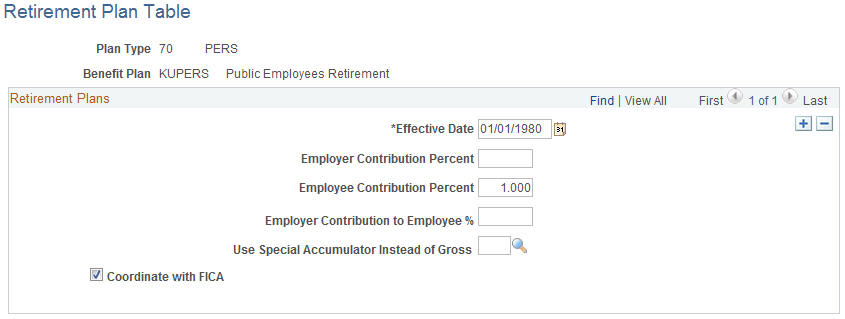

This example illustrates the fields and controls on the Retirement Plan Table page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Employer Contribution to Employee % (employer contribution to employee percentage) |

Define how much the employer contributes to the employee's total contribution percentage. |

Use Special Accumulator Instead of Gross |

To have the system use a special accumulator instead of the total gross, enter the desired accumulator code here. To use a special accumulator, work with your payroll department to define the code and its detail. You can set up special accumulators—as many as you need—to process savings, retirement, and pension plans. |

(USF) Federal Retirement Plans

Federal employees who are enrolled in FERS retirement plans are automatically enrolled in a TSP (Thrift Savings Plan) 1% Agency Contribution plan as well. In this plan, the employee's agency contributes 1% of the employee's basic pay for each pay period to the employee's TSP account. The TSP 1% Agency Contribution plan is predefined; its benefits do not take the place of those offered by other retirement plans. Employees enrolled in the TSP 1% Agency Contribution plan receive these contributions regardless of whether they contribute their own money to their TSP accounts.

Select OASDI Offset for retirement plans that have employee contributions offset by employee contributions to OASDI. The system reduces employee retirement plan contributions by the OASDI contribution amount and the following pre-tax deductions (Medical (plan type 10), Dental (plan type 11), Vision (plan type 14), Flex Spending Health - U.S. (plan type 60), Flex Spending Dependent Care (plan type 61) and Health Savings Account (plan type 67)) until the maximum OASDI/FICA contribution level is reached.

You must define a special accumulator for the system to track the Basic Pay Wages that are used in the retirement deduction calculation.