Collecting FBT-Liable Earnings

The ATO requires that you report FBT-liable earnings when the gross-up value (of all FBT-liable earnings) exceeds a minimum figure. To have the system calculate the reportable fringe benefits amount for inclusion on the payment summary, you run a collect process.

This topic discusses ways to collect FBT-liable earnings.

Summing Category F Earnings

Use the FBT Collection page (select to set the parameters to have the system sum the net amounts of all earnings categorized as F (variable EOY VR CATEGORY) and gross them up. This is the same run control page—GPAU_RC_FBT_COLLEC—as used for Create Payment Summary. The difference is that this process uses the Application Engine program GPAU_FBT_COL and Create Payment Summary uses GPAU_PSM_CRE.

You need to enter the tax year and the population you are generating the data for. The population can be pay entity, pay group, or payee.

The Update if Record Exists check box relates to the record values that appear on the Reportable FBT Earnings page. If you select this check box and the record exists (either because of a manual entry only—status Entered—or because you have run the collect process previously—status Created), rerunning the process updates the calculated amount only. It does not change any manual entry.

The process is Application Engine process GPAU_FBT_COL.

Note: You need to set up your FBT percent and minimum reportable FBT-liable earnings in Salary Packaging before you can run this process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_EE_FBT |

View calculated amounts, add manual amounts, conditionally change the status, or view gross-up values. You view the calculated amounts after you have run the Collect Reportable FBT process. |

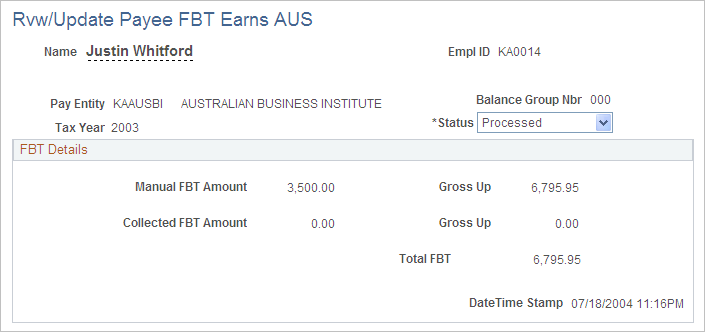

Use the Rvw/Update Payee FBT Earns AUS page (GPAU_EE_FBT) to view calculated amounts, add manual amounts, conditionally change the status, or view gross-up values. You view the calculated amounts after you have run the Collect Reportable FBT process.

Navigation:

This example illustrates the fields and controls on the Rvw/Update Payee FBT Earns AUS page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Status |

You can change the status from Processed to Created but only if the status of the Payment Summary process is still Created (not Processed or Issued). You change it to rerun the collect process to repopulate the Collected FBT Amount field. The statuses are: Entered: The page has had a manual entry only. Created: The Collect Reportable FBT has been run (even if the process didn't pick up any amount) Processed: Payment summaries have been created and the FBT data included (if there was any). Issued: Refers only to the Payment Summary processes. |

Manual FBT Amount |

This is for any manually calculated amounts. Any values entered here are not affected by rerunning the collect process, which updates only the Collected FBT Amount field. The system displays the gross-up value of the amount that you enter in the associated Gross Up field. |

Collected FBT Amount |

This is the result of the Collect Reportable FBT process (which may be 0.00). The system displays the gross-up value of the collected amount in the associated Gross Up field. |

Total FBT Amount |

This is the total of the gross-up amounts. If the amount exceeds the minimum FBT-liable earnings for payment summary reporting, it is reported on the employee's payment summary and included in the electronic file submission to the ATO. |

Date Time Stamp |

This is the date and time that the page (record) was last updated—manually or by the process. |

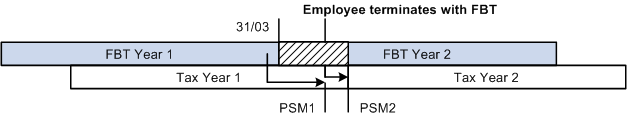

An employee might terminate employment between the end of the FBT year and the end of the corresponding tax year. If, during that period—April 1 to June 30—that employee received reportable FBT-liable earnings over the reportable limit, you need to process two FBT collections and two payment summaries. The first is for the tax year in which the employee terminated employment. The second is solely to report the FBT-liable earnings that would normally have been reported on the payment summary for the next tax year. The system retrieves the FBT-liable earnings even though there is no tax balance record for that next tax year.

In this diagram, the position of PSM2 indicates the tax year to which the FBT belongs.