Converting Data from STP 1 to STP 2

The data conversion process converts the data from pay event 2018 format to pay event 2020 format. While this feature is primarily used for update events, it can also be used to report to the Final Pay Event for terminated employees before transitioning to STP Phase 2.

The pay event data in 2020 format is stored in STP Phase-2 staging tables.

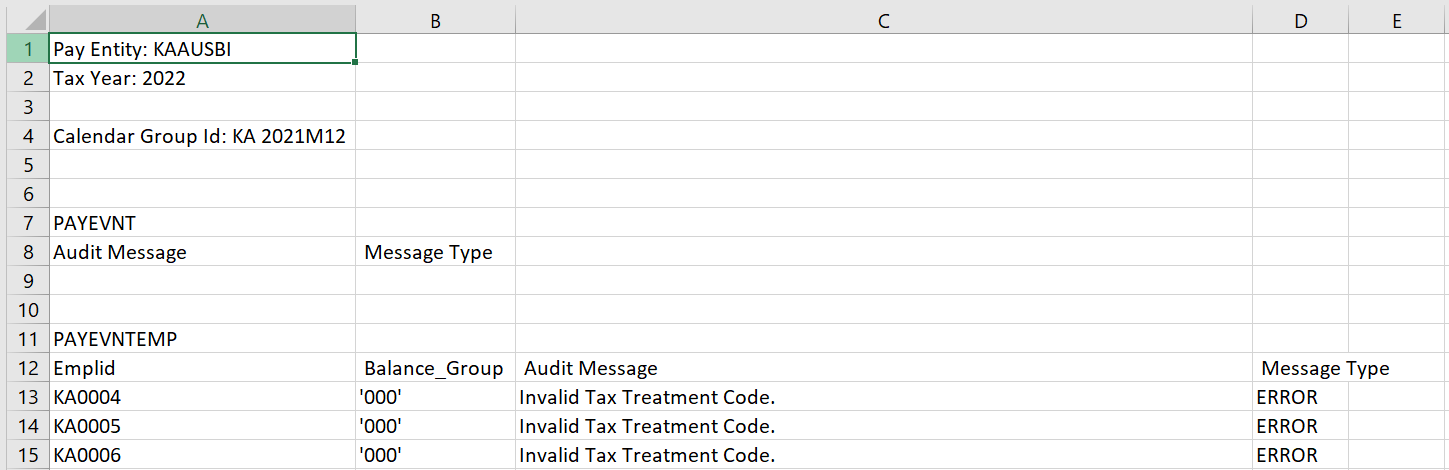

Two validation log files will be generated:

STP Validation Log: This validation log includes the conditional validation on two or more tags and for any missing mandatory information. A CSV file is generated with the list, and they are classified as ‘error’ or ‘warning’.

STP Validation Log

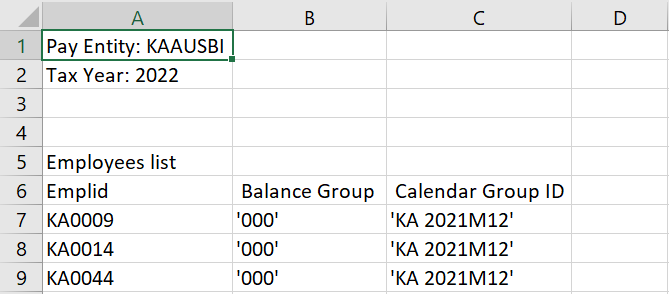

Data conversion log for employees: This log lists employees for whom the data has been converted.This validation log includes details like Employee ID, Balance Group and Calendar Group ID.

Data conversion log for employees

Note: ATO has mentioned that if the payer is unable to provide the data in line with the Income Stream Collection, then they must use the Update 2018 service to amend the finalised Income Statement. There is no mandatory requirement that data needs to be converted to 2020 format. If a user wishes to submit in the new format, such users can make use of the data conversion process.

Once the data is converted into STP Phase 2 format, customers can review and override (if necessary) the data through the STP 2.0 Update Event AUS page. For more information about STP Phase 2.0 setup, see the STP Reconciliation Setup AUS Page. The update event for the converted data can be submitted in Pay Event 2020 format using the regular process, where the update event date has to be added to the respective employee data, and the file generation process is to be run for generating the update event file.

It is stated by the ATO that Tax Treatment Code is mandatory and should be reported as at run date/time stamp of the Update process. The data conversion process updates the tax treatment code based on the system date. In the XML file generated during an update event, the tax treatment code is updated again based on the date and time stamp of the update action run for the employees for whom the data is converted.

Special Note for Allowance and Deduction

Follow these guidelines while converting data from STP I to STP II format:

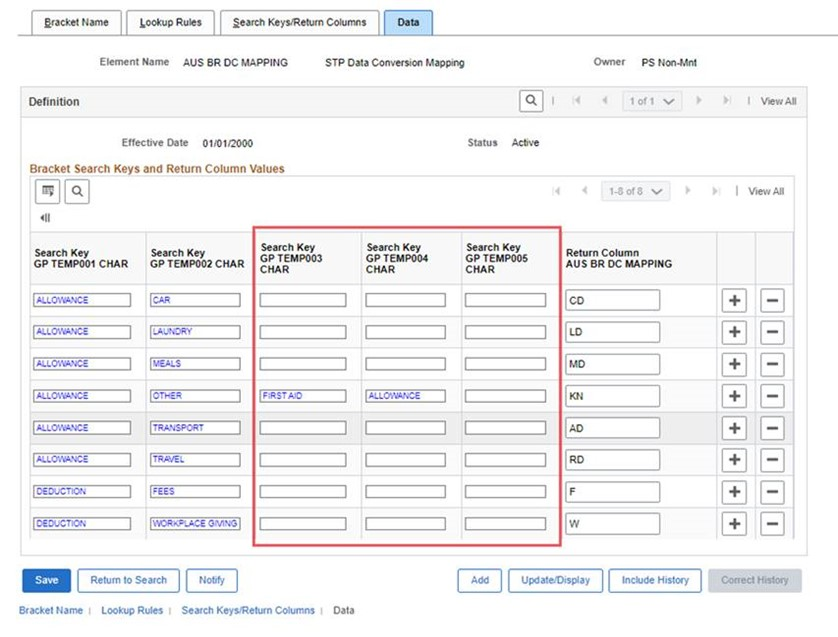

Subcategories reported in STP I should be replaced with the subcategories reported in STP II.

Customers are required to update AUS BR DC MAPPING bracket with any custom allowance codes that differ between STP Phase 1 and STP Phase 2.

The existing bracket [AUS BR RETRO SETUP] has been delivered with a new effective date as 07/01/2000 for accommodating the retro calculations during data conversion.

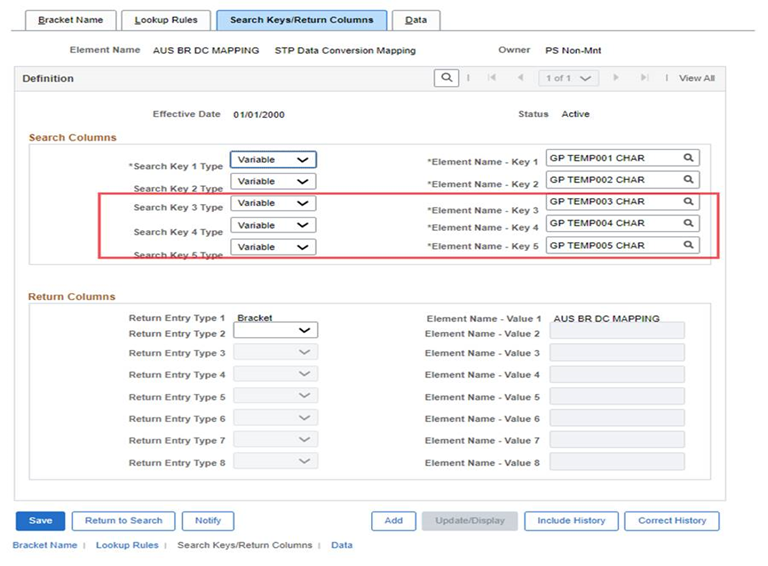

The search keys GP TEMP001 CHAR and GP TEMP002 CHAR are used to search with Category and Sub-Category. If the allowance category in Phase 1 is 'Other', the three additional search keys GP TEMP003 CHAR, GP TEMP004 CHAR, and GP TEMP005 CHAR are used to search with the description of the sub-category.

Search Keys

Since there is a limitation that the number of allowed characters is only 18 for a search key, three fields have been enabled to add the description.

Data

Note: The search keys GP TEMP003 CHAR,GP TEMP004 CHAR, GP TEMP005 CHAR should be populated only when the allowance sub-category is selected as “Other” in STP Phase 1.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_STP_DC_RN |

To amend a file using 2020 service that was initially submitted using the 2018 service. Data can be converted for Update Events or Final Pay Events. |

Use the STP Update/Final Event Data Conversion page (GPAU_STP_DC_RN) to amend a file using 2020 service that was initially submitted using the 2018 service. Data can be converted for Update Events or Final Pay Events.

Navigation:

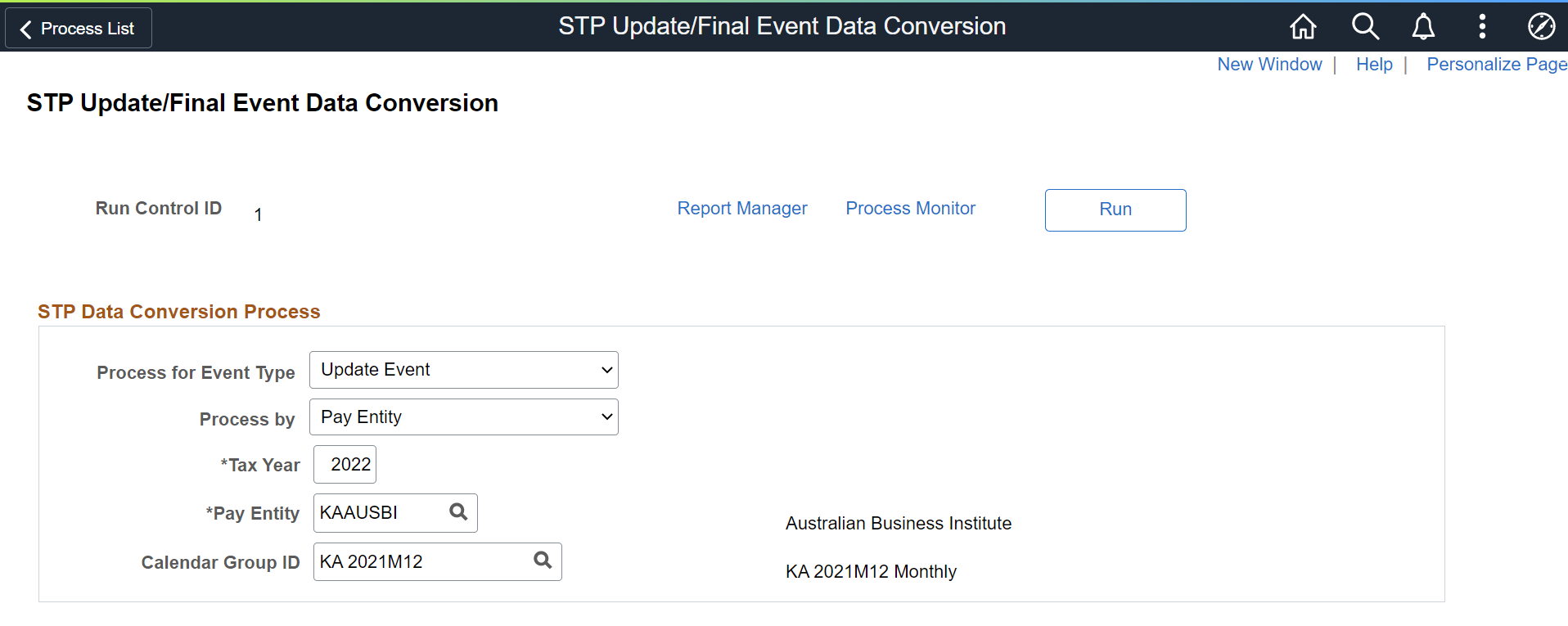

This example illustrates the Data Conversion Processing for Update Event.

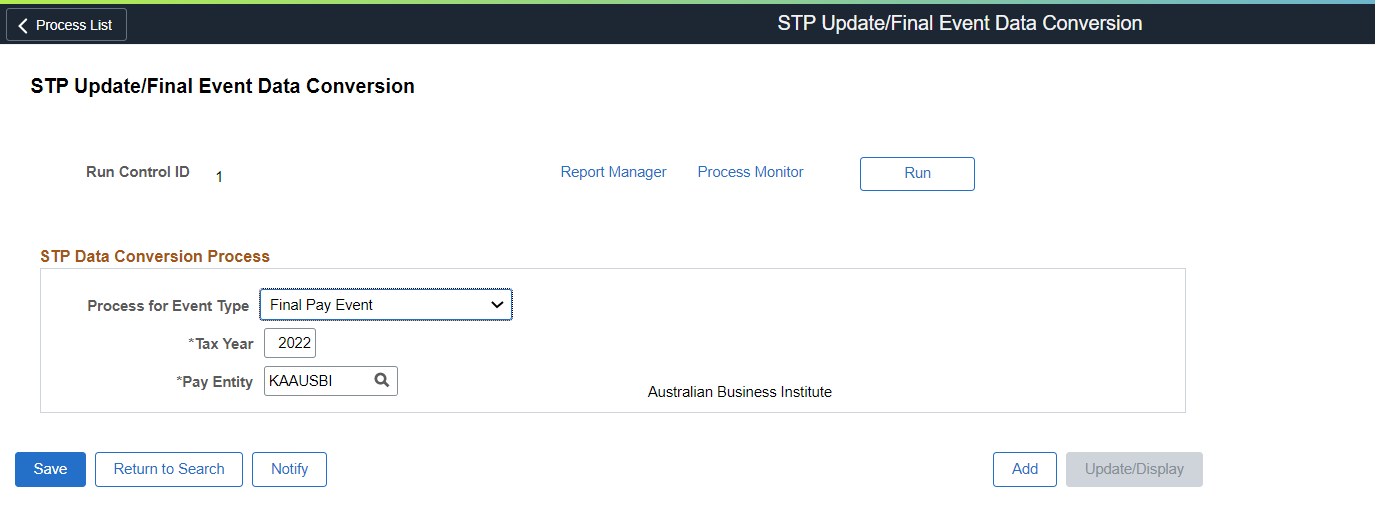

This example illustrates the Data Conversion Processing for Final Event.

|

Field or Control |

Description |

|---|---|

|

Process for Event Type |

Select whether to run the conversion process for an Update Event or a Final Pay Event. Only the Tax Year and Pay Entity fields are considered if Final Pay Event is selected, as the data needs to be converted for the selected Pay Entity regardless of calendars, other parameters are not taken into account. Note: In the case of final pay event, the conversion process should be run only for the terminated employees prior to transition. |

|

Process by |

Select the required value for which the STP data conversion process to be performed. Available options are:

These values are enabled based on the run control parameters, whereas Tax Year and Pay Entity are key fields. |

|

Tax Year |

The Tax Year for which the data should be converted. |

|

Pay Entity |

The Pay Entity for which the data should be converted. |

|

Calendar Group ID |

The Calendar Group ID for which the data should be converted. |

|

Employee ID and BAL GRP |

Select the unique ID of the employee and balance group for which the conversion process to be run. These fields are displayed only when the value selected in the Process by field is 'Emplid'. Note: These fields are applicable if you want to perform the conversion process for an employee. |

|

Group List ID |

Select the required group list ID for which the data conversion process need to be performed. This field is displayed only when the value selected in the Process by field is 'Group List'. Note: This field is applicable if you want to perform the data conversion process for a group of employees. |

|

Period ID and Stream Number |

Select the required payroll period and stream for which the data conversion process need to be performed. These fields are displayed only when the value selected in the Process by field is 'Streams'. Note: This field is applicable if you want to perform the data conversion process for a specific payroll stream. |