Creating the SuperStream Files

SuperStream Standard for Contributions is a new electronic standard for processing superannuation contributions. It is introduced by the Australian Taxation Office (ATO) and provides a streamlined approach for employers and superannuation funds to send and receive superannuation data and payments electronically. It is applicable for the Private, Commonwealth Superannuation Schemes (CSS), Public Sector Superannuation (PSS) Schemes, and the Public Sector Superannuation Accumulation Plans (PSSap).

To meet the standard, employers need to send prescribed data to superannuation funds electronically. SuperStream supports XBRL (eXtensible Business Reporting Language), SAFF (SuperStream Alternate File Format ) and SAFFE (Superannuation Alternate File Format Extended ) file formats. For CSS and PSS, employers can also submit superannuation data using Employer Services Online (ESO).

Global Payroll for Australia enables you to create files based on SuperStream Data and Payment Standard. There are multiple Super Annuity schemes available for employees, based on the organizations they work for. The generic SuperStream report page (Create SuperStream Files AUS Page) is used for non-psu and non- defence funds while CSS/PSS/PSSap page(ComSuper SS Reporting File AUS Page) is to generate report for public sector schemes.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_RECIPIENT_EXT |

Configure the recipient to a unique Super Fund. |

|

|

GPAU_RECIPNT_SPREC |

Enter receiver, target fund, and sender information according to SuperStream standards. |

|

|

GPAU_THRD_PRTY_DTL |

Define any third-party which can act as a payer. |

|

|

GPAU_PYENT_EXT |

Specify the pay entity details. |

|

|

GPAU_PYENT_EXT1 |

Define entities that would be acting as a Payer for the organization. |

|

|

GPAU_PYENT_EXT2 |

Provide CRN/ Super Employer ID details of the recipient. |

|

|

GPAU_RCPPYE_EXT |

Configure Superannuation Fund Member related information |

|

|

GPAU_RC_SS_REPORTS |

Generate the CSV/XBRL file containing the Superannuation registration/contribution details for the employees in the organization. |

|

|

GPAU_RC_COM_REPORT |

Generate SAFFE (SAFF for PSSap)/ XBRL file containing the Superannuation registration/contribution details for the employees in the organization. |

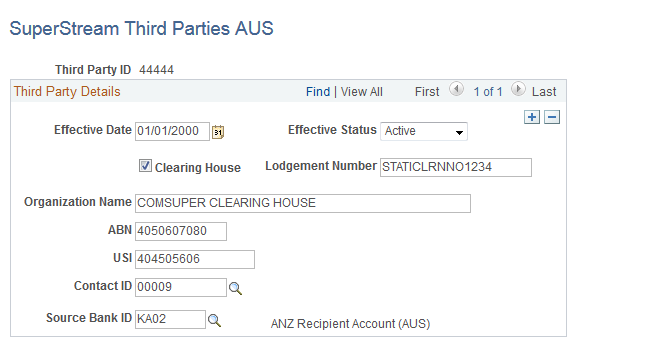

Use the SuperStream Third Parties AUS page (GPAU_THRD_PRTY_DTL) to define any third-party which can act as a payer.

Navigation:

SuperStream Third Parties AUS Page

Field or Control |

Description |

|---|---|

Effective Status |

Select the status as active or inactive |

Clearing House |

Select this check box if a clearing house is used by the employer as the third party to manage their employee super fund contributions. |

Lodgement Number |

Enter the lodgement number. Note: This field appears only when Clearing House check box is selected. |

Organisation Name |

Name of the organization that makes the payment. |

ABN |

ABN of the payer. |

USI |

Enter the Unique Superannuation Identifier (USI) of the payer. Note: If ABN is provided, then this field is not mandatory. |

Contact ID |

Select the ID of the contact person. Note: For this purpose the user should have already added a person (Add a Person) within the Workforce Administration > Personal Information section identifying the person as POI (Person of Interest). |

Source Bank ID |

Select the Source Bank ID of the organization that makes the payment. |

If a clearing house is used by the employer to manage their employee super fund contributions, the clearing house needs to be added as a third party.

To add a clearing house as third party, you need to:

Define a Deduction Recipient (Recipient ID) under General Category with Payment method as ‘Bank Transfer’, using the Define Deduction Recipients page.

Define a Third Party (Third Party ID same as the defined Recipient ID), using SuperStream Third Parties AUS page.

And, also select the Clearing House check box and enter the Lodgement Number while defining a clearing house as the third party.

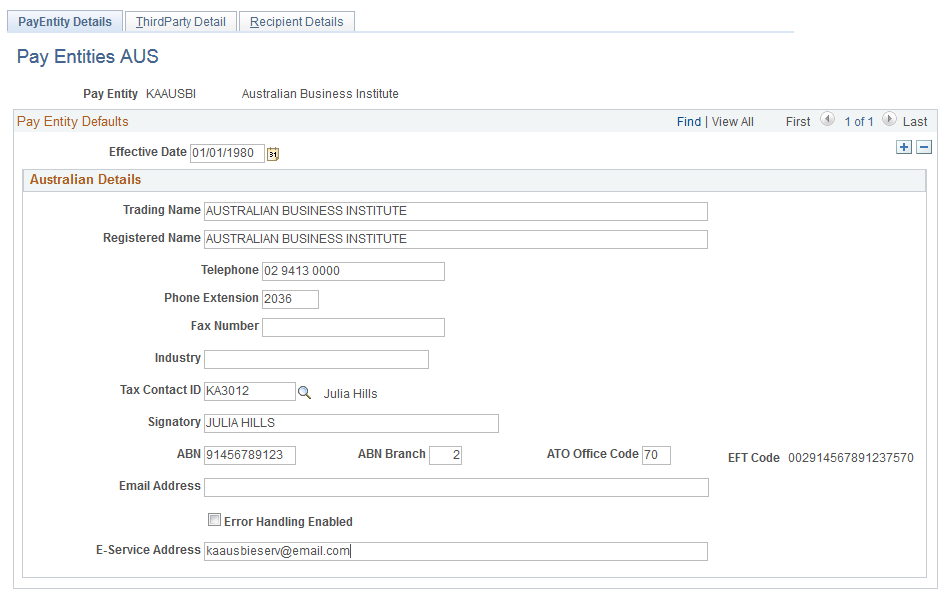

Use the Pay Entities AUS page (GPAU_PYENT_EXT) to define Employer related details to be used in Superannuation reporting with the Australian authorities

Navigation:

Pay Entities AUS page

Field or Control |

Description |

|---|---|

Trading Name |

Enter the trading name of the organization that makes the payment. Note: If the Pay Entity itself is the Payer, then this value will be the Pay Entity Trading Name, else from the field Organization Name as defined in the “Third Party Detail” tab. |

Registered Name |

Enter the registered name of the organization that makes the payment. |

Tax Contact ID |

Contact details of pay entities authorized representative. |

Signatory |

Authorised Signatory |

ABN |

Australian Business Number (ABN) of the employer/ organisation that makes the payment. |

ABN Branch |

Pay entities Individual ABN branch details. |

ATO Office Code |

Enter Australian Taxation Office (ATO) code. |

EFT Code |

Enter the Electronic Fund Transfer (EFT) code |

Error Handling Enabled |

Select the check box if the organisation is capable of decoding the member registration/contribution error responses generated by the target system |

E-Service Address |

Enter the e-service url, if you have selected the Error Handling Enabled check box. |

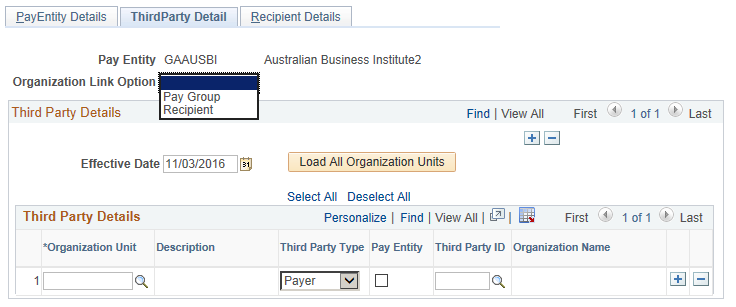

Use the Third Party Detail page (GPAU_PYENT_EXT1) to define entities that would be acting as a Payer for your organization.

Navigation:

Third Party Detail page

Field or Control |

Description |

|---|---|

Organisation Link Option |

Select from the following options: Pay Group Recipient |

Organisation Unit |

Select the organisation unit. List of selection will be based on the value selected in Organisation Link Option field. Note: You can define only one row for each Third Party Type for an Organization Unit selected |

Third Party Type |

Select from the following options: Payer Clr House |

Pay Entity |

Select this checkbox if the selected organization acts as the Pay Entity. |

Third Party ID |

Select the Third Party ID. Note: On selecting Pay Entity check box, this field will be disabled. |

Organisation Name |

The name of the “Payer” that will be printed in the “SuperStream” report. |

If a clearing house needs to be added as the third party (‘Recipient’ as Organization Link Option):

Under Pay Entities AUS component, load all the recipients and assign the clearing House as a third-party for the recipients which contribute to Clearing House.

Set the third Party type to ‘Clr House’ to select a clearing house.

If third-party type is ‘Clr House’, but the ‘Third-party ID’ selected does not have Clearing House flag selected on the third-party definition, then the configuration of clearing house is ignored.

The recipient can be either General or Individual.

‘Load All Organization Units’ will load the recipients which are configured to be of ComSuper/SuperStream reporting format under ‘Deduction Recipients Aus’ component.

With this configuration, EFT process will club all the payments of the recipients (with Super Reporting Format set to SuperStream File Format or Com Super File Format in Deduction Recipients AUS component) in to one and make the payment to Clearing House.

If a clearing house needs to be added as a third party (‘Pay Group’ as Organization Link Option):

Under Pay Entities AUS component, load all the Pay Groups and assign the clearing House as a third-party for the Pay Groups which contribute to Clearing House.

Set the third Party type to ‘Clr House’ to select a clearing house.

If third-party type is ‘Clr House’, but the ‘Third-party ID’ selected does not have Clearing House flag selected on the third-party definition, then the configuration of clearing house is ignored.

With this configuration, EFT process will club all the payments of the recipients (with Super Reporting Format set to SuperStream File Format or Com Super File Format in Deduction Recipients AUS component) under the Pay Group with clearing House in to one and make the payment to Clearing House. Any payments to a recipient with other Super Reporting Formats will continue to be paid to the corresponding recipient.

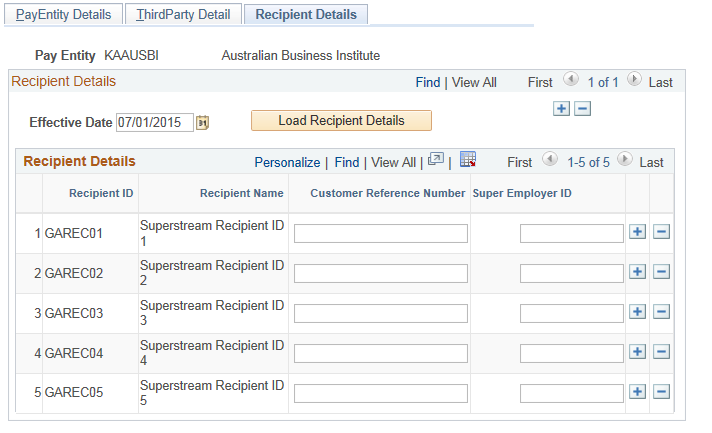

Use the Recipient Details page (GPAU_PYENT_EXT2) to provide CRN/ Super Employer ID details of the recipient.

Navigation:

This example illustrates the fields and controls on the Recipient Details page. You can find definitions for the fields and controls later on this page.

Recipient Details Page

Field or Control |

Description |

|---|---|

Customer Reference Number |

In the case of a BPAY payment, the payment reference number is the customer reference number as issued by, or on behalf of, the relevant superannuation entity. |

Super Employer ID |

Enter the Employer Identifier. |

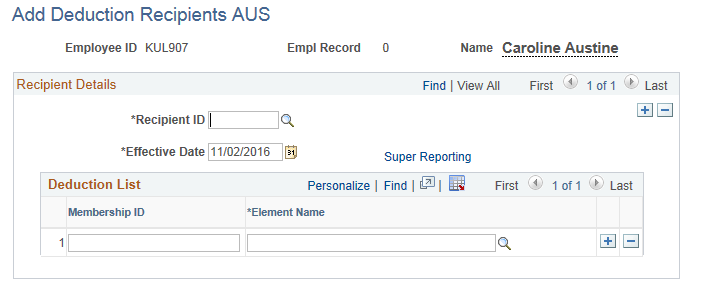

Use the Add Deduction Recipient AUS page (GPAU_RCPPYE_EXT) to configure Superannuation Fund Member related information (Fund Member is the employee in your organization who makes Superannuation contributions to the various Super Funds)..

Navigation:

Add Deduction Recipients AUS page

On clicking the Super Reporting Link, Deduction Recipient page is displayed. Based on the selected Super Reporting Format of the Deduction Recipient ID, the fields under Deduction Recipient section changes to accommodate the requisite super fund member details.

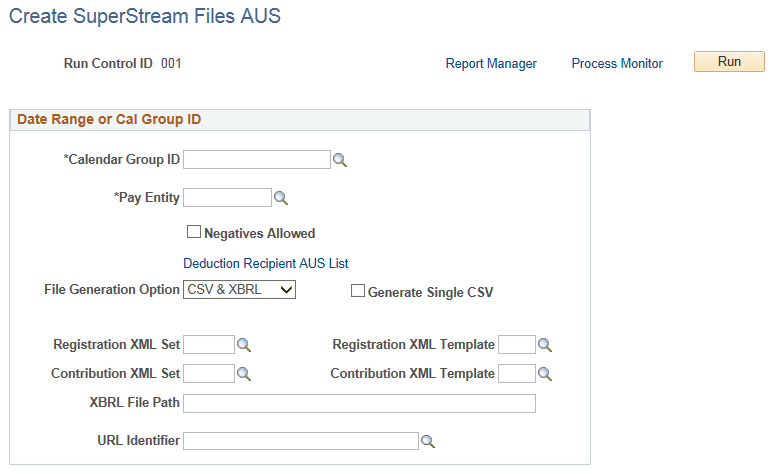

Use the Create SuperStream Files AUS page (GPAU_RC_SS_REPORTS) to generate the CSV file containing the Superannuation registration/contribution details for the employees in your organization.

Navigation:

Create SuperStream Files AUS page

Field or Control |

Description |

|---|---|

Calender Group ID |

Choose the Calender Group. The calendar group should be finalized and the banking process completed. |

Pay Entity |

Choose the Pay Entity. |

Negatives Allowed |

This value is checked to denote that the entity receiving the CSV files is capable of handling any negative values present in the CSV file being generated to report the Superannuation contribution details for the employees in your organization. This value cannot be edited. |

Deductions Recipients AUS List |

Filter the output results can by selecting specific Deduction Recipients. |

File Generation Option |

One CSV file for every unique combination of Sender/Receiver/Payer/Payee as determined by the program is generated based on your organization’s data setup at the Deduction Recipient AUS page and the Pay Entity AUS page and the specified run control parameters. Two other file generation options are also provided to generate XBRL file or both XBRL and CSV files;.XBRL Only and CSV & XBRL. |

Generate Single CSV |

Generate Single CSV is displayed when the file generation option is either CSV Only or CSV & XBRL. Generate Single CSV is unchecked by default. Checking this box would create a single CSV file for all the deduction recipients. Unchecking creates one CSV file for each deduction recipient and lodgment reference umber combination. |

When XBRL Only or CSV & XBRL options are chosen multiple fields are displayed to capture the XML framework details required to create XBRL file. XBRL File Path provided should be a path accessible to the process scheduler server. The XBRL file created is posted to the path provided in URL Identifier

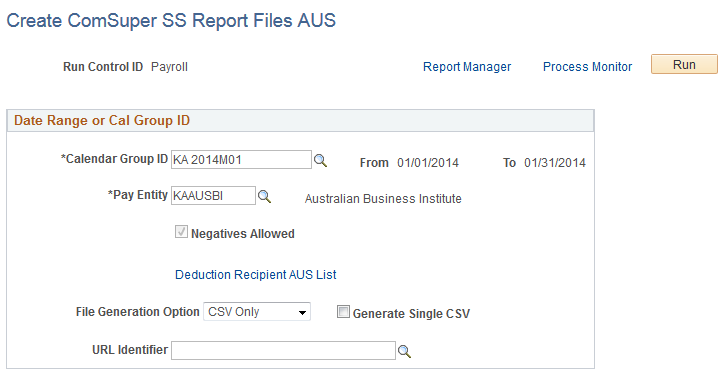

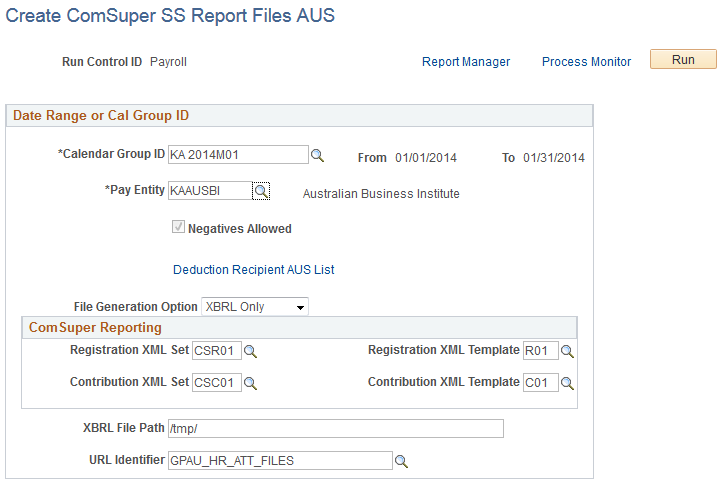

Use the Create ComSuper SS Reports AUS page (GPAU_RC_COM_REPORT) to generate SAFFE (.CSV or .XBRL) file containing the Superannuation registration/contribution details for the employees in your organization.

Navigation:

Create ComSuper SS Report Files - CSV format

Create ComSuper SS Report Files - XBRL format

Field or Control |

Description |

|---|---|

Calender Group ID |

Choose the Calender Group. |

Pay Entity |

Choose the Pay Entity. |

Negatives Allowed |

This value is checked to denote that the entity receiving the CSV files is capable of handling any negative values present in the CSV file being generated to report the Superannuation contribution details for the employees in your organization. This value cannot be edited. |

Deductions Recipients AUS List |

Filter the output results can by selecting specific Deduction Recipients. |

File Generation Option |

One CSV file for every unique combination of Sender/Receiver/Payer/Payee as determined by the program is generated based on your organization’s data setup at the Deduction Recipient AUS page and the Pay Entity AUS page and the specified run control parameters. Two other file generation options are also provided to generate XBRL file or both XBRL and CSV files;.XBRL Only and CSV & XBRL. |

Generate Single CSV |

Generate Single CSV is displayed when the file generation option is either CSV Only or CSV & XBRL. Generate Single CSV is unchecked by default. Checking this box would create a single CSV file for all the deduction recipients. Unchecking creates one CSV file for each deduction recipient and lodgment reference umber combination. |

ComSuper Reporting |

This group box appears when XBRL Only or CSV & XBRL options are chosen. This captures the XML framework details required to create XBRL file. XBRL File Path provided should be a path accessible to the process scheduler server. The XBRL file created is posted to the path provided in URL Identifier. |