Generating Pay Event File

This section provides an overview of Pay Event File file and discusses how to create a Pay Event file.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_STP_PREP_RN |

Fetch or extract Payroll and Non-Payroll Data required for generating STP Pay Event (PAYEVNT and PAYEVNTEMP). |

|

|

GPAU_STP_RUNCTL |

Generate Pay Event files which is to be submitted to principal revenue collection agency. each time the Employer makes a Payment to an Employee. |

|

|

GPAU_STP_EVTOVR |

Change the PTD Values for Payer Total PAYGW Amount and Payer Total Gross Payments after completing the STP PAYEVNT process run. |

A pay event is created when an employer pays the employee a certain amount for the services they have done for the organization within a certain period. It is the combination of the financial records of their employees' salaries, wages, allowances and deductions.

As per the regulation, this information should be submitted to the principal revenue collection agency. as and when the payment happens. Pay Event data consist of employer and individual employee data.

PAYEVNT - Summary Report which helps the Employer, Tax Agent or Business Representative to notify for the payments made to their employees along with related Tax and Super obligations validated and processed by SBR.

PAYEVNTEMP - Detail Report which helps the Employer, Tax Agent or Business Representative to notify for the payments made to an individual employees along with related Tax and Super obligations that is validated and processed by SBR.

For more information on steps to be completed in PeopleSoft before STP Pay Event generation, see Setting Up Single Touch Payroll (STP).

Once the set up is complete, you can move to the preparation processes:

STP Preparation Process: Preparation process is part of the Pay Event to populate the payroll result values. The user has the option to run this process before/after finalization of payroll for the respective pay period. These processes update the Payroll data that is required for generating the PAYEVNT & PAYEVNTEMP file.

STP FBT Collection Process: As part of STP, it requires that you report FBT- liable earnings when the gross-up value (of all FBT-liable earnings) exceeds a minimum figure. To have the system calculate the reportable fringe benefits amount for inclusion on the Pay Event, you run a collect process. An employer may report YTD RFBA through a payroll event (if the information is available in payroll), throughout the financial year. This process takes care of seeding the required data for FBT values that are required for STP PAYEVNTEMP Reporting.

Note: Before running the STP Preparation Process, the SOVR Category setup needs to be defined for the sub-categories and the respective SOVR Value. This is because the preparation process makes a call to Report Data with the help of the Run Control parameters. The Report Data results are stored in GPAU_STP_TMP (instance Number). Preparation process uses a list of temporary tables for processing the payroll data to get the results. These final processed data are stored based on the STP category setup.

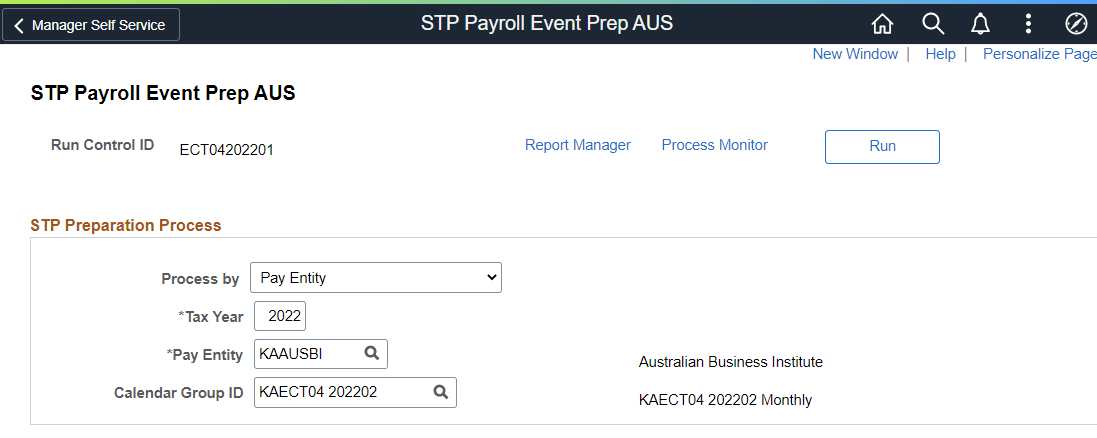

Use the STP Payroll Event Prep AUS Page (GPAU_STP_PREP_RN) to update the Payroll Data required for generating the PAYEVNT & PAYEVNTEMP file.

Note: You can run this process before or after the finalization of payroll for the respective pay period.

Navigation:

This example illustrates the fields and controls on the STP Payroll Event Prep AUS page.

You can run the process by selecting the appropriate options; respective fields are enabled based on the run control parameters. Tax Year and Pay Entity are key fields. The process can run by Pay Entity, Group List, Streams, Pay Group, Period End Date, or individual Employee ID. Some fields will only show with certain processing options.

Field or Control |

Description |

|---|---|

Process by |

Select the processing option.

|

Tax Year |

Enter the Tax Year for which this Payroll Event (PAYEVNT & PAYEVNTEMP) needs to be processed. |

Pay Entity |

The Pay Entity for which data should extracted. Define the pay entity, for which the employer would like to include the payroll data for Payroll Event (PAYEVNT & PAYEVNTEMP). |

Calendar Group ID |

Enter the Calendar Group ID for which the employer would like to consider the payroll results for Payroll Event (PAYEVNT & PAYEVNTEMP). If Process by field is set as Period End Date, then the Calendar Group ID field is not available.. |

|

Employee ID & BAL GRP |

If the user wants to run the process for only one employee, then "Processing Option" should be set to Employee ID and enter the Employee ID in the relevant field. |

Period End Date |

Click the Period End Date field. This displays a list of CAL GRP IDs which has the same Pay Period End Date for that Pay Entity. Select the required Period End Date. |

Period ID |

Period ID associated with the Pay Period End Date. Period End Date remains the same for multiple Period IDs.. If the user selects a Period End Date followed by a Period ID, only those CAL GRP IDs associated with period ID are displayed under the Processed Calendar Groups section. |

Run |

Select the Run button, to run the preparation process. This process extracts the payroll and non payroll data required for STP Pay Event. |

|

Group List |

To run the process for a group of employees, then "Processing Option" should set to Group List and enter the Group List ID in the relevant field. |

|

Streams |

To run the process for a given payroll stream, then "Processing Option" should be set to Streams and enter the Stream Number in the relevant field. |

|

Period End Date |

Select to run the process for a list of CAL_RUN_IDs having the same Period End Date. On selecting this option, two fields, Period End Date and Period ID are displayed. |

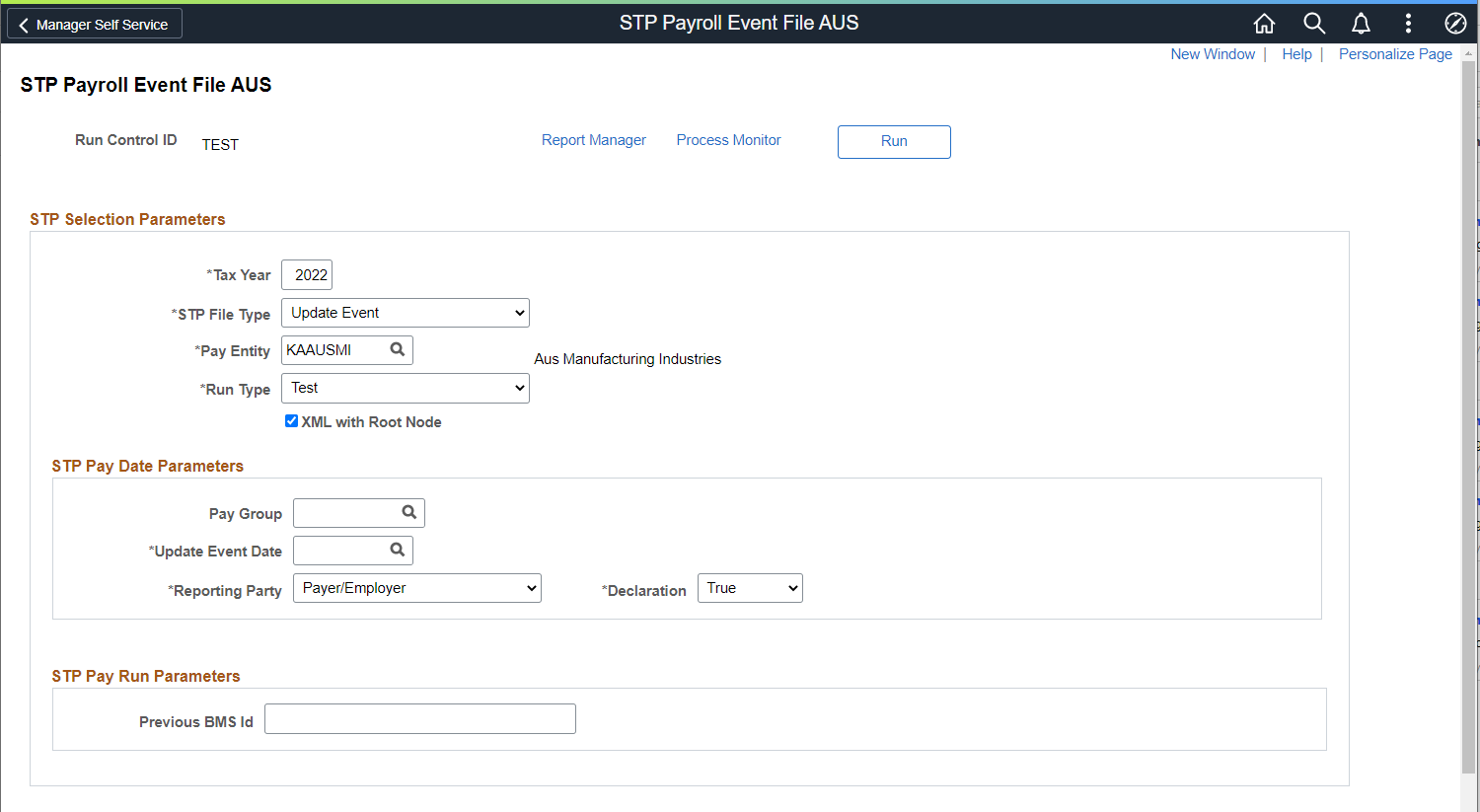

Use the STP Payroll Event File AUS page (GPAU_STP_RUNCTL) to generate Pay Event files.

The Pay Event File needs to be submitted to principal revenue collection agency each time the Employer makes a Payment to an Employee. When you run the process, the payment data for the relevant period for the PAYGW scheme is picked up. It includes all ‘employment’ data within the PAYGW and all the payments & deductions report as year to date figures (YTD). PAYEVNT is the Summary Report that assist Employer, Tax Agent or Business Representative to notify the authority about the payments made to their employees along with the related Tax and Super obligations.

Navigation:

This example illustrates the fields and controls on the STP Payroll Event File AUS page.

This example illustrates the fields and controls on the STP Payroll Event File AUS page.

Field or Control |

Description |

|---|---|

STP Selection Parameters |

|

Tax Year |

Specify the Calendar Year in which Tax Year Begins. For example, "2022" for 2021-22 Tax Year. |

STP File Type |

Select the type of file. Available options are:

Note: It is not mandatory to finalize the payroll to generate the PAYEVNT output file. |

Pay Entity |

The Pay Entity for which data is reported. Select the pay entity, for which the employer would like to generate Payroll Event (PAYEVNT & PAYEVNTEMP). |

|

Pay Group |

Optional field to allow for additional filtering of the employees included in the file. Employers have the option to generate for a particular pay group. For e.g., if there are pay groups for Weekly and Monthly, employers would be able to generate the separate file for each pay group. |

Update Event Date |

Date on which Update carried out for the employees Year to Date Values that submitted to the authority via Pay Event. This Update Event Date is key to generate the Update Event output file. By default, ‘Test’ is selected. |

XML with Root Node |

On selecting this check box, XML file generation process will generate XML file with dummy Root Node and the file can be opened in any browser. Validation file will also be generated against the generated XML file with dummy Root Node. XMLs generated without Root Node will not open in any of the browser. Final XML file needs to be opened in Notepad, Notepad++, Text Pad, etc. By default, this check box is unchecked. When the check box is unchecked, XML file generation process will generate XML file without Root Node and hence no validation file will be generated. |

Pay Group |

Specify the pay group if you want to filter the employees to be included in the file, based on their pay group. For example, if there are pay groups for Weekly and Monthly, employers can select the particular pay groups and generate separate files for each pay group. |

|

Output |

For each entity, there will be a Single File (contains PAYEVNT & PAYEVNTEMP in a single file with Parent and Child) are generated in XML format as per guidelines. |

Final Pay Event |

This indicates whether the report is the employer’s final payroll for the current reporting period. An employer is required to make a declaration to the authority, that they have provided all the information for each employee for a financial year, by providing the finalization indicator as a part of an employee’s Single Touch Payroll report. This declaration allows the agency to make the employee information available for income tax return prefill for employees. It will also update the employee’s myGov payroll page, to show that the Single Touch Payroll reported information is final for the financial year. |

Period End Date |

Enter the Period End Date for the payment period to report Pay Event. |

Period ID |

Period ID associated with the Pay Period End Date. The Period End Date remains the same for multiple Period IDs. If the user selects a Period End Date followed by a Period ID, only those CAL GRP IDs associated with period ID are displayed under the Processed Calendar Groups section. |

|

Submission ID |

A unique identifier to identify a payroll event transaction sent to the Authorities. PeopleSoft while generating the Pay Event automatically generates Submission ID. |

Payment Transaction Date |

Select the required payment transaction date. If the Payment Period End Date has multiple ‘Payment Dates’, then Maximum Payment Date is considered as the Payment Transaction Date by default. |

Reporting Party |

Specify the reporting party. Available options are:

By default, ‘Payer/ Employer’ is selected. |

Declaration |

Select ‘True’ or ‘False’. This field indicates that the terms stated in the Declaration Text have been accepted or declined |

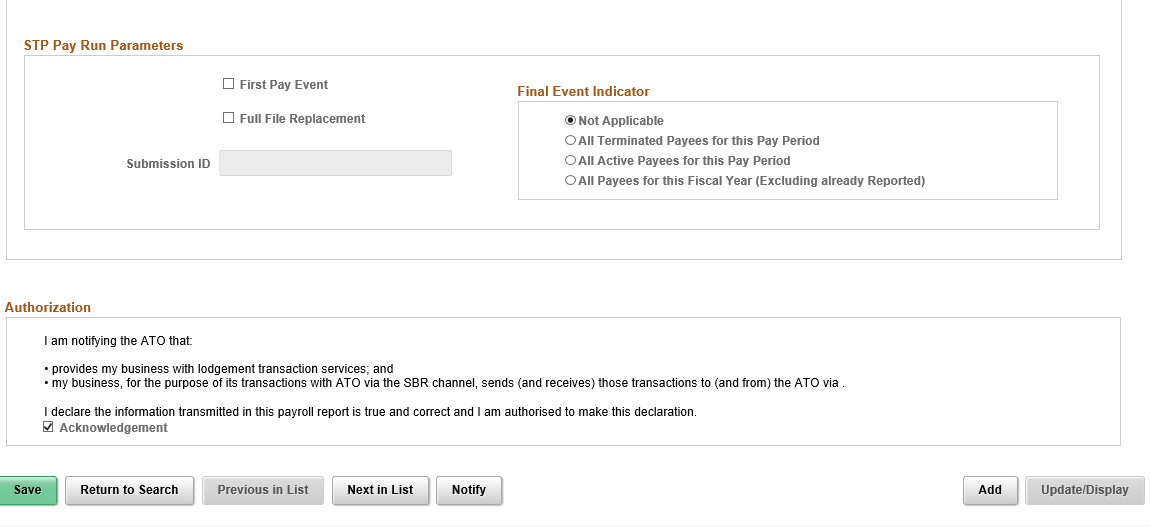

Previous BMS ID |

This can only be reported as part of an Update Event. If the Payer is amending a prior financial year finalised income statement of a payee where BMS and Payroll ID is changed, then the Previous BMS Id should be supplied. |

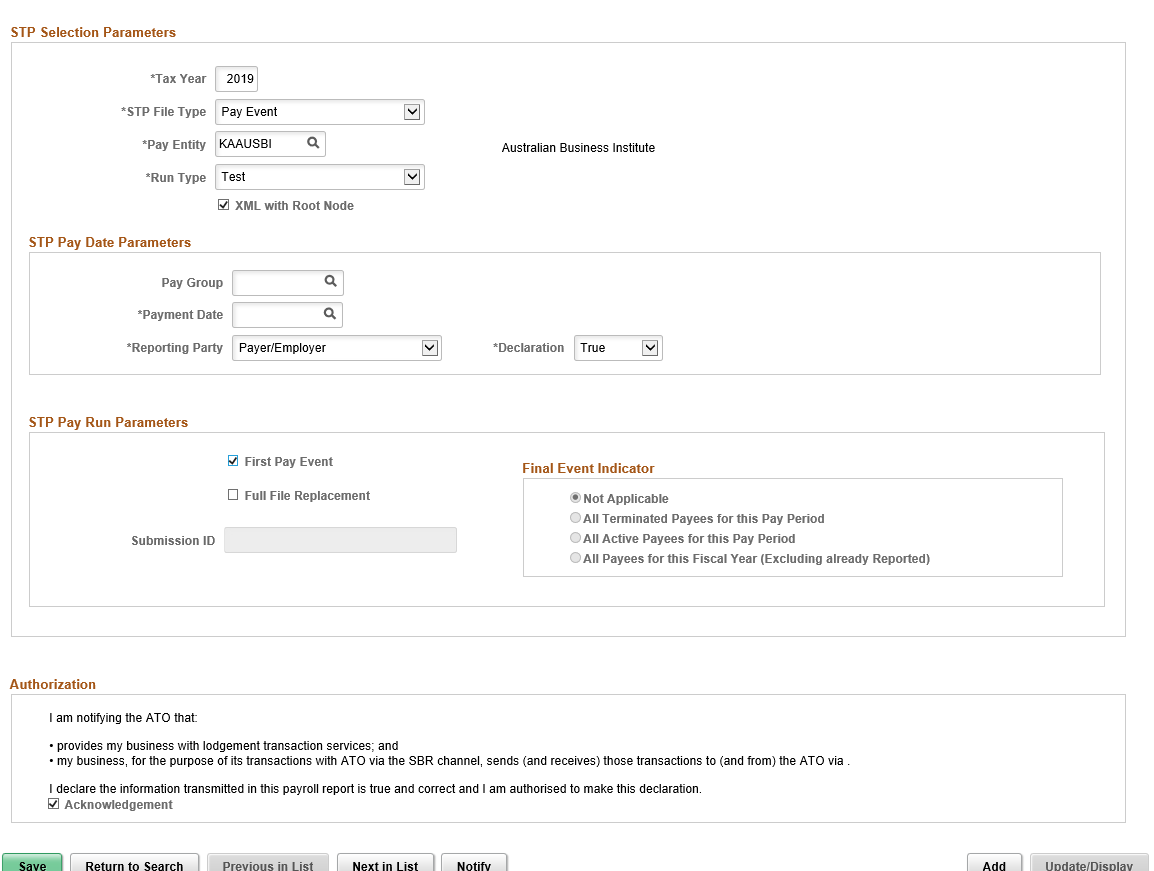

First Pay Event |

Select this option if you are submitting the Pay Event for the Pay Entity/Pay Group for the first time. When you are submitting the First pay Event, other than the employees who have been paid in the period reported, the details about any leaves from the current Tax Year is also added in the report to ensure that their figures are also reported. This indicates whether the report is the employer’s final payroll for the current reporting period. An employer is required to make a declaration, that they have provided all the information for each employee for a financial year by providing the finalization indicator as a part of an employee’s Single Touch Payroll report. This declaration allows to make the employee information available for income tax return prefill for employees. It will also update the employee’s myGov payroll page, to show that the Single Touch Payroll reported information is final for the financial year. Once you select this option, screen refreshes to display the ‘Payment Date’ field instead of ‘Calendar Group’ field. Note: This field should only ever be use on your ‘First Pay Event’. No subsequent Pay Event files must generate using this option, including new Tax Years or Pay Periods. |

|

Full File Replacement |

A full file replacement provides the ability for an employer to replace the latest pay event file that was send to the agency in error or if it contains significant corrupt data. |

This example illustrates the STP Payroll Event File AUS page when First Pay Event is selected.

Field or Control |

Description |

|---|---|

Final Event Indicator |

Select this option if you are submitting the final payment for the reporting period of that fiscal year. An employer is required to make a declaration to the agency, that they have provided all the information for each employee for a financial year, by providing the finalization indicator as a part of an employee’s Single Touch Payroll report. |

Full File Replacement |

Select this option if you are trying to replace the latest pay event file that is submitted to the agency with a new one. A full file replacement provides the ability for an employer to replace the latest pay event file submitted to the principal revenue collection agency, if it has any error, or contains significant corrupt data. |

Submission ID |

You need to select a submission ID if you have selected the option for Full File Replacement. It is a unique identifier to identify a payroll event transaction that is sent to principal revenue collection agency. PeopleSoft automatically generates the Submission ID while the Pay Event file is created. |

Acknowledgment |

Each time the file has to be generated, the user selects this check box to indicate that the file is authorized to be sent by the Sending Service Provider and it is true and correct. This declaration must be auditable so that an auditor could go back and see who checked the box. In order to meet the authorization and declaration, consent is included as part of STP Payroll Event File AUS. |

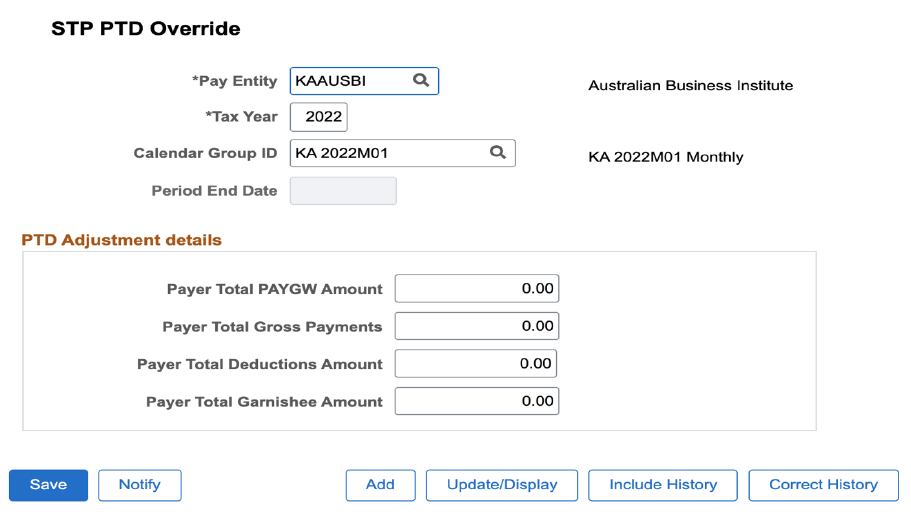

Use the STP PTD Override page (GPAU_STP_EVTOVR) if you want to change the PTD Values for Payer Total PAYGW Amount and Payer Total Gross Payments after you completed STP PAYEVNT process run.

Note: The new PTD value you enter will override the existing value in PAYEVENT. This is not a page to add delta value; it designed to enter expected PTD value, which is required to report in PAYEVNT against each Pay Period.

Navigation:

This example illustrates the STP PTD Override page.

Field or Control |

Description |

|---|---|

Pay Entity |

The Pay Entity for which data is reported. Select the pay entity, for which the employer would like to generate Payroll Event. |

Tax Year |

Enter the Calendar Year on which Tax Year Begins. For example, “2017” for 2016-17 Tax Year. |

Calendar Group ID |

Select the Calendar Group ID for the payroll that you want to report Pay Event. |

Period End Date |

Enter the Period End Date for the payment period to report Pay Event. |

|

Payer Total PAYGW Amount |

Value during the relevant period, for the amount withheld under the Pay As You Go (PAYG). |

|

Payer Total Gross Payments |

The total of salary, wages and other payments paid during the reporting period from which an amount must be withheld. |

|

Payer Total Deduction Amount |

Value during the relevant period, for the amount deducted towards Court Orders. |

|

Payer Total Garnishee Amount |

Value during the relevant period, for the amount deducted towards Child Support. |

Note: Calendar Group ID and Period End date are mutually exclusive. User can override PTD values based on calendar group ID or period end date.

Field or Control |

Description |

|---|---|

Payer Total PAYGW Amount |

Value during the relevant period, for the amount withheld under the Pay As You Go (PAYG). |

Payer Total Gross Payments |

The total of salary, wages and other payments paid during the reporting period from which an amount must be withheld. |