Setting Up Single Touch Payroll (STP)

Single Touch Payroll is an initiative by the Federal government where the Employers are required to report payroll and superannuation information electronically to the ATO as and when employees are paid.

This topic discusses on how to set up Single Touch Payroll in PeopleSoft as an employer.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_SPPLR_DATA1 |

Enter information about the organization submitting the fortnightly TFN declaration. The information entered on this page is included in the electronic file that is generated. |

|

|

GPAU_STP_CAT |

Map the Tuple and Facts along with respective EOY or STP VR Category for extracting data during STP Pre Process for Pay Event Reporting. |

|

|

GPAU_STP_SOVRCAT |

Add STP SOVR category. |

|

|

GP_RPT_TBL |

Assign the output table, writable array, primary input table type, and segment options. |

|

|

XML_SET_TBL |

Maintain XML set definitions. |

|

|

XML_NODE_TBL1 |

Define the nodes that comprise the XML file structure for your country-specific functionality. |

|

|

XML_TEMPLATE |

Define templates for use during XML file generation. |

|

|

XML_RC_TESTER |

Allow running any XML file defined using previous setup, so that the user can validate if the resultant report is the expected one. |

Setting Up Single Touch Payroll

To set up Single Touch Payroll (STP):

Ensure that Supplier Data meets the latest ATO requirements. Prior to submission of STP Pay Event Files, employer must register and work with their account manager to meet the reporting requirement as initiated by ATO and to adhere the compliance. For more information, see Supplier Data Page

Map the Employee category with required sub categories and define the SOVR category and SOVR variable that needs to be considered for reportingMap the Tuple and Facts along with respective EOY or STP VR Category for extracting data during STP Pre Process for Pay Event Reporting. For information, see STP Category Setup AUS Page.

Assign the output table, primary input table type, and segment options using the Define Report Data page. Report data takes the list of PIN Numbers from the SOVR categories defined in STP Category Setup page, and returns the list of Accumulators required for reporting. STP Preparation process derives the Payroll data based on Report data and STP Category setup. The final results are updated in the respective staging tables as defined in the configuration. For more information, see Defining Report Data

Configure the XML Framework:

XML Set Table page: XML set is to define all the Records and the SQL Views used in the Nodes for reporting values in XML. For more information, see XML Set Table Page

XML Node Table page: Node is to define the Tuple and Fact of XML in a configurable way. Simple Node is the last child, which has a value defined in it to report. XML Fact is the simple node. Complex node has a list of Simple nodes associated to it. Root Node is the start of the XML, which is in turn a Complex Node. For more information, seeNode Table Page

XML Template page: Template created to associate each nodes with the key field combination to give the complete XML structure in the report. For more information, see XML Template Page

XML Tester page: Use XML tester to test the generated XML, which generate from above mentioned setup. For more information, see XML Tester Page

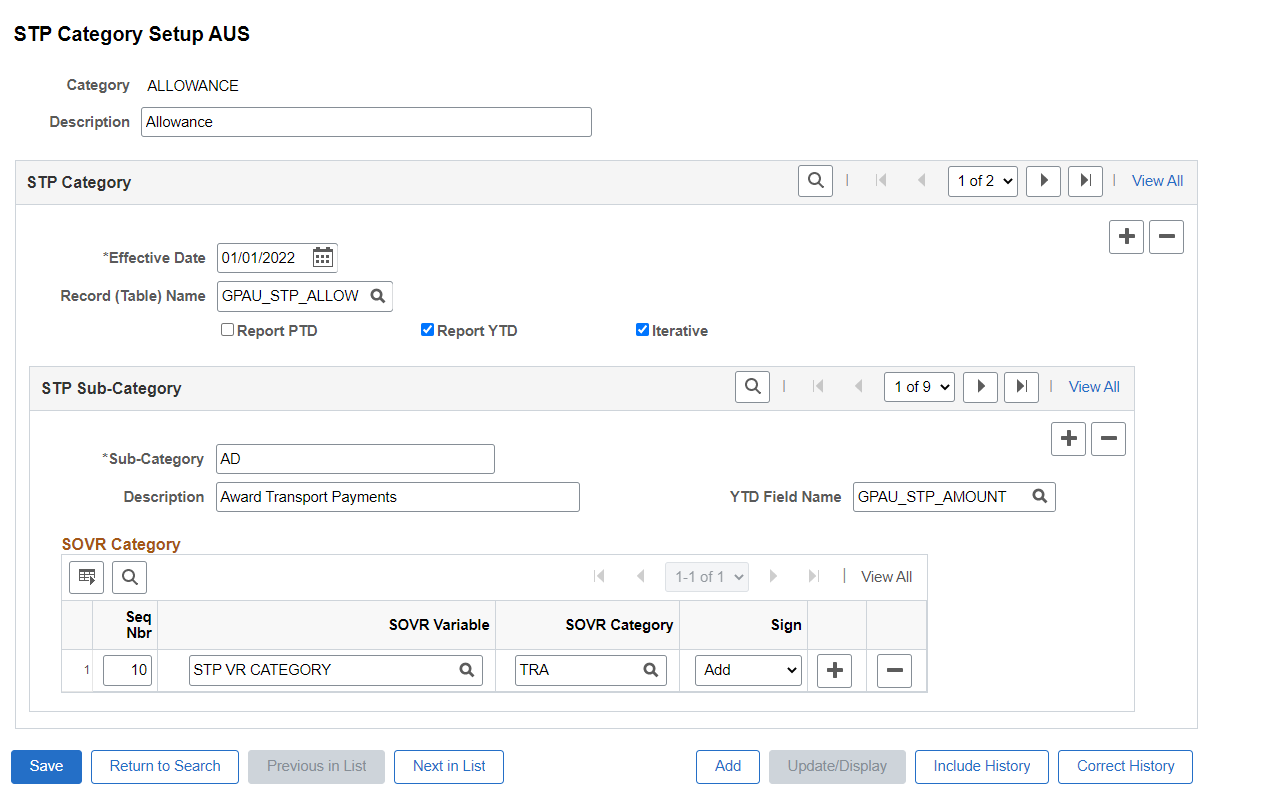

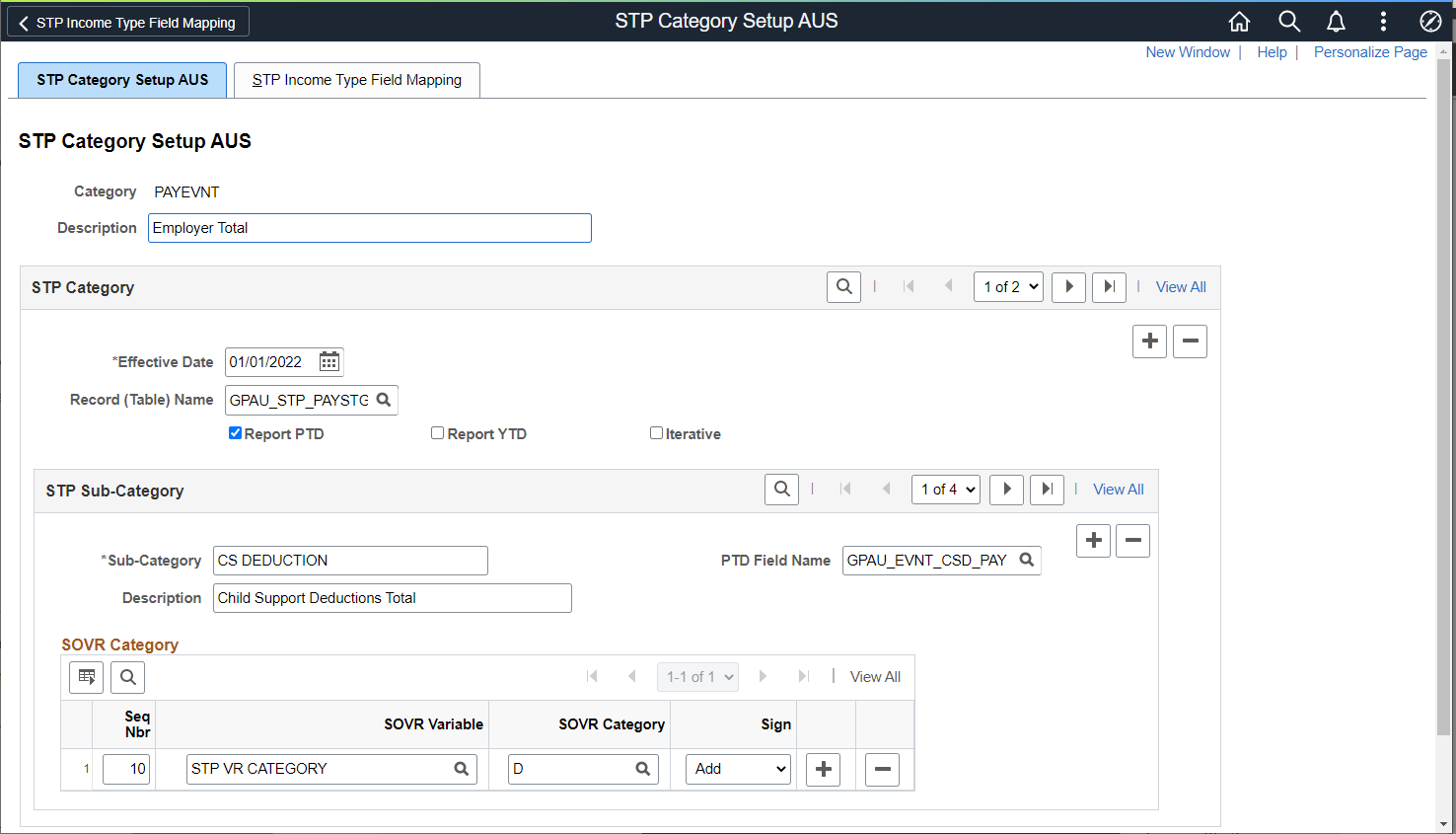

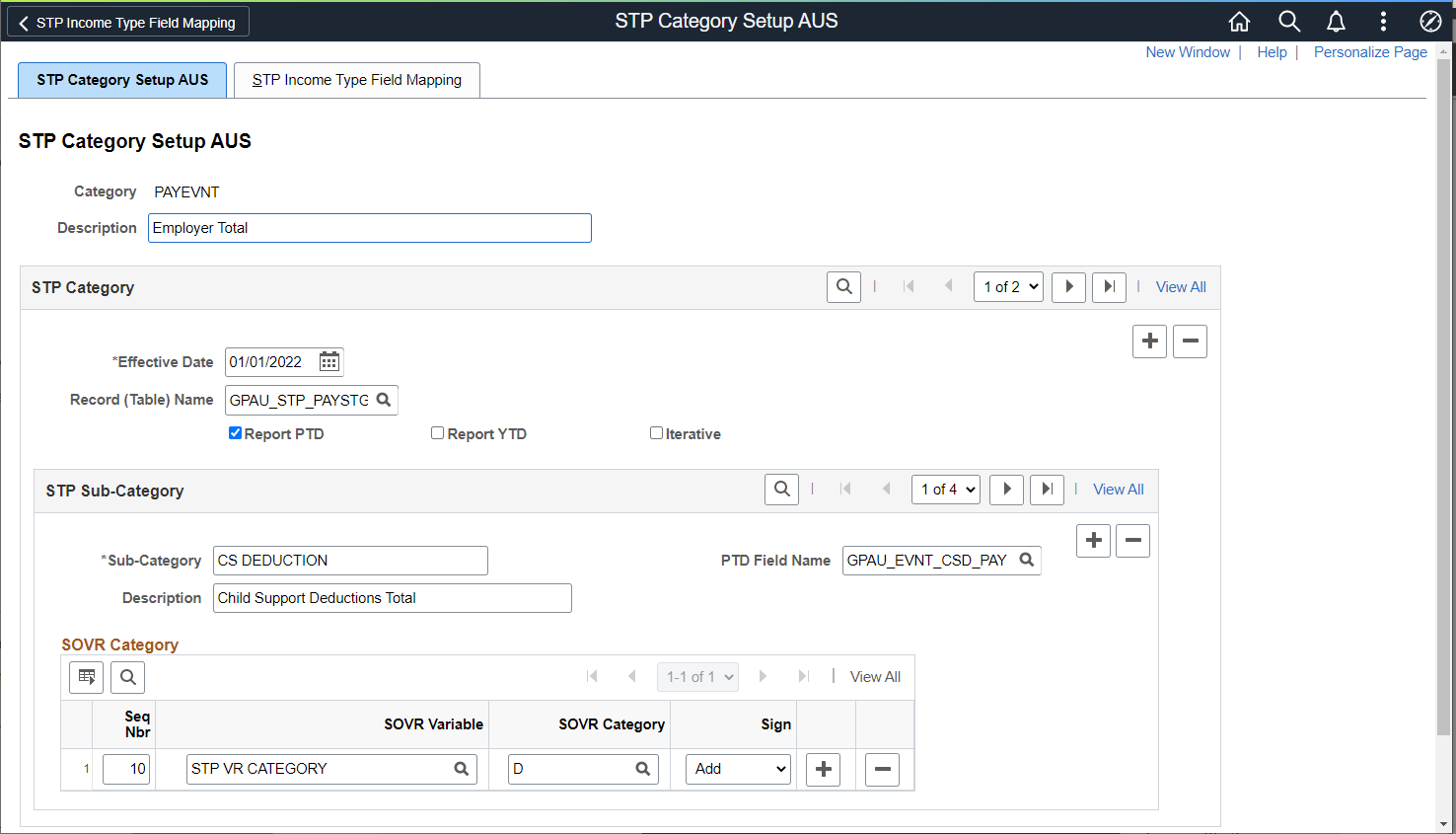

Use the STP Category Setup AUS page (GPAU_STP_CAT) to map between XML Tuple with Category and XML Fact with Sub Category. SOVR Variable determines, the Variable that assigned in the Earnings to determine the SOVR category and the Supplementary Element Override. The setup uses the EOY VR CATEGORY (existing one which is used for generating the Payment Summaries), and STP VR CATEGORY (this is a new variable created to map against respective earnings/deductions) required for STP file generation and reporting.

Navigation:

The STP Category setup AUS page sets the mapping between XML Tuple with Category and XML Fact with Subcategory.

This example illustrates the fields and controls on the STP Category Setup AUS page.

|

Field or Control |

Description |

|---|---|

|

Effective Date |

Mapping should be modified to the actual migration date along with the effective date of STP Category setup. Income Type field mapping is mandatory with the latest effective date in the STP Category setup for addition of new income types like CHP and SWP. |

|

Record (Table) Name |

Select the Staging Record where the data to be stored for reporting while running STP Preparation Process. This field is to define the Staging table record where the data to be stored for final reporting. |

|

Report PTD |

Select the check box if PTDs are required under the specified Category and Sub-Category. This enables PTD field name where we can define the Field of the staging table defined under Record Name. The PTD value calculated update in the respective field defined. |

|

Report YTD |

Select the check box if YTDs are required under the specified Category and Sub-Category. This enables YTD field name where we can define the Field of the staging table defined under Record Name. The YTD value calculated update in the respective field defined. |

|

SOVR Variable |

Select the variable that is assigned in the Earnings. This determine the SOVR category and the Supplementary Element Override. The SOVR Variable are either EOY VR Category or STP VR Category. |

|

SOVR Category |

Select the respective EOY VR or STP VR Category corresponding to those earnings and deductions that is required for each facts of that Tuple. This determines the actual SOVR categories that contribute to the Sub-Category, which is the Final amount to display in the report. |

Note: This setup is pre-seeded as system data and employer can make necessary changes to set up additional categories as part of STP Reporting.

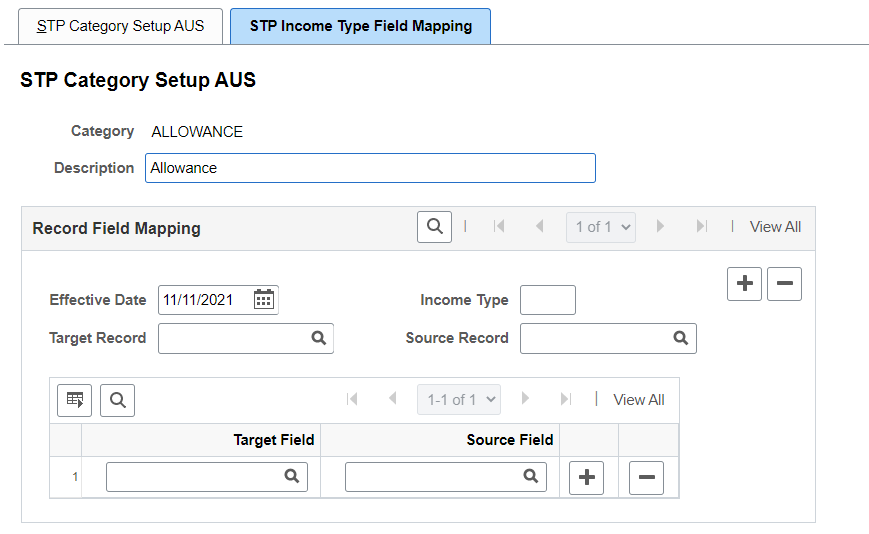

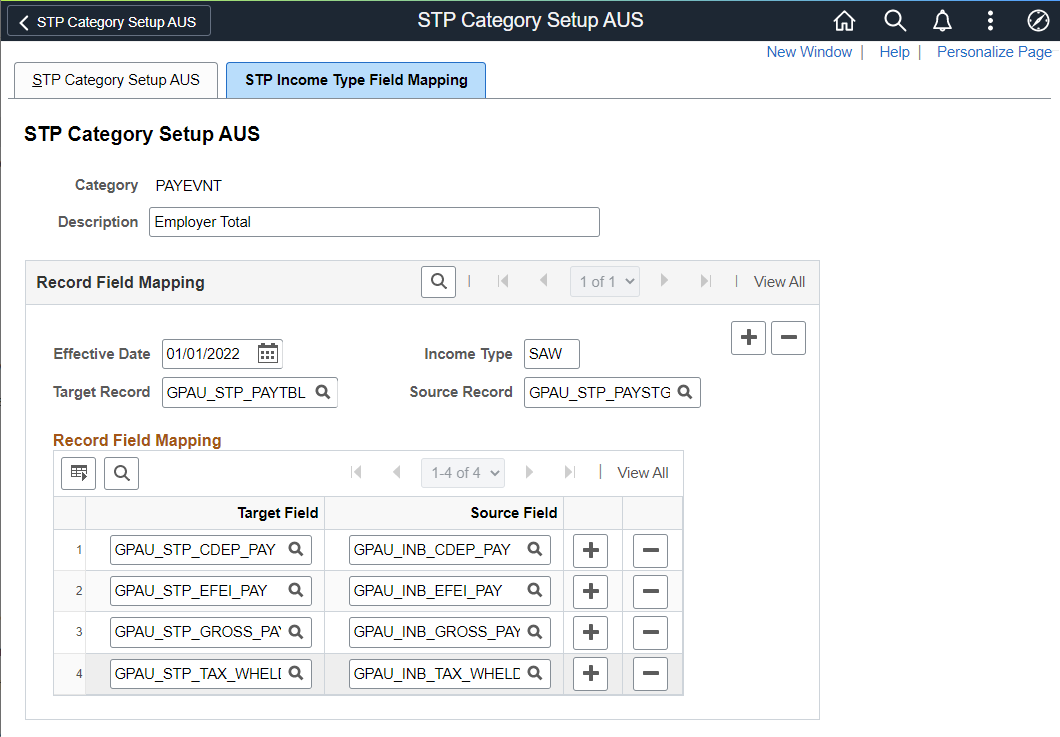

STP Income Type Field Mapping

STP Income Type Field Mapping is to draw between fields for Gross, Tax, CDEP, EFEI between GPAU_STP_PAYSTG and GPAU_STP_PAYTBL to convert payroll data stored in Phase 1 staging record into Phase 2 format of reporting. This transition is from horizontal to vertical data.

In Phase 2, Gross, tax, bonus and commissions, directors’ fee, overtime payments, CDEP, EFEI are still stored in PS_GPAU_STP_PAYSTG but data is converted and stored in PS_GPAU_STP_PAYTBL to make it compatible with the latest format. This conversion is done with the below setup.

This example illustrates the fields and controls on the STP Category Setup AUS_STP Income Type Field Mapping page.

|

Field or Control |

Description |

|---|---|

|

Target Record |

This field is to define the Staging table record of Phase 2. |

|

Source Record |

This field is to define the Staging table record of Phase 1. |

|

Income Type |

This field determines the income type. |

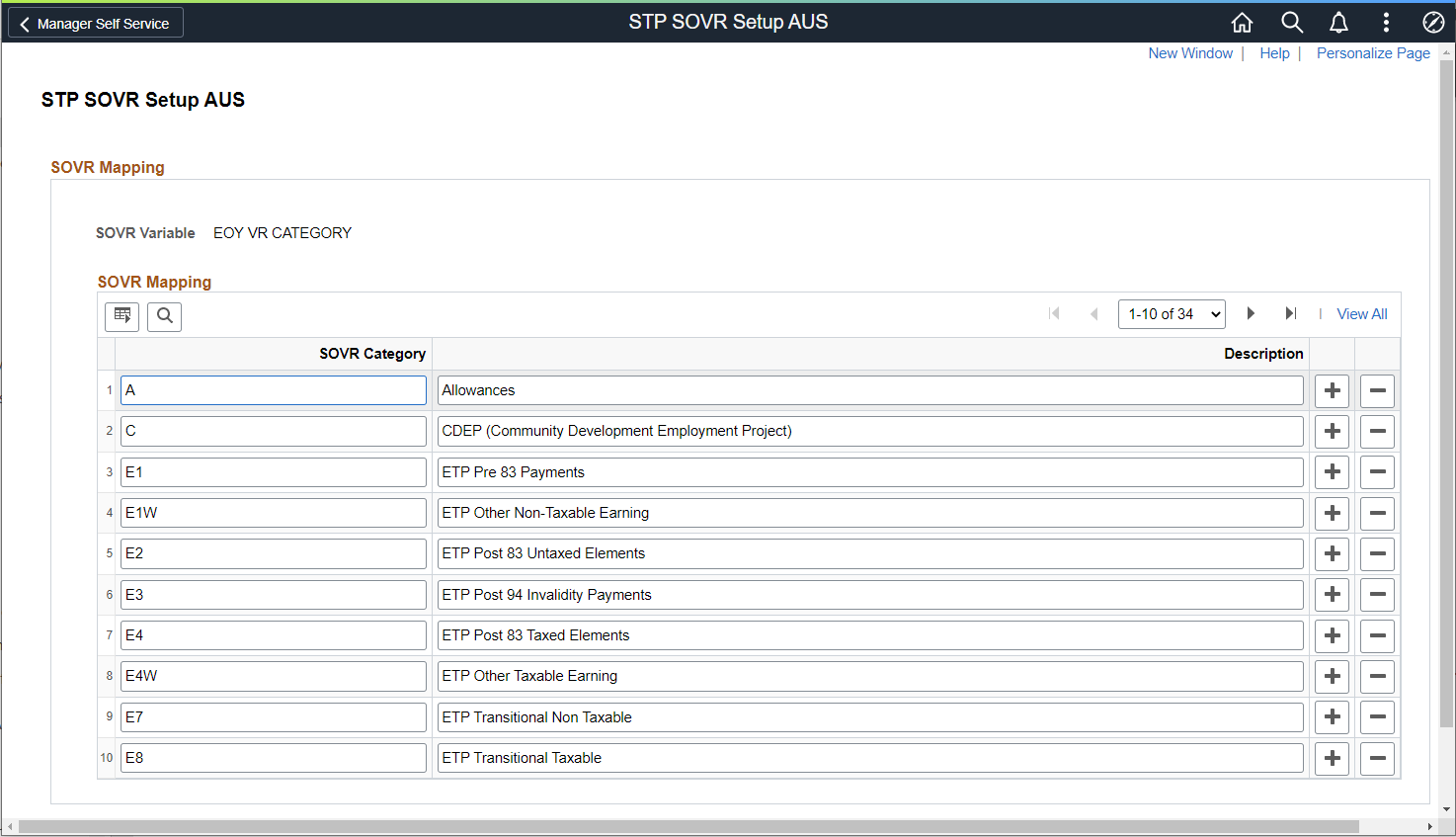

PeopleSoft delivers pre-seeded STP SOVR values that will be displayed in the STP Category Setup AUS page. However, if you want to create a new SOVR value, then you can make use of the GPAU_STP_SOVRCAT component.

Use SOVR Mapping (GPAU_STP_SOVRCAT) page to add SOVR category.

Navigation:

This example illustrates fields and controls of STP SOVR Setup AUS Page.

Use the “+” button to add a new SOVR category.

Map the STP VR CATEGORY “FA” against the respective earning elements with an effective date under the tab Supporting Element Override. Users need to ensure the mapping of the respective SOVR to the correct Earnings and Deductions to report under the correct categories of STP.

Note: Ensure the mapping of the respective SOVR to the correct Earnings and Deductions to report under the correct categories of STP as per ATO definitions.

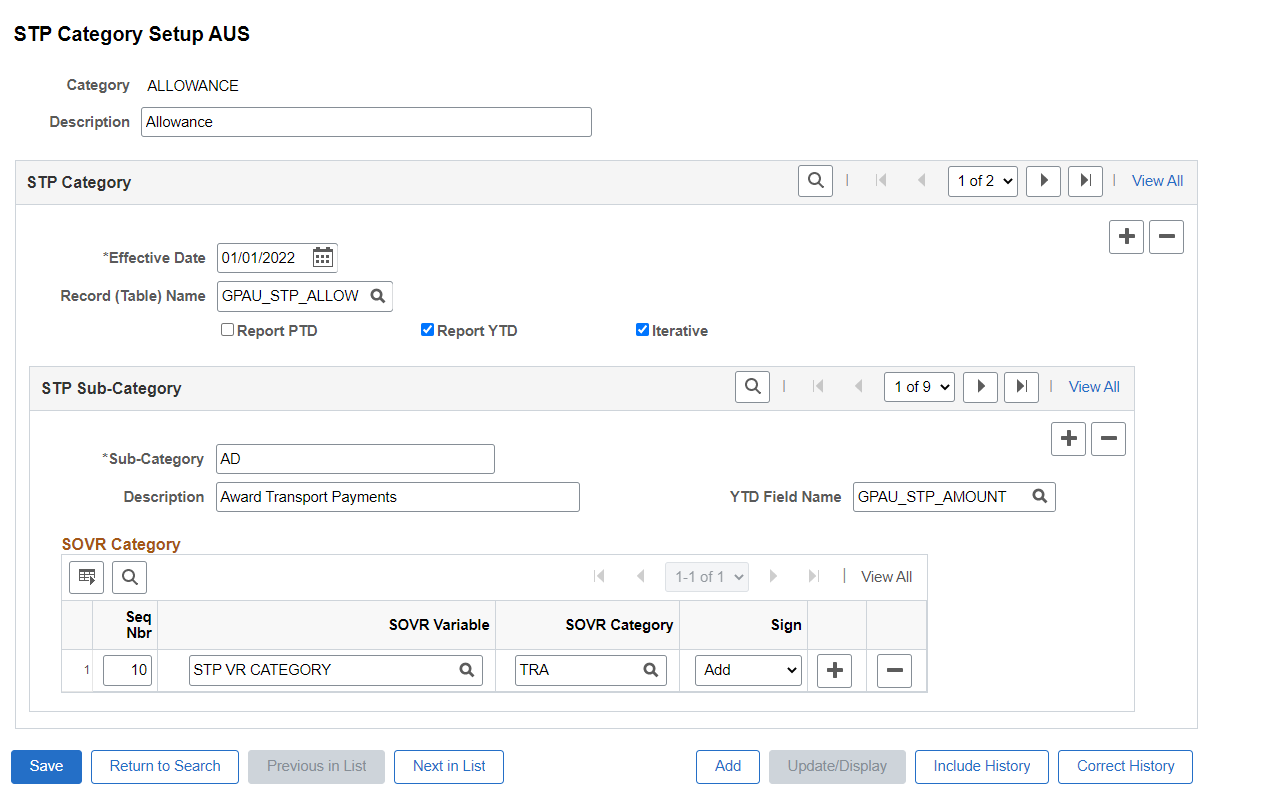

Employee’s year to date payroll results is reported in Single Touch Payroll Pay Event file. Year to date accumulators is contributed by the respective earnings and deductions that are processed in payroll. Each earnings and deductions are assigned with SOVR category in the supporting element override tab as shown above with the help of a variable EOY VR CATEGORY.

These SOVR categories are used to retrieve the list of accumulators for Payment Summary (PSM) reporting in Global Payroll Australia and the same approach is used for STP reporting. Some of earnings and deductions which do not have the SOVR category will be assigned a new category with an element type as variable STP VR CATEGORY or STP VR P2 CATEGORY which are specific to STP instead of existing variable EOY VR CATEGORY so that there will not be any impact on existing PSM reporting and also to make sure if the users are using the feature for any other kind of reconciliation.

New SOVR Category under the variable STP VR CATEGORY is added in order to classify allowance type as others with description “First Aid Allowance” under STP Category Setup, under Category “Allowance”.

The example illustrates STP Category Setup AUS with Allowance category.

This example illustrates the STP Category Setup AUS page

The STP Category setup AUS page sets the mapping between XML Tuple with Category and XML Fact with Subcategory.

This example illustrates the XML mapping with the respective fields in the STP Category Setup AUS page.

|

Field or Control |

Description |

|---|---|

|

Effective Date |

If the customer plans to migrate to STP Phase 2 anytime later than 01-Jan-2022, effective date of the STP Income Type Field mapping should be modified to the actual migration date along with the effective date of STP Category setup. Income Type field mapping is mandatory with the latest effective date in the STP Category setup for addition of new income types like CHP and SWP. |

|

Record Name |

Define the Staging table record where the data to be stored for final reporting. |

|

Report PTD |

This field determines if PTDs are required under the specified Category and Sub-Category. This enables PTD field name where we can define the Field of the staging table defined under Record Name. The PTD value calculated update in the respective field defined. |

|

SOVR Category |

Select the respective EOY VR or STP VR Category corresponding to those earnings and deductions that is required for each facts of that Tuple. This determines the actual SOVR categories that contribute to the Sub-Category, which is the Final amount to display in the report. |

Note: This setup is pre-seeded as system data and employer can make necessary changes to set up additional categories as part of STP Reporting.

In Phase 1, payroll related information is stored in PS_GPAU_STP_PAYSTG along with allowances in PS_GPAU_STP_ALLOW, deduction in PS_GPAU_STP_DED, employee termination payments in PS_GPAU_STP_ETP

In Phase 2, PS_GPAU_STP_PAYSTG is split into below records:

|

Field or Control |

Description |

|---|---|

|

PS_GPAU_STP_PAYTBL |

Gross, tax, bonus and commissions, directors’ fee, overtime payments, CDEP and EFEI. |

|

PS_GPAU_STP_PAIDLV |

Paid Leaves |

|

PS_GPAU_STP_LUMPSM |

Lump sum payments |

|

PS_GPAU_STP_SS |

Salary Sacrifice |

|

PS_GPAU_STP_SUP |

Super Entitlements |

|

PS_GPAU_STP_RFB |

Reportable Fringe Benefits |

Field Mapping

The STP Income Type Field Mapping is to draw between fields for Gross, Tax, CDEP, EFEI between GPAU_STP_PAYSTG and GPAU_STP_PAYTBL in order to convert payroll data stored in Phase 1 staging record into Phase 2 format of reporting.

In Phase 2, Gross, Tax, Bonus and Commissions, Directors’ Fee, Overtime payments, CDEP, EFEI are still stored in PS_GPAU_STP_PAYSTG but data is converted and stored in the new record PS_GPAU_STP_PAYTBL to make it compatible with the latest format.

This example illustrates the STP Category Setup AUS page.

|

Field or Control |

Description |

|---|---|

|

Target Record |

This field is to define the Staging table record of Phase 2. |

|

Source Record |

This field is to define the Staging table record of Phase 1. |

|

Income Type |

This field determines the income type. |

Separate Source Fields are made available for users to capture these other income types as part of the solution. Users will need to appropriately map these Source Fields to the Target Fields.

Note: Users need to do the setup for any non-delivered Income Type using STP Category setup page. In addition, appropriate mapping of Source and Target fields will be required.

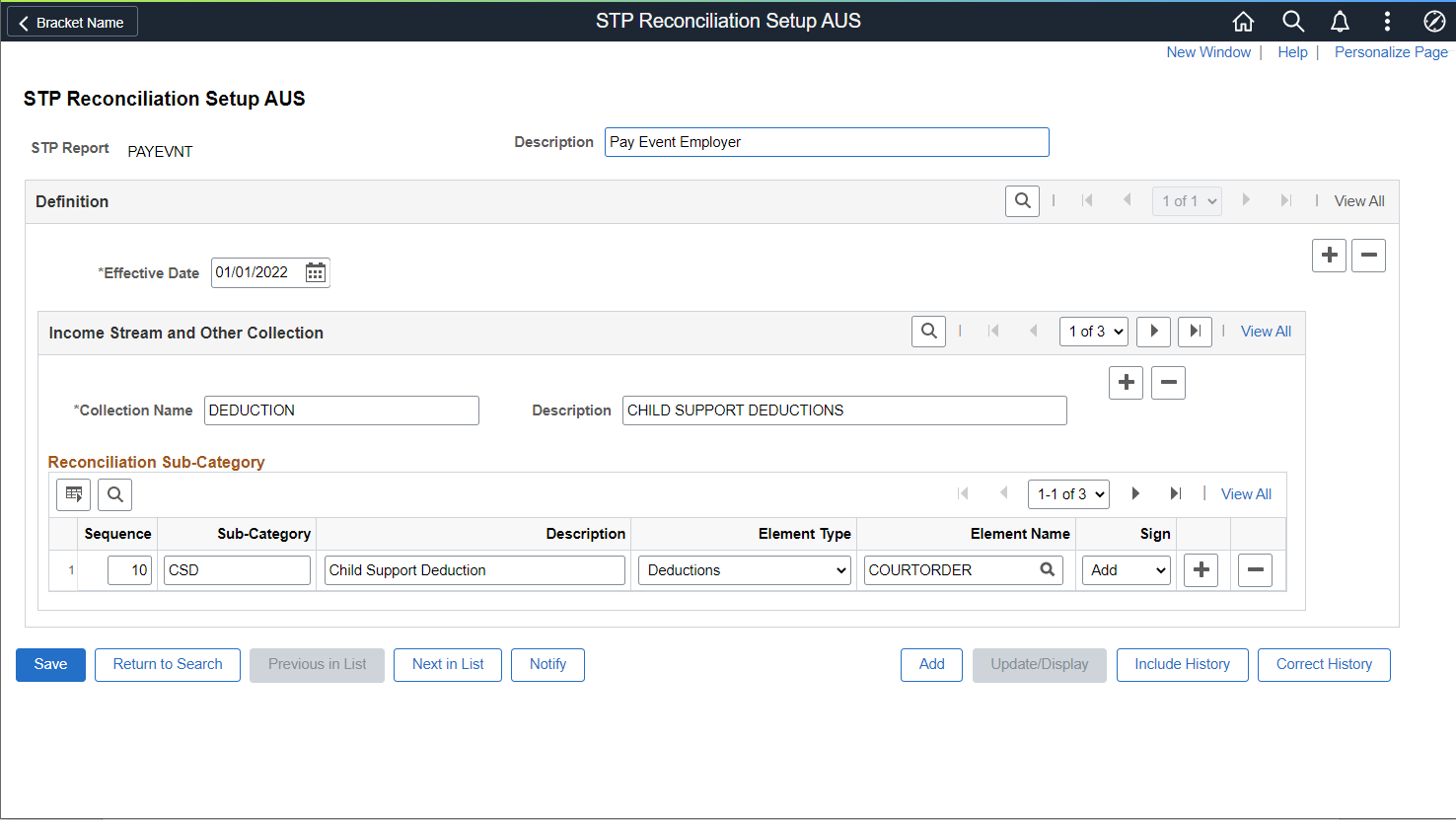

STP Reconciliation Setup AUS is configured with the Earnings/Deductions contributing to the sub-category and the various collections reported in the STP file.

Employee can map any customized Earnings/Deductions used instead of the PeopleSoft delivered Earnings/Deductions that are being reported in STP. This setup is delivered as a system data as part of the Reconciliation solution.

Navigation:

This example illustrates the fields and controls of STP Reconciliation Setup AUS page.

|

Field or Control |

Description |

|---|---|

|

Effective Date |

The date from which the setup is valid. |

|

Collection Name |

The name of the Tuple that are being used for reporting. |

|

Sequence |

The Sequence Order of the Field on the report. |

|

Sub-Category |

The name of the facts that are being used for reporting under the respective Tuple. |

|

Description |

The description of the sub-category. |

|

Sign |

The values are:

|

|

Element Type |

Displays the Element Type. Values can be:

|

Run Control Parameters

Run the Run Control process by Pay Entity, Group List, Streams, Pay Group, Period End Date or individual Employee ID similar to that of the STP Preparation process with an additional input of STP Report Type. Upon the selection of the appropriate options, few fields will be enabled or disabled based on the run control parameters chosen. The Tax Year, Pay Entity and Calendar ID or Period End Date are the mandatory required fields for all types of processing options.

|

Field or Control |

Description |

|---|---|

|

STP Report |

Select the required report type from the following options:

|

|

Tax Year |

The year for which tax year this Payroll Event Reconciliation (Pay Event Employer & Pay Event Employee) needs to be processed. |

|

Pay Entity |

The Pay Entity for which data should extracted. Define the pay entity for which the employer would like to include the payroll data for Payroll Event Reconciliation (Pay Event Employer & Pay Event Employee). |

|

Calendar Group ID |

Input the Calendar Group ID for which the employer considers the payroll results for Payroll Event Reconciliation (Pay Event Employer & Pay Event Employee). |

|

Employee ID & BAL GRP |

If the process run only for one employee, then Processing Option should be set to Employee ID and the Employee ID should be entered in the relevant field. |

|

Group List |

If the process run for a group of employees, then Processing Option should set to Group List and the Group List ID should enter in the relevant field. |

|

Streams |

If the process run for a given payroll stream, then Processing Option should be set to Streams and the Stream Number should enter in the relevant field. |

|

Period End Date |

Select the option as Period End Date to run the process for a list of CAL_RUN_IDs having the same Period End Date. On selecting this option, two fields, Period End Date and Period ID are displayed. |

|

Show EEs with Difference Only |

Select for the report to contain only the employees with differences. Keep it unchecked to include all the employees in the report. By default, this is selected. |

|

Consider STP Payee Override |

Select for the report to include the Payee Override entered. By default, this is not selected. |

|

Sub-Category Filters |

Enables if the STP Report is not ALL, for report to contain only the selected sub-category against Pay Event Employer or Employee, Select the respective sub-category from the filters. By default, this is selected for STP Report Pay Event Employer and Pay Event Employees. |