Understanding Single Touch Payroll (STP)

Single Touch Payroll is an initiative introduced by the Australian government to simplify the tax reporting process for employers. Employers are required to electronically report payroll and superannuation information to the ATO (Australian Tax Office ) as and when employees are paid, rather than reporting in separate periods throughout the year or at the end of the year. In addition, it also streamlines tax file number (TFN) declarations and Super Choice forms by providing a digital channel to simplify the process of employing new employees.

Pay Event

In PeopleSoft, a Pay Event is created as and when an employee is paid. It shows the amount that is paid to employees for the services they have done for the organization within a certain period. It is the combination of the financial records of their employees' salaries, wages, allowances and deductions. Pay Event data consist of both employer and individual employee data:

PAYEVNT - Summary Report which helps the Employer, Tax Agent or Business Representative to notify ATO for the payments made to their employees along with related Tax and Super obligations validated and processed by SBR.

PAYEVNTEMP - Detail Report which helps the Employer, Tax Agent or Business Representative to notify ATO for the payments made to an individual employees along with related Tax and Super obligations that is validated and processed by SBR.

This pay event data is electronically reported to the ATO using Single Touch Payroll.

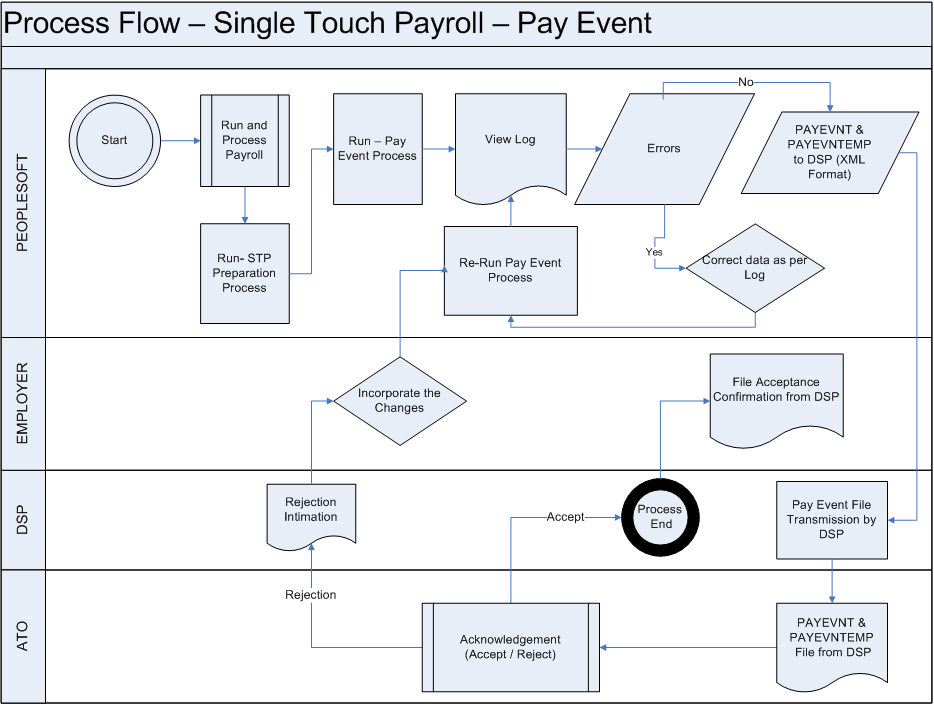

This diagram illustrates the Single Touch Payroll Process Flow.

Single Touch Payroll Preparation process derives the Payroll data with the help of Report data and STP Category setup and updates the final results in the respective staging tables as defined in the configuration. Using the XML framework XML reports are generated, when you run the STP Pay Event process. These reports are transferred to ATO and on receiving positive acknowledgment from ATO the process is considered as complete.

If there is any error, you can correct the data and re run the pay event process. If the file is rejected by ATO, Rejection Intimation is passed on to the employer to make required changes and re run the pay event.

Note: PeopleSoft only supports the generation of the XML files and are dependent on 3rd part DataService Providers (DSPs) to handle submission.