Resolution of Termination Earnings

This section discusses each of the earning elements in the Termination section and shows how they are resolved.

The calculation rule for both AL MARGINAL and AL LUMP A is Unit × Rate, where:

Unit = TER FM AL BAL HRS

Rate = TER FM HOURLY RATE

The unit formula sums accumulators ANN ENTHRS_BAL and ANN ENTHPH_BAL.

Generation controls attached to each earning determine which of the two earnings to use to pay the hours.

For Annual Leave Marginal (hours), generation control TER GC TERM NORMAL uses TER FM NORM TERM to determine if the employee's status is Retired with Pay, Retired, Terminated, or Terminated with Pay. If it is and the action reason is not Staff Reduction, Early Retirement or Partial or Total Disability, then the system pays the hours value as AL MARGINAL.

For Lump Sum A, generation control TER GC TERM REDUN uses TER FM REDUN TERM to determine if the employee's status is Retired with Pay, Retired, Terminated, or Terminated with Pay. If it is and the action reason is Staff Reduction, Early Retirement, or Partial or Total Disability, then the system pays the hours value as AL LUMP A.

Note: The system does not provide for annual leave accrued prior to 1993, so the payout for annual leave on resignation, retirement, or dismissal is all to AL MARGINAL and is taxed at the marginal rate.

The calculation rule for both AL MARGIN DY and AL LUMPA DY is Unit × Rate, where:

Unit = TER FM AL BAL DYS

Rate = TER FM DAILY RATE

The unit formula sums accumulators ANN ENTDYS_BAL and ANN PRODYS_BAL.

The same two generation controls used with AL MARGINAL and AL LUMP A - Hours are attached to these two earnings, respectively. They do the same job, but this time the system pays the days value to either AL MARGIN DY or AL LUMPA DY.

The calculation rule for both LL MARGINAL and LL LUMP A is Unit × Rate × Percent, where:

Unit = TER FM LL BAL HRS

Rate = TER FM HOURLY RATE

Percent = 17.5

The unit formula sums accumulators ANN ENTHPH_BAL and ANN ENTHRS_BAL.

The same two generation controls used with AL MARGINAL and AL LUMP A are attached to these two earnings, respectively. They do the same job, but this time the system pays the hours value to either LL MARGIN or LL LUMP A.

The calculation rule for both LL MARGIN DY and LL LUMPA DY is Unit × Rate × %, where:

Unit = TER FM LL BAL DYS

Rate = TER FM DAILY RATE

% = 17.5

The unit formula is accumulator ANN ENTDYS_BAL.

The same two generation controls used with AL MARGINAL and AL LUMP A are attached to these two earnings, respectively. They do the same job, but this the system time pays the days value to either LL MARGIN DY or LL LUMPA DY.

Long service leave (LSL) payment calculations are affected by legislation that requires different tax rates to apply to the different periods during which the employee accrued the leave. We supply three LSL earnings: LSL MARGINAL, LSL LUMP A, and LSL LUMP B.

To calculate these earnings, you use the PeopleSoft-maintained formula TER FM LSL CALC. This formula is invoked by the formula TER FM PRE PROCESS, which is the first element in the Termination section. As soon as the Termination section's conditional formula TER FM TERM CHECK returns True, TER FM PRE PROCESS is invoked, which in turn invokes TER FM LSL CALC.

Note: TER FM PRE PROCESS also invokes TER FM LSL PRE90, which is used to calculate LSL payments that are exempt from State Payroll Tax in NSW.

The formula first determines if the termination was for redundancy, early retirement, or partial or total disability (referred to as Redundancy in the following table).

Formula TER FM LSL CALC returns values for variables TER VR LS LUMPA, TER VR LS LUMPB and, if the termination was not redundancy, TER VR LS MARGINAL. These three variables are the units in the Unit × Rate calculation rules for the three LSL earnings. (The rate for all three earnings is TER FM DAILY RATE.)

This table shows how LSL may be paid according to the Action Reason of the termination:

|

Action/Reason for Termination |

Payment Options |

|---|---|

|

Termination Is Redundancy |

|

|

Termination Is Not Redundancy |

|

Formula TER FM LSL CALC then uses other formulas that in turn use durations and system-generated accumulators based on the absence entitlements and take elements setup.

Note: TER FM LSL CALC uses formulas that in turn use system-generated accumulators, the current members of which are customary data. If you create new absence entitlement or take elements, you must adjust the formulas to use the accumulators that the system generates for those elements. You may have to adjust the following formulas: TER FM LSL TKES, TER FM LSTKE PST78, TER FM LSTKE PST93, and TER FM LSL BAL. The first three of those four formulas use variables of which you need to set the values. They are, respectively: TER VR LSTKW TOTAL or TER VR LSTKM TOTAL, TER VR LSTKW PST78 or TER VR LSTKM PST78, and TER VR LSTKW PST93 or TER VR LSTKM PST93, depending on the frequency of the take (weekly or monthly). In the formulas and variables tables in these topics, these elements appear in bold to indicate that you may need to adjust them.

Lump Sum D payments, which are not taxed, are for redundancy and approved early retirement payments, but they have a limit. Whatever you pay over that limit is paid as a Lump Sum C employment termination payment (ETP), which may or may not be taxed. The resolution of Lump Sum C payments depends on the prior resolution of Lump Sum D.

The calculation rule for TERM LUMP D earning is Amount, where the amount is formula TERM FM LUMP D.

This is how the formula resolves:

It first uses Australian Tax Office (ATO)-supplied, PeopleSoft-maintained, variable values, and a duration that determines an employee's complete years of service to arrive at a figure—called the calculated amount in this topic.

The calculated amount is the limit that can be paid as Lump Sum D. The variables are TER VR LUMPD YRLY (yearly amount) and TER VR LUMPD INIT (initial amount), and the duration is TER DR TOTAL DAYS. The formula multiplies the yearly amount by the years of service, then adds the initial amount. This is the calculated amount or limit.

The formula then compares the calculated amount with the balance of accumulator TER AC RED/AER (Redundancy/Approved Early Retirement).

Note: The members of accumulator TER AC RED/AER are only ever REDUNDANCY (which is supplied) or [EARLY RETIREMENT] (which is not supplied). Both of these earnings are also members of accumulator TER AC ETP. The redundancy and early retirement earnings are not paid as such; they do not add to accumulator AUS GROSS. They exist so that you can enter their amounts as positive input and add to accumulators. The actual payment of redundancy or retirement amounts is as earning TERM LUMP D or a combination of TERM LUMP D and ETPTAX/ETP NON TAX.

Based on the results of the formula calculation, one of the following events occurs:

If the calculated amount is greater than the accumulator amount, the payments do not exceed the limit and the full accumulator amount becomes the Lump Sum D payment.

If the calculated amount is less than the accumulator amount, the payments exceed the limit, so only the calculated amount (the limit) becomes the Lump Sum D payment.

The balance becomes the basis of ETP calculations.

The balance becomes ETP (taxed or nontaxed—to be calculated) because the redundancy and retirement amounts also add to TER AC ETP, and whatever is paid as Lump Sum D by earning TERM LUMP D subtracts from TER AC ETP. If the redundancy and retirement accumulator was less than the calculated amount, and was therefore paid as Lump Sum D in full, then the balance of redundancy and retirement in the ETP accumulator is nil.

RED/RET = TERM LUMP D so

RED/RET − TERM LUMP D = Nil

If the redundancy and retirement accumulator was more than the calculated amount, only the calculated amount would be Lump Sum D, so there would be a positive balance of redundancy and retirement payment in the ETP accumulator.

RED/RET > TERM LUMP D so

RED/RET − TERM LUMP D = +ve Bal of RED/RET

From 1 July 2019, employees who would otherwise meet the basic requirements to qualify for a genuine redundancy or an early retirement scheme will have changed age conditions. To work out if the employee can access the tax-free limit based on the employee’s years of service, the aged based requirement of 65 years has been replaced with ‘Pension Age’.

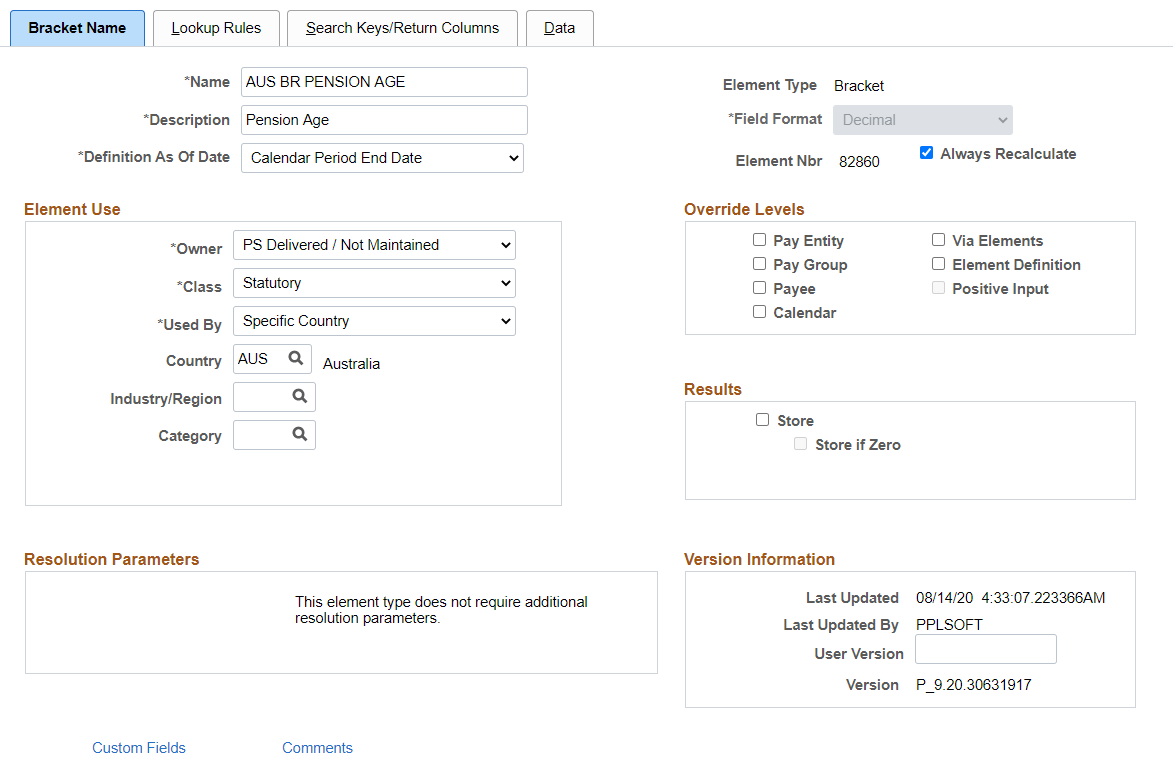

Use the bracket AUS BR PENSION AGE to pick the pension age based on the birth date of the employee.

Bracket Name page when AUS BR PENSION AGE is selected.

Use the Bracket Name page (GP_PIN) to define elements’s basic parameters.

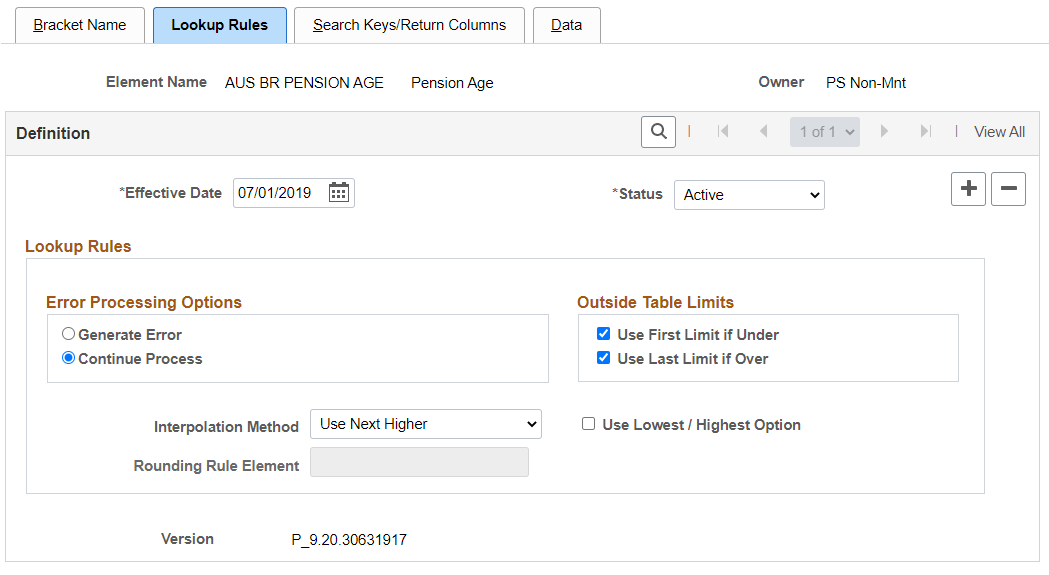

Lookup Rules Page when AUS BR PENSION AGE is selected.

Here, the lookup rules for a bracket is defined.

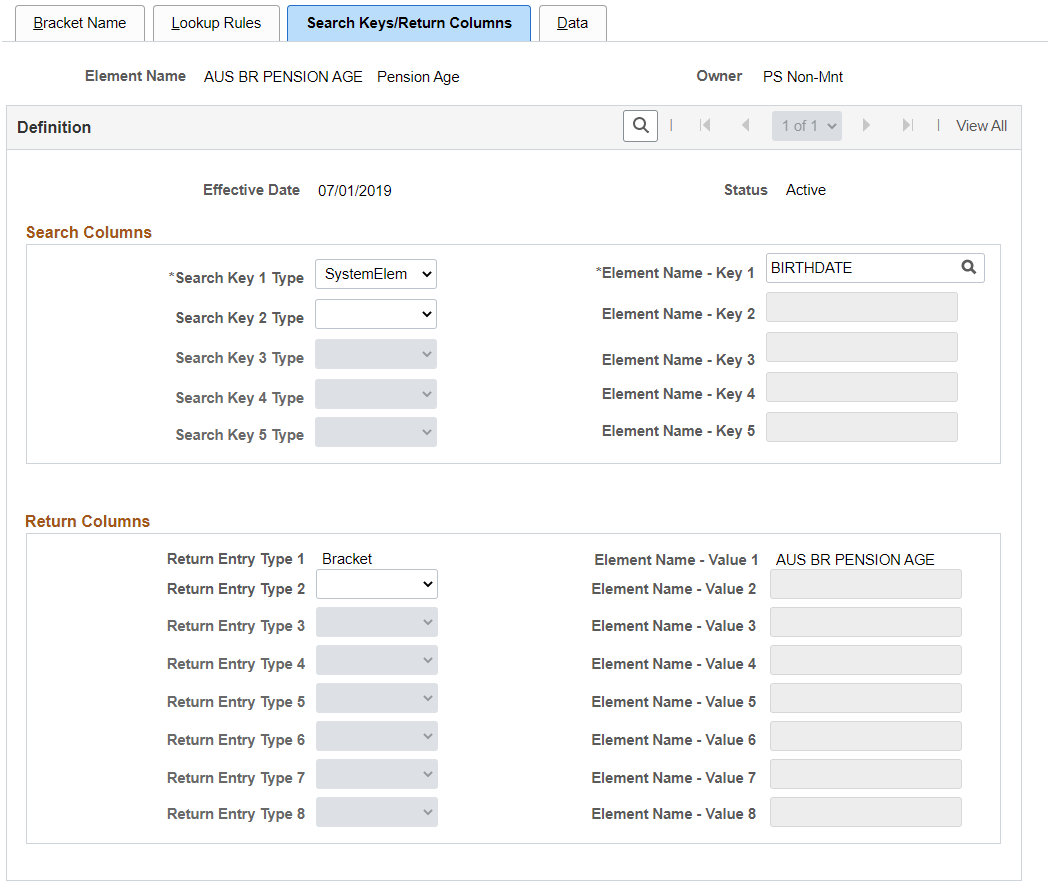

Search Keys/Return Columns Page when AUS BR PENSION AGE is selected.

Use this page to identify the search keys and the return columns for the bracket.

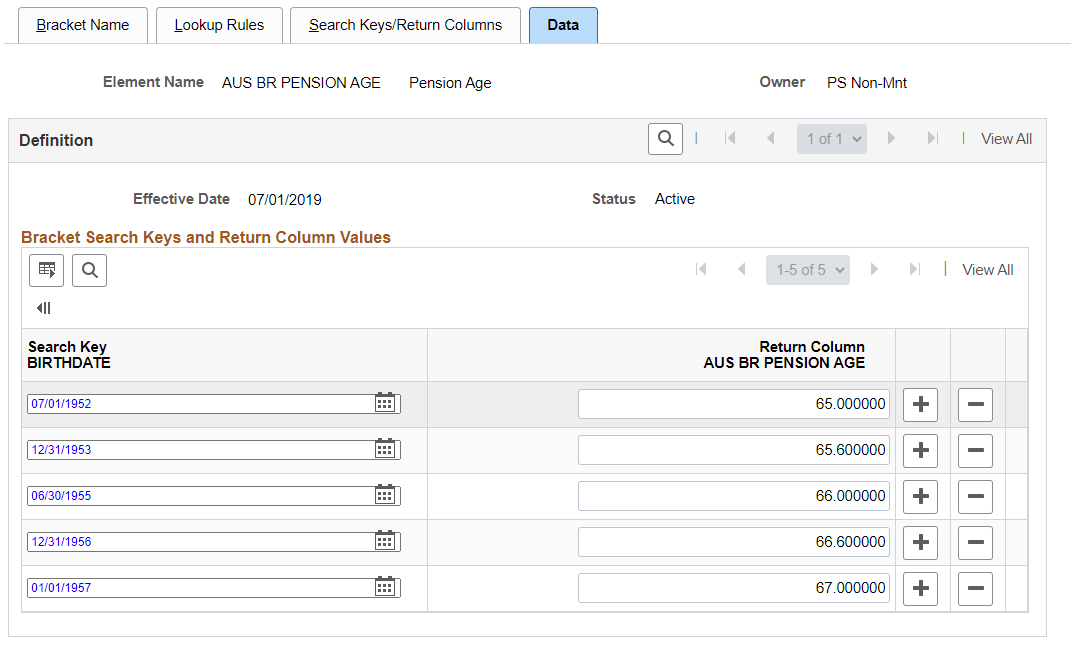

Data Page when AUS BR PENSION AGE is selected.

Here, the lookup values are entered.

For more information on Bracket Elements, see Defining Bracket Elements.

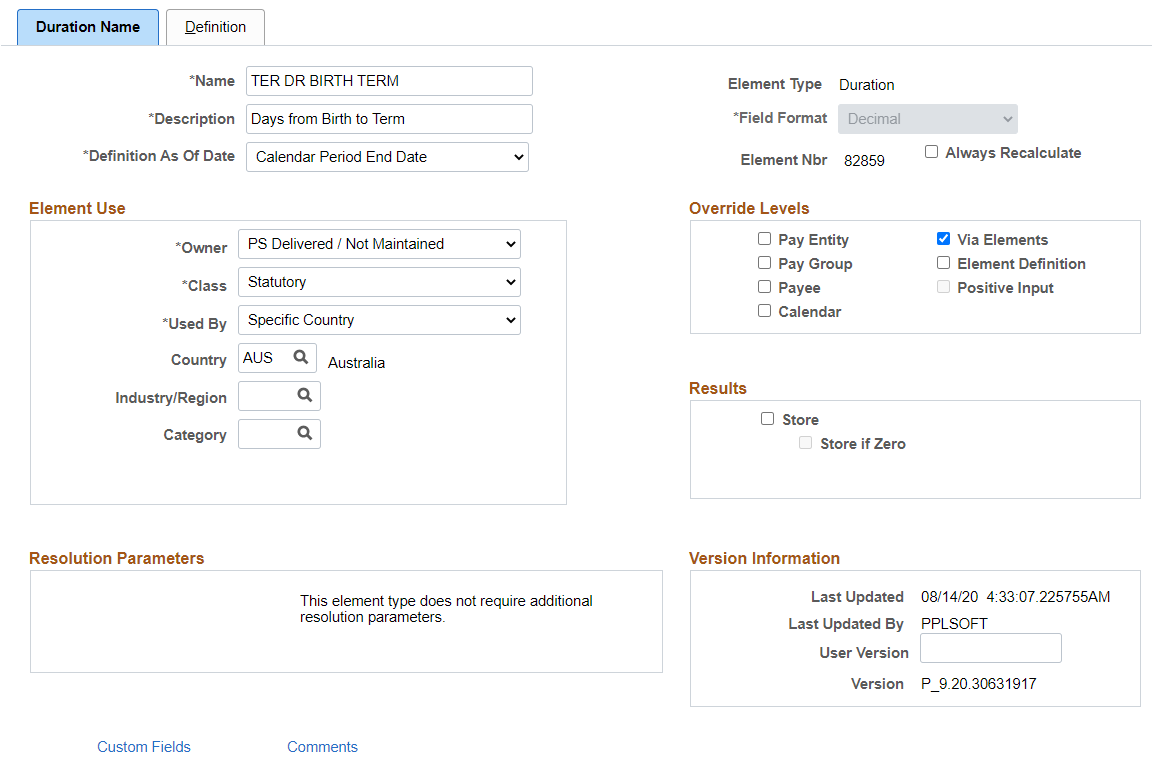

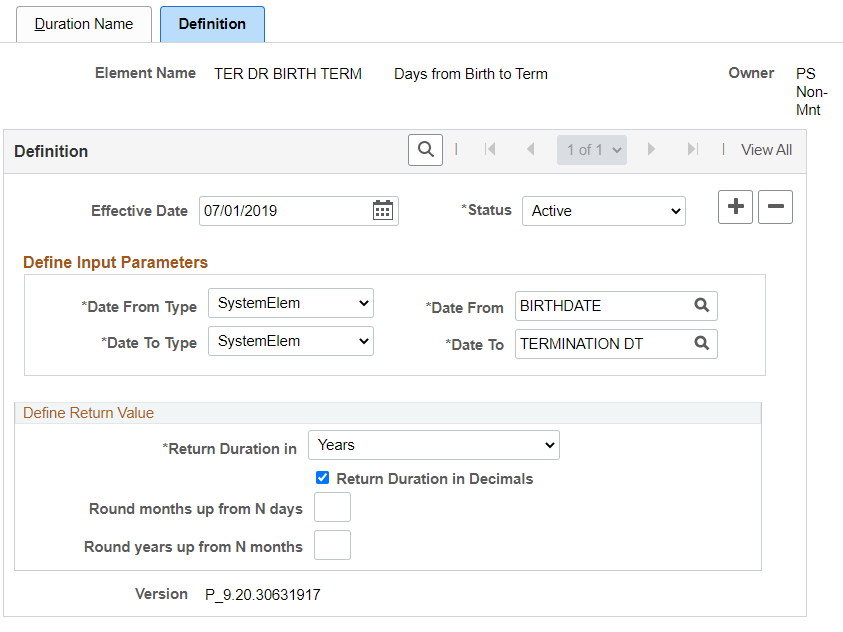

Once the pension age is identified using the bracket element, the duration of the employee from birth date till termination date (to compare with the pension age for identifying genuine redundancy or early retirement) is calculated using the Duration element: TER DR BIRTH TERM.

Definition Name Page when TER DR BIRTH TERM is selected.

Definition Page when TER DR BIRTH TERM is selected.

For more information of Duration Elements, see Defining Duration Elements.

Once, pension age and duration are identified, the redundancy and early retirement payments are calculated using the formula TERM FM LUMP D. For more information, see Calculating Lump Sum D.

ETP payments may or may not be taxed.

The system has to determine which part of the ETP earning is taxable and which part isn't.

Payments such as payment in lieu (of notice), ex gratia, invalidity, and, sometimes, the balance of redundancy and retirement payments are included in the ETP payments.

Note: Earnings for payment in lieu (of notice), ex gratia, and invalidity are, like redundancy and retirement earnings, not resolved and paid as such; the amounts that you enter for them as positive input do not add to accumulator AUS GROSS. They do, however, add to accumulator TER AC ETP, and formulas use that accumulator to determine if the payments are to be ETP-taxed or ETP-nontaxed. Invalidity payments have additional processing.

ETPs are categorized into two: Excluded ETP and Non Excluded ETP.

Excluded ETP

The accumulator for Excluded ETP is TER AC ETP LBP. The delivered accumulator is customary in nature. ETP ER LBP is an earning element created to facilitate contributions to TER AC ETP LBP. You can provide positive input in ETP ER LBP for earnings contributing to the LBP category and calculate the values. You can also create multiple member elements for the accumulator for customized earnings.

Calculating Taxable Excluded ETP

In Excluded ETP, the earnings from Pre83 (ETP NONTAX) are non taxable and tax is calculated only from the Post83 earnings (ETP TAX). The Lump C tax (LUMP C TAX) is calculated from the Post83 earnings.

Non Excluded ETP

The accumulator for Non Excluded ETP payments is TER AC ETP WIC. ETP ER WIC is an earning element created to facilitate contributions to TER AC ETP WIC. You can provide positive input in ETP ER WIC for earnings contributing to the WIC category and calculate the values. Like the accumulator for Excluded ETP, for this accumulator also you can create member elements for customized earnings.

Calculating Taxable Non Excluded ETP

In Non Excluded ETP, the Pre83 earnings (ETP NTAX WIC) are non taxable and tax is calculated only from the Post83 earnings (ETP TAX WIC). The Whole of Income tax (ETP WIC TAX) is calculated from the Post83 earnings of the Non Excluded ETPs.

The calculation rule for earning INVALIDITY is Amount, and the amount is Payee Level. It is another earning for which you enter the value by positive input and that does not add to AUS gross. It does, however, add to the accumulator TER AC ETP. It also adds to its own accumulator TER AC INVALIDITY.

The calculation rule for earning INV POST 94 is Amount, and the amount is formula TER FM INV POST94.

Note: Despite its name, the calculation of post 94 invalidity earning does not involve any durations based on the year 1994.

The formula multiplies the amount of accumulator TER AC INVALIDITY (added to by your positive input) by duration TER DR TERM RETIRE, which calculates the days from the employee's termination date to his or her normal retirement date. It then divides by duration TER DR HIRE RETIRE, which calculates the days from the employee's hire or rehire date to normal retirement date.

Accumulator amount × days from term to norm retirement / days from hire (or rehire) to norm retirement = TER FM INV POST94 = earning INV POST 94

The start date for duration TER DR HIRE RETIRE is formula TER FM DUR START, which returns the rehire date if the hire date is earlier than the rehire date.

Because the positive input for earning INVALIDITY adds to TER AC ETP, and earning INV POST 94 subtracts from it, the balance of INVALIDITY is processed as any other ETP payment.

For employees who accrue annual leave-in hours based on hours worked, you must enter their final hours in the variable TER VR FINAL HRS on the Supporting Elements Override page (select ) when they are terminated. Those hours grant the correct accrual during the resolution of section ABS ENTHPHG in the GEN ABSENCE process list for payment by the AUS PAYROLL process. The section resolves only if its conditional formula returns that the employee has been terminated. Employees who accrue hours based on hours and who are not terminated have their accrual processed through the HRLY ACCRUED process list, which is run after AUS PAYROLL when the hours on which to base the accrual are known.