Scheduling Earnings by Using Generation Control

There may be times when you need to control the periods in which earnings are paid. In that case, you need to control when the system pays the earnings element regardless of the pay frequency (weekly, fortnightly, semimonthly, four-weekly, or monthly). For instance, you might need to pay earnings only in the first weekly pay run of the month or only in the second fortnightly pay run of the month.

Note: Although these generation controls are discussed here in the context of defining earnings, you can use them to control deductions in the same way.

You control the payment of an earnings element—whatever the pay frequency—by assigning one of seven generation controls to the earnings. Five generation controls exist for periods 1 to 5 (there is a maximum of five weekly periods per month), and two additional generation controls cover two periods each (periods 1 and 3 and periods 2 and 4).

The two-period controls have the system process the earnings in both covered periods. For example, the control for periods 1 and 3 affects weekly pay runs in weeks 1 and 3 but not weeks 2, 4, and 5.

A corresponding formula exists for each generation control. When the formula returns True, the earning is paid.

For example, to pay an allowance for the first period of the month (period 1), the formula returns True for the first period of the month and False for the remaining periods, and the earnings element is processed.

The formula attached to each generation control has the same name except the FM element type code replaces the GC type code; for example, the generation control AUS GC PERIOD 1 has the associated formula AUS FM PERIOD 1.

Note: For each of the two-period generation controls, the formula calls two other formulas, one for each period. For example, the formula AUS FM PRD 1+PRD 3 calls formulas AUS FM PERIOD 1 and AUS FM PERIOD 3. Only one of the two formulas needs to return True for the system to pay the earning.

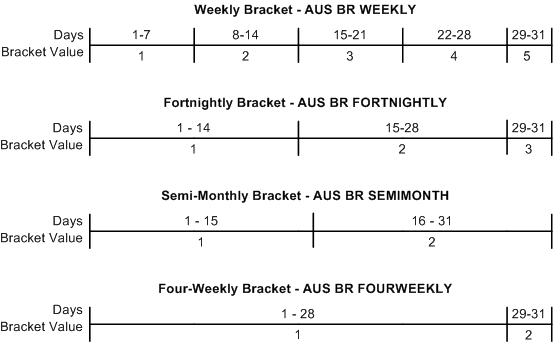

Weekly, fortnightly, semimonthly, and four-weekly brackets return values depending on where the pay period end date occurs.

This diagram shows the bracket values associated with each day of the month.

To provide examples, the following table shows the bracket value that each bracket returns for day 5 and day 27 of the month:

|

Bracket |

Value for Day 5 |

Value for Day 27 |

|---|---|---|

|

Weekly |

1 |

4 |

|

Fortnightly |

1 |

2 |

|

Semimonthly |

1 |

2 |

|

Four-weekly |

1 |

1 |

The formula uses the bracket values, which indicate to the system whether the pay period end date is in the relevant period. The formula checks the bracket that corresponds to the frequency type.

For the period 1 formula for example:

If AUS VR FREQ TYPE = 'W' (weekly) Then

If AUS BR WEEKLY = 1 Then...TRUE

If AUS VR FREQ TYPE = 'B' (biweekly or fortnightly)Then

If AUS BR FORTNIGHLY = 1 Then...TRUEThe formula returns True when the pay period end date is in the bracket value that corresponds to the period. That is, for period 2 when the bracket for a frequency type returns 2, the formula returns True.

For example, to have the earning paid in the first period, you attach the period 1 generation control to the earnings element. If generation control formula for period 1 returns the bracket value 1, the formula returns True—regardless of the frequency specified in variable AUS VR FREQ TYPE, .

If you want the earning paid in the second and fourth periods, attach the AUS GC PRD 2 +PRD4 AUS FM PRD 2 +PRD4

The following table lists the frequencies for which each formula uses the bracket value (W is weekly, B is fortnightly, S is semimonthly, F is four-weekly, and M is monthly):

|

Formula |

Frequency |

Comment |

|---|---|---|

|

AUS FM PERIOD 1 |

W, B, S, F, M |

N/A |

|

AUS FM PERIOD 2 |

W, B, S, F |

M is always true |

|

AUS FM PERIOD 3 |

W, B |

S, F, and M are always true |

|

AUS FM PERIOD 4 |

W |

B, S, F, and M are always true |

|

AUS FM PERIOD 5 |

W |

B, S, F, and M are always true |

Note: None of the delivered earnings elements use the AUS GC PERIOD <number> generation controls; however, you can use these controls for deductions just as you use them for earnings. Deduction INSURANCE, for example, uses the AUS GC PERIOD 1 generation control.

To have an earnings element paid only in the last period in a month, use generation control AUS GC LAST PERIOD to determine if the period being processed is the last period of the month; for example, period 4 or 5 for weekly pay frequency or period 2 for semimonthly. The PHONE earnings element uses this generation control.

The formula attached to this generation control is AUS FM LAST PERIOD. That formula also uses the period formulas—AUS FM PERIOD <number>—that are associated with the seven generation controls.