Defining Average Salary Rules

To define average salary rules, use the Average Versions BRA (GPBR_AVG_VERSION) component and the Union Parameters BRA (GPBR_UNION_PARMS) component.

This topic discusses how to define average salary rules.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPBR_AVG_VERSION |

Identify the earning and deduction elements that are used within the average salary calculations. Also, define the average calculation parameters for these elements. |

|

|

GPBR_AVERAGES |

Define the earning and deduction elements considered by the system for average salary calculations for a given union. |

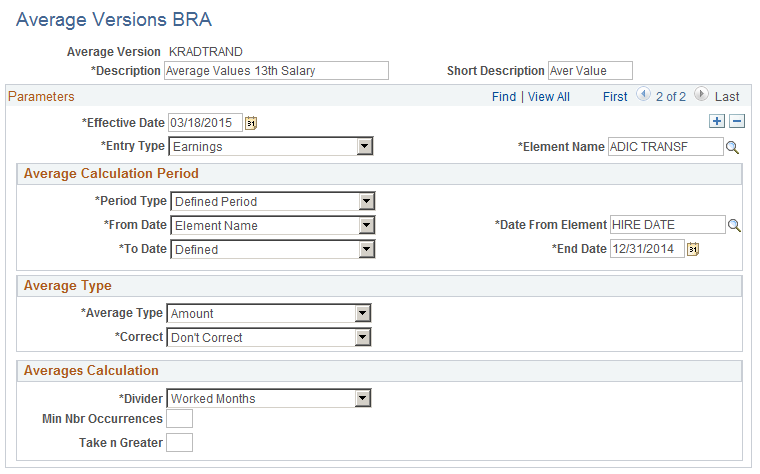

Use the Average Versions BRA page (GPBR_AVG_VERSION) to identify the earning and deduction elements that are used within the average salary calculations.

Also, define the average calculation parameters for these elements.

Navigation:

This example illustrates the fields and controls on the Average Version BRA page.

Field or Control |

Description |

|---|---|

Entry Type |

Select the type of element to include in the averages, for example, Earnings or Deductions. |

Element Name |

Select the earning or deduction element that is to be considered in the average salary calculations. |

Average Calculation Period

Identify the period of time to consider for this earning or deduction element when calculating the average salary. The fields that appear in this group box vary depending on your selection in the Period Type field.

Field or Control |

Description |

|---|---|

Period Type |

Select the type of period on which to base the average salary calculations. Options are: Acquisitive Period: Select to consider amounts that were earned or deducted during the employee's current entitlement period. (The current entitlement period is often based on the employee's service date.) The entitlement period is built during the Vacation process (GPBR_VACN_AP), which includes GP rules and an Application Engine process that updates the entitlement period. The record GPBR_VACN_AP stores entitlement period information and can be viewed on the Vacation Acquisition Prd-Sched page. Defined Period: Select to consider amounts that were earned or deducted during the period defined by the From Date and To Date fields. Year: Select to consider amounts earned during the current year only. Use theTo Date and End Date fields to define what portion of the current year to consider. |

From Date |

This field appears when you select Defined Period in the Period Type field. Select one of the following options: Before: Use values only from the very day before the current period starts (based on the date in the Begin Date field). Current: Use values from the current period being processed. Defined: Enter a date in the Begin Date field to indicate the start date. Element Name: Select an element in the Date From Element field to derive the start date. |

Begin Date |

This field appears when you select Defined Period in the Period Type field and Defined in the From Date field. Enter the first date to take into account when selecting the amounts to include in the average calculation. A begin date functions like historical rule. The begin date is the first date the system takes into account; the process considers information from this date until the end date. Note: Make sure that the specified begin date must be greater than (more recent), but not equal to or less than the period end date. |

Date From Element |

This field appears when you select Element Name in the From Date field. Specify the element, such as a variable, formula, or date, to derive the first date to take into account when selecting the amounts to include in the average calculation. |

To Date |

This field appears when you select Year or Defined Period in the Period Type field. Select one of the following options: Define the last date to be considered. Select one of the following options: Defined: Enter a date in the End Date field to indicate the last date. Element Name: Select an element in the Date To Element field to derive the last date. Months: Enter a number in the Nbr of Months field to derive the last date. |

End Date |

This field appears when you select Year or Defined Period in the Period Type field and Defined in the To Date field. Enter the last date to take into account when selecting the amounts to include in the average calculation. An end date functions like historical rule. The end date is the last date the system takes into account; the process considers information from the begin date until this date. |

Date To Element |

This field appears when you select Element Name in the To Date field. Specify the element, such as a variable, formula, or date, to derive the last date to take into account when selecting the amounts to include in the average calculation. |

Nbr of Months (number of months) |

This field appears when you select Months in the To Date field. Enter the number of months from the begin date that the system is to consider when performing the average salary calculations. |

Average Type

Specify whether the amounts that are eligible for the average salary calculations should be adjusted. The system makes these adjustments when it reads the values for each month. For example, if the system reads the January results and needs to adjust those values, the new value for that month is the original value times the adjustment factor for the month.

Field or Control |

Description |

|---|---|

Average Type |

Identify which component(s) of the earning or deduction element to adjust, if any. Options are Units, Amount, Percentage, and Units * Percentage. |

Correct |

Indicate whether amounts should be adjusted for inflation: Correct Amount: Select to have the system adjust the amounts. Don't Correct: Select if you do not want the system to adjust for inflation. Index by Hourly Salary: If you select this option, the system will read the hourly rate as of the payment date of the earning or deduction to consider any changes not taken for the hourly rate. Reverse Sign: Select for the system to multiply the amounts by -1 (minus one). |

Correct ID |

This field appears if you select Correct Amount in the Correct field. Enter the code for the monthly inflation adjustment. Note: A bracket stores correct IDs and their associated adjustment factors. You must enter the exact correct ID in this field to have the system find and use the correct adjustment factor. |

Averages Calculation

Field or Control |

Description |

|---|---|

Divider |

To calculate the average, the system can divide by a fixed number or by the number of periods that you specify. Options are Worked Months and Months. Months: Select to have the system divide the total earning or deduction amount that is eligible for the average salary calculation by the number that you enter in the By field. Worked Months: Select to have the system divide the total earning or deduction amount only by the number of months in the average period. For example, if the average period is from 12/31 to 01/01 but the employee was hired or terminated during this period of time, then, instead of dividing the result by 12, the system divides by the proportion of months between the hire or termination date. |

By |

If you selected Months in the Divider field, enter the number you want the system to divide by. |

Min Nbr Occurrences (minimum number occurrences) |

Specify the number of times during the defined period that this earning or deduction must occur in order for it to be used in the average salary calculation. For example, if you enter 3 in this field and an employee receives a particular earning twice during the period, that earning will not be considered in the average salary calculations. Enter 0 in this field to have the system always consider the earnings and deductions. |

Take n Greater |

Enter the number of occurrences of the earning or deduction in the defined period that are to be used in the average salary calculations. The system selects the amounts with the highest values (after adjusting for inflation, if you selected Correct Amount in theCorrect field . For example, if you enter 5 in this field for an earning element, the system averages the five highest earning amounts that were calculated for this element during the defined period. Enter 0 (zero) in this field if you want the system to consider all earning and deduction amounts for the defined period. |

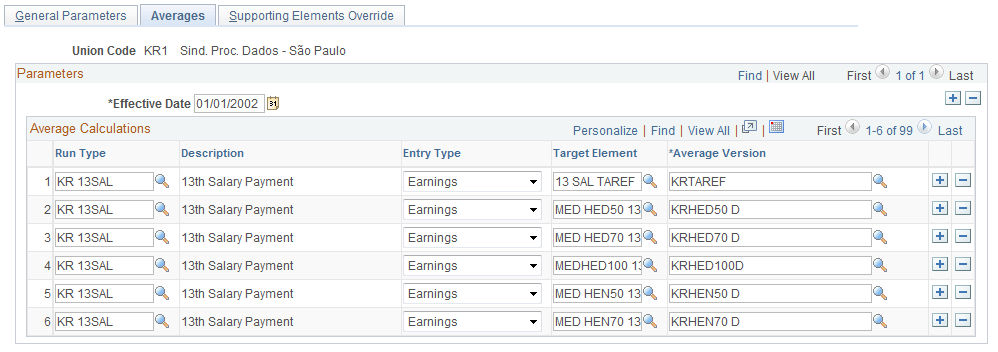

Use the Averages page (GPBR_AVERAGES) to define the earning and deduction elements considered by the system for average salary calculations for a given union.

Navigation:

This example illustrates the fields and controls on the Averages page.

Average Calculations

Field or Control |

Description |

|---|---|

Run Type |

Select the type of payroll process for which you want to define the average version of the pay component. For each run type, you can select a different set of earning and deduction elements to calculate using the average salary calculation. Note: You are not required to enter the same information for different run types. You can override the run type at the calendar level, or any other level, according to your requirements. To enter override instructions, set the value of variable FP VR RUN TYPE to the desired run type. |

Entry Type |

Select the type of element to consider in the average salary calculations: earnings or deductions. |

Target Element |

Select the name of the earning or deduction element. |

Average Version |

Select the name of the set of parameters you defined on the Average Version BRA page. |