Establishing Levy Rates

To establish levy rates, use the Levy Rates FRA (GPFR_TAX_RATES) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPFR_TAX_RATES |

Establish the rates for levies on professional training and apprenticeship taxes. |

|

|

GPFR_TAX_RATES2 |

Establish the levy rates on contingency funds, CSG, and CRDS levies. |

|

|

GPFR_TAX_RATES3 |

Establish the levy tax rate on salaries for organizations that do not pay VAT or pay VAT on only less than 10 percent of sales (such as banks and insurers). |

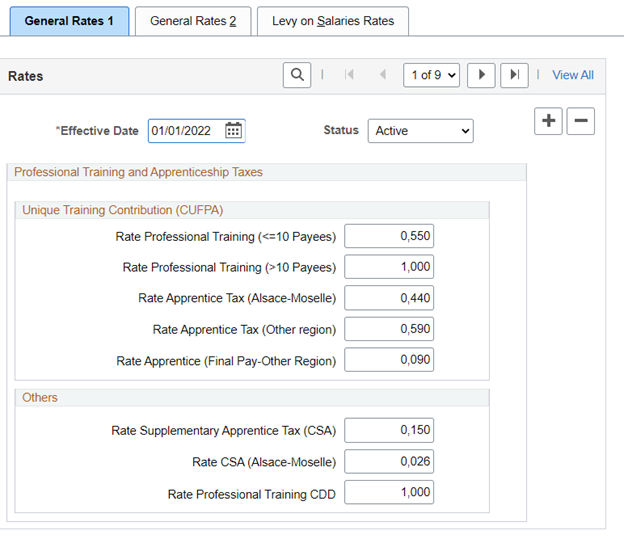

Use the General Rates 1 page (GPFR_TAX_RATES) to establish the rates for levies on professional training and apprenticeship tax.

Navigation:

This example illustrates the fields and controls on the General Rates 1 page.

All the companies in France have the obligation to finance Professional training, through the payment of training contribution/taxes:

Unique training contribution (CUFPA-contribution unique à la formation professionnelle et à l'alternance)

This training contribution is now composed of two parts (from 2019):

Professional Training contribution

Apprenticeship tax

Complementary contribution for apprenticeship (CSA)

This contribution applies to the companies above 250 employees, having at least 5 work-study students, or young people completing a VIE or benefiting from a Cifre. Companies can be exempted.

Contribution for Professional training of employees with CDD contracts (fixed term contracts)

It is calculated just for the employees with fixed-term contacts, although there are some contracts that are exempted.: like employment support contracts, apprenticeship contracts, professionalization contracts.

Additionally, companies may pay:

Contributions for professional training established by Labor Agreement.

Voluntary contributions to professional training: any company can decide to make an additional contribution to the financing of training, through voluntary payments to its OPCO.

Unique Training Contribution (CUFPA)

Field or Control |

Description |

|---|---|

Rate Professional Training (<=10 Payees) |

Displays the rate for the Professional training tax for organizations with less than 10 payees. |

Rate Professional Training (>10 Payees) |

Displays the rate for the Professional training tax for organizations with more than 10 payees. |

Rate Apprentice Tax (Alsace-Moselle) |

Displays the rate of apprenticeship tax for the Alsace-Moselle region. |

|

Rate Apprentice Tax (Other region) |

Displays the rate of apprenticeship tax that applies to all regions, except Alsace-Moselle. |

|

Rate Apprentice (Final Pay-Other Region) |

Displays the rate corresponding to the final payment, to be done annually or the apprentice tax (solde de la taxe d'apprentissage). |

Others

|

Field or Control |

Description |

|---|---|

|

Rate Supplementary Apprentice Tax (CSA) |

Displays the rate corresponding to the Supplementary Apprentice Tax (CSA) that applies to all regions, except Alsace-Moselle. |

|

Rate CSA (Alsace-Moselle) |

Displays the rate corresponding to the Supplementary Apprentice Tax (CSA) for the Alsace-Moselle region. |

|

Rate Professional Training CDD |

Displays the rate corresponding to Professional training tax corresponding to fixed-term contracts (CDD). |

Note: Remember to add the correct contingency funds deduction elements to the base accumulator used by the contingency funds levy.

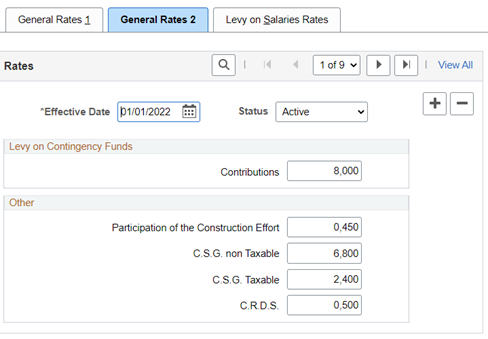

Use the General Rates 2 page (GPFR_TAX_RATES2) to establish the levy rates for the Apprenticeship, Participation of the Construction Effort, CSG, and CRDS levies.

Navigation:

This example illustrates the fields and controls on the General Rates 2 page.

Levy on Contingency Funds

The Contingency levy is paid only by organizations with more than 10 payees. Each training fund has two sets of contribution rates: one for organizations with more than ten employees and one for organizations with fewer than ten employees.

Field or Control |

Description |

|---|---|

Levy on Contingency Funds |

Displays the employer's contribution levy on Contingency funds. The amount is based on the employer's contribution to optional contingency funds. The levy applies only to organizations with more than 10 payees. If an organization has some optional contingency fund contributions, it must update the funding base on the Levy on Contingency fund. It is the employer's responsibility to include these contributions in the base for calculating the contingency levy. These contributions are added to the accumulator used by this levy (the TAX AC BAS PREV SG accumulator). |

Other

This group box lists the remaining levies. CSG levies are paid by all payees to finance social security and retirement funds. The payee pays the CSG levies and the CRDS levy. The funding base for the CSG and CRDS levies consists of the gross salary, the employer's contribution to the contingency fund, and departure or modification allowances that exceed a predefined amount.

Field or Control |

Description |

|---|---|

Participation of the Construction Effort |

Displays the rate for the Participation of the Construction Effort levy. This levy is paid by the employer based on a percentage of the gross funding base. |

C.S.G. non Taxable |

Displays the rate for the portion of the CSG levy that is exempt from tax. |

C.S.G Taxable |

Displays the rate for the portion of the levy that is taxable. |

C.R.D.S. |

Display the rate for the CRDS levy that is paid by payees. |

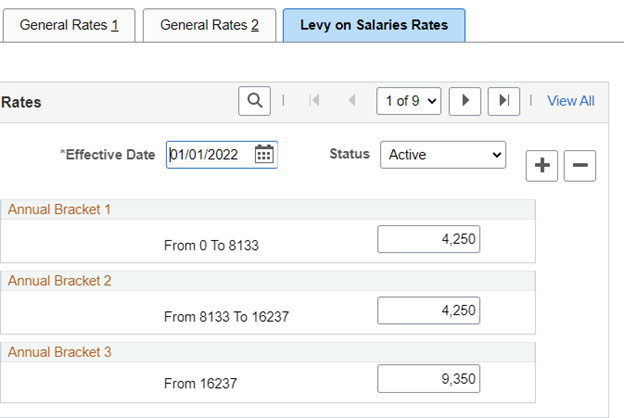

Use the Levy on Salaries Rates page (GPFR_TAX_RATES3) to establish the levy tax rate on salaries for organizations that do not pay VAT or pay VAT on only less than 10 percent of sales (such as banks and insurers).

Navigation:

This example illustrates the fields and controls on the Levy on Salaries Rates page.

The funding base for this levy is the gross salary and employer contributions to retirement and contingency funds, where applicable. There may also be a deduction for organizations that partially pay VAT. Those employer contributions to retirement and contingency funds greater than the tax limits of 19 percent and 3 percent are included in the levy on the salary funding base.

There are three rates of contribution to this levy. The rates are expressed as a percentage of the funding base. The monetary amount ranges and limits appear to the left of the rate.

Field or Control |

Description |

|---|---|

Annual Bracket 1 |

Displays the rate for the salary levy for earnings within annual bracket 1. |

Annual Bracket 2 |

Displays the rate for the salary levy for earnings within annual bracket 2. |

Annual Bracket 3 |

Displays the rate for the salary levy for earnings within annual bracket 3. |

A special element group (TAX EG TAXSAL) indicates which organizations are exempt from VAT contributions and are therefore liable to pay the salary levy.