Setting Up DUCS Information Using Application Framework

This section is intended for new customers or existing customers migrating to a newer release of Global Payroll for France, that are willing to move to the DUCS design based on Application Framework.

To set up DUCS information, use the DUCS Definitions FRA (GPFR_DUCS), DUCS Contacts FRA (GPFR_DUCS_CONTACT), AF DUCS Contributions FRA (GPFR_DUCS_CONTS), DUCS Types FRA (GPFR_DUCS_PARAM0), and DUCS Parameters FRA (GPFR_DUCS_PARAM1) components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPFR_DUCS_PARAM0 |

View declaration codes for each DUCS type in the system and establish new ones. Reference these DUCS types when preparing and generating DUCS files. The information on this page is delivered and maintained by the PeopleSoft system. |

|

|

GPFR_DUCS_PARAM1 |

View the parameters of the identifier qualification code used in the Contact table. The information on this page is delivered and maintained by the PeopleSoft system. |

|

|

GPFR_DUCS_PARAM2 |

Set declaration type parameters for each DUCS type. The information on this page is delivered and maintained by the PeopleSoft system. |

|

|

GPFR_DUCS_PARAM3 |

Set parameters for the contribution family. The information on this page is delivered and maintained by the PeopleSoft system. |

|

|

GPFR_DUCS_PARAM4 |

Set the parameters for the amount contribution type. The information on this page is delivered and maintained by the PeopleSoft system. |

|

|

GPFR_DUCS_PARAM5 |

Set the parameters for pay mode, bank account, and reference type. The information on this page is delivered and maintained by the PeopleSoft system. |

|

|

GPFR_DUCS_CONTRIBS |

View the BRC rows. |

|

|

GPFR_DUCS_CONTACT |

Record the list of contacts for DUCS. Specify the role of these contacts on the DUCS Definition page. |

|

|

GPFR_DUCS_CONTACT1 |

Enter address and phone information for DUCS contacts. |

|

|

GPFR_DUCS |

Define how establishments are used in creating DUCS. |

Create a DUCS file by running a batch program, in which the system searches and compiles relevant data, writes it to a specific table, and then creates a flat file and a control report. If needed, you can change the payment before posting the file.

There are three kinds of setup:

Basic setup.

For this setup, you use the delivered DUCS Types page and the DUCS Parameters component as follows:

Define each DUCS type on the DUCS Types page.

Define DUCS parameters in the DUCS Parameters component.

Contributions setup.

The BRC rows are set up in the details of the BRC Node Set of the DUCS 4.2 application of Application Framework

Organization setup.

This setup involves the DUCS Contacts component and the DUCS Definition page. The PeopleSoft system does not provide this data because it depends on the organization of each company.

Define all DUCS contacts, recipients, transmitters, informants, editors, and establishments in the DUCS Contacts component.

Assign these contacts their specific roles on the DUCS Definition page.

This is where the report information is connected with the transmission and banking information. Transmission of payment is done using the source bank information that you establish in the system.

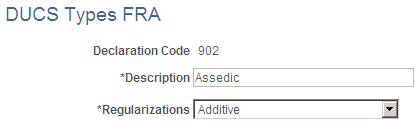

Use DUCS Types FRA page to view declaration codes for each DUCS type in the system and establish new ones. Reference these DUCS types when preparing and generating DUCS files. The information on this page is delivered and maintained by the PeopleSoft system.

Navigation:

This example illustrates the fields and controls on the DUCS Types FRA page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Declaration Code |

Displays the declaration code. Valid values are 901 for URSSAF, 902 for ASSEDIC, and 903 for AGIRC and ARRCO. |

Description |

Displays the description associated with the declaration code. |

Regularizations |

Select the type of method to use for retroactive changes. Values are: Additive: The regularization amount is added to the current declaration period. The retroactively recalculated period is not changed. Rectificative: The regularization amount is declared in a separate record in the DUCS`declaration.. Note: The regularization method to be used is defined by each organization. You must contact the organizations receiving these declarations to determine which method to use. The rectificative declaration is only available with DUCS norm 4.2. |

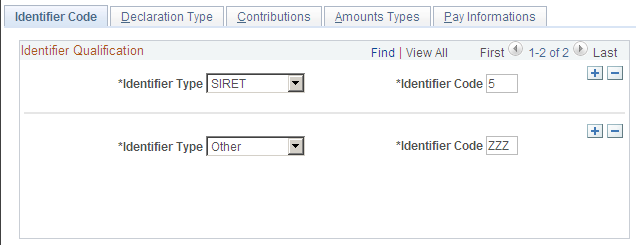

Use the Identifier Code page (GPFR_DUCS_PARAM1) to view the parameters of the identifier qualification code used in the Contact table.

The information on this page is delivered and maintained by the PeopleSoft system.

Navigation:

This example illustrates the fields and controls on the DUCS Parameters FRA - Identifier Code page. You can find definitions for the fields and controls later on this page.

Identifier Qualification

Field or Control |

Description |

|---|---|

Identifier Type |

Displays the identifier types: SIRET: References a previously set up establishment. Other: References any other legal entity. |

Identifier Code |

Displays the identifier code: 5 for SIRET, and ZZZ for other. |

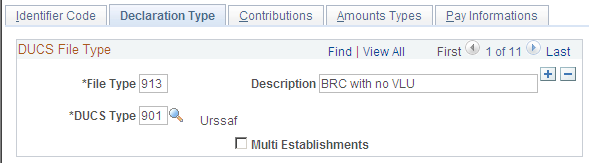

Use the Declaration Type page (GPFR_DUCS_PARAM2) to set declaration type parameters for each DUCS type.

The information on this page is delivered and maintained by the PeopleSoft system.

Navigation:

This example illustrates the fields and controls on the DUCS Parameters FRA - Declaration Type page. You can find definitions for the fields and controls later on this page.

DUCS File Type

Field or Control |

Description |

|---|---|

Multi Establishments (multiple establishments) |

This option is selected if multiple establishments are allowed. This occurs for VLU filed with URSSAF and PG filed with ASSEDIC. |

|

DUCS Type |

File Type |

Description |

|---|---|---|

|

URSSAF |

913 |

BRC with no VLU |

|

URSSAF |

914 |

BRC with VLU |

|

URSSAF |

915 |

TRC with no VLU |

|

URSSAF |

916 |

TRC with VLU |

|

ASSEDIC |

920 |

ADV for one establishment |

|

ASSEDIC |

921 |

ADV for several establishments |

|

ASSEDIC |

922 |

BDA for one establishment |

|

ASSEDIC |

923 |

BDA for multiple establishments |

|

AGIRC/ARRCO/Other |

930 |

Quarterly declaration |

|

AGIRC/ARRCO/Other |

931 |

Monthly declaration |

|

AGIRC/ARRCO/Other |

932 |

Annual declaration |

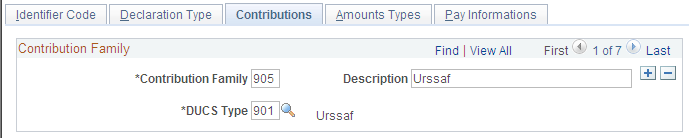

Use the Contributions page (GPFR_DUCS_PARAM3) to set parameters for the contribution family.

The information on this page is delivered and maintained by the PeopleSoft system.

Navigation:

This example illustrates the fields and controls on the DUCS Parameters FRA - Contributions page. You can find definitions for the fields and controls later on this page.

|

DUCS Type |

Contribution Family |

Description |

|---|---|---|

|

URSSAF |

905 |

URSSAF |

|

ASSEDIC |

906 |

ASSEDIC |

|

AGIRC/ARRCO/Other |

907 |

AGIRC |

|

AGIRC/ARRCO/Other |

908 |

ARRCO |

|

AGIRC/ARRCO/Other |

912 |

AGFF |

|

AGIRC/ARRCO/Other |

950 |

APEC |

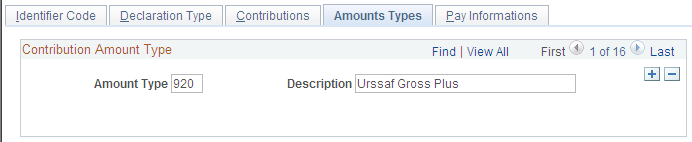

Use the Amounts Types page (GPFR_DUCS_PARAM4) to set the parameters for the amount contribution type.

The information on this page is delivered and maintained by the PeopleSoft system.

Navigation:

This example illustrates the fields and controls on the DUCS Parameters FRA - Amounts Types page. You can find definitions for the fields and controls later on this page.

|

Contribution Type |

Description |

|---|---|

|

920 |

URSSAF Gross |

|

921 |

URSSAF A-Ceiling |

|

925 |

URSSAF Gross Minus (negative value) |

|

926 |

URSSAF A-Ceiling Minus (negative value) |

|

930 |

ASSEDIC Gross Plus (positive value) |

|

931 |

ASSEDIC Lump-Sum Plus (positive value) |

|

932 |

ASSEDIC Gross Minus (negative value) |

|

933 |

ASSEDIC Lump-Sum Minus (negative value) |

|

940 |

IRC Gross Plus (positive value) |

|

941 |

IRC Plus (positive value) |

|

942 |

IRC Lump-Sum Plus (positive value) |

|

948 |

IRC Fictitious Plus (positive value) |

|

950 |

IRC Gross Minus (negative value) |

|

951 |

IRC Minus (negative value) |

|

952 |

IRC Lump-Sum Minus (negative value) |

|

958 |

IRC Fictitious Minus (negative value) |

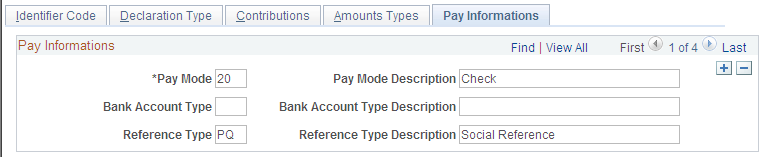

Use the Pay Informations page (GPFR_DUCS_PARAM5) to set the parameters for pay mode, bank account, and reference type.

The information on this page is delivered and maintained by the PeopleSoft system.

Navigation:

This example illustrates the fields and controls on the DUCS Parameters FRA - Pay Informations page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Pay Mode |

Displays the pay mode. Valid payment descriptions are 20 (Check), 30 (Transfer), 31 (Automatic Deduction), and Z10 (Telepayment). |

Bank Account Type |

Displays the bank account type and description. Values are: BF (Recipient bank account) and OR (Declarant bank account). |

Reference Type |

Displays the reference type: PQ for payment by check or transfer or CR for payment by telepayment or automatic deduction. |

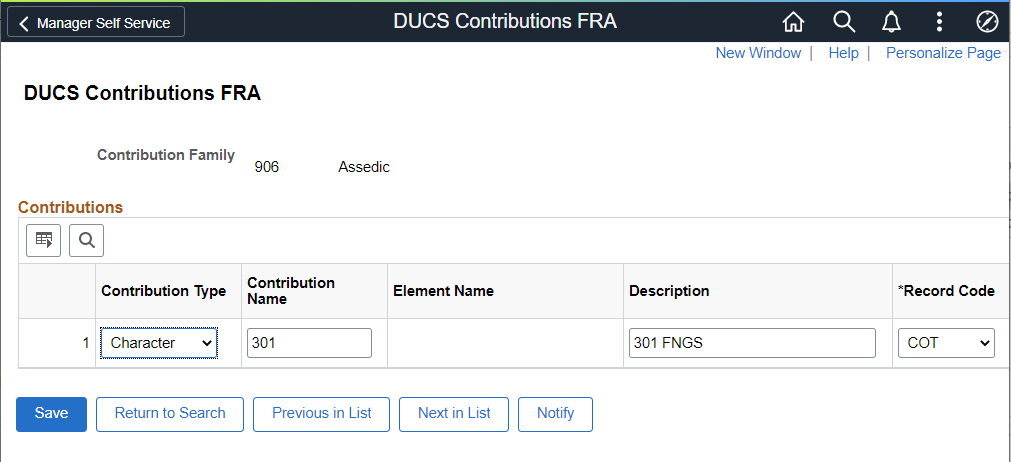

Use the DUCS Contributions FRA page (GPFR_DUCS_CONTRIBS) to .

Navigation:

This example illustrates the fields and controls on the DUCS Contributions FRA page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Contribution Type |

Displays the type of contribution. |

Contribution Name |

Displays the name of the contribution for the contribution type. |

Element Name |

Displays the name of the element for the contribution type. |

Description |

Displays the description of the contribution type. |

Details |

Click to access the DUCS Contribution Details page. Use this page to set up the DUCS text file and PDF report. |

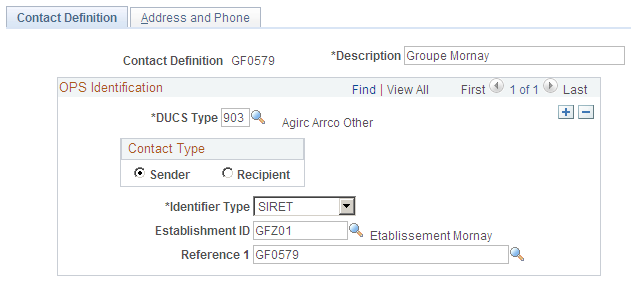

Use the Contact Definition page (GPFR_DUCS_CONTACT) to record the list of contacts for DUCS.

Specify the role of these contacts on the DUCS Definition page.

Navigation:

This example illustrates the fields and controls on the DUCS Contacts FRA - Contact Definition page. You can find definitions for the fields and controls later on this page.

OPS Identification

Field or Control |

Description |

|---|---|

DUCS Type |

Select the DUCS type. Valid values are determined by what is established on the DUCS Types page. |

Identifier Type |

Select Other, SIREN, or SIRET. |

Establishment ID |

Enter the identification number, as requested in the DUCS requirements. |

Reference 1 |

Enter the reference 1, as requested in the DUCS requirements. This field is specific for ARRCO, AGIRC, or contingency fund. Enter the number communicated by your retirement and contingency fund organizations. |

Contact Type

Use this group box to define whether a DUCS contact is a recipient or sender for DUCS type 903 (Agirc Arrco Other).

Field or Control |

Description |

|---|---|

Sender |

Select to indicate that the contact is a sender of DUCS. |

Recipient |

Select to indicate that the contact is a recipient of DUCS. |

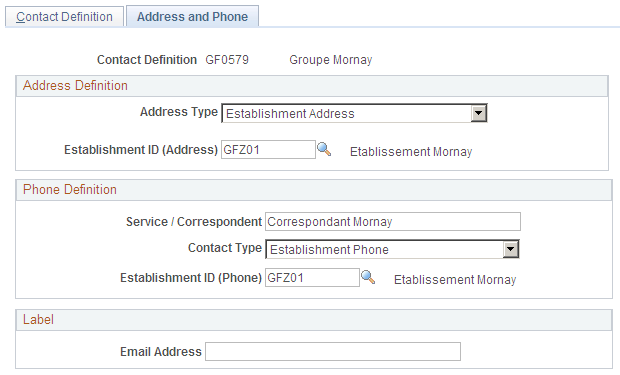

Use the Address and Phone page (GPFR_DUCS_CONTACT1) to enter address and phone information for DUCS contacts.

Navigation:

This example illustrates the fields and controls on the DUCS Contacts - Address and Phone page. You can find definitions for the fields and controls later on this page.

Address Definition

Field or Control |

Description |

|---|---|

Address Type |

Select Company Address, Establishment Address, or Other. |

Address |

Enter the address. If the address type is: Other: Click this link to access the secondary page for the address. Company Address: Enter the company SIREN number. Establishment Address: Enter the establishment SIRET number. |

Phone Definition

Field or Control |

Description |

|---|---|

Service / Correspondent |

Enter the service or correspondent. |

Contact Type |

Select Company Phone, Establishment Phone, or Other. |

Establishment ID (Phone) |

Depending upon the contact type, the phone number may be hidden. |

Label

Field or Control |

Description |

|---|---|

Email Address |

Enter the email address of the contact. |

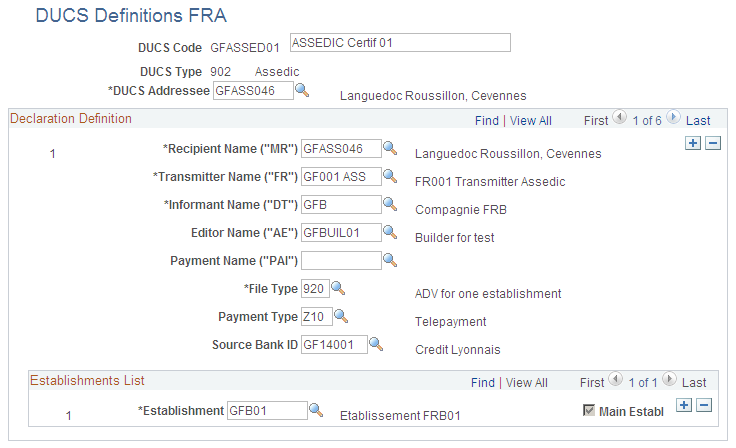

Use the DUCS Definitions FRA page (GPFR_DUCS) to define how establishments are used in creating DUCS.

Navigation:

This example illustrates the fields and controls on the DUCS Definitions FRA page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

DUCS Addressee |

Select the addressee from the DUCS Contact Definition component. This information is for your information only; it's not a DUCS requirement. |

Declaration Definition

Field or Control |

Description |

|---|---|

Recipient Name ("MR") |

Select the recipient of the DUCS file. The Contact Definition field on the Contact Definition page determines available values. The recipient name corresponds to the recipient of the DUCS declaration as defined in the DUCS requirement book. |

Transmitter Name ("FR") |

Select the transmitter name. The Contact Definition field on the Contact Definition page determines available values. In general, it is the establishment responsible for sending the DUCS file. |

Informant Name ("DT") |

Select the informant name. The Contact Definition field on the Contact Definition page determines available values. You must indicate here the legal declaring entity (Entité Juridique Déclarante) as defined in the DUCS requirement book. For URSSAF and ASSEDIC, the informant should be companies, while for ARRCO, AGIRC, and contingency funds, it is the member. |

Editor Name ("AE") |

Select the editor name. The Contact Definition field on the Contact Definition page determines available values. You must indicate here the name of the party preparing the declaration for you. |

Payment Name ("PAI") |

Select the payment name. The payment name is the name of the contact who is in charge of the payment of the contributions. The Contact Definition field on the Contact Definition page determines available values. |

File Type |

Select a file type from the DUCS Parameters - Declaration Type page. Available values correspond to the relevant DUCS type. |

Payment Type |

Select a payment mode or method. Valid values are determined by the Pay Mode field on the DUCS Parameters - Pay Information page: Check, Transfer, Automatic Deduction, and Telepayment. |

Source Bank ID |

Select the bank account to be debited. You must have established a source bank account. |

Establishments List

Field or Control |

Description |

|---|---|

Establishment |

Select the declared entities. For the URSSAF and the ASSEDIC, it is Establishments; for ARRCO, AGIRC, and contingency funds, it is the payment center (centre payeur). If you are setting up VLU or PG, enter at least two establishments; otherwise, enter one establishment. The Contact Definition field on the Contact Definition page determines available values. |

Main Establ. (main establishment) |

If you are setting up VLU or PG, select this check box to indicate the main establishment, as defined by the DUCS requirements. This information produce a type FZ record as defined in the DUCS requirement book. |