Viewing and Maintaining ARRCO and AGIRC Rates

To view and maintain ARRCO, AGIRC, and Contingency Fund rates (previously to 2019), use the ARRCO/AGIRC Rt FRA (GPFR_ARC_RATES) component.

Note: In 2019, ARRCO/AGIRC Rt FRA component is replaced by a new component 'ARRCO/AGIRC 2019 Rt FRA'.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPFR_ARC_RATES |

View the contribution rates for ARRCO. The PeopleSoft system is delivered with these rates, but you must maintain them when the government makes changes. |

|

|

GPFR_AGI_RATES |

View the contribution rates for AGIRC, CET, and APEC. AGIRC contributions are for the non-management pension fund, CET contributions are paid into a special AGIRC fund, and APEC contributions are paid into a managers' unemployment benefit fund. The PeopleSoft system is delivered with these rates, but you must maintain them when the government makes changes. |

|

|

GPFR_APEC |

View the APEC flat amount for managers. The PeopleSoft system is delivered with these rates, but you must maintain them when the government makes changes. |

|

|

GPFR_AGFF_RATES |

View the AGFF rates for employees (based on slices 1 and 2), and for Article 36 and managers (based on slices A and B). |

Use the ARRCO Rates page (GPFR_ARC_RATES) to view the contribution rates for ARRCO.

The PeopleSoft system is delivered with these rates, but you must maintain them when the government makes changes.

Navigation:

This example illustrates the fields and controls on the ARRCO Rates page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Non-Managers Slice 1 |

Displays the contribution rates for the pension fund for both employer and payee. The rates are expressed as a percentage of the payee's funding base. The non-managers slice 1 rate is applied to funding bases below the A ceiling. The A ceiling is populated from the Ceiling page. |

Non-Managers Slice 2 |

Displays the second rate of the pension fund contribution that is applied to non-management payees when the gross salary is between the A ceiling and the A ceiling multiplied by three, known as slice 2. |

Article 36 and 4/4bis Slice A |

Displays the contribution rates for slice A that is paid to ARRCO by those payees categorized by Article 36 and Article 4/4 bis. This rate also applies to payees with salaries below the A ceiling. Note: The fields From <lower limit> to <upper limit> dynamically appear based on the values entered on the Ceilings page. Ceiling values are in euros. The ceilings shown are current as of January 1, 2004. |

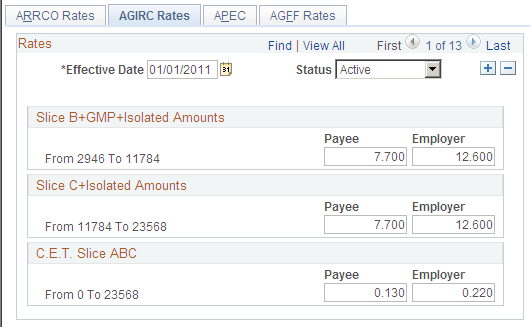

Use the AGIRC Rates page (GPFR_AGI_RATES) to view the contribution rates for AGIRC, CET, and APEC.

AGIRC contributions are for the non-management pension fund, CET contributions are paid into a special AGIRC fund, and APEC contributions are paid into a managers' unemployment benefit fund. The PeopleSoft system is delivered with these rates, but you must maintain them when the government makes changes.

Navigation:

This example illustrates the fields and controls on the AGIRC Rates page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Slice B+GMP+Isolated Amounts (slice B + garantie minimum de points + isolated amounts) |

Displays the AGIRC contribution rates for both employer and payee, for those payees with earnings between the A and B ceilings or on the specific GMP slice. The rates are expressed as a percentage of the payee's funding base. These rates apply to payees classified by Article 36 and Article 4/4 bis. Note: GMP contributions are for the minimum guarantee of points. Payees earning below the GMP limit pay a minimum contribution as if they were earning the same as the limit. Although the GMP contribution is based on an annual amount, the PeopleSoft system performs the calculation monthly and adjusts the contributions accordingly. The GMP ceiling is defined on the Ceilings page. The calculation of the GMP base is done by the base formula of the GMP deduction. Isolated amounts are payments in lieu of a payee leaving a company. They are isolated from the funding base and do not accumulate contribution points towards the payee's retirement fund. They are liable for contributions, regardless of upper and lower limits. They include compensation in lieu of paid vacation; retirement allowance for an amount exceeding ther legal exemption limit; and salary, premium, or bonus payments paid after departure. |

Slice C+Isolated Amounts |

Displays the AGIRC contribution rates for both payee and employer, for payees with a gross funding base between slice B and slice C. These rates apply to payees classified by Article 36 and Article 4/4 bis. |

C.E.T. Slice ABC |

Displays the CET contribution for payees and employers on a gross funding base up to the C ceiling. These rates apply to payees classified by Article 36 and Article 4/4 bis. |

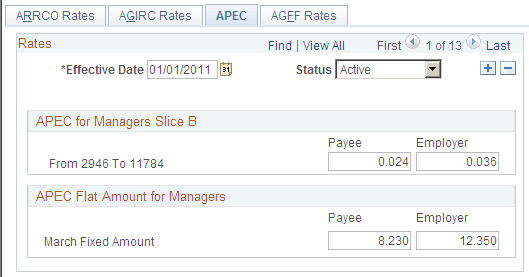

Use the APEC page (GPFR_APEC) to view the APEC flat amount for managers.

The PeopleSoft system is delivered with these rates, but you must maintain them when the government makes changes.

Navigation:

This example illustrates the fields and controls on the APEC page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

APEC for Managers Slice B |

Displays the payee and employer contributions for managers with a funding base between the A and B ceilings. These contributions are paid monthly. These rates apply to payees classified by Article 4/4 bis. Note: The field names From <lower limit> to <upper limit> dynamically appear based on the values entered on the Ceilings page. |

APEC Flat Amount for Managers |

Displays the fixed, annual contribution paid every March by employer and payee for those payees in employment during that month. |

Use the AGFF Rates page (GPFR_AGFF_RATES) to view the AGFF rates for employees (based on slices 1 and 2), and for Article 36 and managers (based on slices A and B).

Navigation:

This example illustrates the fields and controls on the AGFF Rates page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Non Managers Slice 1 |

Displays the contribution rates that are paid on slice 1 for the AGFF contribution for both employer and payee. The non-managers slice 1 rate is applied to funding bases below the A ceiling. |

Non Managers Slice 2 |

Displays the second rate of the AGFF contribution that is applied to non-management payees when the gross funding base is between the A ceiling and the A ceiling multiplied by 3, known as slice 2. |

Article 36 & 4/4bis Slice A |

Displays the AGFF contribution rates for slice A that is paid by payees categorized as Article 36 and Article 4/4 bis. |

Field or Control |

Description |

|---|---|

Article 36 & 4/4bis Slice A |

Displays the AGFF contributions rates for slice B that is paid by payees categorized as Article 36 and Article 4/4bis. |

Note: New AGFF contributions are not included in the reintegration fiscale (fiscal reintegration) calculation.

The pages used to view and maintain ARRCO and AGIRC rates from 2019 onwards are listed in the below table.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ARRCO/AGIRC 2019 Rt FRA page |

GPFR_AGIARR_RATES |

To view the contribution rates for AGIRC-ARRCO. The PeopleSoft system is delivered with these rates, but you must maintain them when the government makes changes. |

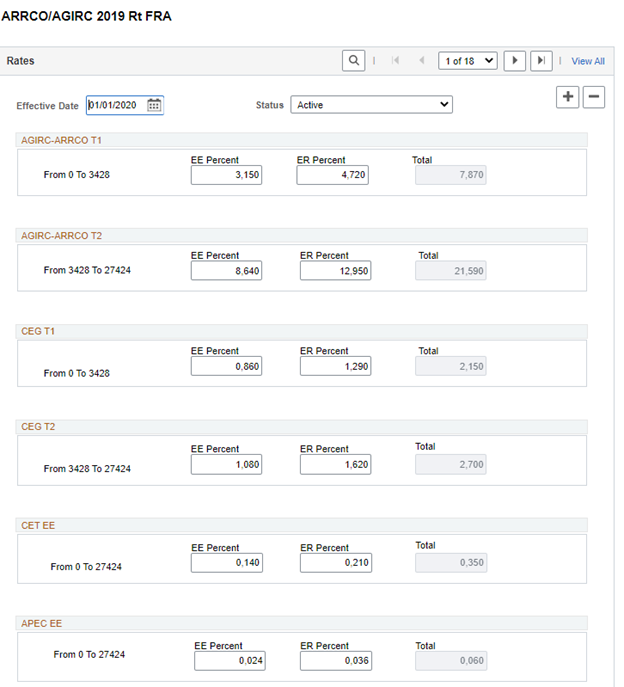

Use the ARRCO/AGIRC 2019 Rt FRA page (GPFR_AGIARR_RATES) to view the contribution rates for AGIRC/ARRCO. The PeopleSoft system is delivered with these rates, but you must maintain them when the government makes changes.

Navigation:

This example illustrates the fields and controls on the ARRCO/AGIRC 2019 Rt page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Description |

|---|---|

|

AGIRC-ARRCO T1 |

Displays the contribution rates for the pension fund for both employer and payee. The rates are expressed as a percentage of the payee's funding base. The rate is applied to funding bases below the A ceiling. The A ceiling is populated from the Ceiling page. Note: The field names From <lower limit> to <upper limit> dynamically appear based on the values entered on the Ceilings page |

|

AGIRC-ARRCO T2 |

Displays the second rate of the pension fund contribution that is applied when the gross salary is between the A ceiling and the A ceiling multiplied by 8 (Base C), known as slice 2. Note: The field names From <lower limit> to <upper limit> dynamically appear based on the values entered on the Ceilings page |

|

CEG T1 |

Displays the contribution rates for Contribution d’équilibre Générale for both employer and payee. The rates are expressed as a percentage of the payee's funding base. The rate is applied to funding bases below the A ceiling. The A ceiling is populated from the Ceiling page. It replaces the AGFF (Association for the management of the financing fund) and the GMP, and affects all employees. Note: The field names From <lower limit> to <upper limit> dynamically appear based on the values entered on the Ceilings page |

|

CEG T2 |

Displays the second rate of Contribution d’équilibre Générale that is applied when the gross salary is between the A ceiling and the A ceiling multiplied by 8 (Base C), known as slice 2. Note: The field names From <lower limit> to <upper limit> dynamically appear based on the values entered on the Ceilings page |

|

CET EE |

Displays the CET (Contribution d'équilibre technique) contribution for payees on a gross funding base up to the C ceiling. This contribution applies only to those employees with Salary above the Social Security Ceiling. Note: The field names From <lower limit> to <upper limit> dynamically appear based on the values entered on the Ceilings page |

|

CET ER |

Displays the CET (Contribution d'équilibre technique) contribution for employers on a gross funding base up to the C ceiling. This contribution applies only to those employees with Salary above the Social Security Ceiling Note: The field names From <lower limit> to <upper limit> dynamically appear based on the values entered on the Ceilings page |

|

APEC EE |

Displays the payee and employer contributions for managers with a funding base between the A and C ceilings. These contributions are paid monthly. These rates apply to payees classified by Article 4/4 bis. Note: The field names From <lower limit> to <upper limit> dynamically appear based on the values entered on the Ceilings page |

|

APEC ER |

Displays the employer contributions for managers with a funding base between the A and C ceilings. These contributions are paid monthly. These rates apply to payees classified by Article 4/4 bis. Note: The field names From <lower limit> to <upper limit> dynamically appear based on the values entered on the Ceilings page |