Setting Up Payee Overrides for Tax Calculation

This topic provides an overview of payee overrides for tax calculation and discusses how to add them.

Global Payroll for China delivers two tax-related variables that you can modify for payees using supporting element overrides:

CN VR EE TYPE (Employee Type)

CN VR TAX AREA (Tax Area)

Employee Type

The employee type, as defined by the CN VR EE TYPE variable, is used by the CN BR TX EXEMPTION and CN BR TX REM EXEM brackets to determine a payee's tax exemption. Four values exist for the CN VR EE TYPE variable:

LOC indicates that the payee is local. This is the default value of the variable.

EXP indicates that the payee is an expatriate.

DIS indicates that the payee is disabled or has special needs and has been granted tax reduction by the government.

REM indicates that the payee is a remunerated employee (intern, contractor, consultant, instructor, other)..

You can change the value of the CN VR EE TYPE variable for a payee by creating a supporting element override (SOVR). In the absence of a SOVR, the system determines the value of CN VR EE TYPE based on the payee's Citizenship Status on the Citizenship/Passport page, Empl Class (employee class) on the Job Information page, and Disability Status on the Disability page.

This table lists the CN VR EE TYPE values that the system assigns based on the payee’s citizenship, disability, and SQVR combination.

|

Citizenship, Disability, and SOVR Combination |

Resulting CN VR EE TYPE Value |

|---|---|

|

Citizenship Status: Citizen Disability Status: No Empl Class: Null SOVR exists: No |

LOC |

|

Citizen Status: Expatriate Disability Status: No Empl Class: Null SOVR exists: No |

EXP |

|

Citizen Status: Not Indicated or Others Disability Status: No Empl Class: Null SOVR exists: No |

LOC |

|

Citizen Status: Citizen, Expatriate, Not Indicated, or Others Disability Status: Yes Empl Class: Null SOVR exists: No |

DIS |

|

Citizen Status: Citizen, Expatriate, Not Indicated, or Others Disability Class: Yes or No Empl Class: CHN Consultant, Contractor, Instructor, Intern, or Others SOVR exists: No |

REM |

|

Citizen Status: Citizen, Expatriate, Not Indicated, or Others Disability Status: Yes or No Empl Class: CHN Consultant, Contractor, Instructor, Intern, or Others; or Null SOVR exists: Yes |

SOVR value |

Tax Area

The tax area, as defined by variable CN VR TAX AREA, is associated with the contribution area location. This assumes that a payee based in a specific location also makes social contributions to this location and pays tax to this location's tax office.

If the default tax area in the CN VR TAX AREA variable does not apply to a payee, you can override the value by creating a supporting element override for the employee.

Tax areas are defined on the Mapping Tax Area CHN Page.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_PAYEE_SOVR |

Override the value of a tax-related variable for a payee. |

Use the Supporting Elements page (GP_PAYEE_SOVR) to override the value of a tax-related variable for a payee.

Navigation:

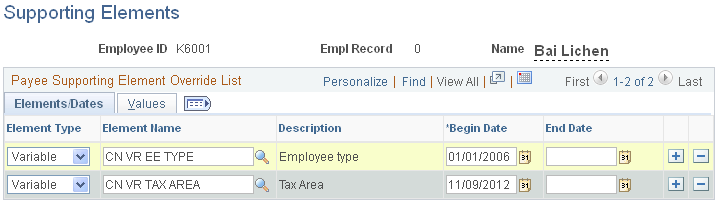

This example illustrates the fields and controls on the Elements/Dates tab of the Supporting Elements page.

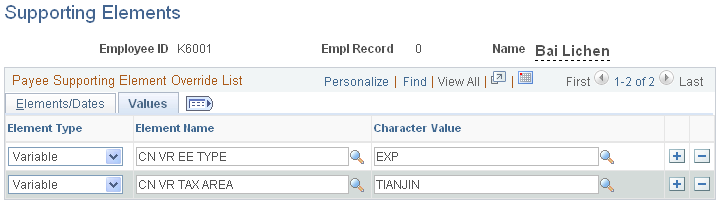

This example illustrates the fields and controls on the Values tab of the Supporting Elements page.