Understanding Overrides

This topic lists common elements used in this topic and discusses:

Override levels.

Overrides available for primary elements.

Overrides available for supporting elements.

Begin and end date logic for overrides.

Element overrides and segmentation.

Use overrides to control the values the system uses to resolve an element for a specified time period. When you run the payroll or absence process, the system retrieves the rule definition for the element and applies any override instructions that you've entered.

Field or Control |

Description |

|---|---|

Element definition override |

Overrides the value of a bracket, date, duration, formula, or variable element that's used in the definition of a primary element (earning, deduction, absence take, or absence entitlement). |

Pay calendar override |

Can exclude specific earning, deduction, and absence elements from a calendar and override the values of associated bracket, date, duration, formula, and variable elements. |

Pay entity override and Pay group override |

Override the value of a bracket, date, duration, formula, or variable element whenever the element is resolved for a payee who's linked to a specified pay entity or pay group, respectively. |

Payee override |

Refers to any one of four types of payee-specific overrides:

|

Positive input override |

Overrides the definition of an earning, deduction, or absence element for a positive input instance. Can override system and variable elements associated with an instance of positive input. |

Via elements override |

Controls whether an element's value can be updated by an array, bracket, date, or formula element. |

Before entering instructions to override an element, you must specify the types of overrides allowed for that element by selecting the appropriate check boxes in the Override Levels group box on the Element Name page.

When you enable overrides for a supporting element, deselect the Always Recalculate check box on the Element Name page. Otherwise the system uses the value of the element according to the element definition, not the override value.

Note: An additional level, payee calendar overrides, exist for supporting elements through the Off-Cycle Requests component. This level is available for off-cycle requests only and does not extend to on-cycle calendars. Before entering supporting element overrides on the Payee Calendar SOVR page, you must select the Payee and the Calendar check boxes in the Override Levels group box on the Element Name page for the supporting element.

Several override levels enable you to control the value of earning, deduction, absence take, and absence entitlement elements, which the system applies in this order:

Payee overrides.

At the payee level, assign or disable an earning, deduction, or absence element or override the definition of an earning, deduction, or absence element.

Pay calendar overrides.

Via element overrides.

Positive input overrides.

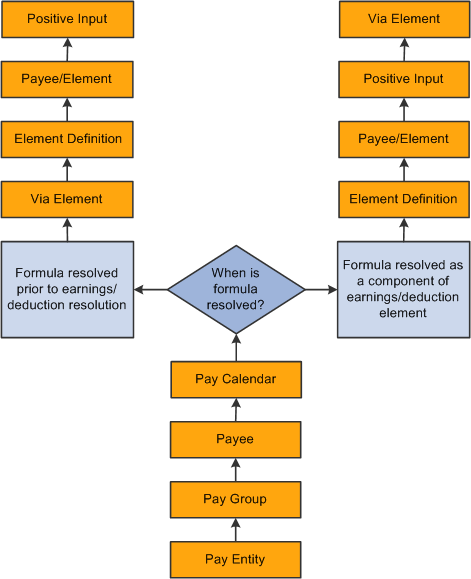

Eight override levels enable you to control the values of brackets, dates, duration, formulas, and variables:

Pay entity overrides.

Pay group overrides.

Payee overrides: Override the value of a bracket, date, duration, formula, or variable element whenever it's resolved for the payee.

Payee/Element overrides. Overrides the value of a variable used by a specific earning or deduction assigned to a payee.

Pay calendar overrides.

Via element overrides.

Element definition overrides.

Positive input overrides.

This diagram illustrates the sequence in which the system applies overrides when it encounters multiple overrides for a supporting element. It begins with pay entity overrides.

Note: A payee/element override refers to the override of a variable element associated with a particular earning or deduction for a payee. Enter such overrides on the Element Detail page, linked to the Payee Assignment By Element and Element Assignment By Payee pages. A payee override is the override of a bracket, date, duration, formula, or variable associated with a payee. Enter such overrides on the Payee Supporting Element Overrides page.

Example

VARIABLE1 has the following values:

30 according to the rule definition.

20 according to a pay entity override.

10 according to a pay group override.

In this case, VARIABLE1 resolves to 10, because pay group overrides take precedence over pay entity overrides.

When entering override instructions, you must specify a begin date.

The begin date tells the system when to start applying the override instructions. The current date is the default.

In most cases, end dates are optional. They specify when the override instructions become inactive. They are required only when you enter multiple rows of instructions for the same element.

The processing rules for begin and end dates vary, depending on the type of override being processed.

This topic discusses:

Payee overrides and segmentation.

Segmentation caused by payee overrides

Proration and segmentation in the case of payee overrides.

Payee Overrides and Segmentation

You can set up your Global Payroll system to slice or segment pay periods due to changes in Human Resource or other data, including:

Changes in job status or title that occur in mid period.

Departmental transfers that occur in mid period.

Changes in compensation rate that occur in mid period.

If there is a payee override in a sliced or segmented period, the system applies the override to the different slices/segments based on the segment/slice end dates as well as the override's end date.

The system follows these rules to determine the slices or segments to which to apply an override:

If an override is to apply to a segment, the end date of the override must equal or be greater (or blank) than the end date of the segment.

An override can apply to more than one segment if the end date of the override is greater than one segment's end date and greater than or equal to the subsequent segment's end date (or blank).

If the end date of the override is less than the end date of the segment, the override doesn't apply to that segment.

Payee overrides must be Active as of the segment end date.

Pay entity, pay group, and element definition overrides are unaffected by segmentation. The system retrieves the definition of the element and the override only once every period, regardless of period or element segmentation.

Note: We discuss the rules for applying overrides to slices/segments in a period in greater detail in the topic on segmentation.

Element Segmentation Caused by Payee Overrides

As noted previously, you can set up your Global Payroll system to slice or segment pay periods due to changes in HR or other data. However, you can also configure the system to initiate segmentation and proration directly in response to an override—in the absence of any other data changes. That is, you can configure the system so that overrides are themselves treated as data changes that trigger segmentation. Then, when you assign or override the value of an element, the system slices the assigned element and any other elements included in the segmentation element list based on the begin and end dates of the override.

For example, assume that you set up the system to trigger element segmentation when you assign or override earning element E1, and that you assign E1 to a payee on the Element Assignment by Payee (GP_ED_PYE) component with begin and end dates of 10 and 20 June respectively (assume a monthly pay period). Based on the assignment/override begin and end dates, the system will slice the element into three segments and process (and prorate) the element in the second slice:

|

Element |

Slice 1 June 1-10 |

Slice 2 June 11-20 |

Slice 3 June 21-30 |

|---|---|---|---|

|

Earning = E1 Calculation Rule = Amount Amount = 300 |

Element not resolved in slice 1. |

Resolved amount = 100 (proration factor = .333333333) |

Element not resolved in slice 3. |

Note: The only type of segmentation that can be triggered by an element assignment or override is element segmentation.

To set up the system to trigger segmentation in response to an element assignment:

Select the Active Anytime Within Segment option on the Countries (GP_COUNTRY) component .

When you do this, the system processes all element assignments/overrides that fall within a period—even those with end dates that are less than the pay period end date.

If you want the element you are assigning to be prorated, associate the element with a proration rule on the earning or deduction definition pages.

Set up segmentation triggers for the begin and end-dated earning and deduction assignment record (GP_PYE_OVRD), and list the earnings and deductions that should trigger element segmentation when the assignment begin date comes after the pay period begin date, and/or the assignment end date comes before the period end date.

Proration and Segmentation in the Case of Payee Level Overrides

Proration of payee level, primary element overrides occurs under the following conditions:

Note: Primary element overrides include earnings and deductions. Supporting element overrides include elements such as variables, formulas, arrays, and brackets.

When period or element segmentation is triggered by data changes not directly related to an element override or assignment.

If there is period segmentation in the period to which an earning or deduction assignment applies (that is, all elements are segmented), the system prorates the assigned element based on the segment begin and end dates if the element is defined to be prorated. If not, the entire value of that element is applied to each of the targeted segments.

If there is element segmentation in the period to which an earning or deduction assignment applies, the assigned element is included in the list of elements to be sliced, and that element is defined to be prorated, the system prorates the element based on the slice dates. If not, the entire value of the element is applied to each of the targeted slices.

When you configure your system so that primary element overrides or assignments directly trigger element segmentation.

In this case, the system slices the assigned element (and any elements associated with that element on the element list) based on the begin and end dates of the assignment as long as that element is defined to be prorated. There does not have to be slicing or segmentation for any other reason. If the element is not defined to be prorated, the full value of the element is processed within the slice defined by the assignment begin and end dates.

Note: You can set up the system to slice an element within a pay period based on the begin and end dates of the overrides assigned to a payee on the Element Assignment by Payee (GP_ED_PYE) and Payee Assignment by Element components (GP_ED_ELEM). We discuss how to do this in the topic on trigger definitions.

Note: Primary element overrides are prorated if the element is defined to be prorated and there is either period segmentation (all elements are segmented), or there is element segmentation and the element being assigned is on the list of elements to be sliced.

In the case of supporting element overrides, the supporting element is prorated if it is a component of an element that is defined to be prorated and that element is segmented/sliced.