Tracking Dependent and Beneficiary Data

These topics provide an overview of dependent and beneficiary data and discuss tracking dependent and beneficiary data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DEPEND_BENEF1 |

Enter or update information about a dependent's name. |

|

|

DEPEND_BENEF_ADDR |

Enter or update information about a dependent's address. |

|

|

DEPEND_BENEF2 |

Enter or update information about a dependent. |

|

|

DEPBEN_RIDERS |

Enter detailed information about the court-ordered benefit for the specified dependent or beneficiary. |

|

|

Personal Profile - Phone Numbers Page |

DEP_BENEF_PHON_SEC |

Enter additional dependent and beneficiary phone numbers. |

|

(NLD) Dependent/Beneficiary Summary Page Review Dep/Ben Summary Page |

DEPEND_BENEF_SUMM |

View an employee's beneficiaries and dependents. |

|

CITIZEN_PP_DEP |

Enter or update dependent citizenship and passport data. |

|

|

VISA_PERMIT_DEP |

Enter or update dependent visa and permit data. |

|

|

Dependen Benf History FPS Page |

FPADEPENLK_PNL |

Maintain dependent and beneficiary history for French Public Sector employees. |

Use the Dependent Information component to record important information for dependents that may accompany an employee on an international assignment or international travel. You must also have these pages set up prior to enrolling employees in specific benefit programs.

The Name and Address pages define the relationship of the person to the employee and determine whether the person is a dependent, beneficiary, or both. This definition affects the person's eligibility to be enrolled in health benefits or to be assigned as a beneficiary in certain benefit plans.

The Personal Profile page defines the personal information about the person. This data also affects whether the person is eligible for benefits.

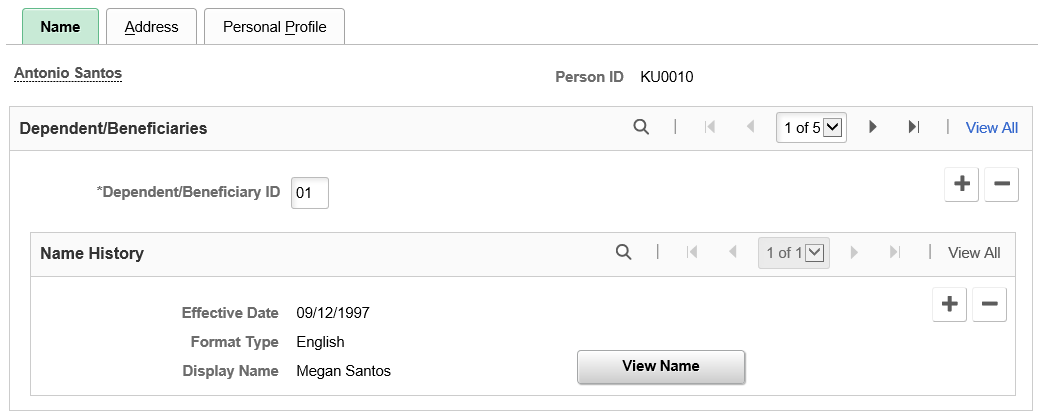

Use the Dependent Information - Name page (DEPEND_BENEF1) to enter or update information about a dependent's name.

Navigation:

This example illustrates the fields and controls on the Dependent Information - Name page. You can find definitions for the fields and controls later on this page.

The system displays the name and the employee ID for the employee.

Field or Control |

Description |

|---|---|

Dependent/Beneficiary ID |

The system assigns the dependent or beneficiary ID. You can change it, although you can't have duplicate IDs for dependents or beneficiaries of the same employee. You can, however, use these same IDs for a different employee's dependents and beneficiaries. |

Effective Date |

The system enters the current system date in this field, and this date is carried through to all pages of the component. You can change this date if necessary, however in the first row of data for this dependent/beneficiary, the effective date must be the same on all of the pages in this component. |

Edit Name |

Click to access the Edit Name page. On this page, enter the dependents name and click Refresh to update the fields that display the dependents' name. |

Note: When running a calculation, the system determines if an employee is married by reviewing the dependent and beneficiary table to determine whether there is a dependent identified as the spouse. It is possible for the dependent and beneficiary pages to show more than one spouse, to show a former spouse as a current spouse, to show no spouse even if the employee's marital status is married, or to show a spouse even though the employee's marital status is single. These and other inconsistencies in the dependent and beneficiary data can cause problems with pension calculations. It is best to verify dependent and beneficiary information when calculating pension benefits.

(FRA) French Public Sector

The page displays this section when French Public Sector is enabled on the Installation Table.

Field or Control |

Description |

|---|---|

Civil Servant Status |

Select to indicate that this dependent is a civil servant. |

Same Public Service |

Select if the dependent is in the same public service as the employee. |

Employee ID of the Dependent |

When the Same Public Service field is selected, this field is editable. Select the Employee ID of the dependent that is in the same public service as the employee. |

Employer Name |

Enter the employer name of the dependent. |

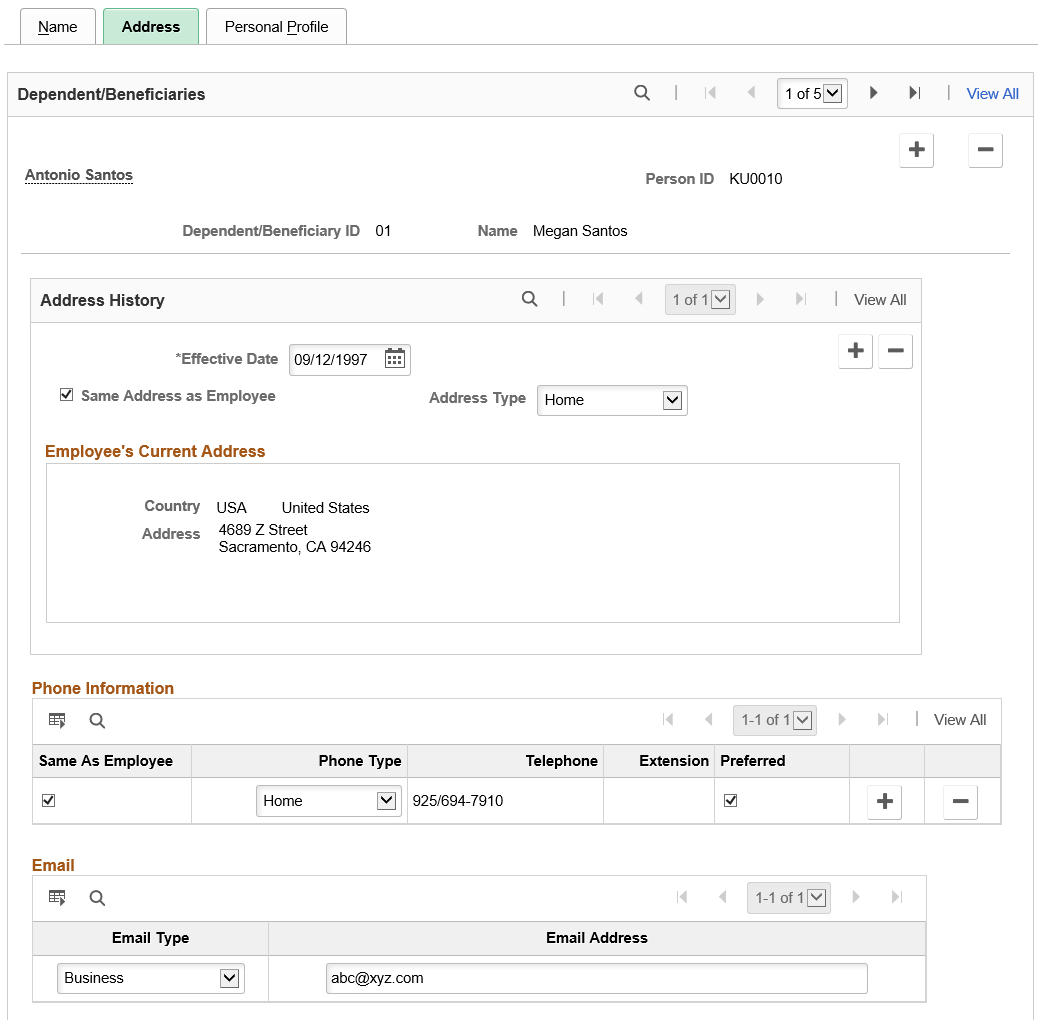

Use the Dependent Information - Address page (DEPEND_BENEF_ADDR) to enter or update information about a dependent's address.

Navigation:

This example illustrates the fields and controls on the Dependent Information - Address page. You can find definitions for the fields and controls later on this page.

The employee's name and employee ID, as well as this dependent or beneficiary's ID, relationship to the employee, and dependent or beneficiary type appear at the top of the page.

|

Field or Control |

Description |

|---|---|

|

Same Address as Employee and Address Type |

Select if the dependent/beneficiary has the same address information as the employee, and then select the employee's address type that matches the dependent/beneficiary's address. If selected, you don't need to complete any of the address fields. To add a different address, deselect the ‘Same Address as Employee’ check box, select an address type and enter the new address. |

|

Same Phone as Employee and Phone Type |

Select if the dependent/beneficiary has the same phone information as the employee, and then select the employee’s phone type that matches the dependent/beneficiary's phone. If selected, you don't need to complete any of the phone fields. To add a different phone number, deselect the ‘Same Phone as Employee’ check box, select a phone type and enter the new number in the Telephone field. A beneficiary can have the same address as the employee but a different phone number. |

|

Preferred |

Select the check box to set the phone number as the preferred number to contact. |

|

|

Select the email type and enter the dependent or beneficiary's email address. |

Use the Dependent Information - Personal Profile page (DEPEND_BENEF2) to enter or update information about a dependent.

Navigation:

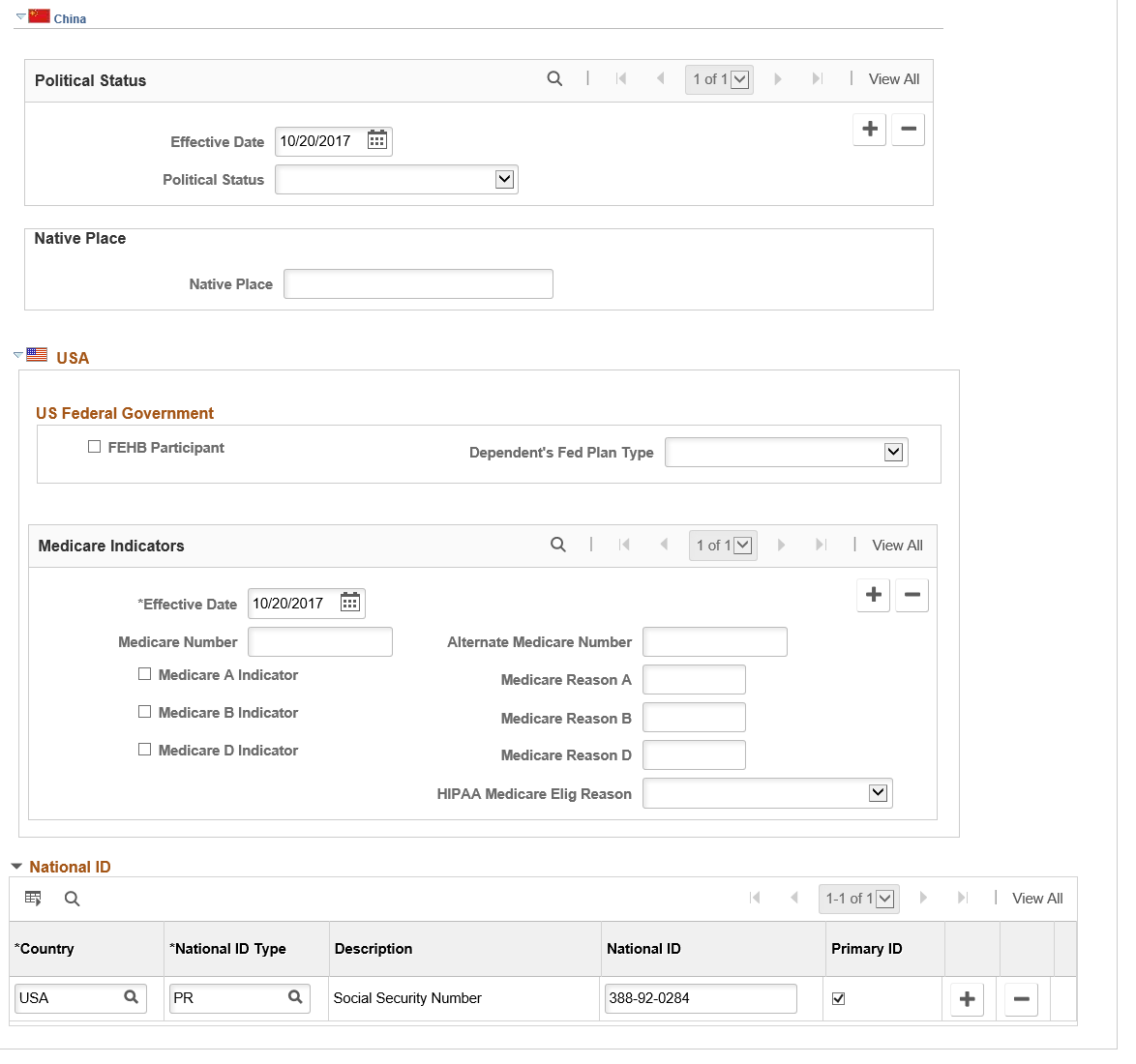

This example illustrates the fields and controls on the Dependent Information - Personal Profile page (1 of 6). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Dependent Information - Personal Profile page (2 of 6). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Dependent Information - Personal Profile page (3 of 6). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Dependent Information - Personal Profile page (4 of 6). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Dependent Information - Personal Profile page (5 of 6). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Dependent Information - Personal Profile page (6 of 6). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Date of Birth |

Enter the dependent or beneficiary's birth date. Certain benefit plans, such as life insurance, require the birthdate to determine an individual's eligibility. |

Birth Location |

Enter a city, county, or both, to further define the place in which the dependent or beneficiary was born. |

Birth Country |

Enter the country in which the dependent or beneficiary was born. Depending on the country you enter, additional fields may appear that require more data entry. |

Date of Death |

When the dependent or beneficiary dies, enter the date of the death. |

Medicare Entitled Date |

Enter the date on which the dependent or beneficiary will become eligible for Medicare coverage. |

Riders/Orders |

Click to access the Dependent/Beneficiary Riders page. |

Dependent Proof

|

Field or Control |

Description |

|---|---|

|

Qualified Dependent |

This check box is automatically ‘De-selected’ when a dependent is added or updated and supporting documents are required. The check box is automatically updated to ‘Selected’ if all required documents are uploaded and approved. Note: If Administrator would like to override this check box, administrator should review and clean up any outstanding document upload and approval requirement first. |

|

Last Updated On |

The date is automatically updated when the Qualified Dependent check box is switched between selected and deselected. |

Personal History

Field or Control |

Description |

|---|---|

Effective Date |

Enter a new effective date for each change to a dependent’s personal history. Note: For a newborn child, make sure that you enter the child’s birth date as the first effective date. |

Relationship to Employee |

Enter the dependent or beneficiary's relationship to the employee. If you've set up the Dependent Relationship table, the system automatically completes the Relationship to Employee field according to the relationships in the table. |

Dependent Beneficiary Type |

Select the type of dependent or beneficiary. Your selection determines whether you can enroll this person into a benefit plan as a dependent or assign this person as a beneficiary. If you have set up the Dependent table, the system uses that information to populate and validate this field. Values are: Beneficiary: Beneficiary only. Both: Dependent and beneficiary. If you plan to enroll the person as a dependent and assign the person as a beneficiary, you must select this option. COBRA Dependent Only: COBRA dependent or beneficiary only. Dependent: Dependent only. None: The person is neither a dependent nor a beneficiary. This option is typically used when the person is a co-owner of a U.S. savings bond, or to make a person ineligible to participate in a benefit plan. QDRO Estate: If the beneficiary of a life plan is the estate of an employee, enter this value. QDRO Representative - Employee: Used for PeopleSoft Pension Administration. QDRO Representative - Recipient: Used for PeopleSoft Pension Administration. Note: (USA) (CAN) The values COBRA Dependent Only, None, QDRO Representative - Employee, and QDRO Representative - Recipient are Canadian and United States values only. |

Marital Status |

Enter the dependent or beneficiary's marital status. |

Marital Status - As of |

When adding a new dependent, enter the as of date for marital status. When an individual undergoes a subsequent change in status, the effective date for the change is recorded and the system no longer uses the as of date. This field is critical for determining eligibility for benefits enrollment. |

Student |

Select if the dependent or beneficiary is a student. |

Student - As of |

When adding a new dependent, enter the as of date for the individual's student status. When an individual undergoes a subsequent change in status, the effective date for the change is recorded and the system no longer uses the as of date. This field is critical for determining eligibility for benefits enrollment. |

Disabled |

Select if the dependent or beneficiary is disabled. |

Disabled - As of |

When adding a new dependent, enter the as of date for the individual's disability status. When an individual undergoes a subsequent change in status, the effective date for the change is recorded and the system no longer uses the as of date. This field is critical for determining eligibility for benefits enrollment. |

Smoker |

Select if the dependent or beneficiary smokes. The Smoker check box is necessary for dependents who are enrolled in benefit plans that use calculation rules. The system calculates age-graded rates for individuals differently depending on whether they smoke. |

Smoker - As of |

When adding a new dependent, enter the as of date for the individual's smoker status. When an individual undergoes a subsequent change in status, the effective date for the change is recorded and the system no longer uses the as of date. This field is critical for determining eligibility for benefits enrollment. |

Occupation |

Enter the dependent or beneficiary's occupation, if known. |

National ID

Use this group box to enter the dependent or beneficiary's national identification number. Dependents and beneficiaries with citizenship in more than one country can have more than one national ID. Add as many rows as required.

Field or Control |

Description |

|---|---|

Country |

Select the country that issued the dependent's national ID. |

National ID Type |

The system populates this field automatically with the default value that you established for this country on the National ID Type Table page. You can select another valid type. |

National ID |

Enter the dependent's national ID number. The system automatically checks the format of your entry against the default format that you entered on the National ID Type Table page. |

Primary ID |

Select if the national ID is the dependent's primary ID. If this is the only data row for this person, the system selects the check box by default. You can override this default. |

(MYS) Malaysia

Field or Control |

Description |

|---|---|

Full Time Student - Within Malaysia |

Select if the dependent is a full time student in Malaysia. |

Full Time Student - Outside Malaysia |

Select if the dependent is a full time student outside of Malaysia. |

(ARG) Argentina

Field or Control |

Description |

|---|---|

Education Level |

Select the dependent's education level. Values are:

Before selecting an education level, make sure that the Student field on the same page is selected. |

School Cert Start Year (school certificate start year) |

Select to indicate that the employee has presented the dependent's school certificate for the current year. It is required if the Certificate Start Year field has a value. |

Certificate Start Year |

Enter the 4-digit year of the current year certificate. It is required if the School Cert Start Year field is selected. |

School Cert End Year (school certificate end year) |

Select to indicate that the employee has presented the dependent's school certificate for the previous year. It is required if the Certificate End Year field has a value. |

Certificate End Year |

Enter the 4-digit year of the previous year certificate. It is required if the School Cert End Year field is selected. |

Eligible for Family Allowance |

Select to indicate that the dependent is eligible for family allowance. The dependent must be a child, disabled child, or spouse. An error is displayed if this field is selected, but the relationship to employee specified on this page is not one of these values:

|

Family Allowance Term Date |

Enter the end date for the dependent to be eligible for family allowance. The value must be a date that is equal or prior to the dependent’s 18th birthday. If a date value is not entered, the system calculates this end date (dependent’s 18th birth date) at save time, if the dependent is:

The date is recalculated at save time, if a change in the relationship to employee, marital status, or disability status occurs. If a date value is not entered, and the dependent’s birth date is not available either, the system doesn’t perform the calculation. If the dependent’s marital status is changed to a non-single value, the effective date of the row becomes the end date of the family allowance. If the dependent is single and disabled, do not enter an end date. |

Income Tax Dependent |

Select the type of taxable dependents for income tax. Valid Values are Child, Other Dependents, and Spouse. |

Income Tax Begin Date |

Enter the begin date for the dependent to be eligible for income tax. |

Income Tax End Date |

Enter the end date for the dependent to be eligible for income tax. |

Tax Dependent Deduction |

Select the percentage that will be able to deduct for the dependent (child). Valid Values are:

Note: Tax Dependent Deduction field will be displayed when Child is selected in Income Tax Dependent field. |

Social Security Condition |

Specify whether the dependent is part of the primary family group or is an adherent of the employee for Social Security benefits. |

Social Security Begin Date |

Enter the starting date of Social Security benefits for the dependent. |

Social Security End Date |

Enter the end date of social security benefits for the dependent. |

Document Issue Date |

Enter the family dependent document issue date. Note: To run the Family Dependents text report of the My Simplification program (Global Payroll for Argentina), be sure to enter values in the Family Dependents Data grid. |

Book |

Enter the book information. |

Folio |

Enter the folio information. |

Act Number |

Enter the act number. |

Birth/Marriage Country, Birth/Marriage State and Birth/Marriage Location |

Enter the country, state, and location of the dependent’s place of birth (for example, if dependent is a child) or marriage (for example, if dependent is a spouse). |

Commune |

Enter the commune information. |

Tribunal |

Enter the tribunal information. |

Court Number |

Select a court number. These numbers are defined on the Court Numbers Page. |

Secretary Number |

Select a secretary number. These numbers are defined on the Secretary Numbers Page. |

School Year |

Enter the dependent’s school year. |

School Type |

Enter the type of school that the dependent attends. Valid values are Summer and Normal. |

Documentation Code |

Select a documentation code. |

Overseas Doc Cd (overseas document code) |

Select a overseas document code. |

DJ Text |

Enter the DJ text. |

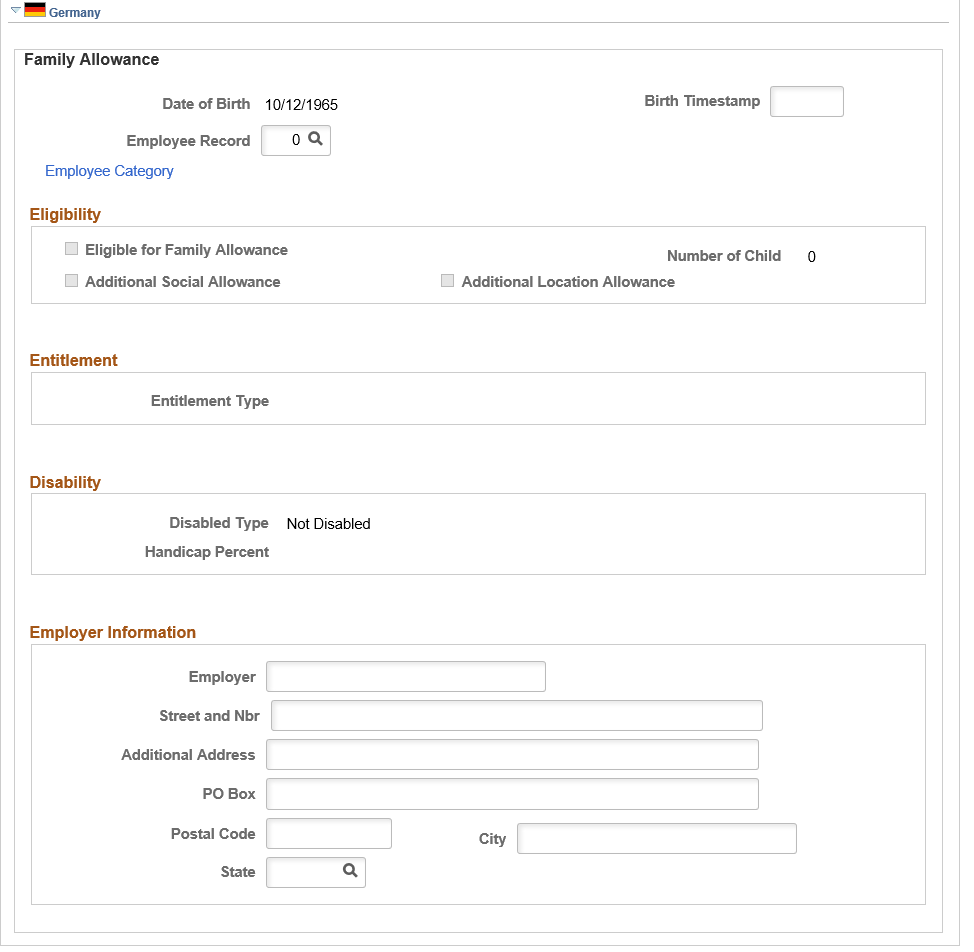

(DEU) Germany

Use the Germany section to enter dependent information that is used for processing family allowances (both marriage-based and child-based).

Field or Control |

Description |

|---|---|

Eligible for Family Allowance |

Select to indicate that the dependent (child) is entitled to the child-based family allowance. This option is available for edit if the dependent is listed as a child or grandchild of any kind of the employee. |

Number of Child |

Enter a number that represents the birth order of the child, 1 for the first child, 2 for the second, and so on. |

Additional Social Allowance |

Select to indicate that the dependent (child) is entitled to child-related Orts- und Sozialzuschlag. This allowance is applicable to all employees (excluding civil servants and apprentices) meeting the entitlement conditions. |

Additional Location Allowance |

Select to indicate that the dependent (child) is entitled to location-based allowance. |

Entitlement Type |

Select an applicable entitlement type for the child. Values are: No Entitlement School Education Search for Education Trainee Transition Period Under 18 Years Unemployed Vocational School Voluntary Ecological Year Children under the age of 18, and children between the age of 18 and 25 who are currently attending school or apprenticeship, are entitled to child allowance if the income they receive, if any, doesn't exceed the amount set by the legislation. |

Disabled Type and Handicap Percent |

Select an applicable disability type for the child and associated disability percentage. Disabled children are eligible for continued child allowance regardless of the age limitation. Note: This section is available for edit if you select the Disabled field in the Personal History section. |

Employer Information |

Enter the employer information for the spouse or child, if applicable. |

(CAN) Canada

Field or Control |

Description |

|---|---|

Eligible for CSB |

If you are entering dependent and beneficiary information for a Canadian employee, select this check box to indicate that the dependent or beneficiary is an eligible registrant for an employee who is purchasing Canadian Savings Bonds (CSBs). The PeopleSoft Payroll-CSB Registrant page verifies the selection of this check box. |

(BEL) Belgium

Field or Control |

Description |

|---|---|

Fiscally Dependent |

Select if the employee is fiscally responsible for the dependent. |

Fiscal Situation Spouse |

Select the appropriate fiscal situation from the list. |

Fiscally Disabled |

Select if applicable. |

Profession Category Spouse |

Select the appropriate category from the list. |

Orphan |

Select if applicable. |

Eligible for Allowance |

Select to track whether the dependent is eligible for a (family) allowance. This field is used for data tracking, there is no validation associated to it |

(FRA) France

Use this group box to store information that can be passed to your payroll system for payroll processing.

Field or Control |

Description |

|---|---|

Family Supplement |

For numerous families, payroll calculates the family allowance amount that your organization gives to an employee based on their family dependents. This calculation is based on the number and type of employee dependents. Select this check box to indicate that the corresponding dependent has to be considered in the calculation of the supplemental family allowance. |

Garnishment |

This option is for court orders that require that an employee's wages be garnished. When an employee is under a court order, payroll can calculate the percentage and amount of the employee's salary that has to be transferred to the relevant government agency in each pay period. Depending on the number of dependents, this amount is reduced. The greater the number of dependents, the lower the percentage of frozen salary. Select this check box to indicate that the corresponding dependent has to be considered in the calculation of the frozen garnishment amount. |

AFB Allowance (French Banking Association allowance) |

The French Banking Association delivers a special allowance based on the number of dependents. Select to indicate that the corresponding dependent has to be considered in the calculation of this allowance. |

CHIC |

CHIC is a medical insurance company that employees can opt to use to supplement their medical insurance coverage. This insurance company delivers a special allowance based on the number of dependents. Select this check box to indicate that the corresponding dependent has to be considered in the calculation of this allowance. |

Schooling |

See Family Supplement. |

Holiday Premium |

See Family Supplement. |

Status 7 andStatus 8 |

Configure these fields to capture additional payroll related status information. |

Collective Agmt |

Select if applicable. |

IJSS Calc. (Indemnités Journalières de Sécurité Sociale) |

IJSS is the social security daily allowances. Select if the dependent should be taken into account in the calculation of the employee's entitlement for IJSS. The IJSS is calculated by PeopleSoft Global Payroll for France. |

(GBR) United Kingdom

Field or Control |

Description |

|---|---|

Eligible for Parental Leave |

Select if the dependent qualifies the employee for parental leave. Select the Disabled check box on the top page if it also applies here. |

Adopted Dependent |

Select if the employee adopted the dependent. |

Adoption Date |

If adopted, enter the adoption date. |

Certificate(s) Verified |

Select to indicate that appropriate certificates have been provided to verify this dependent information. |

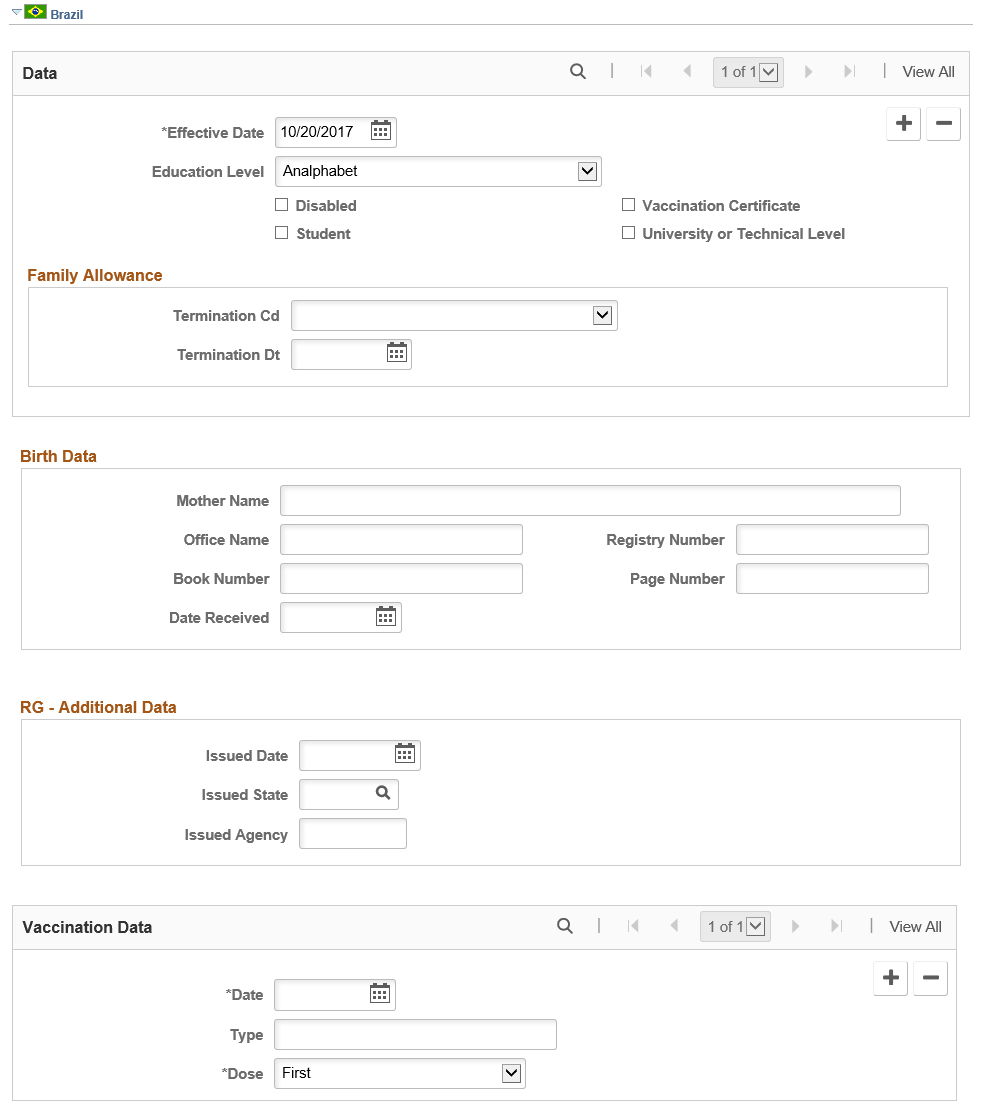

(BRA) Brazil

Field or Control |

Description |

|---|---|

Education Level |

Select the education level of the dependent. |

Disabled |

Select to indicate that the dependent is disabled and the employee can receive the family allowance and income tax benefits for the dependent for additional years. |

Vaccination Certificate |

Select if you have received the dependent's vaccination certificate. This information is used for reporting purposes. |

Student |

Select to indicate that the dependent is a student. Employees receive income tax benefits for all students up to 21 years old. If the dependent is a student and is less than six years old, the employee should provide a vaccination certificate to the company to receive the income tax benefit. |

University or Technical Level |

Select to indicate that the dependent is a student at the university or technical level and the employee can receive the income tax benefit for the dependent for additional years (for students up to 24 years old). |

Termination Cd (termination code) |

Enter the reason code for the family allowance termination. Values are: Child Abandonment: Abandonment of child. Dependent exceeds ceiling: Dependent's age exceeds maximum age. Court Decision: Court decision (in case of divorce or separation). Dependent's Death: Dependent's death. End Disability: Disability ended. Child Custody: Custody has been awarded to the other parent. Termination: Termination. |

Termination Dt (termination date) |

Enter the family allowance termination date. |

Enter information from the dependent's birth certificate in the Birth Data group box. This information is used for reporting purposes.

In the RG - Additional Data group box, be sure to enter for this individual the Registro Geral (RG) issuing agency as well as the issued date and issued state, if a national ID is specified in the National ID group box with a national ID type of RG for the country of Brazil.

Enter the type of vaccination, the dose, and the date received for each vaccination on the dependent's vaccination certificate in the Vaccination Data group box. This information is used for reporting purposes.

(USA) US Federal Government

Field or Control |

Description |

|---|---|

FEHB Participant |

Enter a value to indicate that the dependent has Federal Employee's Health Benefits (FEHB). |

Dependent's Fed Plan Type |

If the dependent is a FEHB Participant, enter the federal plan type. Valid Values are:

|

Medicare Number and Alternate Medicare Number |

If the dependent is on Medicare, enter their Medicare number(s). |

Medicare A Indicator, Medicare B Indicator, and Medicare D Indicator |

Select if the indicator if the dependent is in a Medicare A, Medicare B, or Medicare D program. |

Medicare Reason A, Medicare Reason B, and Medicare Reason D |

If the dependent is a Medicare recipient, enter the reason they have Medicare A, Medicare B, or Medicare D. |

Use the Dependent/Beneficiary Riders page (DEPBEN_RIDERS) to enter detailed information about the court-ordered benefit for the specified dependent or beneficiary.

Navigation:

Click the Riders/Orders link on the Dependent Information - Personal Profile page.

This example illustrates the fields and controls on the Dependent/Beneficiary Riders page. You can find definitions for the fields and controls later on this page.

The Dependent/Beneficiary Riders page enables you to enter any court-ordered benefits or spousal waivers. This page enables the system to validate any changes or omissions in benefit enrollments with a recorded rider. When an employee enrolls in a benefit plan and there is a court-ordered mandate specifying that a benefit be provided, the system does not complete the enrollment.

Field or Control |

Description |

|---|---|

Plan Type |

Enter the type of plan to which the court order relates. |

Start Date |

Enter the date on which the court order becomes effective. |

Sequence |

Prioritizes court orders when you have more than one that takes effect on the same day. Enter a number that indicates which court orders take precedence over others. If there is only one court order, enter a sequence of 1. |

Status |

Select whether the court order is Active or Inactive. This field is typically used to void a court order before the end date takes effect. If the status is Inactive, the system won't enforce any validations against this court order. |

Exception Type |

Select whether this is a court order (a legal document that grants a dependent the right to receive benefit coverage), spousal waiver (document that formally waives a spouse's claim to a minimum beneficiary allocation of funds from a life insurance policy or savings plan), or neither. |

End Date |

Enter the date on which the court order ends. When the court order expires, the system won't enforce any validations against this court order. |

Court Order Number |

Enter the official number that is issued by the state for this court order. |

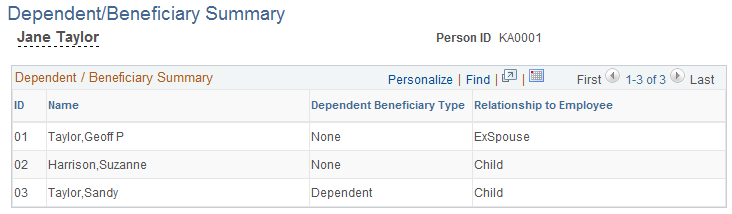

Use the Dependent/Beneficiary Summary page (DEPEND_BENEF_SUMM) to view an employee's beneficiaries and dependents.

Navigation:

This example illustrates the fields and controls on the Dependent/Beneficiary Summary page. You can find definitions for the fields and controls later on this page.

Dependent/Beneficiary Summary

This group box displays a summary of all dependent and beneficiary data for an employee.

Field or Control |

Description |

|---|---|

ID |

This column displays the ID of the dependent or beneficiary. |

Name |

This column displays the name of the dependent or beneficiary. |

Dependent Beneficiary Type |

Indicates whether the person is a dependent or beneficiary. |

Relationship to Employee |

Describes the relationship of the dependents and beneficiaries to the employee. |

Note: Over time, changes occur and you need to terminate dependent enrollments or beneficiary statuses. Remember, you enroll dependents and assign beneficiaries when you enroll employees. As with employees, to terminate a dependent enrollment or beneficiary status, you must enter a row of data with the termination date. Don't make such a change using the Dependent/Beneficiary Data page. Make the change using the benefit detail page for the benefit in question.

Warning! If you delete dependent or beneficiary data by using the Dependent/Beneficiary Data pages, you destroy historical data. When you change enrollment data, it won't matter that the dependent or beneficiary data is available here. It must remain if your system is to provide correct historical information.

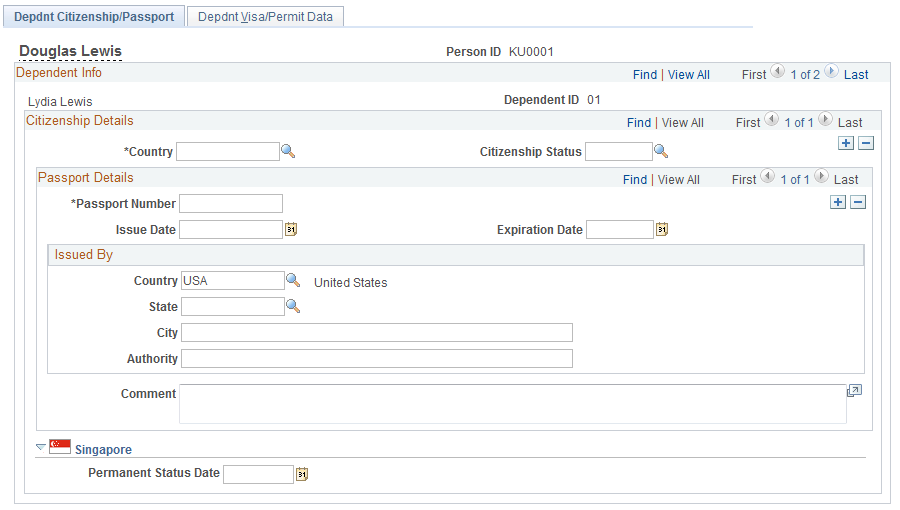

Use the Dependent Identification - Depdnt Citizenship/Passport page (CITIZEN_PP_DEP) to enter or update dependent citizenship and passport data.

Navigation:

This example illustrates the fields and controls on the Dependent Identification - Depdnt Citizenship/Passport page. You can find definitions for the fields and controls later on this page.

Enter information on this page in the same manner that you enter data on the Citizenship/Passport page.

See Citizenship/Passport Page.

Note: (DEU) If you administer a workforce in Germany, use the Visa/Permit table to record OECD work permits for OECD nationals who want to work in a protected industry. Because permit types are keyed by country, if you track a German employee's OECD work permit information on the Identification, Visa/Permit table in the Track Global Assignments menu, select DEU as the country code from among your valid OECD permit types.

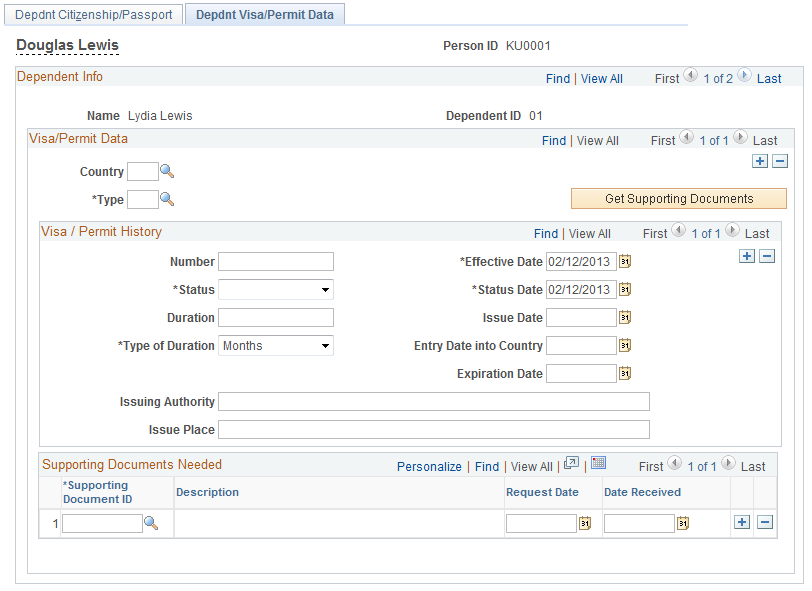

Use the Dependent Identification - Depdnt Visa/Permit Data page (VISA_PERMIT_DEP) to enter or update dependent visa and permit data.

Navigation:

This example illustrates the fields and controls on the Depdnt Visa/Permit Data page. You can find definitions for the fields and controls later on this page.

Enter information on this page in the same manner that you enter data on the Visa/Permit Data page.