Mapping Accounts

To map accounts, use the Deduction Acct Mapping Table component (HP_DED_ACCT), Earnings Account Mapping Table (HP_ERN_ACCT), and the Map Tax Accounts CAN component (HP_CTX_ACCT) or Map Tax Accounts USA component (HP_TAX_ACCT).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

HP_ERN_ACCT |

Map earnings field values to accounts. |

|

|

HP_DED_ACCT |

Map deductions field values to accounts. |

|

|

HP_CTX_ACCT |

(CAN) Map wage loss plans, companies and tax classes to accounts. |

|

|

HP_TAX_ACCT |

(USA) Map companies and tax classes to accounts. |

Combination codes, also known as account codes, are made up of a combination of ChartFields. When you specify a combination code as a funding source, the system funds the earnings, deductions, or tax cost from the ChartFields grouped under that combination code.

Account mapping enables you to direct the system to an account other than the one associated with the selected combination code to fund expenses that meet your mapping criteria. For example, you might want all the earnings in a department budget to be funded by the combination code and its associated account, except for those earnings from a particular job code that are part time, which you funded from a different account. To do this, you set up an earnings account mapping identifying the job code and part time status and tie it to the account you want the system to use instead.

When the Actuals Distribution process (PSPPFUND) distributes earnings, it will distribute part-time earnings from the selected job code to the account you mapped to, instead of the account associated with the combination code.

To create earnings and deductions account mappings, map field values to accounts. The Earnings Account Mapping Table page and the Deductions Account Mapping Table page display the fields you selected on the Earnings Account Template and Deductions Account Template pages. Select values for those fields. When the Actuals Distribution process processes earnings or deductions transactions that have those field values it will distribute the earnings or deductions to the account that you map to on the mapping tables.

To create Canadian tax account mapping on the Tax Account Mapping Table page (HP_CTX_ACCT), map a tax class and account (and the account's SetID) to a company and wage loss plan. When the Actuals Distribution process processes Canadian tax transactions that have the tax class value and the specified company and wage loss plan, it distributes the taxes to the account that you mapped to.

To create U.S. tax account mapping, map a tax class and account (and the account's SetID) to a company on the Tax Account Mapping Table page (HP_TAX_ACCT). When the Actuals Distribution process processes U.S. tax transactions that have the tax class value and the specified company, it distributes the taxes to the account that you mapped to.

Note: The Actuals Distribution process will only use account mapping information when you have selected the account override on Dept Budget Defaults page (DEPT_BUDGET_DFLT) for that department.

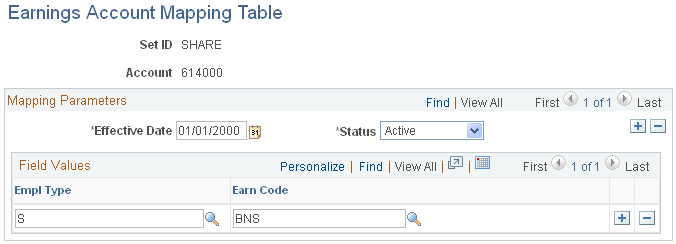

Use the Earnings Account Mapping Table page (HP_ERN_ACCT) to map earnings field values to accounts.

Navigation:

This example illustrates the fields and controls on the Earnings Account Mapping Table page.

To map earnings field values to accounts:

Select the effective date and status of the earnings account mapping.

Select values in each of the fields displayed in the grid to map them to the earnings account. The grid only displays the fields you selected on the Earnings Account Template page.

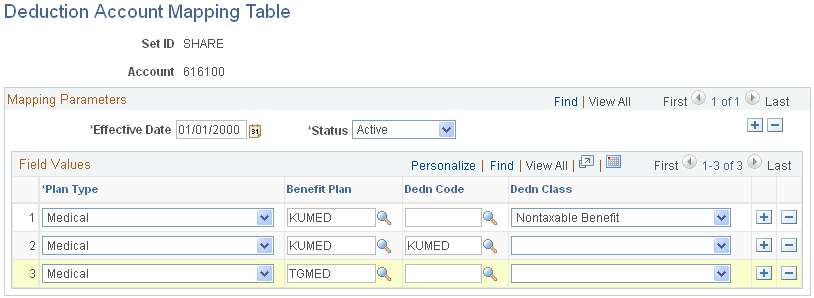

Use the Deduction Account Mapping Table page (HP_DED_ACCT) to map deductions field values to accounts.

Navigation:

This example illustrates the fields and controls on the Deduction Account Mapping Table.

To map field values to deduction accounts:

Select the effective date and status of the deduction account mapping.

Select values in each of the fields displayed in the grid to map them to the deduction account. The grid only displays the fields you selected on the Deductions Account Template page, with the exception of Plan Type, which is required for deduction account mappings.

(CAN) Use the Tax Account Mapping Table page (HP_CTX_ACCT) to map wage loss plans, companies and tax classes to accounts.

Navigation:

This example illustrates the fields and controls on the Tax Accounting Mapping Table page.

Canadian tax accounts are connected to companies and wage loss plans. Connect tax classes with accounts and map these rows to companies and wage loss plans.

To map companies and wage loss plans to tax classes and accounts:

Select the effective date of the tax account mapping.

Associate tax classes with accounts to map to this company and wage loss plan.

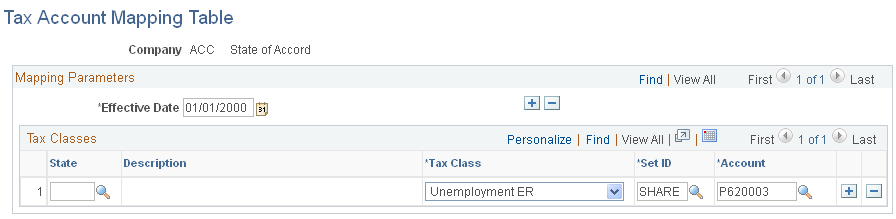

(USA) Use the Tax Account Mapping Table page (HP_TAX_ACCT) to map companies and tax classes to accounts.

Navigation:

This example illustrates the fields and controls on the Tax Accounting Mapping Table page.

U.S. tax accounts are connected to companies. Connect tax classes with accounts and map these rows to companies.

To map companies to tax classes and accounts:

Select the effective date of the tax account mapping.

Associate tax classes with accounts to map to this company.