Option 4: Using the Department Budget Table Component

To use option four, use the Department Budget Table CAN component (DEPT_BUDGET_CN) or the Department Budget Table USA component (DEPT_BUDGET).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Dept Budget Date Page(department budget date) |

DEPT_BUDGET_DATE |

Define the fiscal year budget's begin and end-dates as well as other department budget information. |

|

Dept Budget Defaults Page (department budget defaults) |

DEPT_BUDGET_DFLT |

Set up budget defaults, such as funding source option, default deduction and tax funding sources. |

|

Dept Budget Earnings Page (department budget earnings) |

DEPT_BUDGET_ERN |

Establish department budgets for employee earnings in each department of your organization. |

|

Dept Budget Deductions Page (department budget deductions) |

DEPT_BUDGET_DED |

Budget for employer-paid deductions in each department of your organization. |

|

Dept Budget Taxes Page (department budget taxes) |

DEPT_BUDGET_CTX |

(CAN) Budget for employer-paid taxes in each Canadian department of your organization. |

|

Dept Budget Taxes Page (department budget taxes) |

DEPT_BUDGET_TAX |

(USA) Budget for employer-paid taxes in each U.S. or Global department of your organization. The Dept Budget Taxes page for USA is similar to the Dept Budget Taxes Page for Canada. |

|

ChartField Detail Page |

HMCF_HRZNTL_CFLD |

Use to select individual ChartField values or search for an existing combination code. |

Use the Department Budget Table components to manually create annual budgets and to modify budgets created by the automated budget-building processes.

Budget the salary expenditures for each department by department, position pool, job code, position number, or appointment, or by any combination of these levels. At each budget level, define a budget cap individually for earnings, deductions, and taxes—or for all expenditures together. This cap ensures that the sum of all lower-level budgets doesn't exceed a higher-level budget cap. It isn't used for checking funds during the processing of encumbrance and actuals. The budget amounts are used for the latter purpose.

Note: To use the encumbrance and distribution processes, establish budget data for every department in your organization for which you select the Use Comm Acctg/Budgeting check box on the Departments - Comm. Acctg. and EG page.

Retroactive Changes to Budgets

After a budget has been used by the encumbrance or actuals distribution processes you can no longer correct it. To make changes to the budget, insert an effective-dated and sequenced row that the system will use to make retroactive changes. The Used by Distribution field on each department budget page indicates if a budget has been used.

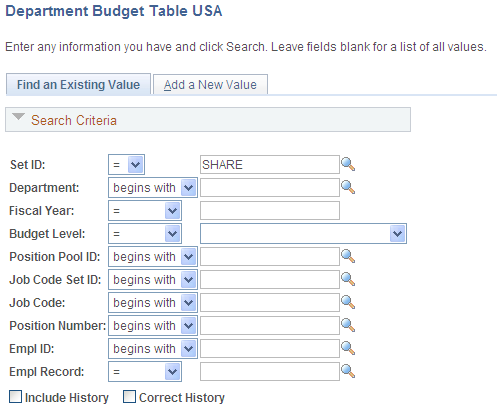

Department Budget Table Search Page

Once you select the budgeting level for a department, enter budgeting information using the Department Budget Table component. When you select Department Budget Table CAN or Department Budget Table USA from the menu, the Department Budget Table search page appears. The budget level you specify in the search page enables you to pinpoint the level of detail you want to see in the Department Budget Table component.

This example illustrates the fields and controls on the Department Budget Table search page.

In the search page, you must select the SetID, Department,Fiscal Year, and Budget Level for the department budget you that are defining. The information you specify here displays at the top of each of the each page in the Department Budget Table component.

Select a Budget Level from the following options:

Appointment: If selected, also select an EmplID. The EmplID can be for a full time employee, part time employee, contractors, and so on. Also select an Empl Record for the selected person.

Department: Select if you are defining the department budget at the department level.

Jobcode: If selected, also select a valid Job Code.

Position Pool: If selected, also select a Position Pool ID.

Position: If selected, also select a Position Number.

When you've specified the department budget information, select OK.

The system uses the combination code information from the Department Budget Earnings page when processing encumbrances and actuals distribution if there isn't a person-specific combination code override.

For encumbrance calculations, a combination code override can be entered on Job Earnings Distribution page (JOB_DATA_ERNDIST) or Job Data - Payroll page (JOB_DATA2). For actuals distribution process, the combination code override is automatically populated from the Job Earnings Distribution page, the Job Data - Payroll page, and the Additional Pay page (ADDITIONAL_PAY1). Otherwise, the override can manually entered on paysheet pages (PAY_SHEET_ADD_S, PAY_SHEET_LINE_S, PAY_SHEET_LN_S, PAY_OL_SHEET_S1).

When you run the encumbrance process to calculate encumbrance data, the system looks first for a combination code on the Job Earnings Distribution page. If no code is specified there, it next looks for a combination code on the Job Data - Payroll page, and if that code doesn't exist, it looks for combination code information on the Department Budget Earnings page. The system looks first for appointment level funding, then position or job code level funding, the position pool, and finally department level funding. To calculate pre-encumbrance data, the system looks for combination code information on the Department Budget Earnings page. The system looks first for the position, then the position pool and finally department level funding.

The encumbrance process looks first for an entry with the earnings code you've defined as regular for your organization, then at the default funding source (blank earnings code).

Similarly, when you run the Actuals Distribution process (PSPPFUND) to distribute your actuals across funding sources and accounting periods, the system looks first for a combination code specified on the Paysheet record (PAY_EARNINGS), which originates from the Job Earnings Distribution page or the Job Data page, and which you can override on the Paysheet. If there is no code specified there, then it looks at the combination code information on the Department Budget Earnings table.

The system performs fund checking when you run the Actuals Distribution process (PSPPFUND). If there is insufficient budget to distribute all or part of a person's earnings, benefits, or employer-paid taxes, the system generates messages to the Pay Messages component (PAY_MESSAGES) and distributes the unfunded amount to suspense combination code. If the budget is sufficient to cover part of the earnings, benefits, or taxes, then that part is distributed. Note also that funds checking is performed against the information on the Dept Budget pages (and not against the Overall/Detail caps; the latter are used to edit the budget amounts).

During this processing, the system searches active budget levels and stops using a funding source if a funding end date is specified and the processing occurs at a later date. For actuals distribution, the earnings end date is used for comparison with the funding end date.

To create multiple funding sources, insert multiple entries (there is no limit) to specify additional funding source. However, be aware of the following guidelines:

Enter either a budget amount or a percentage of distribution (Distrib %) in each row.

If you have some dollar-limited funding sources (budget amount) and others that are unlimited (percentage of distribution), assign lower sequence numbers to the limited entries and higher sequence numbers to the unlimited entries.

When you use percentages (Distrib %), the sum of percentages for all funding source (combination code) must equal 100.

When the Default Funding Source Option on the Dept Budget Data page is either Actual or Earnings, you must enter one earnings distribution record with a blank earnings code.

Note: Although you can choose to set up budgeting and funding at the department, position pool, job code, position, or appointment (EmplID) levels, the system stores actuals and encumbrance information at the lowest level, even if you define your budgeting and funding for the entire department. In this way, if you change the levels during your fiscal year, the system calculates the encumbrances and actuals according to your new funding levels.

When you run the Actuals Distribution process, the process distributes to the override combination code specified on Job Data - Payroll page. If there is no override, the process distributes actual employer-paid deductions across the funding sources defined on Dept Budget Deduction page.

The system searches active budget levels and stops using a funding source if a funding end date is specified and the processing occurs at a later date. For actuals distribution, the earnings end date is used for comparison against the funding end date.

Unlike the Dept Budget Earnings page, the information specified here isn't used during encumbrance processing. Information specified on the Encumbrance Definition component is used for that purpose.

When the default funding source option is Actual or Earnings the system creates a Dept Budget Deductions record using the earnings combination code as a default combination code.

When you run the Actuals Distribution process, the process distributes to the override combination code specified on Job Data - Payroll page as the override. If there is no override, the process distributes actual employer-paid taxes across funding sources defined on Dept Budget Taxes page.

The system searches active budget levels and stops using a funding source if a funding end date is specified and the processing occurs at a later date. For actuals distribution, the earnings end date is used for comparing against the funding end date.

The system ignores budget levels that have become inactive. It also stops using a funding source if a funding end date is specified and the processing occurs at a later date. For actuals distribution, the earnings end date is used for comparing against the funding end date.

Unlike the Dept Budget Earnings page, the information specified here isn't used during encumbrance processing; information specified on the Encumbrance Definition component is used for that purpose. Also unlike earnings information, you cannot override funding sources for employer-paid taxes at the job data or paysheet level.

When the default funding source option is Actual or Earnings the system creates a Dept Budget Tax record using the earnings combination code as a default combination code.

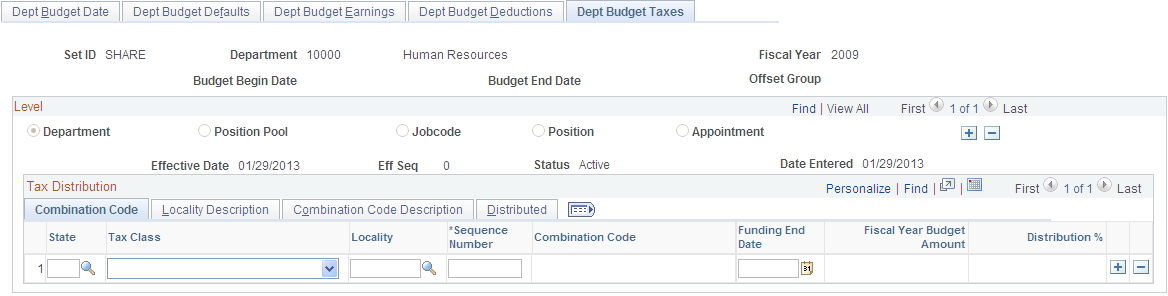

The Dept Budget Taxes page is virtually the same on the Department Budget Table CAN and Department Budget Table USA components. There are two small differences:

The Dept Budget Taxes (U.S.) page has a State field; the Dept Budget Taxes (CAN) page has a Province field.

The Dept Budget Taxes (U.S.) page has a Locality field; the Dept Budget Taxes (CAN) page doesn't.

Field or Control |

Description |

|---|---|

Effective Date and Effective Sequence |

These indicate when a budget row takes effect and in what order to apply the row. The system uses these fields to determine when and what order to apply retroactive budget changes. |

Sequence Number |

Indicates the order (sequence) in which to use funding sources. If you have some dollar-limited funding sources (Budget Amount) and some unlimited sources (% of Distribution), assign lower sequence numbers to the limited entries and higher numbers to the unlimited entries. |

Combination Code and Edit ChartFields |

For each earnings, deductions, or tax class row, select a combination code or a new combination of ChartFields. Select the Edit ChartFields link to search for an existing combination code or select a unique combination of ChartFields on the ChartField Detail page. |

Allow Overspend |

Select this option to enable the encumbrance and actuals processes to continue to post transactions to a combination code even when the budget cap has been exceeded. This option is available only when the budget is expressed with a dollar amount. |

Fiscal Year Budget Amountand Distribution % |

For earnings and deductions, establish budgets in the Fiscal Year Budget Amount field or the Distribution %field. Once you enter one of these options, the other field becomes unavailable for entry. For example, if you decide to change from a budget amount to a percentage of distribution, first delete the existing amount. Similarly, to change from a percentage of distribution to a budget amount, first delete the percentage. Fiscal Year Budget Amount determines funding using a dollar amount, whereas Distribution % uses percentages. When you specify multiple combination codes with a budget amount for a single budget sequence, percentage distribution is implied by the ratio between the amounts. If you elect to use a budget amount, you'll update budget information annually with the new budget amounts for each department, job code, position pool, position number, or appointment. Funds checking uses the budget amount. If you don't want to exceed a dollar limit for a particular budget level, use only budget amounts rather than percentages. If you use a combination of amounts and percentages (for example, some rows have amounts while others have percentages), make sure to apply percentages only to the last sequence numbers to ensure that there is sufficient funds to cover the flat amounts. |

Funding End Date |

Enter the date (if applicable) on which this funding source ends. Funding sources can continue beyond the current fiscal year. The system creates multiyear encumbrances based on this date. If you do not enter a date, the system creates encumbrances for the current fiscal year only, but the funding source remains available for future fiscal years. If you select the Funding End Date Defaults From Funding Source field on the Dept Budget Defaults page, the default funding end date for all earnings, deductions, and tax rows is the default funding end date for the funding source (as defined on the Funding Source Information page). |

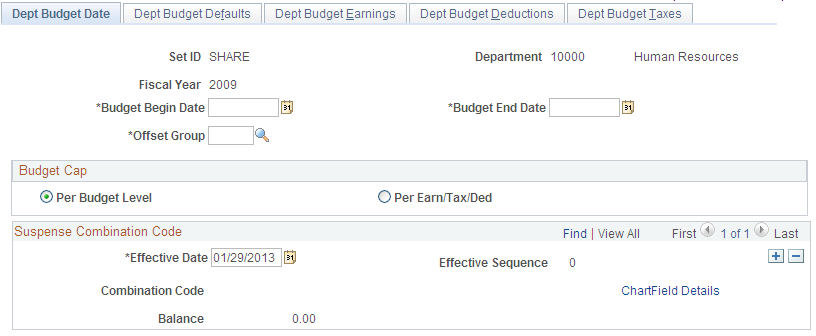

(CAN) Use the Dept Budget Date (department budget date) page (DEPT_BUDGET_DATE) to define the fiscal year budget's begin and end-dates as well as other department budget information.

Note: (USA) The Dept Budget Date (department budget date) page (DEPT_BUDGET_TAX) for USA is similar to the one for Canada.

Navigation:

This example illustrates the fields and controls on the Dept Budget Date page.

The options on the Dept Budget Date page are available only when you create a new department budget or access an existing budget in correction mode.

Field or Control |

Description |

|---|---|

Budget Begin Date and Budget End Date |

Enter the begin and end dates of this department budget. |

Offset Group |

Enter an offset group to specify the offset combination code to be used for each type of transaction. |

Budget Cap

Field or Control |

Description |

|---|---|

Budget Cap |

Specify the type of budget cap for this department budget. At each budget level, define a cap as follows:

Overall budget and earnings caps are maintained on the Dept Budget Earnings page. Separate caps for taxes and deductions are maintained on the Dept Budgets Deduction and Dept Budget Taxes (U.S. and Canada) pages, respectively. |

Suspense Combination Code

Field or Control |

Description |

|---|---|

Combination Code |

Select the ChartField Details link to specify a suspense combination code. The encumbrance and actuals processes will charge all unfunded amounts to this account enabling the encumbrance and actuals processes to continue posting to the specified combination code even when the funding source is exhausted or inactive. Indicate at least one suspense combination code and indicate the effective date of the suspense combination code for each department budget. The combination code you use here cannot be used anywhere else in the department budget. Don't correct this combination code after it has been used; instead, enter a new, effective-dated suspense combination code. |

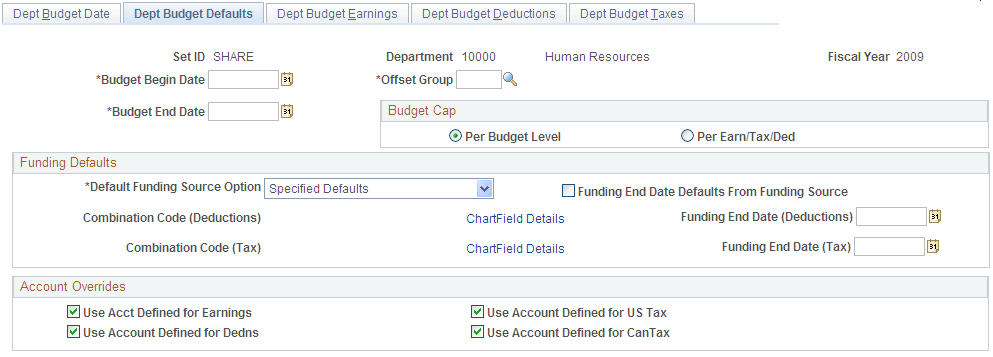

Use the Dept Budget Defaults (department budget defaults) page (DEPT_BUDGET_DFLT) to set up budget defaults, such as funding source option, default deduction and tax funding sources.

Navigation:

This example illustrates the fields and controls on the Dept Budget Defaults page.

Funding Defaults

Field or Control |

Description |

|---|---|

Default Funding Source Option |

Indicate if the Default Funding Source Option is Specified Defaults, Distrib over Actual Earnings or Earnings Funding Source If there is no Default Funding Source Option, select No Defaults. The default value, whether you create a budget manually or use one of the budget creation processes, is Actual Distrib over Actual Earnings. The system uses the funding source (combination code) specified for earnings as a default for deductions and taxes and distributes deductions and taxes over actual earnings unless you specify funding sources on the Dept Budget Deductions and Dept Budget Taxes pages. When Distrib over Actual Earnings or Earnings Funding Source is the Default Funding Source Option, the system hides the Combination Code (Deductions), Funding End Date (Deductions), Combination Code (Tax), and Funding End Date (Tax) fields and the system uses the funding source (combination code) specified for earnings as a default for deductions and taxes. When you select Specified Default, the system displays the Combination Code (Deductions), Funding End Date (Deductions), Combination Code (Tax), and Funding End Date (Tax) fields for you to specify the default funding options. |

Funding End Date Defaults From Funding Source |

Select this check box if you want the default funding end date for all new earnings, deductions, and tax rows, and for new encumbrance definitions, to be the funding end date from the Funding Source Information page. This option applies regardless of the method you use to create your fiscal year budget. Note: Changes on the Funding Source Information page do not affect existing funding end dates in the department budget; the system uses this setting only to set the default funding end date in newly created rows of budget data. |

Exclusion Fringe Group |

Select a group of fringe expenses to exclude from funding from the earnings funding source. This field is informational only and will be used as a default on Dept Budget Earnings page. This field is available only when the Default Funding Source Option is Actual or Earnings. |

Combination Code (Deductions) |

If the Default Funding Source Option is Actual, enter a default combination code for deductions. The value in appears in the Combination Code field on the Dept Budget Deductions page, but you can override it. |

Funding End Date (Deductions) |

Enter the date (if applicable) on which the deductions combination code ends. If you do not enter a date, the system creates encumbrances for the current fiscal year only, but the funding source remains available for future fiscal years. If the Funding End Date Defaults From Funding Source field is selected, the default value is the funding end date that is defined on the Funding Source Information page. |

Combination Code (Tax) |

Enter a default combination code for taxes. The value appears in the Combination Code field on the Dept Budget Taxes page, but you can override it. |

Funding End Date (Tax) |

Enter the date (if applicable) on which the tax combination code (funding source) ends. If you do not enter a date, the system creates encumbrances for the current fiscal year only, but the funding source remains available for future fiscal years. If the Funding End Date Defaults From Funding Source field is selected, the default value is the funding end date that is defined on the Funding Source Information page. |

Account Overrides

Field or Control |

Description |

|---|---|

Use Acct Defined for Earnings, Use Acct Defined for Dedns, Use Acct Defined for US Tax, and Use Acct Defined for Can Tax |

Select to enable account mapping for earnings, deductions, U.S. taxes, or Canadian taxes. The Actuals Distribution uses the account mapping you set up on the account mapping tables to map earnings, deductions, or taxes to a different account than the one associated with the specified combination codes. |

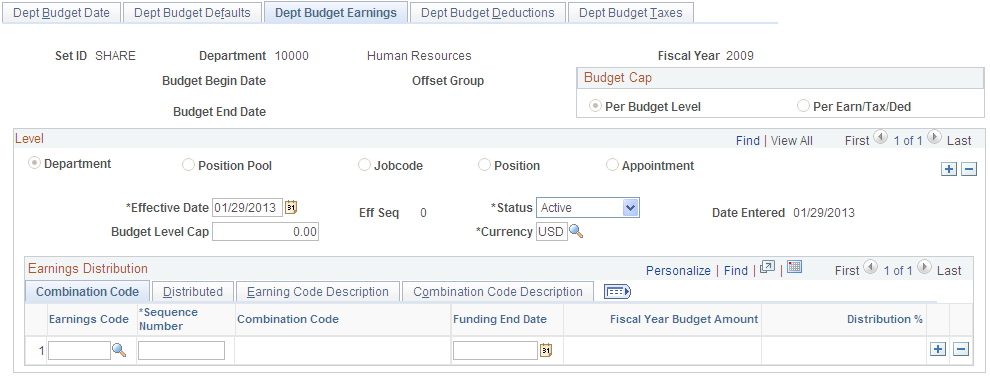

Use the Dept Budget Earnings (department budget earnings) page (DEPT_BUDGET_ERN) to establish department budgets for employee earnings in each department of your organization.

Navigation:

This example illustrates the fields and controls on the Dept Budget Earnings page.

Field or Control |

Description |

|---|---|

Budget Level Cap and Currency |

Enter the budget level cap that you want to place on this budget level. The cap is used to ensure that the sum of all lower-level budgets doesn't exceed this higher-level budget cap. It isn't used for checking funds during the processing of encumbrances and actuals. Also select a currency code. |

Earnings Distribution

Use this grid to establish multiple funding sources and (optionally) specify a Funding End Date for each source. Funding sources are defined using a combination code that represents a valid General Ledger ChartField combination.

Establish one entry for each budget level in which the earnings code is blank. This entry is the default funding source and is used as the funding for all earnings where a specific entry for an earnings code hasn't been established.

Field or Control |

Description |

|---|---|

Earnings Code |

Select an earnings code to establish a budget for particular earnings type. Establish budgets for as many different types of earnings as needed. |

% Effort (percentage of effort) |

Represents a university's estimate of activity attributable to and associated with a specific grant (or funding source) for the defined begin and end-dates. This field was designed for those higher education customers who need to track a "percentage of effort" as defined in the OMB A-21 regulations. |

Exclusion Fringe Group |

Select a group of fringe expenses to exclude from funding from the earnings combination code. If you leave this field blank, the system funds all fringe costs from the combination code. This field is available only when the Default Funding Source Option is Actual or Earnings. |

Redirect Combination Code |

If you have specified a fringe group, you can select a combination code to fund the fringe expenses included in the selected group. Individual fringe costs within the fringe group that have a funding source specified on the Dept Budget Deductions or Dept Budget Taxes pages are funded by those sources, not this redirect combination code. The system does not override the account associated with this combination code even if the appropriate override is selected on the Dept Budget Data page. |

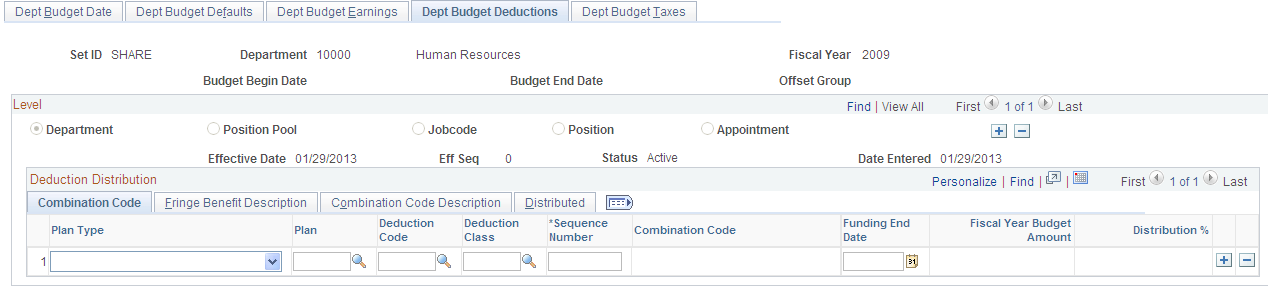

Use the Dept Budget Deductions (department budget deductions) page (DEPT_BUDGET_DED) to budget for employer-paid deductions in each department of your organization.

Navigation:

This example illustrates the fields and controls on the Dept Budget Deductions page.

Field or Control |

Description |

|---|---|

Deduction Budget Cap |

If you selected Per Earn/Tax/Ded as the Budget Cap value on the Dept Budget Date page, the system displays the Deduction Budget Cap field. Use this field to define budget caps individually for earnings, deductions, and taxes. Enter the deduction budget cap that you want to place on this budget level. The cap is used to ensure that the sum of all lower-level budgets doesn't exceed this higher-level budget. It isn't used for checking funds during the processing of encumbrances and actuals. |

Deduction Distribution

Establish multiple deduction-plan types and (optionally) specify a Funding End Date for each of those plans. Funding sources are defined using a combination code that represents a valid General Ledger ChartField combination.

Establish one entry for each budget level in which the deduction Plan Type, Plan, Ded Cd, and Ded Class are blank. This entry is the default funding source and is used as the funding for all deductions where a specific entry for a deduction type hasn't been established.

Field or Control |

Description |

|---|---|

Plan Type, Plan, Deduction Code,and Deduction Class |

Select a deduction plan type, plan, deduction code, and deduction class from the available options. |

Override |

Indicates if this funding source overrides the default funding source established on Dept Budget Earnings page. |

Note: If you make an entry in one of these fields (Plan, Deduction Code, or Deduction Class), you must enter all fields.

Use the Dept Budget Taxes (department budget taxes) page (DEPT_BUDGET_CTX) to budget for employer-paid taxes in each Canadian department of your organization.

Navigation:

This example illustrates the fields and controls on the Dept Budget Taxes page.

Field or Control |

Description |

|---|---|

Tax Budget Cap |

If you selected Per Earn/Tax/Ded as the Budget Cap value on the Dept Budget Data page, the system displays the Tax Budget Cap field. Use this field to define budget caps individually for earnings, deductions, and taxes. Enter the Tax Budget Cap that you want to place on this budget level. The cap is used to ensure that the sum of all lower-level budgets doesn't exceed this higher-level budget. It isn't used for checking funds during the processing of encumbrances and actuals. |

Tax Distribution

Establish multiple state or province taxes and tax classes and (optionally) specify a Funding End Date for each of those classes. Funding sources are defined using a combination code that represents a valid General Ledger ChartField combination.

Establish one entry for each budget level in which the deduction Tax Class, State or Province, and Locality (U.S. only) are blank. This entry is the default funding source and is used as the funding for all tax classes where a specific entry for a Tax Class hasn't been established.

Field or Control |

Description |

|---|---|

State or Province,Tax Class, and Locality |

Specify a budget for a particular type of tax. (For U.S. federal tax, enter $U. as the state) |

Override |

Indicates if this funding source overrides the default funding source established on Dept Budget Earnings page. |

Note: If you enter one of these fields (State/Province, Locality, or Tax Class), you must enter all fields.