Setting Up Encumbrance Definitions

To set up encumbrance definitions, use the Encumbrance Definition component (ENCUMB_DEFN).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ENCUMB_DEFN |

Create an encumbrance definition for taxes and deductions. |

|

|

ChartField Detail Page |

HMCF_HRZNTL_CFLD |

Use to select individual ChartField values or search for an existing combination code. |

PeopleSoft Human Resources uses the distribution information you enter on the Encumbrance Definition page to calculate an encumbrance amount for employer-paid taxes and employer-paid deductions. (The system doesn't calculate projected actuals.) It also uses this information to determine the funding sources for employer-paid taxes and deductions (but not for earnings: the funding source for encumbered earnings is defined on the Dept Budget earnings page).

If you choose not to encumber employer paid taxes and employer paid deductions, leave the Tax Distribution and Deduction Distribution sections of this page blank, but at a minimum, you must still establish each department on this page.

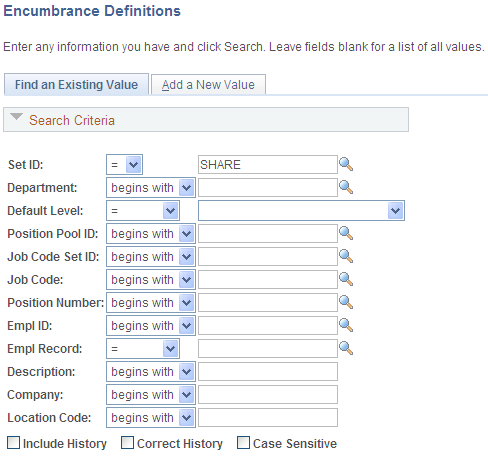

When you select Encumbrance Definition from the Define Commitment Accounting, Setup menu, the following search page appears.

This example illustrates the fields and controls on the Encumbrance Definition search page.

Using this search page, you can pinpoint the exact level of detail you want to see on the Encumbrance Definition page. Enter the SetID and Department of the encumbrance definition.

Select a Default Level by selecting one of the following options:

Appointment: Select if you are setting up the encumbrance definition at the appointment level. When you select this option, also select an EmplID. People may include full time employees, part time employees, contractors, and so on. Also indicate an Empl Record for this person.

Department: Select if you are setting up the encumbrance definition at the department level.

Jobcode: Select if you are setting up the encumbrance definition at the job code level. When you select this option, also select a valid Job Code.

Position: Select if you are setting up the encumbrance definition at the position level. When you select this option, also select a valid Position Number.

Position Pool: Select if you are setting up the encumbrance definition at the position pool level. When you select this option, also select a Position Pool.

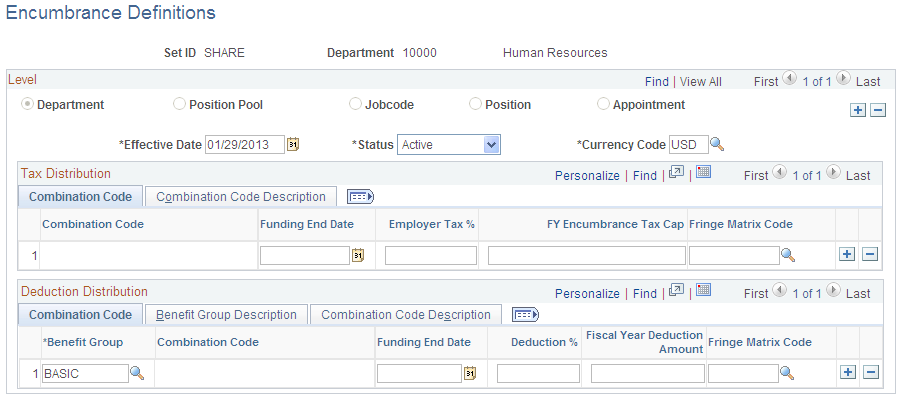

Use the Encumbrance Definitions page (ENCUMB_DEFN) to create an encumbrance definition for taxes and deductions.

Navigation:

This example illustrates the fields and controls on the Encumbrance Definitions page.

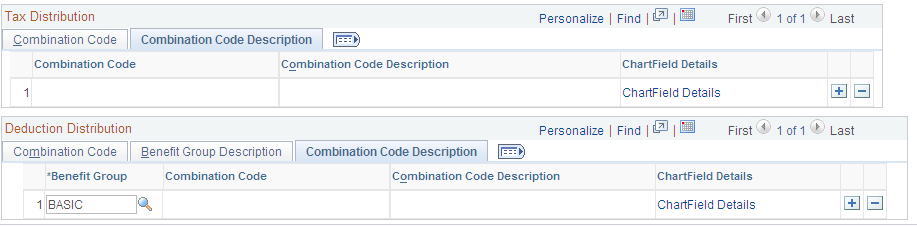

Combination Code

Both the Tax Distribution grid and the Deduction Distribution grids list the combination codes that you use for fringe encumbrances. The column that displays the selected combination code is read-only; to enter a combination code, access the Combination Code Description tab and select the ChartField Details link.

This example illustrates the fields and controls on the Encumbrance Definitions page, Combination Code Description tabs.

Field or Control |

Description |

|---|---|

ChartField Details |

Select the ChartField Details link in the Deduction Distribution group box, Combination Code Description tab, to access the ChartField Detail page, where you can search for an existing combination code or select a unique combination of ChartFields. The ChartField values are based on the general ledger ChartField values that you imported as part of the combination code. |

Funding End Date

You can optionally enter a funding end date for each combination code in both the Tax Distribution grid and the Deduction Distribution grid.

Field or Control |

Description |

|---|---|

Funding End Date |

Enter the date through which to create encumbrances. If you do not specify a funding end date, the encumbrance processes calculate fringe encumbrances through the end of the fiscal year. Otherwise, the encumbrance processes create encumbrances and pre-encumbrances up to the date you enter. This can result in partial-year fringe encumbrances for the current or future fiscal years. Note: If the funding end date for earnings (as entered on the Department Budget Earnings page) is earlier than the funding end date for fringe encumbrances, the system does not calculate future fiscal year fringe encumbrances past the funding end date for earnings. This cut off occurs because fringe encumbrance calculations are based upon the salary encumbrances, and once the salary encumbrances end, there can be no fringe encumbrances. If the Funding Source Information page has a funding end date for the combination code, and if the Department Budget Defaults page is configured to use that date as a default, then that date appears as a default value when you insert a row in either the Tax Distribution or Deduction Distribution grid. When checking to see if the Department Budget Defaults page is configured to use the default ending date, the system looks at the settings for the fiscal year that matches the fiscal year on the Encumbrance Process Control page. Note: To activate funding end date defaulting on the Encumbrance Definitions page, you must set up the Encumbrance Process Control page. See Defining Processing Parameters for Real-Time Budget Checking. |

Tax Distribution

Field or Control |

Description |

|---|---|

Employer Tax % or Fringe Matrix Code |

For each combination code, specify the percentage of salary to encumber for taxes. You can either enter a fixed percentage in the Employer Tax % field, or you can select a fringe matrix code. A fringe matrix code matches the employee or position to the appropriate salary range code, which in turn provides a percentage that is based on the salary for the employee or position. (Any additional amount specified in the salary range code is disregarded for tax encumbrances.) Because you must choose between entering a flat percentage and selecting a fringe matrix code, entering data in one of these fields makes the other one unavailable for entry. To switch which field you use, you must clear data from the field you don't want to use before you can enter data in the field that you do want to use. Leave both fields blank if you do not want to generate encumbrances or pre-encumbrances for employer-paid taxes. |

FY Encumbrance Tax Cap (fiscal year encumbrance tax cap) |

Enter the encumbrance tax cap amount per fiscal year. The encumbrance calculation only encumbers employer paid taxes up to this amount per fiscal year. Any employer paid taxes above and beyond this amount won't be encumbered. |

Deduction Distribution

Field or Control |

Description |

|---|---|

Benefit Group |

Select a benefit group. |

Deduction %, Fiscal Year Deduction Amount, and Fringe Matrix Code |

For each combination code, specify the percentage of salary to encumber for deductions in this benefit group. You can either one of the following:

When you enter data for one of these options, the other option is not available for entry. To switch which option you use, you must clear data from the fields that you don't want to use before you can enter data in the fields that you do want to use. Leave all three fields blank if you do not want to generate encumbrances or pre-encumbrances for employer-paid deductions. |