(USF) Administering Mass Pay Adjustments

To administer mass pay adjustments for federal workers, use the Mass Pay Adjustments USF (MASS_PAY_SETUP) and Create Mass Pay Adjustment USF (RUN_FGPY005) components.

This section provides overviews of mass pay adjustments and mass pay adjustment parameters and discusses how to define mass pay adjustments.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GVT_MPA_TYPE_TBL |

Define the percentage of the pay increase and the date that the pay adjustment will go into effect. In addition, adjustment control information, such as Action, Reason Code, and NOA code data is necessary for the SF50. |

|

|

GVT_MPA_ERNPGM_TBL |

Identify the pay plan to be included in the pay adjustment processing as well as the type of calculation to be used. Multiple pay plans can also be processed one at a time. |

|

|

Mass Pay Adjustment Pay Tables Page |

GVT_MPA_PAYTBL_SEC |

View the pay table associated with the mass pay adjustment. |

|

RUN_FGPY005 |

Indicate the parameters required to process the mass pay adjustments or, alternatively, to generate a report. You can process a single agency and pay adjustment type or multiple agencies and adjustment types. |

|

|

RUNCTL_FGHR029 |

Load salary adjustment information from a file into the system for a particular company. |

|

|

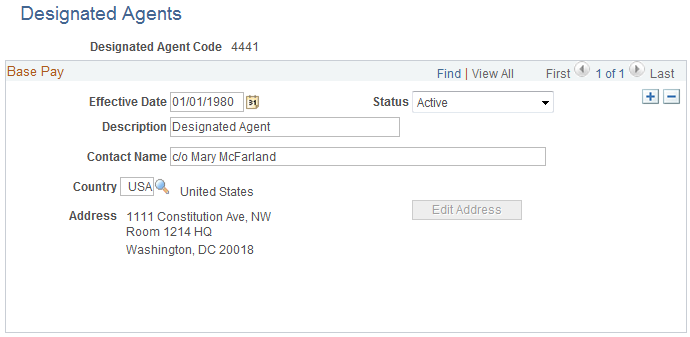

GVT_DESIG_AGT_TBL |

Enter contact and address information for another person to whom you may want to have your paycheck delivered. |

PeopleSoft HR for U.S. Federal Government enables you to administer and manage mass pay adjustments.

During the calendar year, the U.S. President or his or her pay agent may authorize changes in the salary structures for executive branch workers covered by Title 5 of the United States Code. This authority extends to other workers covered under other sections of Title 5, as well as some workers covered under other sections of the law.

The President may also authorize changes in geographic comparability adjustments, such as Locality Pay Adjustments, Interim Geographic Adjustments, or Special Pay Adjustments for Law Enforcement Officers, authorized by the Federal Employees Pay Comparability Act (FEPCA) and administered under 5 USC 5304.

The U.S. Congress, as well as heads of certain agencies, has the discretionary authority to adjust pay for certain categories of their workers. These authorities generally authorize pay adjustments for salaried workers to be effective government-wide at the beginning of the first pay period of the new calendar year.

You complete these steps to administer mass pay adjustments:

Define mass pay adjustment parameters on the Mass Pay Type page and the Mass Pay Plan page.

Process a pay adjustment for workers on the Create Mass Pay Adjustments page.

Generate a mass pay adjustment report.

Before performing mass pay adjustments, you must define Mass Pay Types and Mass Pay Plans for each Mass Pay Adjustment Type. The Mass Pay Adjustment Types that are available include:

Annual Federal Wage Service

FWS Special Rate Increase

GS Annual Pay Adjustment

GS Special Rate Increase

LEO Special Pay Adjustment

Locality Pay Adjustment

Note: Mass pay adjustments can be processed using either a percentage increase or a calculated increase using the updated pay table salaries. Once a pay adjustment is calculated, you must update the Next Scheduled Pay Adjustment data in the Salary Plan table.

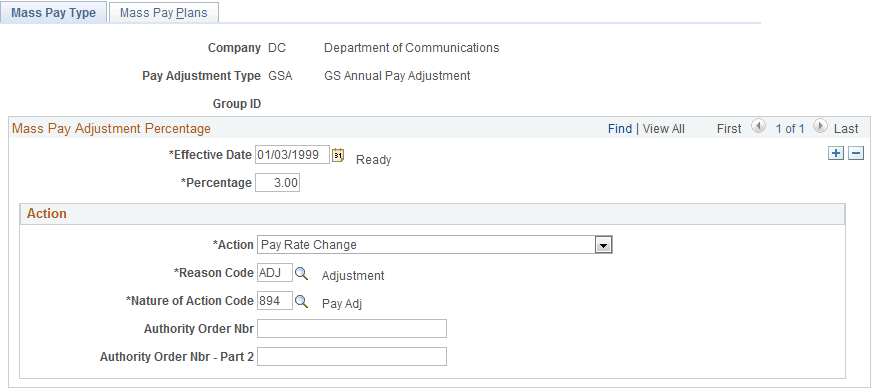

Use the Mass Pay Type page (GVT_MPA_TYPE_TBL) to define the percentage of the pay increase and the date that the pay adjustment will go into effect.

In addition, adjustment control information, such as Action, Reason Code, and NOA code data is necessary for the SF50.

Navigation:

This example illustrates the fields and controls on the Mass Pay Type page.

Field or Control |

Description |

|---|---|

Group ID |

Displays the group ID that you entered in the search criteria to access the page. Specifying a group ID enables the FGPY005 application engine program to process mass pay adjustments for that group of employees rather than all employees, thereby reducing performance time. |

Percentage |

Specify the percentage of increase for the pay adjustment. If the calculation type on the Mass Pay Plan equals Percent, the system will use the value in this field. The Effective Date and Percentage entered become part of the key fields in the Mass Pay Plan table. |

Action |

Specify the appropriate action code for this mass pay adjustment. The value selected here will be reflected on the Data Control page at the worker level. |

Reason Code |

Enter the corresponding reason code for the specified action. The value selected here will be reflected on the Data Control page at the worker level. |

Nature of Action Code |

Enter the nature of action (NOA) code that justifies this mass pay. |

Authority Order Nbr (authority order number) |

Use this free-format field to enter the executive order number or other legal authority number that identifies which executive order was issued for pay raises. This information will print on SF50. |

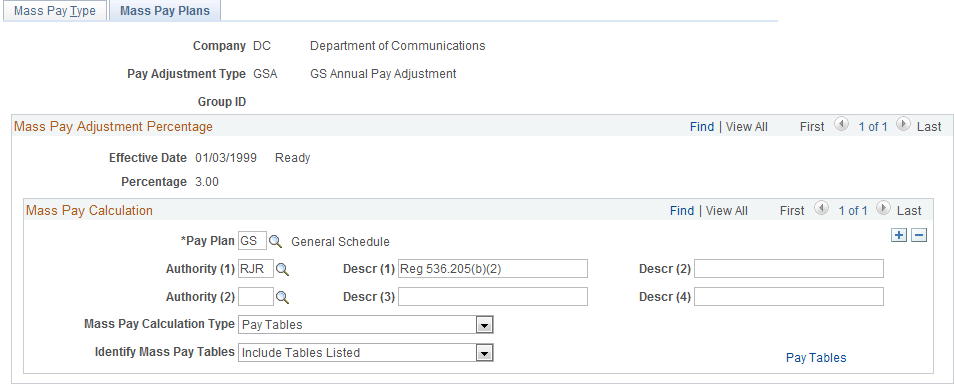

Use the Mass Pay Plans page (GVT_MPA_ERNPGM_TBL) to identify the pay plan to be included in the pay adjustment processing as well as the type of calculation to be used.

Navigation:

This example illustrates the fields and controls on the Mass Pay Plans page.

Field or Control |

Description |

|---|---|

Group ID |

Displays the group ID that you entered in the search criteria to access the page. Specifying a group ID enables the FGPY005 application engine program to process mass pay adjustments for that group of employees rather than all employees, thereby reducing performance time. |

Pay Plan |

Enter the pay plan for the group of workers to receive the pay adjustment. You can include multiple pay plans, if necessary. |

Authority (1) and Authority (2) |

Enter the legal authorities for the mass pay adjustment. |

Mass Pay Calculation Type |

Specify the type of calculation to be used in pay adjustment processing: Pay Tables, Percentage, or Special Calculation Routine. |

Identify Mass Pay Table |

Specify which pay table entries should be included or excluded from the pay adjustment. Values are Exclude Tables Listed, Include All For Pay Plan, and Include Tables Listed. Unless all pay tables are to be included in processing pay adjustments, the Pay Tables link will appear, enabling you to specify the appropriate selections. |

Pay Tables |

Click to access the Mass Pay Adjustment Pay Tables page (GVT_MPA_PAYTBL_SEC) to specify the pay tables to include or exclude when processing this mass pay adjustment. |

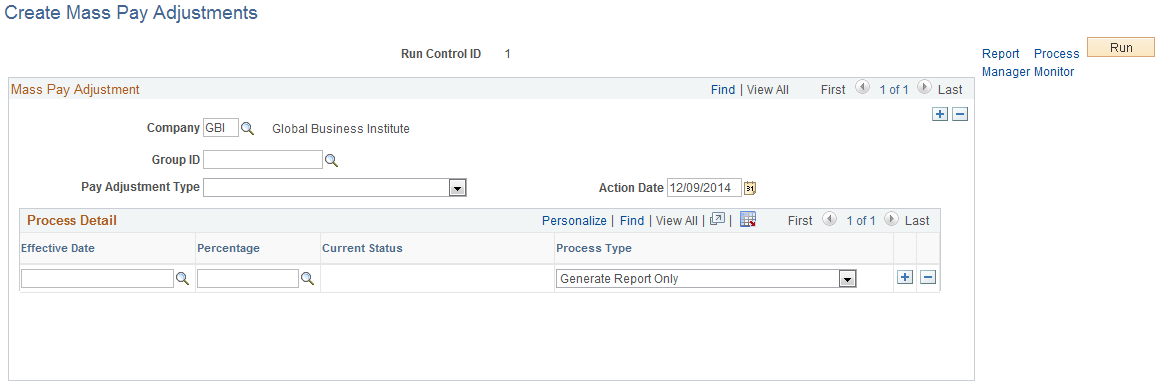

Use the Create Mass Pay Adjustments page (RUN_FGPY005) to indicate the parameters required to process the mass pay adjustments or, alternatively, to generate a report.

You can process a single agency and pay adjustment type or multiple agencies and adjustment types.

Navigation:

This example illustrates the fields and controls on the Create Mass Pay Adjustments page.

Field or Control |

Description |

|---|---|

Group ID |

Select the group ID to process. Selecting a group ID enables the FGPY005 application engine program to process mass pay adjustments for that group of employees rather than all employees, thereby reducing performance time. |

Pay Adjustment Type |

Select the type of pay adjustment to be processed by agency. You can process multiple agencies and pay adjustment types. |

Percentage |

Specify the percentage of the pay adjustment. |

GVT Mass Pay Adj Process Act (government mass pay adjustment process action) |

Indicate whether you want to generate a report only or process the action and produce a report. |

Important! Run the Mass Pay Adjustments Application Engine process before you run the Mass Pay Adjustments SQR report.

Note: Make sure that an entry for Mass Pay (FGPY005) for the USFED transaction appears on the Transaction Setup page (). Click the Batch Programs tab to verify that the USFED transaction is included.

The Mass Pay Adjustment report lists workers who cannot be processed. For one condition or another, the workers listed in this error report failed to be updated.

You can generate this report only after running the pay adjustment process. This report should not be run with the processing of the adjustment since it relies on a table that is created by that process—otherwise, no results will be generated. If you run this report before processing the Mass Pay Adjustment, you will be able to determine which workers have an exception. Then, you can process the exceptions manually.

These types of exceptions will appear in the report:

Pay Rate Determinant of worker—review and process manually.

Future effective-dated action detected—review and process manually.

Duplicate action found for transaction—review and process manually.

No pay rate found for the worker.

No hourly conversion factor for worker standard hours.

The FEGLI base rate is not updated because of the override flag.

Once the Mass Pay Adjustment process executes, the Mass Pay Type Definition you created will be updated with a status of Processed.

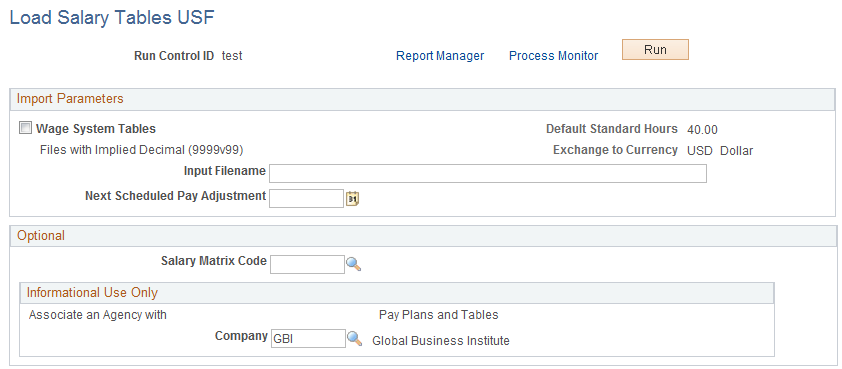

Use the Load Salary Tables USF page (RUNCTL_FGHR029) to load salary adjustment information from a file into the system for a particular company.

Navigation:

This example illustrates the fields and controls on the Load Salary Tables USF page.

Field or Control |

Description |

|---|---|

Wage System Tables |

Select this check box if you want the system to import information from the tables containing data for wage system employees. |

Input Filename |

Enter the path to the file from which you want to load salary table information. |

Next Scheduled Pay Adjustment |

Select or enter the date of the next scheduled pay adjustment. |

Salary Matrix Code |

Select the salary matrix code. Salary matrices define the common characteristics of a salary plan. |

Company |

Select the name of the company for which you wants to load salary table information. |

Use the Designated Agents page (GVT_DESIG_AGT_TBL) to enter contact and address information for another person to whom you may want to have your paycheck delivered.

Navigation:

This example illustrates the fields and controls on the Designated Agents page.

Note: In the Payroll Interface application on the Payroll Options 2 page, you can enter a different location code to use as a sort option for printing checks. In this case, the system uses the designated agent address and transmits the check for office delivery. If you select the Other Location option, you also must select a setID and a location code. On the Address Information page in Workforce Administration, the designated agent identifies the person designated in the employee's agency to whom the employee's check is mailed. This value is prompted from the Designated Agent table.

Field or Control |

Description |

|---|---|

Description |

Enter Designated Agent in this field. |

Contact Name |

Enter the name of the person to whom you want the company to send your paycheck. |

Country |

Select the country in which the address is located. |

Address |

Displays the address where the paycheck will be sent. |

Edit Address |

If you are entering a new address or if the page is in correction mode, the system activates this button. Click it to enter a new address or overwrite the old one. |