Setting Up Additional Salary Package Components

This topic discusses how to define salary package component liabilities.

To set up additional salary package components, use the Additional Components (PKG_ADD_CMP_TBL) component.

Many components that make up your salary package might incur additional liabilities, such as FBT, GST, or payroll tax. The cost of these liabilities can be borne by either the employer or the employee. Define the cost liability and who will carry it—the employee or the employer—as additional components.

Note: Additional component codes must be unique. You cannot associate an additional component with a component of the same name. Consider this carefully when defining codes for both components and additional components. The system warns you when you use a duplicate component code.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PKG_ADD_CMP_TBL |

Define the liabilities associated with each of your salary packaging components. Determine the level of package remuneration in which to include these liabilities Total Package Value (TPV) or Total Employment Cost (TEC). |

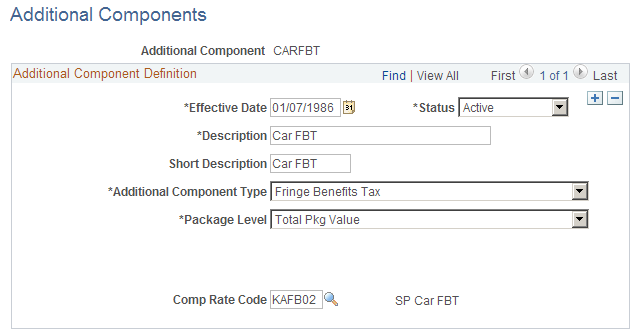

Use the Additional Components page (PKG_ADD_CMP_TBL) to define the liabilities associated with each of your salary packaging components.

Determine the level of package remuneration in which to include these liabilities Total Package Value (TPV) or Total Employment Cost (TEC).

Navigation:

This example illustrates the Additional Components page.

Additional Component Definition

Field or Control |

Description |

|---|---|

Additional Component Type |

The type of liability the additional component represents. Your choice determines the tax tables and rates the system references when it calculates the salary package component liability. Select Fringe Benefits Tax, Goods & Services Tax, or Payroll Tax. The value you select here controls the display of the Gross Up Calculation field. |

Package Level |

Enables you to set how this additional component affects the employee's package. Select: No Effect: Has no effect on the employee's package either in total employee cost or total package value. Typically used where you selectGoods & Services Tax in theAddl Component Type field. Total Empl Cost: Usually relates to the cost or oncost that is borne by the employer as a result of employing the employee. If you select this option, you could be indicating that the employer will pay the cost of the liability. Total Pkg Value: Typically used where the cost or oncost is borne by the employee. An example of this would be FBT. The value of this additional component forms part of the employees overall package. Selecting this could indicate that the employee will pay the liability. |

Gross up Calculation |

This field appears only when you select Goods & Services Tax in the Additional Component Type field. The type of component this additional component relates to determines the calculation method. There are, however, no set rules for components and calculation rules. You must select one of the following options:

See Employee Salary Package - Additional Comp Page. Input tax credits are tax credits that a company can claim back for the GST paid on the supply of a good or service. Where that good or service forms part of an employee's salary package, the calculation of the total value of the package item changes if the company is claiming part of the cost back as an input tax credit. |

Comp Rate Code (compensation rate code) |

Enables you to utilize the multiple components of pay functionality for your salary packaging. The Enrolment process creates the compensation rates on the employee's Job Data - Compensation page. If you are using Global Payroll, you can link salary package components and additional components to different types of PeopleSoft payroll entities to facilitate the payment of earnings and deductions through your payroll system. Note: Only compensation rate codes with the Salary Packaging check box selected on the Comp Rate Code Table can be assigned to package components and additional components. You must also define the rate code as a flat amount rate code type. |