Setting Up Salary Packaging Human Resources and Global Payroll Tables

To set up salary packaging payroll components, use the Pay Calendar-GP (PKG_CALENDAR_GP), Pay Calendar-HR (PKG_CALENDAR_TBL), the Comp Rate Code Table (COMP_RATECD_TBL), and the Included Earnings/Deductions (PKG_ERN_DED_INCL) components.

This topic provides overviews of salary packaging setup and discusses how to set up human resources and global payroll tables for salary packaging.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PKG_CALENDAR_TABLE |

Create pay calendars for your salary packaged employees in specific pay groups. Used for package modelling so that it can determine the budget values on the employee's package. Use only if you have both Global Payroll and Human Resources installed. |

|

|

PKG_CALENDAR |

Create and schedule pay calendars for your salary packaged employees in specific pay groups. Used for package modelling so that it can determine the budget values on the employee's package. Use if you have Human Resources installed. |

|

|

Comp Rate Code Table Page (compensation rate code table page) |

COMP_RATECD_TBL |

Define compensation rate codes. |

|

PKG_ERN_DED_INCL |

Specify the non-packaged earnings and deductions elements that appear on the Package Summary component after you run the expense calculation process. |

|

|

GPAU_PYGRP_EXT |

Define additional information specific to Australian pay groups, such as the pay frequency for salary packaging. The frequency you select enables the budgeting capabilities in the actual salary package, selecting the frequency lets the system know the type of frequency to divide the component totals |

|

|

GPAU_PSLP1 |

Create sections of earnings and deductions, select description options, and set the element components that the payslip displays. This information interrelates to salary packaging setup as well. |

Administer Salary Packaging relies on information defined in Global Payroll and Human Resources to ensure accurate payroll processing and to facilitate expenditure monitoring. When setting up your Administer Salary Packaging business process, identify the different forms of remuneration and define the Global Payroll and Human Resources components that you'll use in your salary packages.

Set up the earnings and deductions elements that represent the different forms of remuneration in your organization. Although you establish these tables as part of your Global Payroll system, review them for use with Salary Packaging. Attach earnings and deductions elements to your package components using the Package Components - Expense Data page. These elements are used in the expense calculation process.

Note: Assign a unique earnings or deductions element for all package components, which enables you to track expenditure for each individual component. If you don't define and link different elements for each earning or deduction component, the system aggregates your salary packaging expenditures when it calculates them. As a result, you can't identify expenditures against individual components.

When defining your salary package components, you can link them to business expenses to help you track expenditures against the appropriate components. You must have a unique code for each package component (identified as an expense payroll type) to facilitate reconciliation of package expenditure.

Note: Monitoring expenditure for Administer Salary Packaging is possible only if you are using Global Payroll.

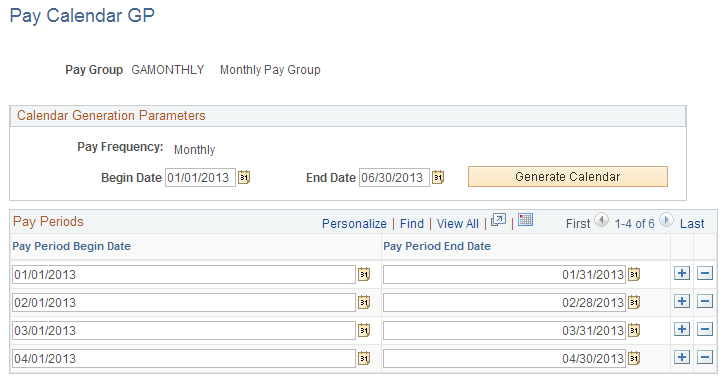

Use the Pay Calendar GP page (PKG_CALENDAR_TABLE) to create pay calendars for your salary packaged employees in specific pay groups. This information is used for package modelling so that the system can determine the budget values on the employee's package.

Note: Use only if you have both Global Payroll and Human Resources installed.

Navigation:

This example illustrates the Pay Calendar GP page.

Calendar Generation Parameters

Field or Control |

Description |

|---|---|

Pay Frequency |

Value comes from the Pay Frequency field on the Pay Groups AUS page in Global Payroll— This group box enables you to set up default pay frequencies for the pay groups you use as part of Salary Packaging. The Package Calendar Table page also retrieves the frequency you selected. |

Generate Calendar |

Click this button to build a pay calendar. Note: The calendars that you generate on this page are used to determine the periods for budgeting purposes only. You must set up calendars before you can use the Administer Salary Packaging budgeting feature. Use the Pay Calendar GP page if you have both Global Payroll and Human Resources installed. If you have only Human Resources installed, use the Pay Calendar GP page. Both pages have the same functionality, except Global Payroll uses the pay group key and Human Resources uses the company/pay group key. |

Use thePay Calendar HR - Pay Calendar Table page (PKG_CALENDAR_TABLE) to create pay calendars for your salary packaged employees in specific pay groups. This information is used for package modelling so that the system can determine the budget values on the employee's package.

Note: Use only if you have Human Resources installed and you do not have Global Payroll Installed.

Navigation:

This page functions the same as the Pay Calendar GP Page except that the Global Payroll version of the page uses the pay group key, while the Human Resources version of the page uses the company/pay group key.

Use the Comp Rate Code Table (compensation rate code table) page (COMP_RATECD_TBL) to define compensation rate codes.

Navigation:

When implementing Administer Salary Packaging, define and review the compensation rate codes for your salary packages on this page. When defining your salary package components and additional components, you can link them to compensation rate codes. After the employee is enrolled in the package, these are stored on the employee's Job Data - Compensation page

Maintained Via Package Only

If you are going to use pay components with Administer Salary Packaging, select the Maintained via Package Only check box in theAustralian Salary Packaging group box on the Comp Rate Code Table page. This check box, combined with other information on the employee's job record, works to maintain salary package integrity.

Selecting this check box prompts a warning message when a salary packaged employee's compensation rate codes are changed manually. The following warning message appears if you update or change an employee who has these rate codes assigned to them: "Salary Packaging Compensation Rate Code fields should be changed through Salary Packaging menu."

Note: Set up your Administer Salary Packaging rate codes with a rate code type of flat amount and a frequency of A (annual).

Rate codes are attached to salary package components and are enrolled on the employee's Job Data - Compensation page. If the rate code is managed by salary packaging, the rate matrix functionality can not be used.

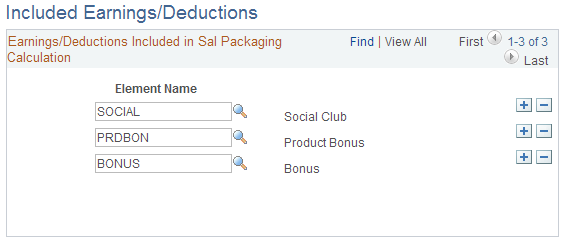

Use the Included Earnings/Deductions page (PKG_ERN_DED_INCL) to specify the non-packaged earnings and deductions elements that appear on the Package Summary component after you run the expense calculation process.

Navigation:

This example illustrates the Included Earnings/Deductions page.

Field or Control |

Description |

|---|---|

Element Name |

Specify the non-packaged earnings and deductions elements that you want to appear on the Package Summary page after you run the expense calculation process. You can then view the total value of any deductions, earnings, and expenses that are not included as a packaged component but have been paid out to the employee in the payroll. You can see if expenditure outside the package has occurred for the employee and quickly respond to the non-packaged payments. These types of payments may prompt you to perform a package review or some other corrective action. |

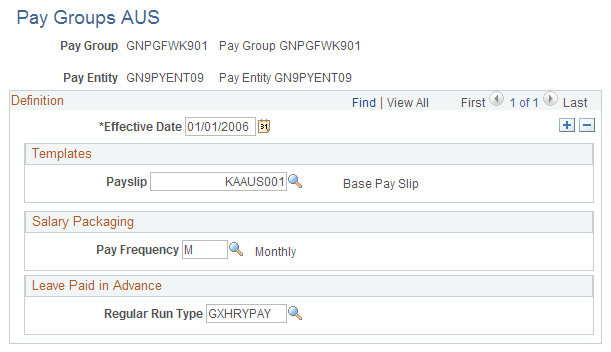

Use the Pay Groups AUS page (GPAU_PYGRP_EXT) to define additional information specific to Australian pay groups, such as the pay frequency for salary packaging.

The frequency you select enables the budgeting capabilities in the actual salary package, selecting the frequency lets the system know the type of frequency to divide the component totals

Navigation:

This example illustrates the Pay Groups AUS page.

Salary Packaging

The pay frequency is used as the default value for the pay groups that are used as part of the administer salary packaging. The defined value is also retrieved by the package calendar table to divide the component totals that budgeting uses in salary packages.