Creating Payees

This topic provides overview of payee record creation and of record numbers for payees. It then and discusses how to create pension payees.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_RT_EMP_SETUP |

Create payee records. The Personal Data and Job Data links on this page provide access to the HR pages that you use to finish entering payee information. |

|

|

Personal Data - Payee Name Page |

PERSONAL_DATA1 |

Set up a payee's personal data, including date of birth, gender, marital status and national identification. |

|

Personal Data - Biographical Data Page |

PERSONAL_DATA2 |

Add and view payee name, addresses, phone information, and email addresses. |

|

Personal Data - Original EMPLID Page |

PERSONAL_DATA_PA |

View the originating employee record that is associated with the payee record. |

|

Job Data - Job Data Page |

PA_RA_JOB_DATA1 |

Set up a payee's new job data. |

|

Job Data - Benefit Program Data Page |

PA_JOB_DATA_BENPRG |

Record information that a plan uses to determine eligibility for retiree benefits. |

You create a payee record based on an "originating employee." For a retiree, you base the payee record on the retiree's employee record. For a beneficiary or QDRO alternate payee, you base the payee record on the employee record of the person who actually earned the benefit.

To create retirees and terminated vested deferred payees, you start on the Create Payee page and from there access the Personal Data and Job Data pages to update personal and job data about a payee. After you complete the fields on each page and save the page, the system returns you to the Create Payee page, and the links are replaced by messages indicating that the personal and job data is complete.

To create beneficiaries and QDRO payees, you use the Create Payee page, which includes fields from the Personal Data (PERSONAL_DATA) and Job Data (JOB_DATA) components.

Pension benefits are always associated with the employee who earned the pension. Therefore, when you establish payee records, you do so based on an existing employee ID.

You use the Create Payee page to create payee records. Because you establish a payee based on an existing employee, you enter this page with an Update/Display action using the existing employee ID.

Selecting a Record Number

When you set up a retiree record, enter the person's existing employee ID and enter the record number of the active employment record.

When you set up a beneficiary or QDRO alternate payee record, enter the employee ID of the employee who earned the benefit that you are now distributing to a beneficiary or alternate payee.

Reviewing Examples of Record Numbers

Consider the case of an employee, Susan Martinez, her beneficiary, Salvatore Martinez, and her former husband, Carl Vega. Carl was granted part of her pension in their divorce settlement and is therefore a QDRO alternate payee.

When Susan retires, you set up her payee record as record number 1. When she dies, you will set up Salvatore's record. You access the Create Payee page using Susan's employee ID and record number 1.

If Susan receives benefits from two plans, she has two payee records, record number 1 and record number 2. When Susan dies, you set up two payee records for Salvatore, one under Susan's record number 1 and one under her record number 2.

Because employees do not receive pension benefits under an active employment record, you would not set up a beneficiary under an employee's active employment record except in cases of a preretirement survivor annuity, where the employee dies before retiring and pension benefits are due to the beneficiary.

When you set up a beneficiary record under the record number used to pay the original retiree, this provides a crucial link between the beneficiary and the benefit that the retiree receives. This link enables the system to maintain the appropriate beneficiary amounts as the retiree receives cost-of-living adjustments, and to automatically use the adjusted beneficiary amounts when you set up beneficiary payments.

Note: If a retiree has multiple payee job records corresponding to separate plans, you must set up beneficiaries separately for each plan.

On the other hand, payments to QDRO alternate payees do not depend on the original employees' payments. The two are related, of course, since the original employee's benefit is offset by the amount set aside for the alternate payee. However, you run a separate calculation to determine an alternate payee's pension benefit, rather than basing it directly on the original employee's calculation.

For this reason, you set up QDRO alternate payee records under the originating employee's active service record. This is handy because you typically create an QDRO alternate payee's record at the time of a divorce, while you do not necessarily create an employee's payee record until the employee is ready to retire, which could be years later.

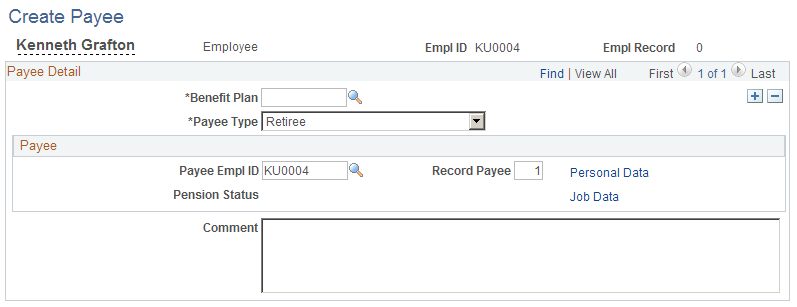

Use the Create Payee page (PA_RT_EMP_SETUP) to Create payee records.

Navigation:

This example illustrates the fields and controls on the Create Payee page.

Note: If there are already payee rows on the page—for example, for an employee's own payee records—insert a new payee row.

Payee Detail

Field or Control |

Description |

|---|---|

Benefit Plan |

Enter the pension plan that is the source of the pension benefit. If a payee will receive pension benefits from more than one plan, you have to create separate payee records for each plan. You can set up additional retiree and QDRO alternate payee records by simply inserting additional rows under the same payee ID and record number (Rcd# Payee). If a beneficiary requires multiple payee records, you have to access the page using different record numbers in order to correctly associate each beneficiary record with the corresponding retiree record. |

Payee Type |

Select one of the following values:

|

Dependent/Beneficiary ID |

If the payee type is Beneficiary or QDRO Alternate Payee, the payee record is based on an existing dependent/beneficiary record, rather than an existing employee record. In this case, the Dependent/Beneficiary ID field appears. You use it to identify the existing dependent/beneficiary record for a non-employee. You can prompt to see a list of the existing dependents and beneficiaries. Note: You can establish a payee record only for the beneficiaries or QDRO alternate payees who already exist as dependents or beneficiaries of the original employee. If you need to add a beneficiary or QDRO alternate payee, access the Perform Election Entry (BAS_ELECTION_ENTRY) - Dependents/Beneficiaries, using the employee ID of the original employee. You can give a QDRO alternate payee the dependent or beneficiary type QDRO Rec (QDRO recipient). |

Payee Empl ID |

This is the payee's employee ID. Retirees and terminated deferred-vested employees use the same IDs that they used as employees. For this reason, the value that appears in the EmplID field also appears by default in the Payee ID field. Note: Do not change this value for retirees or terminated vested employees. If you do, you will not be able to complete the Create Payee process. An individual who has multiple roles—for example, an employee and a beneficiary of another employee—needs a separate payee record number for each role. Use a naming standard for Employee ID's that is suitable for your needs. Devise a naming standard for beneficiaries and QDRO alternate payees. Adding a suffix to the originating employee's ID clusters beneficiaries and QDRO alternate payees with the originating employee. Using prefixes, one for beneficiaries and one for QDRO alternate payees, clusters everyone with the same payee type. When you set up a Beneficiary or a QDRO Alternate Payee, use an existing Employee ID if this Beneficiary or QDRO Alternate Payee already has an Employee ID. Enter a new Payee ID if this person does not have an Employee ID. |

Record Payee |

Enter the record number for the payee record that you are creating. If a person retires under multiple plans and thus requires multiple record numbers, you can continue to number them sequentially. You might set up a standard that associates certain record numbers with certain plans. For example, you might always use record number 1 for Plan A payees and record number 2 for Plan B payees. For a Beneficiary or a QDRO Alternate Payee who already has an existing Employee ID and employee record number, enter a new employee record number. If a Beneficiary or a QDRO Alternate Payee does not already have an existing Employee ID and employee record number, you can use any record number that is suitable for your needs. |

Personal Data and Job Data |

Click the Personal Data or Job Data link to view a payee's pension status on the personal and job data records. When you complete the information on the Personal Data and Job Data pages and save the records, the system returns you to the Create Payee page. The links are replaced by messages indicating that the data is complete. Note: The system automatically sets the Person Type field, displayed in the Payee Personal Data component, to Pension Payee. For non-employees, data from the dependent/beneficiary record is automatically transferred to the personal data record. |

When you click the Personal Data and Job Data links on the Create Payee page, you access pages that are nearly identical to those found in the Personal Data (PERSONAL_DATA) and Job Data (JOB_DATA) components of Human Resources. This section discusses only the fields that affect Pension Administration.

Personal Data - Payee Name Page

Verify that this information is correct and enter new information if required. You must click the OK button to save the data, even if no changes are made.

Field or Control |

Description |

|---|---|

Edit Name |

Select this link to access the Edit Name page. |

Personal Data - Biographical Data Page

Verify that this information is correct and enter new information if required. You must click the OK button to save the data, even if no changes are made.

Field or Control |

Description |

|---|---|

Add Address Detail and Edit/View Address Detail |

Select these links to access the Address History page. On the Address History page, select the Update/View Address or Add Address links to access the Edit Address page. Use the Edit Address page to add or edit addresses. |

Personal Data - Original EMPLID Page

The display-only fields on this field help you track the origins of non-employees in the system.

Field or Control |

Description |

|---|---|

Originating Empl ID |

The Employee ID of the originating employee. For retirees, this will be the same ID. In fact, comparing the ID to the Originating Emplid is a quick way to ascertain whether the payee is a retiree or a non-employee. Note: When you first enter a payee's personal data (that is, when you come to this page from the Create Payee page) this page displays the personal data that already exists in the HR personal data record. None of this data is permanent until you save. In particular, the newly assigned person type Pension Payee on the second page needs to be saved. Be sure to review this data and make appropriate corrections. For example, there may be a new address. |

Original Dependent Beneficiary |

For non-employees (beneficiaries and QDRO alternate payees), the Original Dependent Beneficiary tells you the person's original ID from the dependent/beneficiary table. This is the value you put in the Dep/Benef field on the Create Payee page. |

When you have completed this information for Retiree or Terminated Deferred Vested payee types on the Payee Name, Biographical Data and Original EMPLID pages, click the OK button to save the record and return to the Create Payee page. The system will change the payee to a person type of Pension Payee.

Note: Be sure to save the Payee Name and Biographical Data pages even if you do not make any manual changes. If you do not save, the Person Type field does not get set to Pension Payee, and the record is not recognized as a payee record.

Job Data - Job Data Page

Job Data, the first page in the Payee Job Data component, displays selected fields and data from the job record. This payee job is completely independent of the employee's active employment job. Normally, your human resources staff is responsible for maintaining this record; it is not important to pension processing that the termination or retirement be entered into the active employment record.

Field or Control |

Description |

|---|---|

Payroll Status |

The system automatically sets the Payroll Status to Retired - Pension Administration based on the fact that you created this job using Pension Administration. If you change the Action to Termination, or if you add a new row with a termination action, the employee status for that row will automatically switch to Retired - Pension Paid Out. Because this is a payee record and not an employee record, the termination action does not kick off a termination workflow. The payroll status does not affect pension processing, but it can matter to your other HCM applications. Either of the two pension-related payroll statuses enables other HCM applications to recognize that this is a payee job record. Therefore, those applications will filter this record from certain processes, such as COBRA processing, that apply to active employees only. |

Effective Date |

The Effective Date defaults to the current date. For retirees and terminated deferred-vested employees, you should change it to the termination or retirement date. For beneficiaries, use the day after the original employee died. For QDRO alternate employees, use the date on the court QDRO. |

Action / Reason |

The Action / Reason defaults to Retirement regardless of the payee type. |

Company |

This is a very important field because tax reporting is based on companies. If you use Payroll for North America, you must select a company with a tax reporting type of 1099R. Typically, there is a company for each retirement plan; the company you enter will correspond to the plan you entered on the Create Payee page. If an employee is getting benefits from more than one plan, you will have to create another retiree record after you return to the Create Payee page. You need a new job record. |

Tax Loc (tax location) |

This is required for Payroll for North America processing. Pension Administration assumes you pay retirees using a third-party trustee, rather than Payroll for North America, and therefore does not require this field. |

Benefit Record Number, Service Date, Employee Classification, and Union Code |

These fields are used by Benefits Administration. If you use Benefits Administration for retiree benefits, be sure you understand how the Benefit Record Number affects retiree benefit eligibility. Compensation rate, which does not appear on this page but which is relevant to Benefits Administration, is automatically set to zero. |

Most of the other fields (for example, Standard Hours) are not relevant to a retirement job. Some of the fields are required for all jobs and therefore appear on the page. Others might be of interest if you were to access the active employee job for a pension payee, if for example, if you wanted to look at the union code history.

You can accept any defaults for these fields or, if there are no defaults, enter some standard value in these fields.

Note: Remember that this page uses the same table that stores active employee job data, and there are a number of fields that are not displayed. Although these fields are irrelevant to pension, be aware that they have the same default values as employee job records.

Job Data - Benefit Program Data Page

The Benefit Program Data page includes information used for Benefits and Benefits Administration. If you are using either of these applications for retiree benefits, enter the appropriate benefit eligibility information here.

When you have completed this information, save the record to return to the Create Payee page.