Adjusting Paychecks

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_PAY_REV |

Run the check reversal and adjustment process. |

|

|

Reverse/Adjust Paycheques Page |

RUNCTL_PAY_REV |

Run the cheque reversal and adjustment process. The Reverse/Adjust Paycheques page is similar to the Reverse/Adjust Paychecks Page. |

|

Paycheck Earnings Page |

PAY_CHECK_E |

View adjusted checks. |

|

Paysheet Page |

PAY_SHEET_ADD_S |

View and update the paysheet to affect the Pay Calculation process. |

There are two segments to the check adjustment process: a reversal of the incorrectly issued check and an adjustment.

When you adjust a paycheck, there are three possible outcomes:

No change in net pay (such as correction of taxing locality).

The company owes the employee money.

In this situation, the system produces a check for the amount owed.

The employee owes the company money.

In this case, you can put the amount into an arrears balance to be taken out of subsequent paychecks. Or you can attempt to get the money back from the employee by other means.

Use the Reverse/Adjust Paychecks page to both adjust and reverse paychecks.

Note: After being confirmed, adjustment checks cannot be adjusted. The system does not perform adjustments to online checks.

To process adjustments, the system uses a special deduction called Net Pay Adjustment with a deduction code of NETPAY. Before processing adjustments, you must set up this deduction code on the Deduction and the General Deduction tables and add it to the Company General Deductions table. You can use the NETPAY deduction that is supplied with the demonstration database as an example.

During the reversal step of the adjustment process, the system reverses the original check, producing a calculated check reversal. It does this by subtracting a NETPAY deduction equal to the employee's net pay on the original check.

If the adjustment results in the employee owing the organization, you must have set up an adjustment deduction code and a corresponding adjustment earnings code that the system uses to process adjustments of this type.

When you set up the adjustment earnings code, you link it to the corresponding adjustment deduction code through the Payback Deduction Code field on the Earnings Table - Taxes page.

Setting Up an Adjustment Deduction Code

An adjustment deduction code is necessary to process check adjustments for which the employee owes the company money. If you have not already done so, you can set up a generic adjustment deduction code, such as PAYADJ. Alternatively, you can establish several such deduction codes, one for each negative adjustment payback situation you're likely to encounter, but each would require a corresponding adjustment earnings code. For example, if you're adjusting checks that were calculated using the wrong taxing jurisdiction, you could set up a tax adjustment deduction code: TAXADJ.

To set up the adjustment deduction code:

Set up the Deduction table.

On the Deduction Table - Process page, select the Deduction Arrears Allowed check box and enter the appropriate general ledger expense and or liability accounts.

Set up the General Deduction table.

If you use the generic PAYADJ code, the General Deduction table is set by default with the information needed to calculate the payback adjustment deduction.

If you choose to specify your own deduction for this purpose, you must define the code on the General Deduction table with your own calculation routine and specifications.

Set up the Company General Deductions table.

For each company, add each adjustment deduction code in the Deduction Code column.

Setting Up an Adjustment Earnings Code

An adjustment earnings code is necessary to process check adjustments for which the employee owes the company money. Use a suitable code to designate this earnings, such as ADJ.

To set up the adjustment earnings code, use the Earnings and the Earnings Program tables.

Define the earnings code on the Earnings Table - General page:

Field or Control

Description

Payment Type

Select Either Hours or Amount OK.

Effect on FLSA (effect on Fair Labor Standards Act)

Select None.

Eligible for Retro Pay

Not used for adjustment earnings.

Set up the Earnings Table - Taxes Page:

Field or Control

Description

Payback Deduction Code

Enter a deduction code here to link to the earnings code. During the pay calculation process for the paycheck reversal/adjustment, the system creates an arrears balance for this deduction that is equal to the amount of the adjustment. On subsequent payrolls, where the employee is paid, the system attempts to deduct the overpayment from the employee's future check(s) until the entire amount has been collected.

Tax Method

Select Specified on Paysheet. The system selects the default values from the paysheet.

Earnings

Select Add to Gross Pay and Maintain Earnings Balances. Deselect all other check boxes.

(USA) U.S. Only

Clear all fields. This is important, because the adjustment earnings code should not add to any taxable gross fields.

(CAN) Canadian Only

Clear all fields. This is important, because the adjustment earnings code should not add to any taxable gross fields.

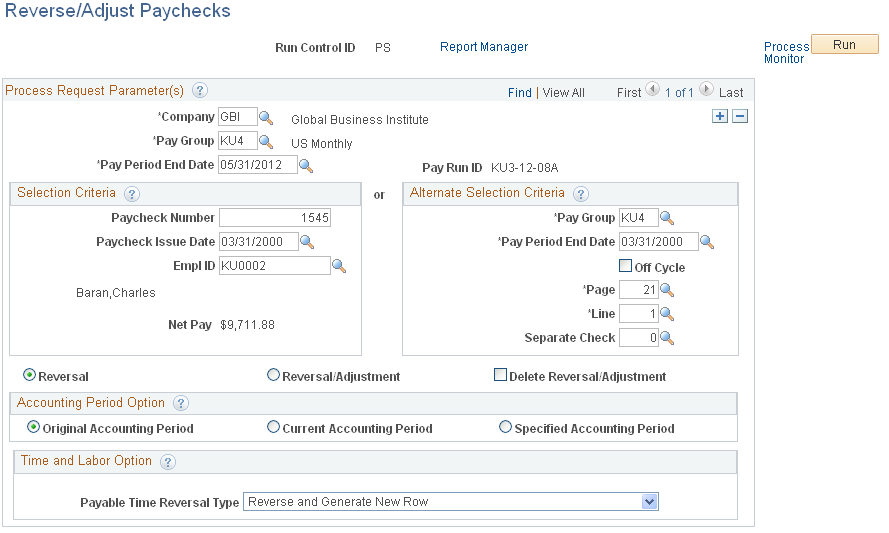

(USA, USF) Use the Reverse/Adjust Paychecks page (RUNCTL_PAY_REV) to run the check reversal and adjustment process.

(CAN) Use the Reverse/Adjust Paycheques page (RUNCTL_PAY_REV) to run the cheque reversal and adjustment process.

Navigation:

This example illustrates the fields and controls on the Reverse/Adjust Paychecks page.

This is the same page that you use to run paycheck reversals

If you're adjusting more than one check, add a row for each additional check and then run the process.

When you run the Paycheck Reversal/Adjustment process, the system produces an off-cycle paysheet page. The first paysheet entry appears as a Reversing Adjustment, with all fields unavailable and a net pay of zero (blank). Use the Paysheet page to enter necessary adjustment information for earnings, deductions, and taxes.

Navigation:

Use the top scroll area to move to the other system-generated paysheet entry, the Adjustment paysheet. This is where you enter the necessary adjustment information for earnings, deductions, and taxes.

For example, if you forgot to pay the employee for 10 hours of overtime, enter 10 in Overtime Hours; if you taxed her in the wrong taxing jurisdiction, enter the correct state or locality.

Save the paysheet when you finish entering your adjustments.

Set up a run control and run the Pay Calculation process just as you do for your normal payroll calculation.

Your next steps depend on whether you owe the employee or the employee owes you.

If you owe the employee money, the system produces a calculated check for the amount that you owe. You can then complete the following steps:

Set up pay confirmation parameters and run the Pay Confirmation process, which updates the employee's balances and assigns a check number.

Print the check.

If the employee owes you money, the following message appears in the Paysheet, Payroll Messages page (assuming there are no other errors):

The net pay calculated for this check is a negative amount.

The Message Data field at the bottom of the page displays a negative amount, which is the amount the system has calculated the employee owes you. The system treats this as an error because it is designed to produce checks for positive or zero amounts. A negative paycheck amount is not valid.

If the employee is still employed, you can get the money back by putting it in an arrears balance and having the system attempt to take it out of the next paycheck. In effect, you "give" the employee the amount she owes by using an adjustment earnings code on the adjustment paysheet. When you run pay calculation, the system converts the earnings to the corresponding payback deduction code.

Here's how you set up the arrears balance to collect the overpayment:

Make sure you have set up the necessary adjustment earnings and adjustment deduction codes.

On the adjustment paysheet, enter the overpayment amount as Other Earnings, using the earnings code you set up for negative adjustments.

Save the paysheet.

Set up off-cycle pay calculation parameters and run the Pay Calculation process.

The system converts the earnings to a deduction (assigning it to the corresponding payback deduction code) and puts the amount the employee owes into an arrears balance to be processed in the next payroll.

Set up off-cycle pay confirmation parameters and run the Pay Confirmation process.

View results on the Review Paycheck pages.

The overpayment is deducted in the next pay cycle.

To delete the adjustment payline of a paysheet that was created with Reversal/Adjustment selected on the Reverse/Adjust Paychecks page:

Run the Pay Unsheet SQR process (PAYUNSHT).

Run the Paycheck Reversal/Adjustment process with Reversal selected.