Crediting Military Service to Civilian Retirement

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GVT_MILDEP_PNL |

(USF) Enter information about the type and dates of military service. |

|

|

GVT_SVCPER_PNL |

(USF) Enter service period earnings and deduction information. |

|

|

GVT_SVCTRN_PNL |

(USF) View dated deposit and interest information. |

|

|

Calc Military Service Interest Page (calculate military service interest) |

GVT_RUN_FGPY020 |

(USF) Run the Calculate Military Service Deposit Interest process. |

|

RUN_FGPY012 |

(USF) Run the FGPY012 report, which lists closed military service deposit accounts that need a retirement date adjustment PAR for the date range that is specified. |

|

|

RUN_FG1514 |

(USF) Run the FG1514 process, which creates an OPM report listing closed military service deposit accounts. |

Federal civilian employees with prior military service, whose military service is not otherwise creditable for the purposes of civilian retirement, may in certain cases choose to buy into or buy back that military service so that it will be creditable for civilian retirement. This applies to military service after December 31, 1956. Military service may not otherwise be creditable for civilian retirement because the employee did not make their required contributions to the selected civilian retirement system (Federal Employee Retirement System [FERS] or Civil Service Retirement System [CSRS]) while they were in military service. Therefore, to make their military service creditable, they must get their contributions to their civilian retirement account up-to-date. Military service deposits are subject to interest accruals.

This feature enables you to:

Record past service details required for OPM Form 1514.

Process military service payroll deductions using Payroll for North America.

Calculate interest adjustments and add them to the military deposit register.

Process accounts through automatic payroll deductions or unscheduled deposits that you track manually.

Maintain current balance records of scheduled and unscheduled payments and annual interest assessments.

Identify closed military service deposit accounts that require a PAR (FGPY012).

Generate the required Individual Retirement Record (IRR) for military service payments.

Create and print OPM Military Deposit Worksheet (Form 1514).

Military Deposit Interest

The Calculate Military Service Deposit Interest process (FGPY020) is generally run weekly to calculate military deposit interest and post the values to the military deposit ledger. The process determines who has interest due and reads the interest rate that is stored on the Military Deposit Interest page to determine the correct amounts.

Closed Accounts

Use the Military Deposits Closed Accounts report (FGPY012) to identify accounts that were closed during RITS (Retirement and Insurance Transfer System) Interface processing. For the accounts identified, you must:

Process a PAR to change the SCD-Retire.

Print OPM Form 1514.

Generate an IRR.

You can produce the OPM Military Deposit Worksheet, a report (FG1514), for reporting to OPM when the military service deposit is completed.

Before you can credit military service, you must:

Define a deduction code for military deposit.

Enter the military deposit interest rate on the Military Deposit Interest page.

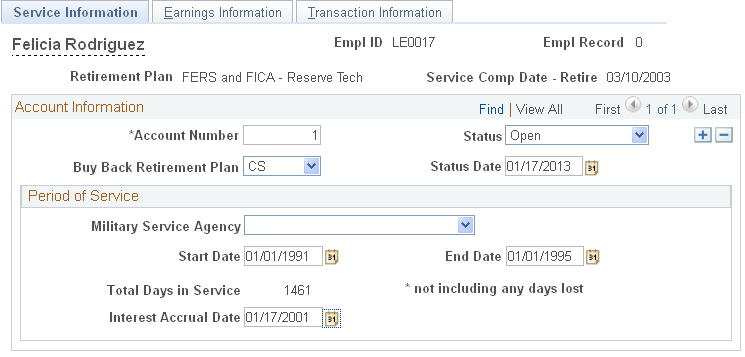

(USF) Use the Service Information page (GVT_MILDEP_PNL) to enter information about the type and dates of military service.

Navigation:

This example illustrates the fields and controls on the Service Information page.

The information that is entered here appears on the military service IRR and on OPM Form 1514.

Field or Control |

Description |

|---|---|

Retirement Plan |

The retirement plan is set by default from the employee's election on the FEGLI/Retirement Data (Federal Employee Group Life Insurance/retirement data) page of the PAR Job Data page. |

Service Comp Date - Retire (service computation date - retire) |

The date is set by default from the Employee Data 1 page. |

Account Information

Field or Control |

Description |

|---|---|

Account Number |

The system automatically assigns an account number, in sequence, for each military service period; you can override it. If, for example, an employee served in Panama, Grenada, and Desert Storm, when you define the three different accounts, the system assigns them account numbers: 1, 2, and 3, in that respective order. |

Status |

Select Open if the account record is active. Select Cancelled if the employee chooses to stop payments and cancel the previously opened record. Select Closed if the employee paid the full amount. If the employee has a balance, the system does not let you select Closed. When the account is closed, the system opens the Data Control page to create the PAR request to adjust the service computation dates. |

Status Date |

The default is the system date when you establish the account and is used as the date of computation on OPM Form 1514. The system will not change the date when the status changes, but you can update it when the account closes or leave the original date. |

Buy Back Retirement Plan |

Select the retirement plan that the employee is buying into for military service credit. Values are: CS: CSRS (Civil Service Retirement System) FS: FERS (Federal Employees Retirement System) RS: FERS RAE (Revised Annuity Employees) XS: FERS FRAE (Further Revised Annuity Employees) |

Period of Service

Field or Control |

Description |

|---|---|

Start Date/End Date |

Select the start and end date for the service period. You obtain period of service information from the employee's military documentation, and the system prints it on the IRR and on OPM Form 1514. |

Total Days in Service |

The total days in service appears. The system calculates the total days in service between the start and end dates. If an employee's DD-214 was produced before 1979 and therefore indicates lost days, you must manually adjust the end date to account for the lost days. |

Interest Accrual Date |

The Interest Accrual Date (IAD) is the annual date when interest is added to the deposit that is owed by the employee. It is recorded on OPM Form 1514. The initial IAD for CSRS employee is three years from the date the employee returns to a position subject to CSRS retirement deductions. The FERS law provides a two-year interest free grace period on deposits. The initial date must be entered manually. The Calculate Military Service Deposit Interest process updates the IAD for the remaining years. |

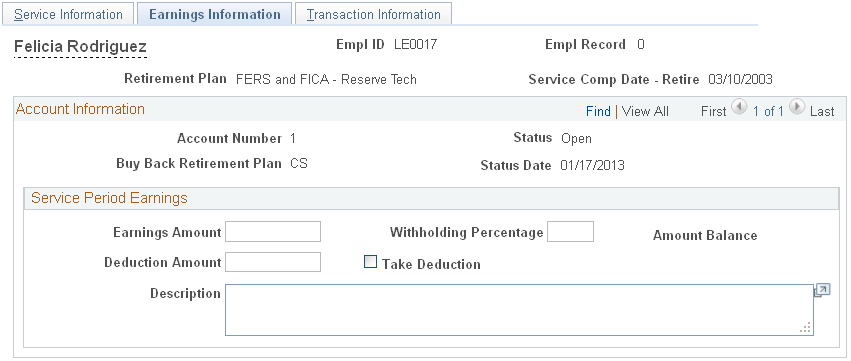

(USF) Use the Military Deposit - Earnings Information page (GVT_SVCPER_PNL) to enter service period earnings and deduction information.

This example illustrates the fields and controls on the Military Deposit-

Navigation:

Field or Control |

Description |

|---|---|

Retirement Plan |

This field value is set by default from the employee's election on the FEGLI/Retirement Data page. |

Service Comp Date-Retire (service computation date-retire) |

This field value is set by default from the Employee Data 1 page. |

Service Period Earnings Information

Field or Control |

Description |

|---|---|

Amount of Earnings |

Enter earnings (in dollars) for each service period, based on verified documentation that is supplied by the employee. This is the cumulative total amount that the employee earned while in the service branch for this account. This field value appears on OPM Form 1514. |

Withhold % |

Enter the withholding percent, either 3 percent for FERS or 7 percent for CSRS, determined by the retirement service that is in effect during the military service period. This field value appears on OPM Form 1514. |

Amount Balance |

The system multiplies earnings amount by withholding percent to calculate the amount balance. This field value appears on OPM Form 1514. |

Take Deduction |

Select this check box if the employee elects to pay military deposits through a payroll deduction. If this check box is not selected, enter the promissory amount in the Deduction Amount field. |

Deduction Amount |

Enter a deduction amount that is greater than 50 USD if the employee elects to pay military deposits through a payroll deduction. The system creates a new row in the employee's Create General Deductions page with the deduction code that you previously set up (for example, MILDEP) and populates the Flat/Addl Amount (flat/additional amount) field with the deduction amount that you enter on this page. |

Multiple Military Service Deposit Accounts

For multiple Military Service deposit accounts, the employee can only pay one account at a time through payroll deductions. If you have multiple accounts and select the Take Deduction check box, the system makes the Deduction Amount field and Take Deduction check box unavailable for entry for all other accounts.

When an account closes, the system applies deductions to the next account. It makes the Take Deduction check box and Deduction Amount field unavailable on the closed account and makes available for entry these fields on the next account. For this next account, the system selects the Take Deduction check box and populates the Deduction Amount field with the amount from the most recently closed account. You can enter a different deduction amount if necessary. When you save the page, the system automatically reflects the value on the Create General Deductions page.

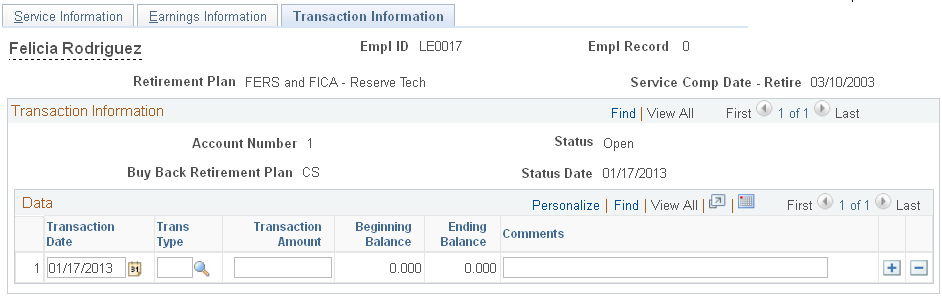

(USF) Use the Military Service Deposit -Transaction Information page (GVT_SVCTRN_PNL) to view dated deposit and interest information.

Navigation:

This example illustrates the fields and controls on the Military Service Deposit -

The first transaction is type A which is the account opening information including the status date and deposit balances. As payroll is processed, transaction information is updated with the pay period end date, transaction type S, deduction amount, and remaining balances. Interest adjustments and unscheduled payments can be added in the Transaction Information, which will update the balance in the Transaction page and the General Deduction page.

For employees with military deposit payroll deductions, the system maintains current values of the goal amount and current goal balance for military deposit deductions on the employee's Create General Deductions page. The goal amount value is the total amount to be paid by payroll deductions: the sum of the initial deposit amount and interest adjustments, less any unscheduled payments, for all military service accounts. This automatic updating occurs when you save the Military Service Deposit component. The system also adjusts the current goal balance during pay confirmation after posting the military service deduction. Current goal balance displays the total amount already paid by payroll deduction.

Field or Control |

Description |

|---|---|

Trans Date (transaction date) |

The transaction date is the status date when the account was opened. The date is populated differently depending on the type of transaction; for scheduled payments it is the pay period end date, for unscheduled payments it is the system date, for interest adjustments it is pay end date of the last confirmed payroll. You can change this date because it might not be the true historical date that the employee started making deposits. |

Trans Type (transaction type) |

Select a transaction from the available options. The system creates A the first row to record the initial balance. The transaction date is the status date when the account was opened. You can change this date, because it might not be the true historical date that the employee started making deposits. Both the Begin Balance and End Balance fields show the amount balance from the previous page. The Trans Amount (transaction amount) field is left blank. Select I if this is an interest adjustment. Enter the interest calculation date in the Trans Date column and the manually calculated interest amount in the Trans Amount column. You must enter this information, the system does not calculate interest. Transaction type S is a scheduled payment. The system enters automatic payroll deductions here during pay confirmation. The transaction date is the date the deduction is posted. The transaction amount comes from the employee's Create General Deductions page. Select U if this is an unscheduled payment. Enter the transaction date and transaction amount for all other payments, for example, check payments. For employees transferring into your agency, use this transaction type to document payments that are made while with the previous federal employer. |

Trans Amount (transaction amount) |

This is the dollar amount the employee owes. |

Begin Balance |

Displays the previous row's end balance. The beginning balance is first calculated from the amount of earnings and withhold percent that you defined for the deposit on the Earnings Information page. |

End Balance |

The system calculates this by subtracting the transaction amount from the begin balance, or for interest payments, adding the transaction amount to the begin balance. |

Comments |

Enter comments here. When the system enters a scheduled payment row, it inserts a comment that the row is a payroll deduction. |

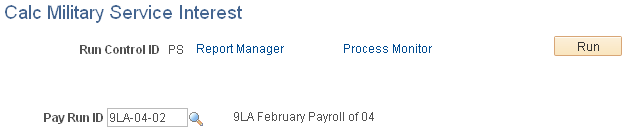

(USF) Use the Calc Military Service Interest (calculate military service interest) page (GVT_RUN_FGPY020) to run the Calculate Military Service Deposit Interest process.

Navigation:

This example illustrates the fields and controls on the Calc Military Service Interest.

Select the appropriate pay run ID. The pay run ID identifies the next open pay period.

Interest is calculated for employees with an IAD that is within the next open pay period. The interest is calculated on the ending balance, reporting in the transaction field, and then added to the end balance. The transaction date is the pay end date of the last payroll the RITS Interface was run.

If the interest period crosses multiple years, the process calculates accordingly. The process increases the IAD date by one year, if applicable.

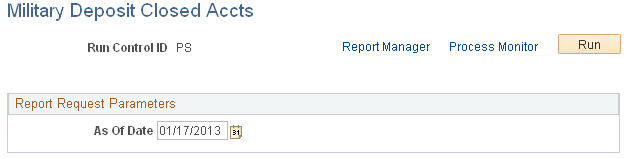

(USF) Use the Military Deposit Closed Accts (military deposit closed accounts) page (RUN_FGPY012) to run the FGPY012 report, which lists closed military service deposit accounts that need a retirement date adjustment PAR for the date range that is specified.

Navigation:

This example illustrates the fields and controls on the Military Deposit Closed Accts page.

Use the Military Deposits Closed Accounts report (FGPY012) to identify accounts that were closed during RITS Interface processing. For the accounts identified, you must process a PAR to change the SCD-Retire, print OPM Form 1514, and generate an IRR. You can produce the OPM Military Deposit Worksheet report (FG1514), for reporting to OPM when the military service deposit is completed.

Field or Control |

Description |

|---|---|

As of Date |

The report identifies military deposit accounts closed on, or before, this date. The default value is the system date. |

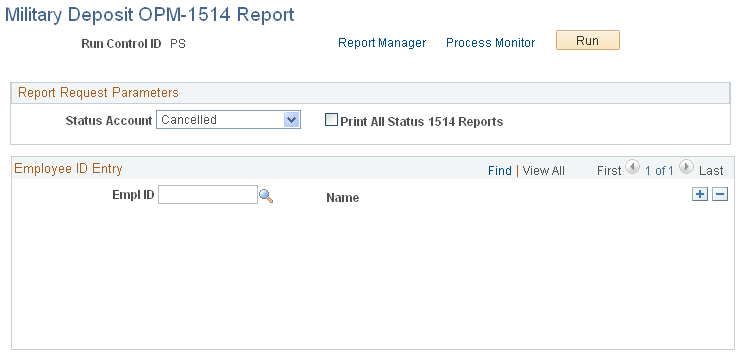

(USF) Use the Military Deposit OPM-1514 Report page (RUN_FG1514) to run the FG1514 process, which creates an OPM report listing closed military service deposit accounts.

Navigation:

This example illustrates the fields and controls on the Military Deposit OPM_1514 Report page.

Field or Control |

Description |

|---|---|

Status Account |

Cancelled: Prints canceled Military Service Deposit reports. Closed: Prints closed Military Service Deposit reports. Open: Prints open Military Service Deposit reports. None: Prints all reports. |

Print All Status 1514 Reports |

Select to print a report for each employee of the designated status. |

EmplID (employee ID) |

Select the employee ID of each employee for whom you want to print a report. |

When the end balance on the Transaction Information page reaches zero, the military deposit account must be closed.

If the balance drops to zero when a payroll deduction is posted during RITS Interface processing, the system changes the status account to Closed. To identify accounts that have closed during RITS Interface processing, run the Military Deposits Closed Accounts report (FGPY012) as often as you need to, most likely after your payroll runs are completed for the pay period. This report alerts you to take further action to fulfill your regulatory requirements. You must process a PAR to change the employee's service computation date for Retirement (SCD-Retire). Use a Nature of Action (NOA) Code 882 and adjust the date earlier by the total days in service listed on the Service Information page.

If you enter an unscheduled payment that zeroes the account balance online, the system changes the status account on the Service Information page to Closed and makes the field unavailable for entry when you save the page. It then transfers you to the HR Processing USF page, where you create a PAR with NOA code 882.

When the system changes the status to Closed, it also creates a Military Deposit IRR control record. This IRR is separate from any other that the employee may have, and each different period of military service has its own IRR. The IRR includes military deposit payroll deductions by year and service period information. Print the final IRR for transfer to OPM. Consult the OPM CSRS/FERS Handbook for guidance on preparing the Military Deposit IRR.

Process the Military Deposit (OPM1514) report to print the OPM Military Deposit Worksheet.