Defining General Deductions

To set up general deductions, use the General Deduction Table (GENL_DEDUCTION_TBL) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GENL_DEDUCTION_TBL |

Define how nonbenefit deductions are calculated. |

|

|

GVT_GENL_DED_SEC |

(USF) Define the distribution routing level and summary level to use in the US Treasury Interface. |

|

|

GVT_DED_DIST_TBL |

(USF) Define general deduction distribution information to use in the US Treasury Interface. |

|

|

Deduction Contact Information Page |

GVT_DED_CONT_SEC |

(USF) Enter contact information for the general deduction distribution. |

|

Deduction Distribution Information Page |

GVT_DED_DIST_SEC |

(USF) Enter distribution information for the general deduction distribution. |

|

GVT_DED_REMIT_FREQ |

(USF) Enter remittance frequency information for the general deduction distribution to use in the US Treasury Interface. |

|

|

General Ded/Frequency Report Page (general deduction / frequency report) |

PRCSRUNCNTL |

Generate the PAY703 report, which lists information from the General Deduction/Deduction Frequency table, which contains payroll deductions that do not fit into a category that is covered by a benefit table, such as United Way, union dues, or parking fees. |

In PeopleSoft HR, a general deduction is any deduction that isn't a benefit deduction. Charitable deductions, union dues, parking, garnishments, and so on all fit into this category. Use the General Deduction table to define how these nonbenefit deductions are calculated.

Setting Up Benefit Deductions as General Deductions

Even though the system enables you to set up benefit deductions as general deductions on the General Deduction table, we recommended against this because the general deductions cannot process the complex calculations and rules needed for some benefit deductions, such as 401(k) participation.

If you decide to set up benefit deductions on the General Deduction table rather than the Benefit Program table, you must:

Set up separate deduction codes for each tax class.

Even though the system enables you to set up one deduction code with multiple tax classes, you cannot do this if you are using the deduction code as a general deduction.

For example, you would require a deduction code for the after tax portion and a separate deduction code for the before tax portion.

Set up a separate general deduction for each deduction code.

For example, you would require a general deduction for the after tax deduction code and a separate general deduction for the before tax deduction code.

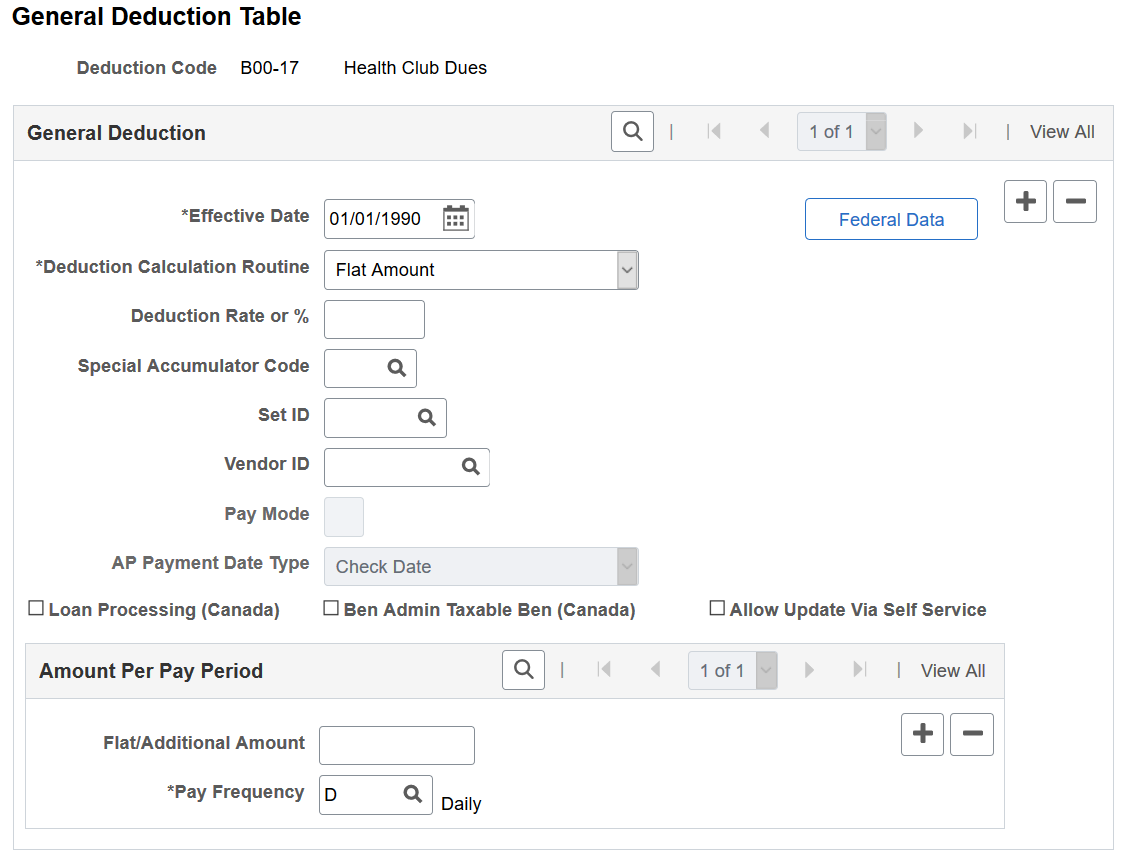

Use the General Deduction Table page (GENL_DEDUCTION_TBL) to define how nonbenefit deductions are calculated.

Navigation:

This example illustrates the fields and controls on the General Deduction Table page.

Note: For general deductions, you do not have to specify a plan type because it is always 00. However, there must be a matching entry on the Deduction table with a plan type of 00 using the same deduction code that you enter on this table.

General Deduction

Field or Control |

Description |

|---|---|

(USF) Federal Data |

Select to access the Federal General Deduction Routing Information page. |

Deduction Calculation Routine |

For each general deduction, indicate a specific deduction calculation routine for the system to use to determine the amount of the deduction. You can override any of these calculation routines at the employee level. Remember that regardless of which deduction calculation routine you select, the default deduction rate or percent and the calculation routine that you enter here can be overridden at the employee level. Values are: Calculated by Salary System: Select this value to calculate the deduction by the payroll system. Note: The Calculated by Salary System option does not apply to Payroll for North America. Default to Deduction Table: Select this value to use the calculation routine that is specified on the Deduction Table. Flat Amount: Select this value to calculate the deduction as a flat amount and enter the amount in the Flat/Additional Amount field. However, if the amount varies from employee to employee, such as with charitable contributions, leave the Flat/Additional Amount field blank and enter the amount on the employee's Create General Deductions page. Percent of Federal Gross: Select this value to calculate the deduction as a percent of the employee's federal taxable gross. Enter the percent in the Deduction Rate or % (deduction rate or percent) field. Percent of Net Pay: Select this value to calculate the deduction as a percent of the employee's net pay. Enter the percent in the Deduction Rate or % field. Net pay is determined at the time that the deduction is calculated. You establish the priority of the calculation on the Deduction table. Percent of Special Earnings: Select this value to calculate the deduction as a percentage of the employee's special accumulators, such as 401(k). Enter the percentage in the Deduction Rate or % field, then enter the appropriate special accumulator code. Percent of Total Gross: Select this value to calculate the deduction as a percent of the employee's total gross. Enter the percent in the Deduction Rate or % field. Percentage: Select this value to calculate the deduction as a percentage. Enter the percentage in the Deduction Rate or % (deduction rate or percent) field. Note: The Percentage option does not apply to Payroll for North America. Rate x Hours Worked: Select this value to calculate the deduction as rate multiplied by hours worked. Enter the rate in the Deduction Rate or % field. The system adds all employee earnings types that have the FLSA Hours Worked (Fair Labor Standards Act hours worked) check box selected in the Earnings table, and multiplies the total by the rate stated here. Rate x Special Hours: Select this value to calculate the deduction as a rate multiplied by special hours. Enter the rate in the Deduction Rate or % field, and select the special accumulator code to be used to accumulate the special hours. Select a special accumulator code in the Special Accumulator Code field. Rate x Total Hours: Select this value to calculate the deduction as a rate multiplied by total hours worked in a period. Enter the rate in the Deduction Rate or % field. This rate is multiplied by all the hours specified on employee paysheets during a pay period. Special Deduction Calculation: Select this value to indicate that you've created a calculation for this deduction. Be sure to consult with your PeopleSoft Account Manager before making changes to the program. |

Deduction Rate or % (deduction rate or percent) |

Enter the deduction rate or percentage of the nonbenefit deduction. |

Special Accumulator Code |

If you select Rate x Special Hours as the deduction calculation routine, select the code of the special accumulator that you want associated with this deduction. |

SetID |

Enter the setID for the vendor. (The Vendor table is keyed by setID so when a vendor is entered, a setID must also be entered). This field applies only if you are using PeopleSoft Payables to pay deductions withheld from employee paychecks to vendors—such as a garnishment collector or tax collection authority. |

Vendor ID |

Enter the ID of the vendor to whom monies for this deduction should be paid. The interface between Payroll for North America and PeopleSoft Accounts Payable uses this vendor ID to extract data and create accounts payable (AP) vouchers. This field applies only if you are using Accounts Payable to pay deducted amounts to third parties. The prompt table lists only those vendors that are associated with the setID that you entered in the previous field. |

Pay Mode |

Enter the pay mode to use when creating AP vouchers. This field becomes available when you select a setID and vendor ID. It indicates when to pay the deducted amount to the vendor. When you run the extract program, the system reads the value that you entered in this field to determine whether to create a voucher for Accounts Payable. Values are: Pay as Deducted: Select this option if you want Accounts Payable to pay the vendor each time Payroll for North America calculates this deduction. Pay when Collection Completed: Select this option if you want Accounts Payable to pay the vendor only when the goal amount or deduction end date has been reached. (This pay mode is valid for general deductions and garnishments). Pay when Bond Price Met: If the deduction is for a bond purchase, select this option if you want Accounts Payable to pay the vendor only when the bond purchase price has been reached. Pay at Specified Date: Select this option if you want to pay the vendor on the date indicated on the run control page for the PY-AP Extraction - Deductions (PYAP_XDEDN) Application Engine process. This option is appropriate when deductions for more than one pay period must be extracted (for example, benefit deductions that are withheld every pay period and sent to the vendor at the end of the month). |

AP Payment Date Type (accounts payable payment date type) |

The PY-AP Extraction - Deductions process uses this date when it processes deductions with a pay mode of Pay at Specified Date. Indicate which type of date should be used to create the AP voucher. Values are: Check Date: Select this value if the date is a check date. Pay Period End Date: Select this value if the date is a pay period end date. |

(CAN) Loan Processing (Canada) |

Select this check box if you are establishing a deduction for Canadian low-interest loan paybacks. This activates the unique calculation routines that are used for low-interest loans. Important! Do not select this check box for deduction codes that are for home purchase or home relocation loans. The PeopleSoft system does not calculate the taxable benefit for these types of loans. |

(CAN) Ben Admin Taxable Ben (Canada) (benefits administration taxable benefits [Canada]) |

Select this check box if you are a Canadian organization using PeopleSoft Benefits Administration and want to identify the taxable benefit deduction codes specified on the Credit Allocation Hierarchy table. |

Allow Update Via Self Service |

Select this check box to include the deduction in any employee self-service transaction. |

Federal Data |

This button appears only in a Federal database. Select it to access the Federal General Deduction Routing Information page where you can identify the payment distribution routing information. |

Amount Per Pay Period

Use this group box for deductions that are a flat amount for the month, regardless of the pay frequency. Set up each pay frequency with it's own entry. For example, a parking deduction for the month is 100 USD for all employees. Rather than setting up individual deductions for each pay frequency, you can set up one deduction with a flat amount of 100 USD. You can then enter a line for pay frequency weekly with an amount of 25 USD, pay frequency biweekly with an amount of 50 USD, pay frequency semimonthly with an amount of 50 USD and pay frequency monthly with an amount of 100 USD.

Field or Control |

Description |

|---|---|

Flat/Additional Amount |

If you select a deduction calculation routine that uses a deduction rate or percent, you can also enter an additional or flat amount per pay period to be deducted. However, you must indicate the amount here only if it's the same for all employees within a pay frequency. If it varies from employee to employee, enter the amounts for each employee on the Create General Deductions page. |

Pay Frequency |

If you have a deduction that varies by pay frequency, you must indicate the dollar amount to be taken each pay period for each pay frequency. Values prompt from the Frequency table. |

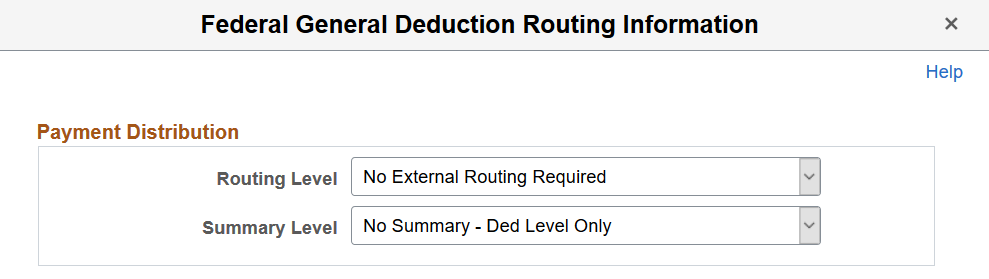

(USF) Use the Federal General Deduction Routing Information page (GVT_GENL_DED_SEC) to define the distribution routing level and summary level to use in the US Treasury Interface.

Navigation:

Select the Federal Data button on the General Deduction Table page.

This example illustrates the fields and controls on the Federal General Deduction Routing Information page.

Field or Control |

Description |

|---|---|

Routing Level |

Select a routing level to group the deductions. They can be grouped according to distribution code such as Federal Employee Retirement System Retirement or the groupings can be defined at the employee level with Routing Number and Account Number. If the deduction is not routed, leave the routing level at the default value No External Routing Required. |

Summary Level |

Select a summary level to further define whether the deduction data is to be summarized or detailed. The data can be summarized by distribution code or defined at the employee level. If the deduction is not summarized, use No Summary - Ded Level Only (no summary - deduction level only). |

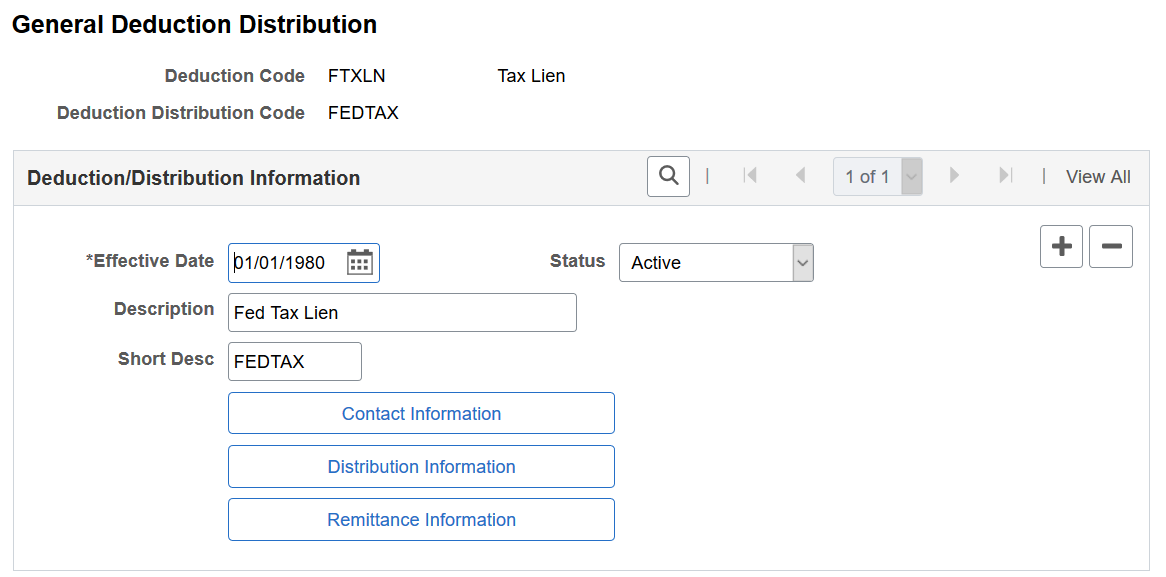

(USF) Use the General Deduction Distribution page (GVT_DED_DIST_TBL) to define general deduction distribution information to use in the US Treasury Interface.

Navigation:

This example illustrates the fields and controls on the General Deduction Distribution page.

Field or Control |

Description |

|---|---|

Contact Information |

Select to access the Deduction Contact Information page (GVT_DED_CONT_SEC). |

Distribution Information |

Select to access the Deduction Distribution Information page (GVT_DED_DIST_SEC). Note: The page layout of the Deduction Distribution Information page and (USF) GVT Employee Distribution Page are identical. If data encryption is enabled and the encryption process is run for the GVT_DED_DIST record, the account number (which appears on the Deduction Distribution Information page) is encrypted in the database if it belongs to a country that is specified on the Define Country for Encryption Page. Also, the account number appears as masked on that same page. An exception to this is when the user is assigned the Bank Account Admin role, and this role is defined on the Grant Unmasked Access Page for the GVT_DED_DIST record. In this case, the user sees the unmasked account number. See Also Understanding Data Encryption for Payroll for North America. |

Remittance Information |

Select to access the Deduction Remittance Information page (GVT_DED_REMIT_FREQ). |

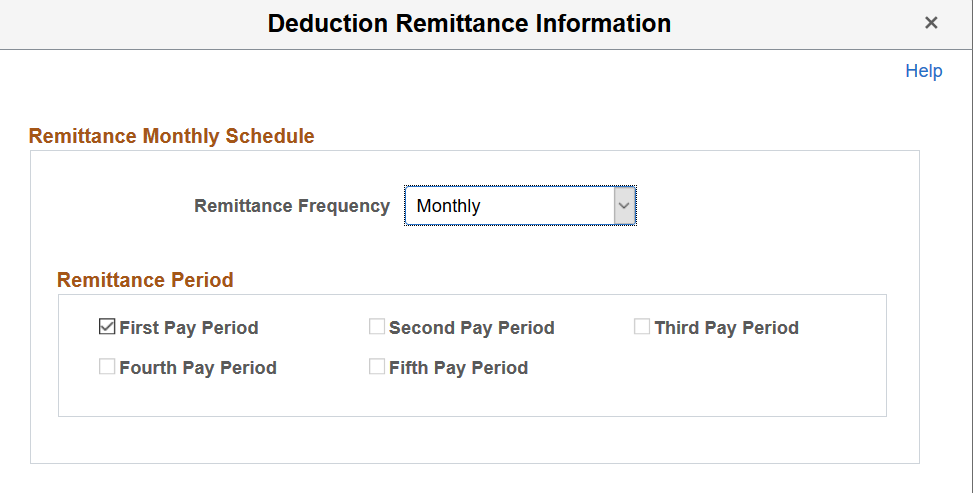

(USF) Use the Deduction Remittance Information page (GVT_DED_REMIT_FREQ) to enter remittance frequency information for the general deduction distribution to use in the US Treasury Interface.

Navigation:

Select the Remittance Information button on the General Deduction Distribution page.

This example illustrates the fields and controls on the Deduction Remittance Information page.

Select the remittance frequency and then select the pay period in which distribution should be paid.