Defining the Final Check Process

To set up the final check program, use the Final Check Action Reason (TERM_ACTN_RSN), Final Check Program Table (TERM_PGM_TBL), and Final Check Program Table USF (GVT_TERM_PGM_TBL) components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TERM_ACTN_RSN |

Define the action and action reason code combinations that automatically trigger a final check request when an employee termination Job record enters the system. |

|

|

TERM_PGM_TBL |

Establish a final check program ID description. |

|

|

Final Check Program Table - Earnings Definition Page Final Check Program Table - Earnings Def Page |

TERM_PGM_DEFERN |

Define earnings for the final check program. |

|

Final Check Program Table - Leave Accrual Definition Page Final Check Program Table - Leave Accrual Def Page |

TERM_PGM_DEFLVE |

Define rules that apply to paying leave accruals to employees for whom you decide to pay earned or prorated accruals. |

|

Final Check Program Table - Deduction Definition Page Final Check Program Table - Deduction Def Page |

TERM_PGM_DEFDED |

Define which deductions to include in a final check and which limits and special rules to use when calculating the deduction. |

|

Final Check Program Report Page |

RUNCTL_PAY751 |

Generate the PAY751 report. The report lists information from the Final Check Program table, which contains final check processing rule definitions for earnings, leave accruals, and deductions. |

|

RUNCTL_FCXCLONE |

Run the Final Check Pgm Clone Utility (final check program clone utility) SQR Report process (FCXCLONE). |

Employee terminations occur for various reasons: some are initiated by the employee, others by the employer. When employment is terminated, regardless of the reason, the law requires employers to give employees their final wages. Some states require that the employee receives final wages before leaving the premises.

The Final Check process enables you to:

Define a set of termination rules as a final check program that identifies the earnings, deductions, and leave plans to process when creating a final check.

Automate the application of these rules to provide a clean, quick way of creating final checks.

Create a final check for a terminated employee whether or not the termination has been processed through PeopleSoft HR.

To process final checks for an employee whose termination has not been processed through PeopleSoft HR, enter the employee ID, termination date, and final check program ID on the Request Final Check page.

Note: Because this process is workflow-enabled, the system automatically generates a worklist item to notify the personnel administrator that a final check request has been created for an employee who is not yet terminated on the Job page.

Assign a final check program to each pay group using a final check program ID that you identify.

The pay group's final check program becomes the default for final check requests of terminated employees in that pay group. However, you can override the default final check program for any employee on the Request Final Check page.

Define a set of rules in each program for processing deductions or refunds on an employee's final check.

For example, you might refund or override a general or benefit deduction on a final check.

The system adds deductions and refunds to an employee's paysheet as one-time deductions. This enables a payroll administrator to further override any values on collections or refunds by deduction class, if there are any additional rules that are outside the scope of final checks.

Note: Leave may be accrued each payroll by the hour, but the system does not prorate hour-to-hour leave accrual in the final check process. Even if you set up final check leave accrual to prorate leave on an hour-to-hour basis, the Final Check process does not calculate it.

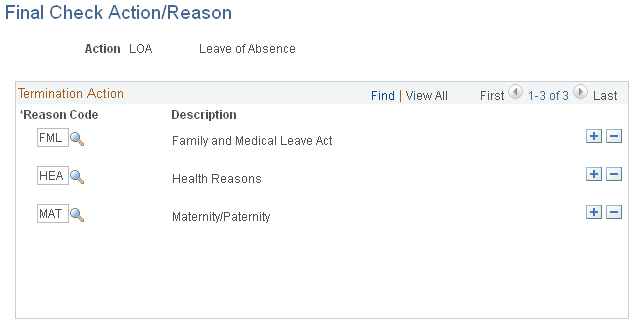

Use the Final Check Action/Reason page (TERM_ACTN_RSN) to define the action and action reason code combinations that automatically trigger a final check request when an employee termination Job record enters the system.

Navigation:

This example illustrates the fields and controls on the Final Check Action/Reason page.

Field or Control |

Description |

|---|---|

Reason Code |

Select an action reason to associate with the action code. Maintain action codes and reasons on the Action Reason Table page. |

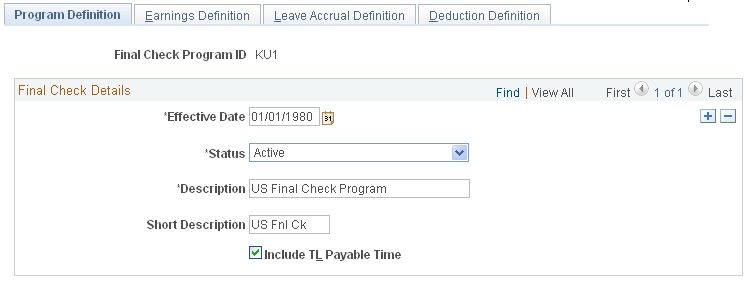

Use the Final Check Program Table - Program Definition page (TERM_PGM_TBL) to establish a final check program ID description.

Navigation:

This example illustrates the fields and controls on the Final Check Program Table - Program Definition page.

Field or Control |

Description |

|---|---|

Include T&L Payable Time (include time and labor payable time) |

Select this check box if you have an interface with PeopleSoft Time and Labor. If you select this check box, the system uses the time from PeopleSoft Time and Labor to create the paysheet for the final check and marks the time and labor paysheet as processed by final check. |

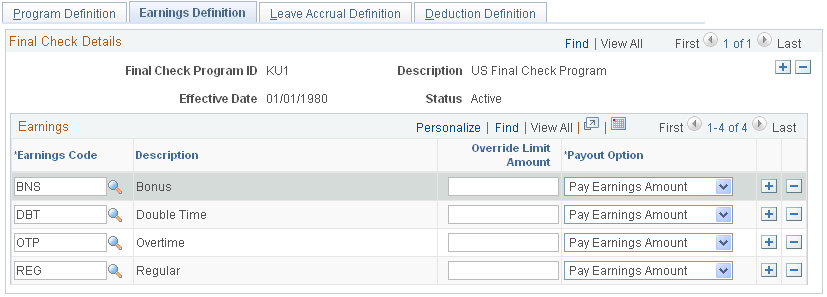

Use the Final Check Program Table - Earnings Definition page (TERM_PGM_DEFERN) to define earnings for the final check program.

Navigation:

This example illustrates the fields and controls on the Final Check Program Table - Earnings Definition page.

Field or Control |

Description |

|---|---|

Payout Option |

Select: Pay Earning Amount: Select this value if the Final Check process uses the regular earnings amount to pay the earnings for the earnings code. Pay Goal Difference: Select this value if the Final Check process searches for a corresponding Additional Pay record for the earnings code and calculates the remaining balance on the employee's goal amount. |

Note: The final check includes only earnings that you identify here. For example, to include additional pay earnings for a car, you must include the appropriate earnings code for those earnings on this page. Otherwise it is not included in employees' final checks.

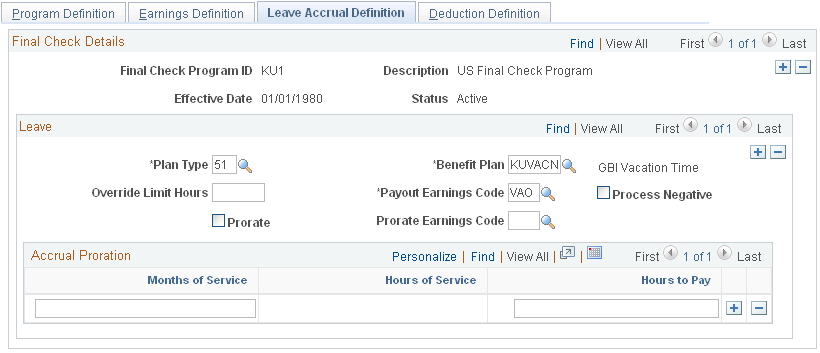

Use the Final Check Program Table - Leave Accrual Definition page (TERM_PGM_DEFLVE) to define rules that apply to paying leave accruals to employees for whom you decide to pay earned or prorated accruals.

Navigation:

This example illustrates the fields and controls on the Final Check Program Table - Leave Accrual Definition page.

Leave

Field or Control |

Description |

|---|---|

Override Limit Hours |

To apply an override when the payout earned and prorated hours exceed the limit, enter the number of hours. |

Payout Earnings Code |

Select a payout earnings code to use for paying the accruals that are earned and awarded for the benefit plan. You can pay only the earned and awarded accruals, only the prorated portion, or both. Define the earnings code that you use for paying the earned and awarded accruals in the Earnings table as earnings that do not reduce regular pay but do add to hours taken. This ensures the integrity of the Accrual Balance records when you pay employee leave accruals upon termination. |

Process Negative |

Select this check box to pay negative accruals. |

Prorate Earnings Code |

Select a prorated earnings code to use for paying the prorated portion of accruals for the benefit plan. You can pay either:

Define the earnings code that you use for paying prorated accruals as earnings that do not reduce regular pay, but do add to hours taken and hours adjusted. This ensures the integrity of the Accrual Balance records when you pay employee leave accruals upon termination. Note: Leave may be accrued each payroll by the hour, but the system does not prorate hour-to-hour leave accrual in the final check process. Even if you set up final check leave accrual to prorate leave on an hour-to-hour basis, the Final Check process does not calculate it. |

Accrual Proration

If you prorate accruals for the benefit plan, use this group box to establish the proration rules.

Field or Control |

Description |

|---|---|

Months of Service |

To prorate accruals by months of service, enter the monthly increments. For example, less than or equal to 1 month of service, 2 months of service, and so on. The system computes the months of service based on the employee's termination date and the last date on which you ran the Run Leave Accruals COBOL SQL process (FGPACCRL). |

Hours of Service |

To prorate accruals by hours of service, enter the hourly increments. For example, less than or equal to 160 hours of service, 320 hours of service, and so on. |

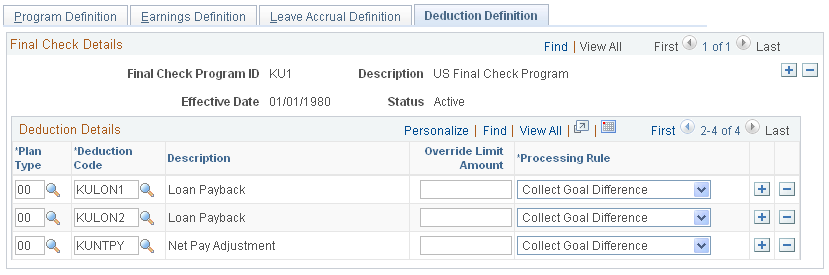

Use the Final Check Program Table - Deduction Definition page (TERM_PGM_DEFDED) to define which deductions to include in a final check and which limits and special rules to use when calculating the deduction.

Navigation:

This example illustrates the fields and controls on the Final Check Program Table - Deduction Definition page.

Field or Control |

Description |

|---|---|

Deduction Code |

Select the deduction code that identifies the deduction in the Deduction table. Note: U.S. Savings Bond deductions are not valid deductions. Do not use deduction code KUUSBD (U.S. Savings Bond Deduction). |

Processing Rule |

Select a processing rule for each deduction code: Collect Goal Difference: Select this value to collect general deductions only. You collect the amount of the general deduction data goal amount minus the goal balance. Collect Pay Period Deduction: Select this value to collect general deductions and benefit deductions. You collect the amount of the scheduled pay period deduction. Refund Bond Bal-Ready to Dist (refund savings bond balance ready to distribute): U.S. Savings Bond deductions are not valid. Do not use this value. Refund ESPP Balance (refund employee stock purchase plan balance): This value is reserved for future use. Do not use this value. Refund Goal Balance (refund goal balance): Select this option to refund general deductions only. You refund the amount of the general deduction data goal balance. Refund Last Deduction (refund last deduction): Select this value to refund general deductions and benefit deductions. You refund the amount of the pay deduction data current deduction, which represents the amount deducted at the last time the deduction was taken. Refund Month-to-Date Balance: Select this value to refund general deductions and benefit deductions. You refund the amount of the deduction balance data MTD deduction. Refund Quarter-to-Date Balance (refund quarter-to-date balance): Select this value to refund general deductions and benefit deductions. You refund the amount of the deduction balance data QTD deduction. Refund Sav Bond Balance (refund savings bond balance): U.S. Savings Bond deductions are not valid. Do not use this value. Refund Year-to-Date Balance: Select this value to refund general deductions and benefit deductions. You refund the amount of the deduction balance data YTD deduction. |

Important! The Final Check process performs normal payroll arrears processing whether or not you include the deduction in the final check program.

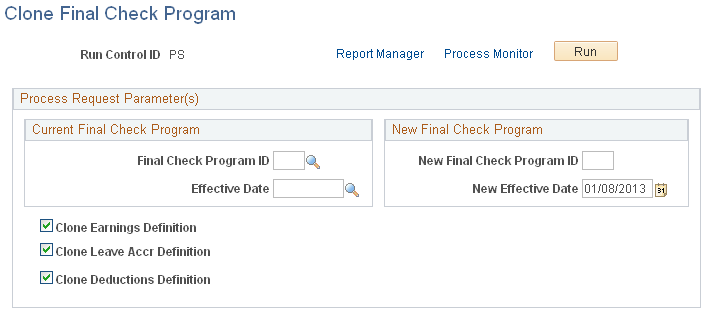

Use the Final Check Program Clone page (RUNCTL_FCXCLONE) to run the Final Check Pgm Clone Utility (final check program clone utility) SQR Report process (FCXCLONE).

Navigation:

This example illustrates the fields and controls on the Clone Final Check Program page.

Identify the final check program that you're cloning, specify a final check program ID and the effective date for the new program, and indicate which program elements to copy to the new final check program.