Mapping Treasury TAS and BETC to Payroll Activities

Use the Treasury Interface USF, TAS BETC Mapping (GVT_TAS_MAPPING) component to map Treasury TAS and BETC to payroll activities.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GVT_TAS_MAP_ERN |

Map a componentized TAS by fund code and BETC for net pay earnings transactions. |

|

|

GVT_TAS_MAP_DED |

Map a componentized TAS by fund code and BETC for deduction transactions. |

|

|

GVT_TAS_MAP_TAX |

Map a componentized TAS by fund code and BETC for appropriate state and local taxes. |

After you set up the required TAS and BETC identifiers, you must map them to specific payroll activities for use in your U.S. Treasury reporting. You can map at the company, department, job code, position, or employee level, and you can define a default or primary TAS/BETC to use. Mappings are also effective-dated to accommodate changes that might occur.

To map existing TAS and BETC identifiers to specific payroll activities, do the following:

Enter the company and business unit to use, and enter criteria for the level (company department, employee, job code, or position) at which you want to map earnings, deductions, and taxes payroll activities. You must map at the company level. You can map at additional levels to support your business requirements. When you select a mapping level, you must map all payroll activities (earnings, deductions, and taxes) at that level. For example, you might map Federal Reserve Board (FRG) US001 business unit at the company level, at which time you must map all earnings, deductions, and taxes at that level. You might also choose to map FRG US001 at the employee level, at which time you must map all earnings, deductions, and taxes at that level.

Use the search page of the TAS BETC Mapping component (GVT_TAS_MAPPING). Navigation:

Specify the Fund Code and BETC to use for net pay earnings payroll activity.

Specify the Plan Type, Deduction Code, Fund Code, and BETC to use for deductions payroll activity.

Specify the State, Locality, Tax Class, Fund Code, and BETC to use for state and local taxes payroll activity.

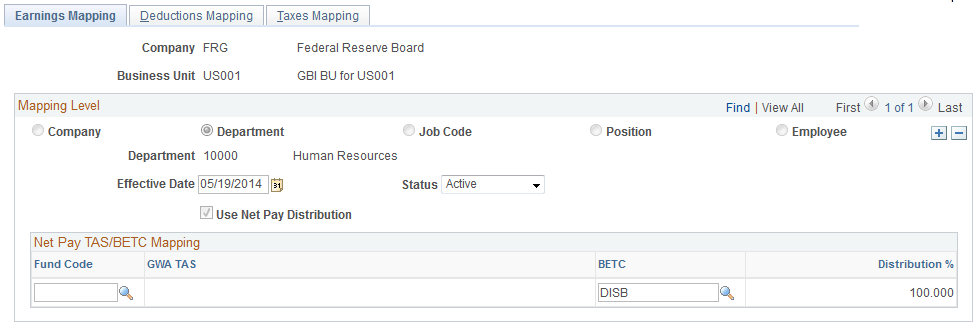

Use the TAS BETC Mapping - Earnings Mapping page (GVT_TAS_MAP_ERN) to map a componentized TAS by fund code and BETC for net pay earnings transactions.

Navigation:

Note: Consider entering as much information as you can on the search page when adding a new TAS BETC mapping. Consider entering the relevant code or ID to use for the mapping level that you select (for example, if you select the Department mapping level, enter the Department number to use; if you select the Job Code mapping level, enter the Job Code to use; and so on). Only Company and Business Unit values are required to access the TAS BETC Mapping component. If you do not select a mapping level, the system uses the default Company level. You cannot change the mapping level or associated code or ID from within the component . If you want to map to a different level (department, job code, position, or employee) you must select it on the search page, or exit the component and enter criteria to access it again.

This example illustrates the fields and controls on the TAS BETC Mapping - Earnings Mapping page.

Mapping Level

Field or Control |

Description |

|---|---|

Company, Department, Job Code, Position, or Employee |

The system selects the mapping level that you selected on the component search page (or selects Company if you did not select a mapping level). You cannot change the mapping level or associated code or ID from within the component. To change these, exit the page (click TAS BETC Mapping in the bread crumbs), and access the component again. This time select the desired mapping level and associated code or ID to use. Note: Only one TAS per employee paycheck is permitted for reporting net pay regardless of earnings codes or multiple jobs. |

Net Pay TAS/BETC Mapping

Field or Control |

Description |

|---|---|

Fund Code |

Select the fund code to use for net pay earnings mapping. Only fund codes that are associated with the componentized TAS are available. |

GWA TAS (Government Wide Accounting Treasury Account Symbol) |

The system displays the system-generated GWA TAS code (componentized TAS) that is associated with the fund code. |

BETC (Business Event Type Code) |

The system displays the default BETC for the componentized TAS. DISB (Payroll Disbursement) is the default BETC for all TAS components. If additional BETCs are defined in your system, you can select from the list of valid values here. |

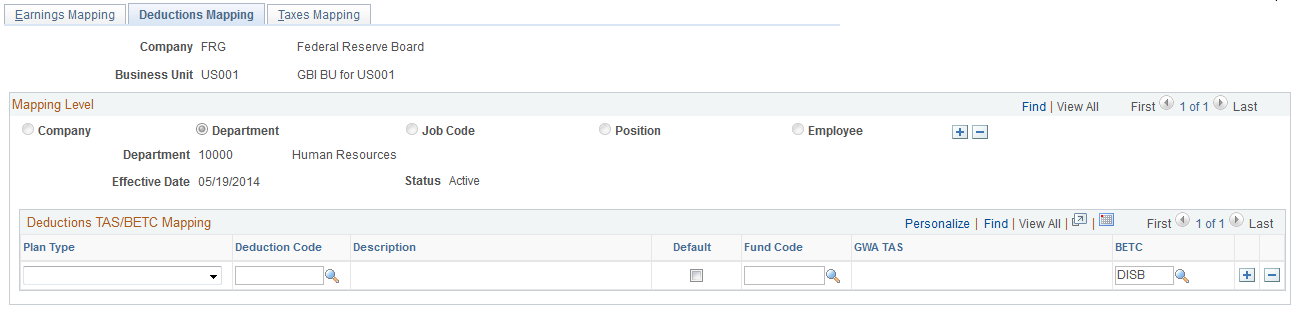

Use the TAS BETC Mapping - Deductions Mapping page (GVT_TAS_MAP_DED) to map a componentized TAS by fund code and BETC for deduction transactions.

Navigation:

This example illustrates the fields and controls on the TAS BETC Mapping - Deductions Mapping page.

Deductions TAS/BETC Mapping

Field or Control |

Description |

|---|---|

Plan Type and Deduction Code |

Select the plan type and deduction code to use for this deduction mapping. Note: If the Plan Type field is blank, the Deduction Code field must also be blank. If this row is the default deduction mapping row, then both the Plan Type and Deduction Code fields can remain blank. If this is not the default mapping row, you can enter a plan type and deduction code, enter only a plan type, or leave both fields blank. |

Default |

Select this check box to use the row as the default deductions mapping row. Note: One row must be selected as the default deduction mapping row, and only one row can be selected as the default. |

Fund Code |

Select the fund code to use for deduction mapping. Note: Only fund codes that are associated with the componentized TAS are available. |

GWA TAS (Government Wide Accounting Treasury Account Symbol) |

The system displays the system-generated GWA TAS code (componentized TAS) that is associated with the fund code. |

BETC (Business Event Type Code) |

The system displays the default BETC for the componentized TAS. DISB (Payroll Disbursement) is the default BETC for all TAS components. If additional BETCs are defined in your system, you can select from the list of valid values here. |

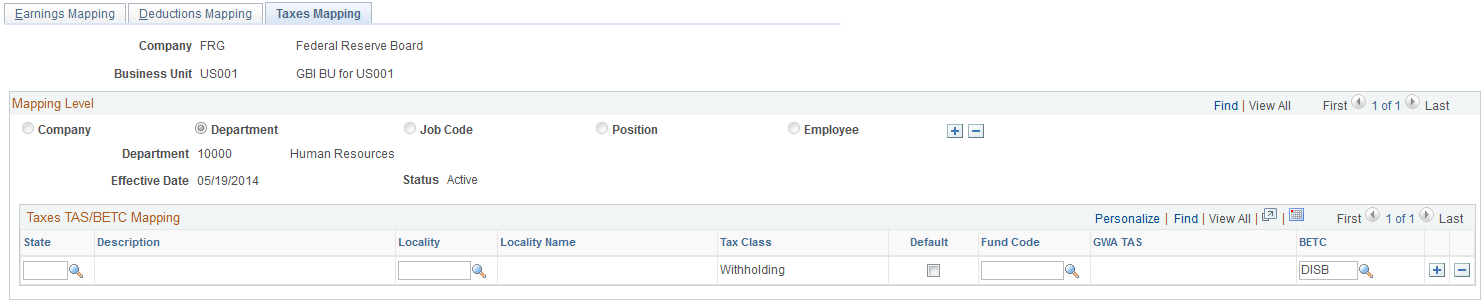

Use the TAS BETC Mapping - Taxes Mapping page (GVT_TAS_MAP_TAX) to map a componentized TAS by fund code and BETC for appropriate state and local taxes.

Navigation:

This example illustrates the fields and controls on the TAS BETC Mapping - Taxes Mapping page.

Taxes TAS/BETC Mapping

Field or Control |

Description |

|---|---|

State and Locality |

Specify the state and locality for which taxes must be paid by employees in the company and business unit. Add rows to cover each state and locality as applicable. For example, additional rows may be required if you are mapping at the department level and departments are located in different states or different areas with different tax laws in the same state. If the row’s Default check box is selected, the State and Locality fields can remain blank. If the State field remains blank, the Locality field must remain blank. If a State field value is entered, a Locality field value is optional. |

Tax Class |

The system displays the only tax class that applies, which is Withholding. |

Default |

Select this check box to use the row as the default tax mapping row. Note: One row must be selected as the default tax mapping row, and only one row can be selected as the default. |

Fund Code |

Select the fund code to use for the tax mapping. Note: Only fund codes that are associated with the componentized TAS are available. |

GWA TAS (Government Wide Accounting Treasury Account Symbol) |

The system displays the system-generated GWA TAS code (componentized TAS) that is associated with the fund code |

BETC (Business Event Type Code) |

The system displays the default BETC for the componentized TAS. DISB (Payroll Disbursement) is the default BETC for all TAS components. If additional BETCs are defined in your system, you can select from the list of valid values here. |