Recording One-Time Garnishments

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PAY_SHEET_ADD_G |

Enter a one-time garnishment to take in the current pay period only, override an existing garnishment, suspend an existing garnishment, and refund an existing garnishment. |

|

|

By Payline - One-Time Garnishments Page |

PAY_SHEET_LINE_G |

Enter a one-time garnishment to take in the current pay period only, override an existing garnishment, suspend an existing garnishment, and refund an existing garnishment. |

|

By Payline Security - One-Time Garnishments Page |

PAY_SHEET_LN_G |

Enter a one-time garnishment to take in the current pay period only, override an existing garnishment, suspend an existing garnishment, and refund an existing garnishment. |

This topic discusses how to:

Make a one-time change in processing a garnishment.

Take only a garnishment deduction.

Process only selected garnishments.

Process a garnishment refund.

Making a One-Time Change in a Garnishment

You cannot override a garnishment deduction on the One-Time Deductions page. Although you can enter and save a garnishment deduction code on the page, the Pay Calculation process generates error message 000010, indicating that the override is invalid.

To change a garnishment, such as overriding the calculation or amount, use the One-Time Garnishment page.

Taking Only a Garnishment Deduction

To take only the garnishment deduction and no other deductions:

Select Subset in the General Deductions Taken field on the One-Time Deductions page.

Enter a deduction subset that you have defined to include only the garnishment deduction code.

Processing Selected Garnishments

Some employees have more than one garnishment. If you want to take one or more but not all of the employee's garnishment deductions, you must suspend the garnishment deductions that you don't want to take.

To process selected garnishments, use the One-Time Garnishment page and enter a garnishment override with the One-Time Code of Suspend Garnishment for each active garnishment that you don't want to process.

Processing a Garnishment Refund

To process a garnishment refund:

Enter the garnishment ID on the One-Time Garnishment page.

Select Refund Garnishment Amount as the one-time code.

Enter the amount to be refunded for the garnishment and/or for the company and payee fees.

If the employee has other garnishments, select Suspend Garnishment as the garnishment override for each of them if necessary.

Some U.S. garnishment orders related to support require that all of an employee's bonus or other special payment be garnished, over and above the garnishment rule limitations. The order might require that all or a defined part of a certain check be paid toward the garnishment order, without regard for the normal exemptions and allowances usually permitted. Examples of special payments include checks for bonuses, dividends, commissions, and so forth.

This topic discusses how to use two special deduction calculation routines to garnish:

All of a special payment.

A specific amount without exemptions.

The entire special check while garnishing the regular check normally.

All of a check after taxes and specified other deductions.

Note: To process this type of garnishment override, the earnings to which the garnishment override applies must be on a separate check. The override is applied to all earnings on a check; it cannot be applied to only part of the earnings on a single check.

Example 1: Garnish All of the Special Payment

To process a garnishment when a court has ordered that all of a bonus or special payment check is to go to a support order:

Select Subset in the General Deductions Taken field on the One-Time Deduction page.

Enter a deduction subset that you have defined to include only your garnishment deduction code.

If the employee has other garnishments that are not to be taken, on the One-Time Garnishment page, enter a garnishment override with the One-Time Code of Suspend Garnishment for each active garnishment that you don't want to process.

On the One-Time Garnishment page, select a value in the Deduction Calculation Routine field:

If the earnings are taxable, you can select either No exempt; % of Gross (no exemptions; percent of gross) or No exempt; % DE + Amt (no exemptions; percent of disposable earnings plus amount) and enter 100 percent.

The system calculates and takes all applicable taxes and the remainder of the check then goes to the garnishment.

If the earnings are not taxable, select No exempt; % of Gross (no exemptions; percent of gross) and enter 100 percent.

Example 2: Garnish a Specific Amount Without Exemptions

To take a specific amount without regard to the limits imposed by exemptions and/or allowances:

On the One-Time Garnishment page, select No exempt; % DE + Amt (no exemptions; percent of disposable earnings plus amount) in the Deduction Calculation Routine field.

Do not enter a percentage.

Enter the amount you want to be taken.

If there is not enough net amount of the check to take the specified amount, the system performs the appropriate proration processing.

Example 3: Garnish the Regular Check Normally and Garnish the Entire Special Check

To pay an employee's regular pay from which you take the regular garnishment deduction and also a bonus from which you take the entire amount after taxes for a particular garnishment:

On the paysheet, enter the bonus as a separate check.

Enter the deduction subset and garnishment overrides as described in Example 1 for the bonus check only.

The system takes the regular garnishment from the regular paycheck and the entire amount from the bonus paycheck.

Example 4: Garnish All of a Check After Taxes and Specified Other Deductions

If you want to take all of a check after taxes and after other deduction such as medical insurance have been deducted, you could:

Use a garnishment rule that allows the deduction(s) in calculating the disposable earnings.

Use the override of No exempt; % DE + Amt and enter 100%.

If the rule does not allow the other deduction(s) you want to take, you could use the override as follows:

Set up a deduction override with a deduction subset that includes the garnishment deduction code and any others you want to process.

Set up garnishment overrides to suspend all of the garnishments except the one you want to process.

Set up an override for the garnishment you want to take using No exempt; % DE + Amt and enter a small dollar amount in the Amount box, such as $10.

Calculate the check.

Look at the net amount of the check; go back to the One-Time Garnishments page for the garnishment you want to take and add the net check amount to the $10 you entered previously.

When you calculate the check again, you should have the correct garnishment amount and a net check amount of zero.

If your first calculation resulted in some "deduction not taken" amounts, you'll have to hand calculate how much is available for the garnishment and/or for the other deductions on the check and redo your overrides to produce the results you need. You might have to repeat the process until the correct amount is calculated.

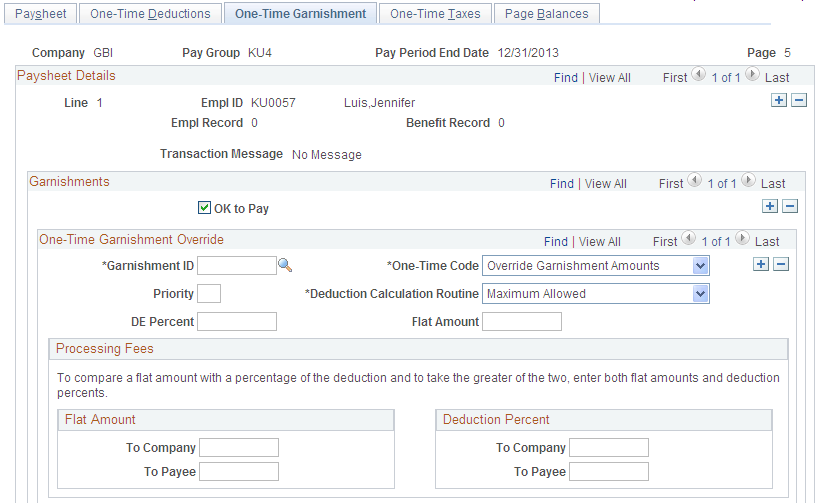

Use the By Paysheet - One-Time Garnishment page (PAY_SHEET_ADD_G) to enter a one-time garnishment to take in the current pay period only, override an existing garnishment, suspend an existing garnishment, and refund an existing garnishment.

Navigation:

This example illustrates the fields and controls on the By Paysheet - One-Time Garnishment page.

One-Time Garnishment Override

Field or Control |

Description |

|---|---|

Garnishment ID |

Select the Garnishment Specification Data record to override. |

Priority |

Enter the priority to override from the Garnishment Spec Data pages. |

Do Not Apply Exemption |

This check box is visible only if a garnishment tax levy has been defined for the employee on the Garnishment Spec Data pages. Use this check box when processing additional checks so that the exemption amount, which is automatically applied to regular checks, is not also applied to the additional checks. Selecting the check box prevents the system from applying the exemption amount to this check. When it is selected, the batch process does not calculate any exemption amount for the tax levy garnishment, and a message appears on the Garnishment Detail page to indicate that the exemption was overwritten on the payline for this check. |

One-Time Code |

Select from these values:

Note: If you override or refund this garnishment, the system uses all the calculation and processing fees fields on this page to calculate the garnishment, even if they are blank. For example, if you leave the fields in the Processing Fees fields blank, the system treats them as though you entered 0. |

Deduction Calculation Routine |

Select the deduction calculation routine for the one-time garnishment:

|

DE Percent (disposable earnings percent) |

Enter the percent of disposable earnings to use in the override calculation. |

Flat Amount |

Enter the flat amount to use in the override calculation. |

Processing Fees

Use this group box to override the normal processing fees. If the order requires you to withhold the greater of the percent of the garnishment amount or a flat amount, enter both; the system withholds the greater of the two.