(USF) Specifying Garnishment Data for U.S. Federal Government Employees

Note: The Create Garnishments component (GVT_GARNISH_SPEC) for Federal users is very similar to the component of the same name for the U.S. and Canada, but retains unique object names and provides slight variations in fields.

|

Page Name |

Usage |

|---|---|

|

Garnishment Spec1 Page (garnishment specification 1) |

(USF) Enter garnishment order information. |

|

Deduction Deduction Distribution Information Page |

(USF) Enter the payee's garnishment deduction distribution information. |

|

Garnishment Spec2 Page (garnishment specification 2) |

(USF) Enter information regarding the payee. |

|

Garnishment Spec3 Page (garnishment specification 3) |

(USF) Define garnishment deduction parameters and limitations. |

|

Garnishment Spec4 Page (garnishment specification 4) |

(USF) Define deduction information when deducting from all payrolls. Before using this page, select Deduct on All Payrolls in the Deduction Schedule field on the Garnishment Spec3 page. |

|

Garnishment Spec5 Page (garnishment specification 5) |

(USF) Define the payment schedule for the garnishment. Before using this page, select Deduct by Schedule in the Deduction Schedule field on the Garnishment Spec3 page. |

|

Garnishment Spec6 Page (garnishment specification 6) |

(USF) Indicate which garnishment rule governs each garnishment. |

|

Garnishment Spec7 Page (garnishment specification 7) |

(USF) Enter the court-ordered amount or percent by which to prorate the employee's garnishments. Use this page only if the proration rule of the garnish law state is either CRTORD or CRTDET. |

|

Garnishment Prorations Report Page |

(USF) Generate PAY719 that provides a listing by court ID of employees whose garnishment amounts were prorated. |

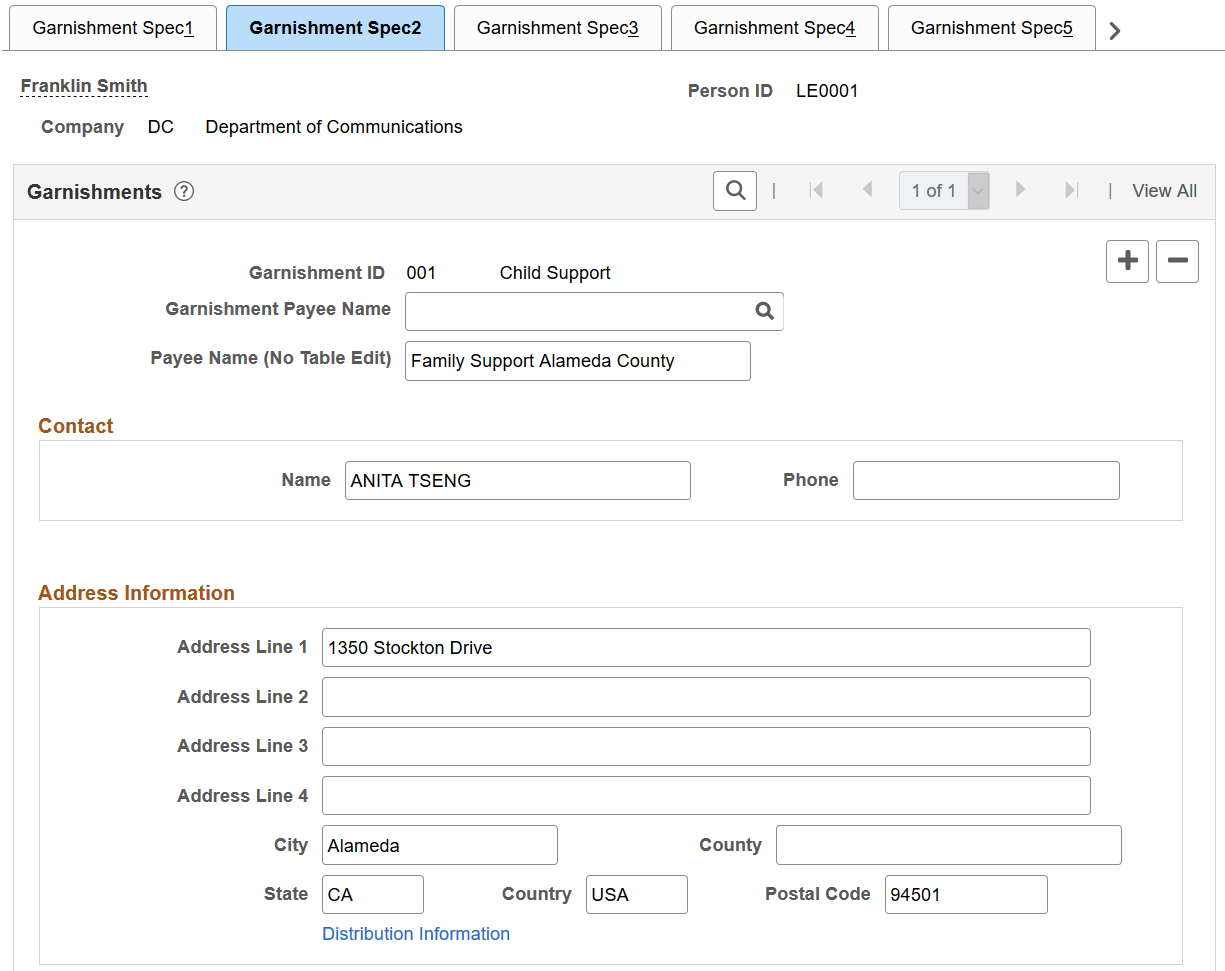

(USF) Use the Garnishment Spec2 (garnishment specification 2) page (GVT_GARNISH_SPEC2) to enter garnishment order information.

Navigation:

This example illustrates the fields and controls on the Garnishment Spec2 page.

Field or Control |

Description |

|---|---|

Payee Name (No Table Edit) |

Enter a payee's name that is not from an existing table. |

Distribution Information |

Select this link to access the Deduction Distribution Information page where you enter distribution information for this garnishment. |

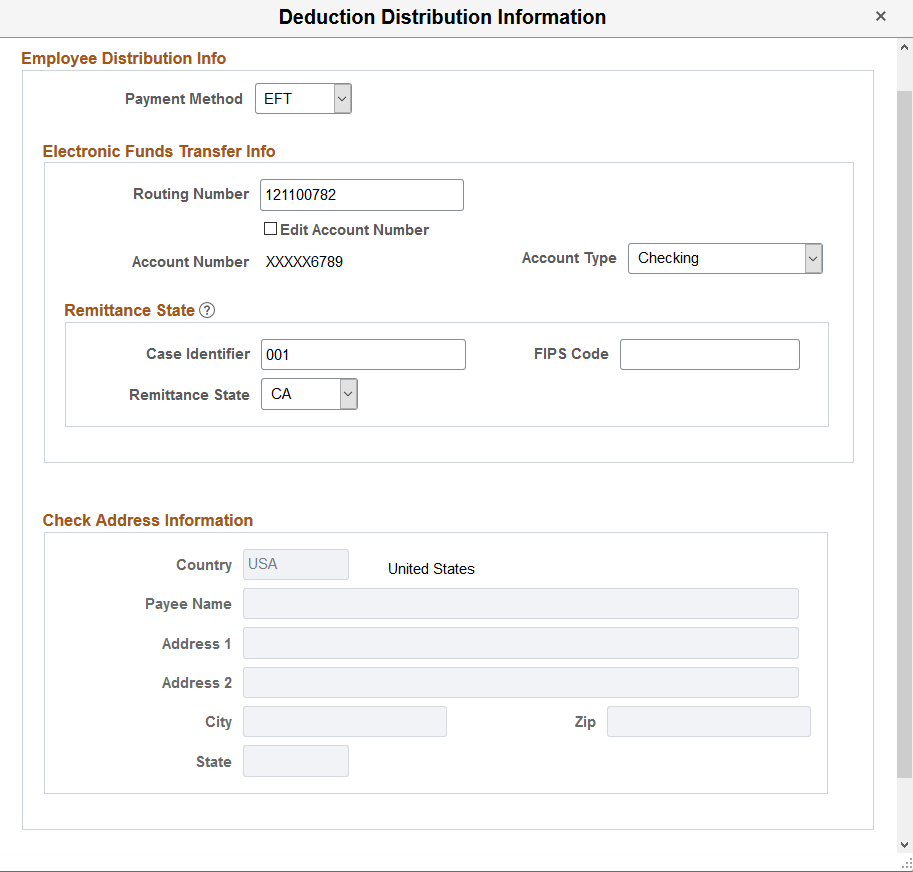

(USF) Use the Deduction Distribution Information page (GVT_GARN_SPEC2_SEC) to enter the payee's garnishment deduction distribution information.

Navigation:

Select the Distribution Information link on the Garnishment Spec2 page.

This example illustrates the fields and controls on the Deduction Distribution Information page (USF).

|

Field or Control |

Description |

|---|---|

|

Payment Method |

Values are: Check EFT None |

Electronic Funds Transfer Info

Enter the electronic funds transfer and remittance state information. This section becomes editable when the selected payment method is EFT.

All fields are required in this section.

|

Field or Control |

Description |

|---|---|

|

Edit Account Number |

Select to update the bank account number. This field appears when the encryption process has been run and the account number previously existed. When selected, the existing read-only account number is cleared from the field for you to enter a new one. |

|

Account Number |

Enter the bank account number. If data encryption is enabled and the encryption process is run for the GVT_GARN_SPEC record, the account number is encrypted in the database if it belongs to a country that is specified on the Define Country for Encryption Page. Also, the account number appears as masked on this page. An exception to this is when the user is assigned the Bank Account Admin role, and this role is defined on the Grant Unmasked Access Page for the GVT_GARN_SPEC record. In this case, the user sees the unmasked account number. |

Check Address Information

Enter the check address information. This section becomes editable when the selected payment method is Check or None.

All fields are required in this section for the Check payment method, except the Address 2 field.