(E&G) Setting Up 1042 Processing for Non-resident Aliens

To establish 1042 processing for non-resident aliens, use the Treaty/NR Alien Table component (TREATY_NR_ALIEN_TA), the Income Code Table component (INC_CD_1042_TABLE), and the Exemption Code Table component (EXM_CD_1042_TABLE).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

INC_CD_1042_TABLE |

(E&G) Set up the income codes used for 1042–S processing. |

|

|

EXM_CD_1042_TABLE |

(E&G) Set up the exemption codes used for 1042–S processing. |

|

|

TREATY_NRA_TABLE |

(E&G) Set up the rules associated with the treaties required for each country with which the U.S. has an agreement. |

|

|

Treaty/Non Resident Alien Rpt Page |

PRCSRUNCNTL |

(E&G) Report on information from the Tax Treaty Table using Tax Treaty Table report (TAX720.SQR) |

The U.S. government has entered into tax treaties with nearly 40 foreign jurisdictions. Income tax treaties coordinate the tax systems of the United States and other countries that are parties to treaties. Treaty provisions affect the taxation of non-resident aliens working in the U.S. While tax treaties are generally based on a standard model, each treaty might have slightly different provisions.

In addition to employees covered by tax treaties, you must also report earnings on a 1042-S form for some non-resident alien employees, such as those with specific types of earnings such as scholarships, fellowships, and grants.

Employee and Employer Requirements

To claim benefits of a treaty, an employee must have a visa and be a resident of one of the treaty countries. An employee can claim benefits of only one treaty at any given time. Employees who want to claim benefits under a tax treaty must submit a written statement and applicable forms (W-4, Form 8233, Form 1001) to their employer.

As an employer, you must apply the specific treaty rules when calculating federal withholding tax. These rules often include time limits and earnings caps. Different types of earnings, such as scholarships, grants, and fellowships, might be subject to different taxation rates. You must produce a Form 1042-S and a 1042 summary form for each non-resident alien employee affected by the special withholding rates. If you file 250 or more 1042-S forms, you must report on magnetic media. Earnings reported on a 1042-S are not reported on a W-2; so, an employee may need both a W-2 and a 1042-S if some earnings are covered by the special tax treaty rates and some are not.

Income Code and Exemption Code Setup in Payroll for North America

Use the Income Code Table page and the Exemption Code Table page to view income and exemption codes for IRS 1042–S reporting. Oracle delivers and maintains the values in these tables, which are updated only when the IRS changes the value for an Income Code or Exemption Code. The most current effective-dated rows in each table reflect the correct IRS code values for the current tax year.

Tax Treaty Setup in Payroll for North America

Use the NR Alien Tax Treaty Table page to capture the tax rates specified in tax treaties (including exempt earnings, which are recorded with a 0% tax rate). This table identifies those earnings subject to a 30% flat withholding tax.

If you employ nonresident aliens from countries that do not have a tax treaty with the U.S., set up a record with NO TREATY as the treaty ID. You can either set up a record for each country that does not have a treaty, or one record for all countries without treaty. You must also identify these employees as nonresident aliens on their federal tax data records.

Note: PeopleSoft re-delivers the tax treaty table with each major version and, if required, with the year-end Tax Update. If interim changes are required, you must track and apply the changes in your environment.

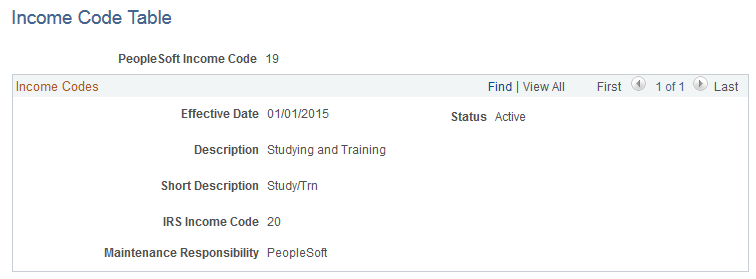

(E&G) Use the Income Code Table page (INC_CD_1042_TABLE) to set up the income codes used for 1042–S processing.

Navigation:

This example illustrates the fields and controls on the Income Code Table page.

Field or Control |

Description |

|---|---|

PeopleSoft Income Code |

Displays the system’s unique identifier for the income code. This value does not always match the IRS Income Code, which can change over time. |

IRS Income Code |

Displays the income code used by the IRS. This is the code that appears on pages and reports that reference the income code. |

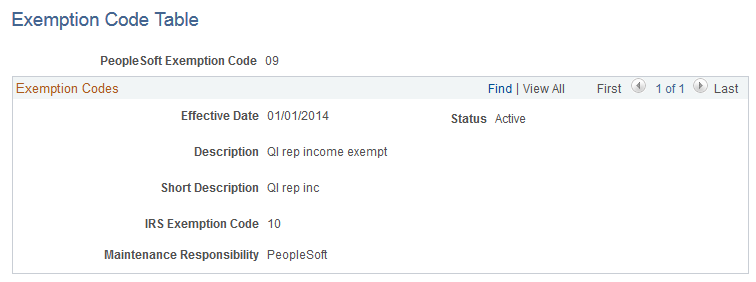

(E&G) Use the Exemption Code Table page (INC_CD_1042_TABLE) to set up the exemption codes used for 1042–S processing.

This example illustrates the fields and controls on the Exemption Code Table page.

Field or Control |

Description |

|---|---|

PeopleSoft Exemption Code |

Displays the system’s unique identifier for the exemption code. This value does not always match the IRS Exemption Code, which can change over time. |

IRS Exemption Code |

Displays the exemption code used by the IRS. This is the code that appears in reports that reference the exemption codes. |

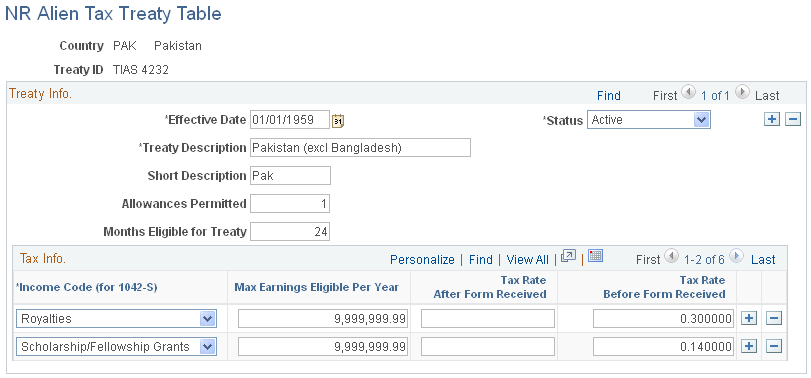

(E&G) Use the NR Alien Tax Treaty Table page (TREATY_NRA_TABLE) to set up the rules associated with the treaties required for each country with which the U.S. has an agreement.

Navigation:

This example illustrates the fields and controls on the NR Alien (non-resident alien) Tax Treaty Table page.

Field or Control |

Description |

|---|---|

Country |

If you want to establish entries on the NR Alien Tax Treaty table that are applicable to more than one country (for example, to use for all scholarship income that is to be taxed at 30%, or for countries that do not have a treaty), you can use any value prefixed by a $ in the country code (for example, Country = $S). |

Treaty ID |

For countries that do not have a treaty agreement with the U.S., enter NO TREATY in this field on the search page. |

Allowances Permitted |

For each tax treaty record you establish, specify the number of allowances permitted by the treaty. The system issues an error message when the employee's claimed allowance is over the maximum allowance permitted. For countries with no treaty, enter 1. |

Income Code (for 1042-S) |

Select each type of earnings subject to special tax treatment under the treaty. Values come from the Income Code Table Page. |

Max Earnings Eligible Per Year |

Specify the earnings caps that apply for each earnings type. |

Tax Rate After Form Received |

Specify the taxation rates that apply for each earnings type. |

Tax Rate Before Form Received |

Specify the taxation rates that apply for each earnings type. |