(AUS) Defining VAT Thresholds

Set up VAT Thresholds using the Thresholds - VAT (ASSET_THRESHOLDS) component, the VAT Defaults (VAT_DFLT_SRCH_DTL) component.

This topic provides an overview of VAT thresholds and discusses how to define VAT thresholds.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ASSET_THRESHOLD |

Store thresholds for a number of adjustment periods. |

|

|

VAT Defaults Setup |

VAT_DEFAULTS_DTL |

Specify VAT Defaults Setup. |

The Asset Thresholds page enables you to store thresholds for a number of adjustment periods to satisfy Australia's legislative requirements. Under Australia's "Goods and Services Tax: Division 129 - Making Adjustments For Changes In Extent Of Creditable Purpose," clients who make a form of supply known as Input Taxed Supply need to track fixed assets utilized in making this type of supply. You can track fixed assets used for Input Taxed Supply from reporting period to reporting period and make adjustments to account for any changes.

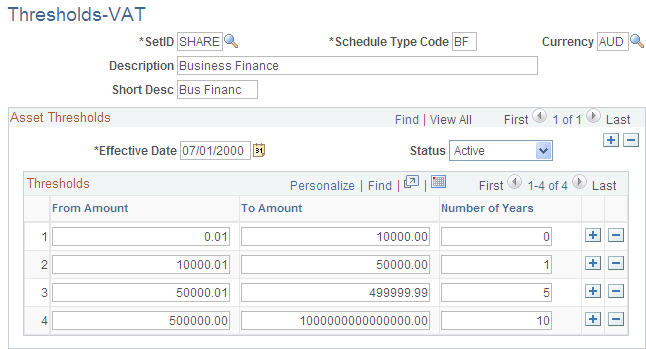

Use the Thresholds - VAT page (ASSET_THRESHOLD) to store thresholds for a number of adjustment periods.

Navigation:

This example illustrates the fields and controls on the Thresholds-VAT page. You can findVAT_DEFAULTS_DTL definitions for the fields and controls later on this page.

Enter the thresholds from amount and to amount range, as well as the number of years required for mandatory review.

Note: The system does not validate the range of thresholds that you specify. To satisfy the threshold ranges specified by the legislation, the amount ranges do not overlap.

Keep the following criteria in mind when identifying thresholds:

The minimum threshold is 0.01.

The From Amount, To Amount, and Number of Years fields are required for each row.

The basis From Amount must be 0.01 more than the previous basis To Amount.

The number of years must be greater in each subsequent row.

Note: For calculation of last date of review, if the cost of an asset is greater than the maximum to amount threshold, the number of years for the maximum to amount threshold is used.

See (AUS) Using PeopleSoft Asset Management Options to Meet Australian Requirements.

See Asset Classes Page.