(IND) Defining Tax Entities and Tax Options

Use the Tax Entity Definition (TAX_ENTITY_DEFN) component to define tax entities and tax options.

This topic discusses how to define Tax Entities and Tax Options.

The tax entity is the reporting entity for depreciation and taxes in India. It is defined by the asset blocks, tax class tax rates, SetID calendar, and business unit and books that are associated with it.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAX_ENTITY_DEFN |

Define the tax reporting entity. Tax entity is composed of one or more business units, and tax reporting is required per entity for India. |

|

|

TAX_ENTITY_ATTR |

Define the 50 percent rule as it applies for assets. Assets in India are grouped separately to include assets that have been in service for more than 180 days in one group and those that have been in service for less than 180 days in another. For assets in service less than 180 days, only 50 percent of normal depreciation rate is allowed (per Section 32). |

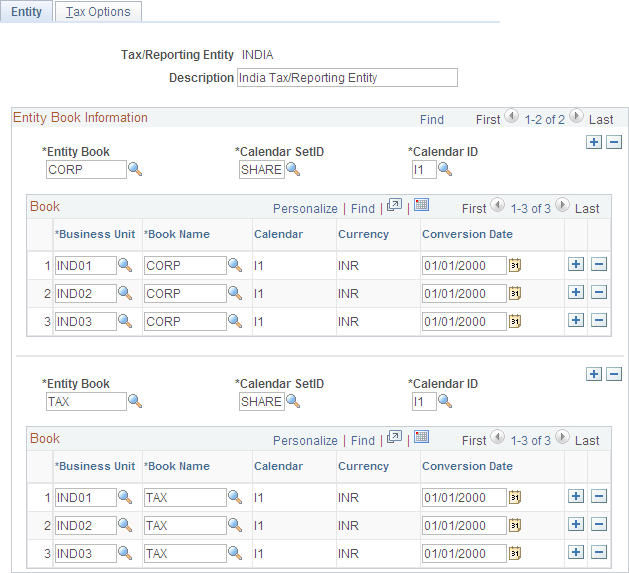

Use the Entity page (TAX_ENTITY_DEFN) to define the tax reporting entity.

Tax entity is composed of one or more business units, and tax reporting is required per entity for India.

Navigation:

This example illustrates the fields and controls on the Entity page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax/Reporting Entity |

Displays the name of the tax reporting entity that you are defining or working with. |

Entity Book |

The value selected here defines how to group the tax or reporting entity. All asset books are available regardless of SetID. |

Calendar SetID |

Select the SetID for the calendar that you want to associate with this entity book. Once a calendar SetID is selected, you are limited to the calendar IDs available within that SetID. |

Calendar ID |

Select the calendar ID from the available calendars for the selected SetID. |

Business Unit |

Enter the business unit to be included in this tax reporting entity from the list of available business units. |

Book Name |

Enter the asset book name (business unit or book) to be included in this tax reporting entity from the list of available business unit or book definitions. |

Calendar |

Displays the calendar code. |

Currency |

Displays the currency code based on the value associated with the book entered. |

Conversion Date |

The conversion date is equal to the actual date or fiscal year start date of the beginning of asset management operations in India. This determines whether you can modify the opening balance calculated in the first fiscal year. This is used only for tax report entity and not just reporting entity. |

Use the Tax Options page (TAX_ENTITY_ATTR) to define the 50 percent rule as it applies for assets.

Assets in India are grouped separately to include assets that have been in service for more than 180 days in one group and those that have been in service for less than 180 days in another. For assets in service less than 180 days, only 50 percent of normal depreciation rate is allowed (per Section 32).

Navigation:

This example illustrates the fields and controls on the Tax Options page. You can find definitions for the fields and controls later on this page.

This page defines whether to use the Indian 50 percent rule. Assets owned for less than the specified number of days are depreciated at half of the normal rate, or 50 percent. It also defines whether manual adjustments to the tax depreciation balance inquiry (TAX_DEPR_BAL) page are allowed.

Field or Control |

Description |

|---|---|

50% rule, assets in service < |

Enter the maximum number of in-service days to which the 50 percent rule applies. For example, if the 50 percent rule applies for assets in service less than 180 days, enter 180. |

Country |

Select the country for which the 50 percent rule applies. |

Update on Close Balances |

Select one of these options: Update on Close Balances: Select this option if the calculated closing balance can be manually adjusted. Update on other amounts: Select this option if other calculated amounts can be manually adjusted. |