(IND) Using PeopleSoft Asset Management Options to Meet Indian Requirements

PeopleSoft Asset Management addresses issues related to fixed-asset accounting in India. This topic provides an overview of asset depreciation processing for India and discusses how to process tax depreciation.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Calculate Balances IND Page |

AM_DEPR_TAX |

Calculate tax depreciation balances for India. |

|

Tax Depr Bal (tax depreciation balances) Page |

TAX_DEPR_BAL |

Displays tax depreciation balance for India that you can update. |

|

Assets Register - IND Page |

RUN_AMDP2510 |

Reports historical depreciation for the fiscal year. |

|

Depreciation Balance - IND Page |

TAX_DEPR_RQST |

Generate tax depreciation balance report for the tax period. |

PeopleSoft Asset Management provides asset processing features that correspond to the tax reporting requirements established by Indian tax legislation. Indian tax law does not recognize depreciation on individual assets. Instead, it groups similar pools of assets under a prescribed tax block. There are only four tax blocks of assets provided for under the tax act: buildings, furniture and fixtures, machinery and plant, and intangibles. Further, each tax block of assets comprises tax groups, and each tax group has its own individual tax rate. The Indian tax year is fixed on a fiscal year calendar that runs from April 1 through March 31. Annual tax depreciation is reported to the tax authority per tax block per fiscal year .

To meet these requirements, PeopleSoft Asset Management allows for the grouping of assets by asset blocks for accumulating and reporting depreciation and taxes. Each asset block can have as many depreciation rates associated with it as necessary to delineate Indian tax groups. To meet reporting requirements, a tax entity is defined, associated with a specific book, and has as many business units and asset books associated with it as necessary.

The Straight Line Percent method of depreciation in PeopleSoft Asset Management uses the asset useful life to calculate the depreciation rate. India calculates useful life based on the depreciation rate guidelines published by the governmental finance authority. The rates established depreciate 95 percent of the cost over the useful life of the asset, at minimum: accelerated depreciation is allowed. India calculates depreciation based on the rates rather than useful life. In addition, these rates also consider the residual or salvage value at the end of the asset useful life. To determine useful life of an asset in India, the straight line percent method multiplies the depreciation rate by cost and this results in the useful life. Further, there are two different ways to calculate depreciation adjustments under the Indian Straight Line Percent method: remaining value and life-to-date. All transactions use an actual day (AD) convention for calculating depreciation. Assets are depreciated when they are placed in service. Processing for leased assets is included.

During the end-of-year processing of depreciation and taxes for India, assets are grouped into blocks based on the tax entity and asset profile definition in place for the asset. The opening written down value (WDV) is retrieved from the prior year WDV for the corresponding tax entity, asset block, and rate.

Asset Management provides these reporting processes to manage Indian tax and depreciation requirements:

Produce the Asset Register - India: Reports an historical record of assets over the fiscal year period.

Produce the Depreciation Balance - IND report: Displays the calculated opening WDV balance and reports depreciation during the year.

Calculate and Update Depreciation Balance - IND processes: Calculates depreciation balances for India and provides an online update of balances (depending on your setup options).

The system provides functionality to process operating and capital leases when manually specified.

When you accumulate assets subject to India's depreciation and tax guidelines, you must first assign an asset block, a guideline (tax) class, and a tax entity to each asset. Also, you should set up each asset to depreciate when in service. These attributes are defined in the Book Definition component and the Book - Depreciation (ASSET_BOOK_01) and Book - Tax (ASSET_BOOK_02) pages. When depreciation and tax processing commences, the system retrieves these designated assets for processing.

See Adding and Maintaining Asset Information.

To process and report on depreciation and tax for India:

To process depreciation for India, request the depreciation calculation process (AM_DEPR_CALC).

To calculate depreciation balances for India for the tax period, request the process to calculate balances for India (AMTX2000).

To update depreciation balances for India for the tax period, request the process to update balances for India (TAX_DEPR_BAL).

To review the asset register for India, request the assets register for India (AMDP2510).

Calculating Tax Depreciation Balances for India

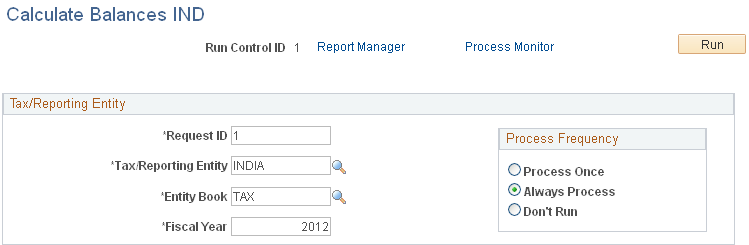

Use the Calculate Balances IND page (AM_DEPR_TAX) to calculate tax depreciation balances for India.

Navigation:

This example illustrates the fields and controls on the Calculate Balances IND page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax/Reporting Entity |

Select the tax and reporting entity for this process. The available tax entities are defined by the asset blocks, tax class tax rates, setID calendar, and business unit/books that are associated with it. |

Entity Book |

Select the entity book for this process. The entity book defines how to group the tax or reporting information. |

Updating Depreciation Balances for India

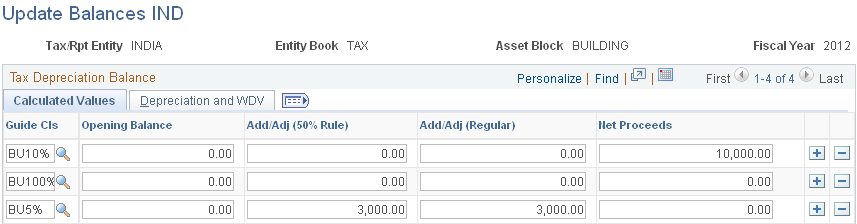

Use the Tax Depr Bal (tax depreciation balances) page (TAX_DEPR_BAL) to displays tax depreciation balance for India that you can update.

Navigation:

This example illustrates the fields and controls on the Tax Depr Bal page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Tax Depr Bal page (2 of 2). You can find definitions for the fields and controls later on this page.

If your setup options have enabled manual adjustments to depreciation balances, you can access calculated balances and enter adjustments in the Manual Adjustment column. No recalculations are processed on the basis of any manual adjustment entered, but the values are added to the WDV.

Assets Register - IND Page

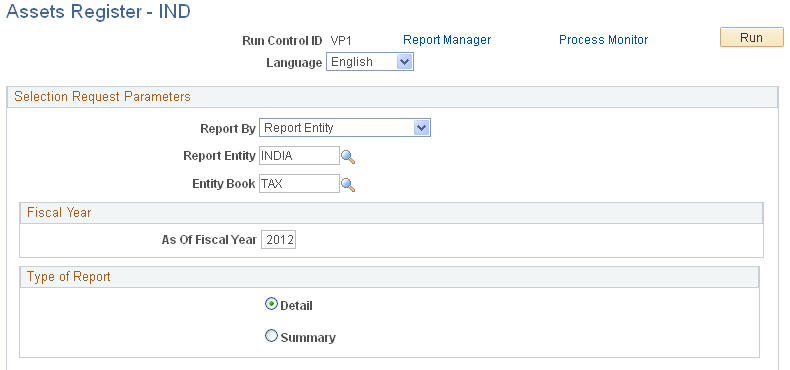

Use the Assets Register - IND page (RUN_AMDP2510) to reports historical depreciation for the fiscal year.

Navigation:

This example illustrates the fields and controls on the Assets Register - IND page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Selection Request Parameters |

Define the parameters for the asset register to report by business unit or report entity. Complete these fields as dictated by your needs:

|

Depreciation Balance - IND Page

Use the Depreciation Balance - IND page (TAX_DEPR_RQST) to generate tax depreciation balance report for the tax period.

Navigation:

When calculating the annual tax depreciation balances, the following rules apply:

Tax depreciation is calculated for each tax group per the tax group tax rate.

Opening balance (WDV) is required for each tax group each year.

The opening balance in the conversion year is entered; in subsequent years, the opening balance is processed by Asset Management and is equal to the ending balance of the previous year.

Additions and adjustments for the fiscal year are lumped together.

However, these are subgrouped separately to include assets that have been in use for more than 180 days and those that have been in use for less than 180 days. For assets in use for less than 180 days, only 50 percent of the normal depreciation rate is allowed (per Section 32).

To determine the assets that fall in the category of Additions/Adjustments more than 180 days, the system calculates the difference between the fiscal year end date (March 31) and the in-service date for ADD and ADJ transaction types. For additions less than 180 days, the system calculates the difference between the year end (March 31) and the in-service date for ADD and ADJ transaction types. If the in-service date is in the current year but the acquisition date is in prior years, the asset is depreciated at the regular rate rather than at 50 percent of the prescribed rate.

Proceeds for the assets sold during the year are calculated.

Use the formula for calculating WDV depreciation, where:

A = Opening WDV/Balance.

B= Proceeds from sale of an asset.

C= Additions/Adjustments > 180 days.

D= Additions/Adjustments < 180 days.

E= Rate of Depreciation, Depr Value.

In case the entire tax block of assets ceases to exist (for example, all of the assets are sold or transferred), the net income is taxed as short term capital gain. In this case, the opening WDV of all the tax groups in this block becomes zero for the subsequent year.