Adding Assets with the Asset ExpressAdd Component

The Asset ExpressAdd component is a series of pages that enable you to add owned assets quickly and efficiently. Assets added with the Asset ExpressAdd component are assigned a capitalization status automatically when you save, and most of the information in the pages can be defaulted from an asset profile. This component also enables you to enter accumulated depreciation for assets.

When entering joint venture assets that are shared among several business units, it is best to assign a unique asset ID. This ensures that the assets created at the participant level have the same ID as the asset created at the joint venture business unit level. You can make these asset IDs easy to identify by including the prefix JV, for example, you might create the asset ID JV000022.

If an asset is subject to asset retirement obligation (ARO) treatment, you can designate it as such by selecting an ARO profile or simply selecting to use ARO from the ExpressAdd component.

When entering assets that have a parent/child relationship, you must first enter a parent ID on the Cost/Asset Information page before assigning the profile ID default.

Add assets with the Asset ExpressAdd component as follows:

Enter information about how the asset will be capitalized. (If you are adding parent/child assets, you must specify the parent ID in this step.)

Assign a profile ID.

Identify if the asset is subject to ARO treatment.

Identify the asset's books and information needed for calculating depreciation.

Specify property type and tax depreciation criteria.

See also Understanding Leased Assets

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ASSET_ENTRY_00 |

Enter information about how the asset will be capitalized. |

|

|

ASSET_ENTRY_01 |

If you set up book information in the asset profile, all book information appears by default. The Depreciation Information page identifies the asset's books and information needed for calculating depreciation. |

|

|

Tax Information |

ASSET_ENTRY_02 |

Specify property type and tax depreciation criteria and identify the investment credits that are taken for the current asset. If the fields on this page are unavailable, the book was not set up as a tax book. |

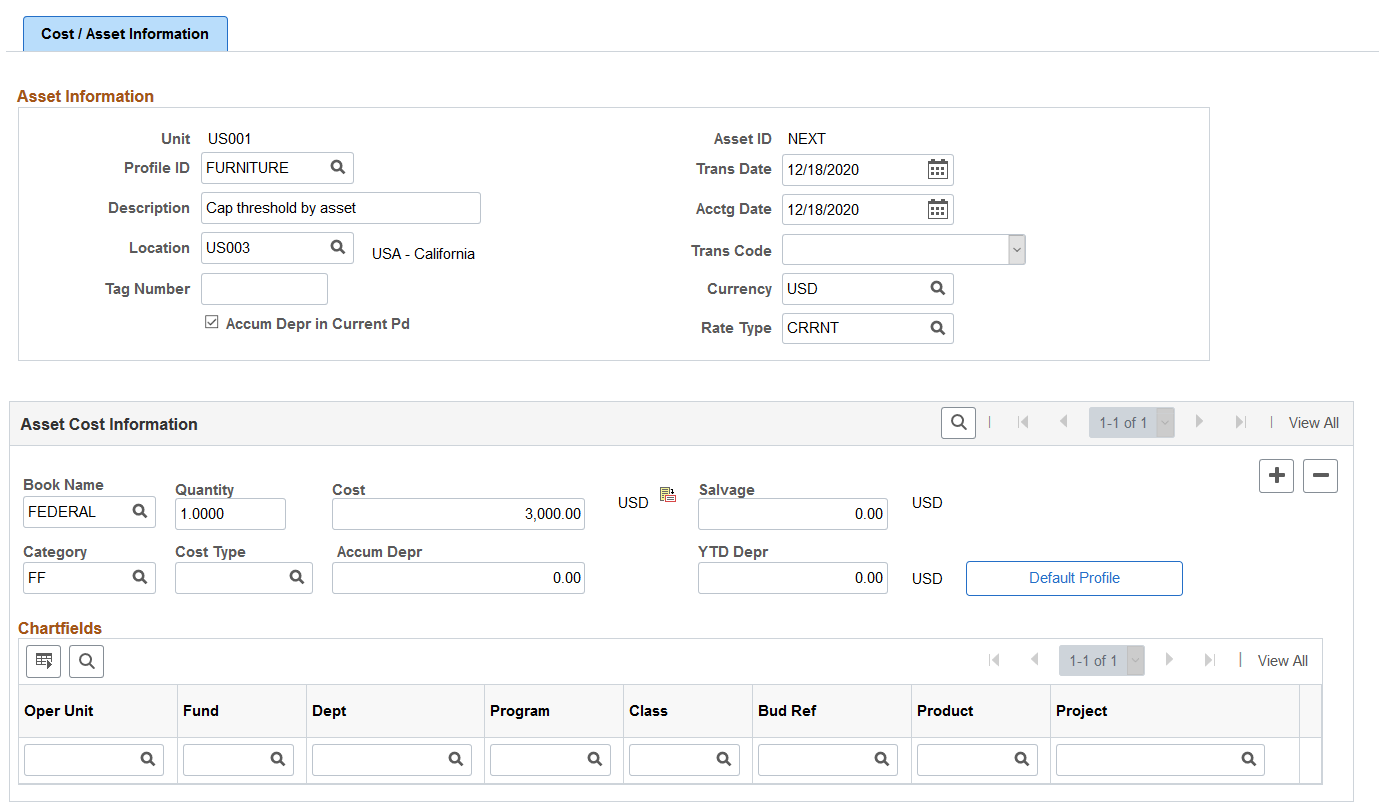

Use the Cost/Asset Information page (ASSET_ENTRY_00) to enter information about how the asset will be capitalized.

Navigation:

This example illustrates the fields and controls on the Cost/Asset Information page. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Cost/Asset Information page. You can find definitions for the fields and controls later on this page.

Asset Information

Field or Control |

Description |

|---|---|

Accum Depr in Current Pd (accumulated depreciation in current period) |

Select to have the system book accumulated depreciation for the asset to the current period. Otherwise, accumulated depreciation is booked to the previous period. If that is the case, you may need to reopen the period. |

Trans Date (transaction date) and Acctg Date (accounting date) |

Typically, the transaction date represents the date that you actually acquired the asset and the accounting date represents the date that the transaction is posted to the general ledger. The accounting date is validated against the FIN_OPEN_PERIOD table to determine the period to which the transaction is posted. The difference between the transaction date and the accounting date determines if any prior period depreciation needs to be calculated. For example, suppose that a computer was acquired and placed in service on March 15, 2001, but the information was not entered in PeopleSoft Asset Management until August 1, 2001. All general ledger periods prior to August are closed. In this case, PeopleSoft Asset Management automatically calculates depreciation starting in March and posts it to the general ledger in August. |

Location |

Identify the asset location by selecting from a list of valid values. Identification of the asset location is required for managing hazardous material assets, which must often be monitored and reported on. This location is automatically populated with the ship from location for VAT-enabled business units. |

Trans Code (transaction code) |

Identify which accounting entry template is used for the asset, such as Abandoned, Inventory, or Scrapped. The system accepts only valid combinations of the category, cost type, transaction code, and transaction type for which accounting entry templates exist. |

Currency and Rate Type |

Select the currency and exchange rate type. |

Note: When working with parent/child assets, you must go to the Asset Additional Information section and enter the parent ID before you select Default Profile.

Asset Cost Information

Enter one row of cost information before populating fields with the default information from the asset profile.

Field or Control |

Description |

|---|---|

Cost Type |

Break down portions of the asset cost, and enter as many cost types as needed for each transaction. For example, the costs of constructing a building are often broken down into categories reflecting the type of cost, such as material, labor, permits, and so on. Only valid cost types are accepted. The cost types are user-defined during the system implementation. |

Salvage |

Displays the salvage value that is calculated based on the option defined at the asset profile level (either flat amount or percentage). Salvage value is prorated based on a ChartField's cost if a flat amount is used, and it appears as a percentage of cost if the percentage option is selected. |

Accum Depr (accumulated depreciation) |

Enter the amount of depreciation already recognized. If you are adding assets that have depreciation from prior years or prior periods, enter that amount in this field. |

YTD Depr (year to date depreciation) |

If any portion of the accumulated depreciation amount applies to the current fiscal year, enter the amount of that portion. |

Note: The accumulated depreciation, YTD depreciation, and salvage amounts entered while creating a foreign currency asset, will not be converted into the Business Unit's or book's base currency. These values needs to be entered in Primary Book's base currency.

Note: After you save this page, you cannot change the asset information here. To modify the information, you must use the Asset Cost Adjust/Transfer page or the Basic Add page. When working with parent/child assets, remember to designate the parent ID before you continue.

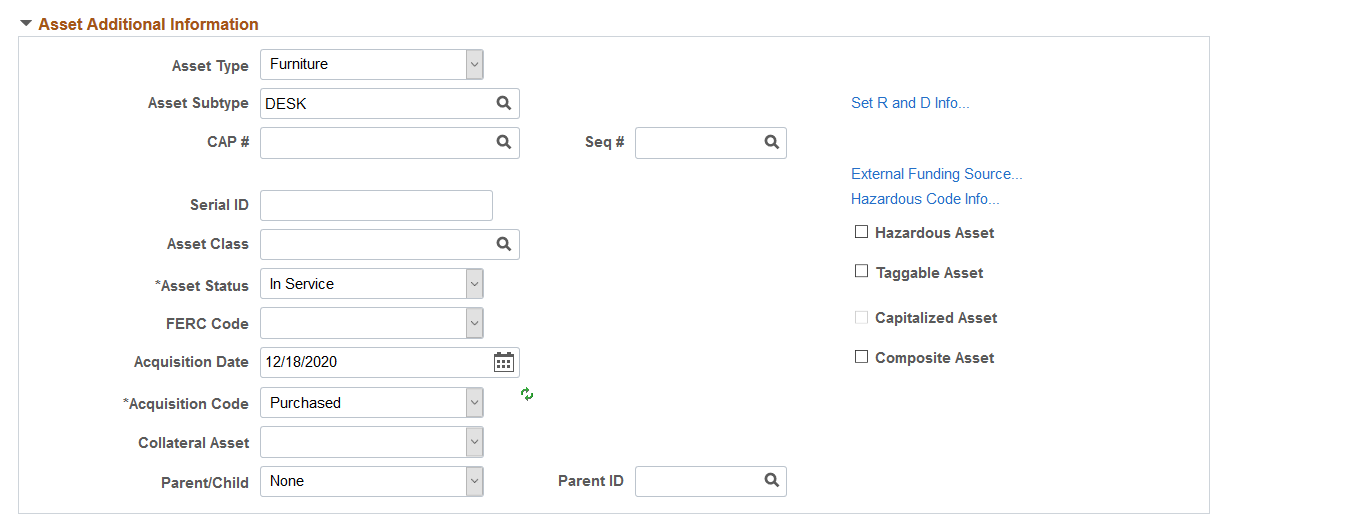

Asset Additional Information

Field or Control |

Description |

|---|---|

Asset Type |

Select a value to indicate a type of asset. The available options are: Equipment Facility Fleet Furniture Hardware Intangible Machinery Other Property Software |

Asset Subtype |

Select a value to indicate a subset of asset type. Subtypes are optionally user-defined and directly related to the asset type. Only asset subtypes of the selected asset type are available when defining the asset. |

CAP # (capital acquisition plan number) and Seq # (sequence number) |

The capital acquisition plan (CAP) number ties the asset to a CAP. Enter a valid number and sequence. You set up CAP numbers in the CAP table. |

Threshold ID |

This value defaults from the capitalization Threshold ID that is associated with the asset profile for a given asset. You can override the Threshold ID if needed. If no threshold was defined for the profile, you can select an asset based threshold ID. When adding an asset, the system uses the capitalization definition for the applicable Threshold ID to determine the appropriate capitalization action to take. Upon saving, the system compares the total cost of the line (cost x quantity) with the cost established for each bracket, as well as the basis option to decide the action to take. This field is available for editing only when:

|

Serial ID |

If applicable, enter the serial number for the asset. |

Asset Class |

This field is used to classify assets for reporting purposes. It can be used in combination with an asset category to refine asset classification. These fields can also be used for VAT purposes. |

Asset Status |

Indicate the status by selecting one of the following options:

|

FERC Code |

Select a FERC code if it applies. |

Acquisition Date and Acquisition Code |

Enter the date the asset was acquired and select an acquisition code: Construct, Donated, Leased, Like Exch, Purchased, Trade In, and Transfer |

Collateral Asset |

Japanese accounting principles require that assets offered as collateral be treated according to financial reporting regulations under the commercial law. If the asset is a collateral asset, select one of the available options that comply with Japanese requirements. |

Parent/Child and Parent ID |

If you are adding a parent or child asset, select the parent-child asset option that applies. The default is None. If this is a child asset, enter the parent asset ID with which to associate it. |

Asset Retirement Obligations |

Select to identify an asset that is subject to asset retirement obligation (ARO) treatment in accordance with Financial Accounting Standards for proper reporting and processing. This field appears only when you have enabled ARO on the Installation Options – Asset Management page and enabled ARO at the business unit level. |

Field or Control |

Description |

|---|---|

Hazardous Asset |

Check if the asset qualifies as hazardous. |

Taggable Asset |

Check if the asset can be physically assigned a tag number. |

Capitalized Asset |

This check box is display-only, and the status is determined automatically by the asset profile. Non capitalized assets have no cost or books and are not depreciated in Asset Management. Sometimes you need to track physical information only (such as location, physical specifications, number of units, and so forth), but you don't want information about the assets to appear in the general ledger. |

Composite Asset |

Check if the asset is a composite asset. |

Set R and D Info (set research and development information) |

Click this link to enter research and development information on the Asset R&D Information page. In Australia, this option is used for tax reporting purposes. Otherwise, this field is informational only. |

External Funding Source |

Click to access the External Funding Source Page and associate the asset with an external funding source. |

Hazardous Code Info (hazardous code information) |

Click on this link to go to the Hazardous Asset Codes page and select a hazardous code to identify with and associate to this asset. |

Asset Retirement Obligations |

Select to identify an asset that is subject to asset retirement obligation (ARO) treatment in accordance with Financial Accounting Standards for proper reporting and processing. This field appears only when you have enabled ARO on the Installation Options – Asset Management page and enabled ARO at the business unit level. |

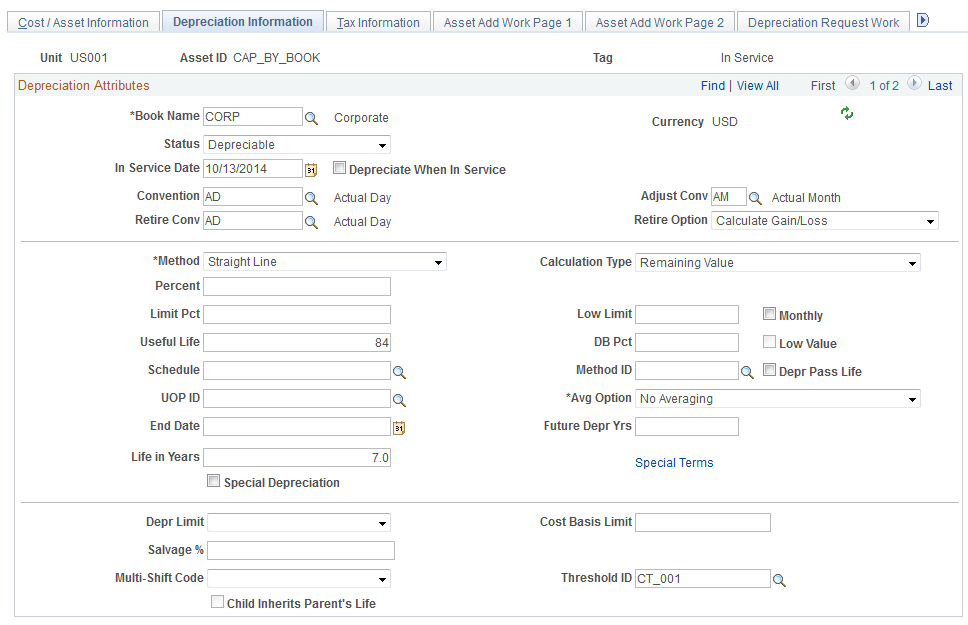

Use the Depreciation Information page (ASSET_ENTRY_01) to identify the asset's books and information needed for calculating depreciation.

Navigation:

This example illustrates the fields and controls on the Depreciation Information page. You can find definitions for the fields and controls later on this page.

If you set up book information in the asset profile, all book information appears by default. An asset can be linked to any number of books. Typically, separate books are required for financial and tax purposes. If you manage assets in multiple currencies, each currency can have its own book.

The Threshold ID value defaults from the capitalization Threshold ID that is associated with the asset profile for a given asset. You can override the Threshold ID if needed. If no threshold was defined for the profile, you can select an asset based threshold ID. When adding an asset, the system uses the capitalization definition for the applicable Threshold ID to determine the appropriate capitalization action to take.

The Threshold ID field is available for editing only when:

the Capitalization Threshold feature is enabled from the Installation Options - Asset Management page

the Threshold ID on the Cost/Asset Information page is unpopulated

the business unit where the asset is added uses it