Creating Third-Party Vouchers with Customs Duty

This section provides an overview of customs duty processing for India and third-party vouchers and discusses how to:

Create the voucher.

Add or modify the customs duty amount.

View recoverable and nonrecoverable amounts.

Basic customs duty is calculated based on the assessable value of the item. Because the assessable value plus the calculated duty equal the base amount, the duty along with additional and special duty must be calculated in a specific order. The customs duty is calculated in the following order:

The customs authority holds and assesses the goods being imported.

The duty payable must be paid to the customs authority before the goods are released.

The customs authority issues a bill of entry (BOE) assessing the duty payable.

Send the BOE to purchasing for processing.

Pass the BOE to accounts payable where the third-party voucher is used to enter and pay the customs authority.

Copy the purchase order (PO) into the third-party voucher to ensure that the items or distribution are reflected on the third-party voucher.

Override the amounts copied into the third-party voucher from the PO and enter new custom duty codes (the amounts as shown on the PO are generally different from what is actually payable to customs authorities) using the Invoice Line Custom Duty Tax Detail page.

When a new customs duty is added to the voucher line, the amount should roll up to the header. Also, at the time of creation of third-party voucher for payment to custom authorities, receiving is not complete; therefore, the third-party voucher cannot be created on the basis of receipts.

Pay the customs authority.

After the payment is made, the goods are released and a receiver is entered.

Associate the receiver to the third-party voucher.

Run the Landed Cost Extraction Application Engine process (LC_EXTRACT).

The Landed Cost Extraction process captures any variances between the PO calculated amount and the amount entered on the third-party voucher and correctly cost the inventory.

Note: The customs duty assessable value should not be confused with the excise assessable value defined on the Item Tax Applicability page.

You must create vouchers for customs duty by copying from the PO. This ensures that the percentage of recoverable and nonrecoverable custom duty populates to VCHR_LN_EXS_DTL. If the actual amounts differ from those on the BOE, override them on the voucher. After you send payment to the government and create the receiver, reopen the voucher and associate the receiver. Otherwise, the Landed Cost Extraction process does not allocate the customs duty.

Note: Customs duty charges are nonprorated.

To create third-party vouchers for customs duty:

Create a third-party voucher by selecting Third Party Voucher in the Voucher Style field in the Voucher component (VCHR_EXPRESS).

Click the Copy PO button in the Copy from a Source Document group box on the Invoice Information page to copy from the PO to create the third-party voucher.

This copies the customs duty charges from the PO. The duty amounts appear by default on the Invoice Line Custom Duty Detail page. If you change amounts in the Tax Amount field and tab out, the system recalculates the amounts in the custom duty Recovery Amount and custom duty Non Recovery Amount fields.

Note: Amount fields are not populated from the PO if the transaction currency of the PO is different than the third-party voucher currency.

For example, if the PO transaction currency is USD (for import purchase orders supplier is normally outside of India) and the third-party voucher transaction currency is INR (for the Indian customs authority), the PO copy function does not populate required fields. In order to copy required fields from the PO, change the transaction currency of the third-party voucher to be in sync with the transaction currency of the PO (USD). After changing the transaction currency on the voucher header, copy from the PO to create the third-party voucher. Specify the correct payment currency at the time of payment (INR).

Issue the payment and send it along with the BOE to the appropriate government agency.

When the government receives your payment and releases your goods, create the receiver and manually associate the receiver to the third-party voucher.

Manually associating the receiver enables the Landed Cost Extraction process to properly allocate the nonmerchandise costs.

Note: The Associate Receiver(s) link on the third-party voucher is only available to custom duty vouchers. This link is not available until the PO copy function is performed. You can then associate receivers to the third-party voucher. The Associate Receiver(s) link is available if the third-party voucher is not posted or posted.

Use the Invoice Information page (VCHR_EXPRESS1 ) to enter or view invoice information, including invoice header information, nonmerchandise charges, and voucher line and distribution information.

Navigation:

Field or Control |

Description |

|---|---|

Custom Duty |

Displays the custom duty amount for the voucher. |

Copy from a Source Document

Field or Control |

Description |

|---|---|

PO Unit |

Select the PO business unit. |

Purchase Order |

Select the appropriate PO. |

Copy PO |

Click this button to copy the document to voucher and transfer back to the Invoice Information page. |

Use the Invoice Line Custom Duty Tax Detail page (VCHR_LINE_CSD) to review and modify the customs duty charges for the voucher at a more detailed level.

Navigation:

Click the Custom Duty link in the Invoice Lines group box on the Invoice Information page.

Field or Control |

Description |

|---|---|

Custom Duty Applicable |

This is selected if the supplier is defined as custom duty applicable in the Supplier Location Tax Applicability page. |

Custom Duty Details

Field or Control |

Description |

|---|---|

Tax Type |

Displays C for customs duty tax type. |

Tax Component Code |

Displays the customs duty tax elements. The total of these elements would be the amount remitted to the customs authorities. Values are: BCD (basic customs duty). SAD (special customs duty). |

Basis Amount |

Displays the assessed value of the item. The BCD is calculated based on the assessed value of the item. The other elements are compounded, meaning that the assessed value plus the duty amount calculation form the basis for the other amounts. Because assessed value plus the calculated duty are the basis amount, ACD and SAD must be calculated in that order, respectively. |

Tax Amount |

Displays the basis amount multiplied by the tax rate percentage. Enter a tax amount to override the amount displayed. When you tab out of this field, the system recalculates the amounts in the Recovery Amount and the Non Recovery Amount fields. |

Rcvry Percent (recovery percent) |

Displays the recoverable tax percentage defined on the Tax Calculation Code page. |

Recovery Amount |

Displays the amount which can be reclaimed. Tax amount multiplied by the recovery percentage. |

Non Recovery Amount |

Displays the amount which cannot be reclaimed and is generally included in the total cost of the item. The difference between the tax amount and the recovery amount. |

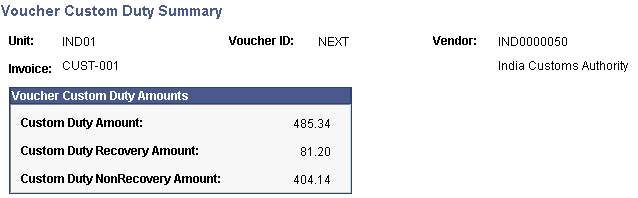

Use the Voucher Custom Duty Summary page (VCHR_CSD_SEC) to display the custom duty amounts.

Navigation:

Click the Custom Duty Summary icon on the Invoice Information page.

This example illustrates the fields and controls on the Voucher Custom Duty Summary page.

You can view the customs duty recovery and nonrecovery amounts at the voucher level.