Managing Voucher Line Tax Information with Taxware and Vertex

This section provides an overview of voucher unposting when using Taxware and Vertex.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AP_SUT_SUMM_PG |

Review the sales and use tax information for all the voucher lines, and if applicable, modify tax information. |

|

|

VCHR_LINE_TAX |

Review and, if applicable, override tax settings for the voucher line. |

|

|

VCHR_LINE_TXGEO |

Define a new tax location for vouchers (Taxware or Vertex users only). |

Unposting a voucher does not activate Taxware and Vertex to recalculate any edited amounts. This means if you are using Taxware or Vertex and need to change the tax parameters on the Invoice Line Tax Information page when unposting vouchers, first enter a reversal voucher to reverse all the accounting entries, then enter a new voucher with the changed tax parameters. This applies if you are reversing single vouchers, or multiple vouchers using the Voucher Mass Maintenance component (VCHR_MASS_MAINT).

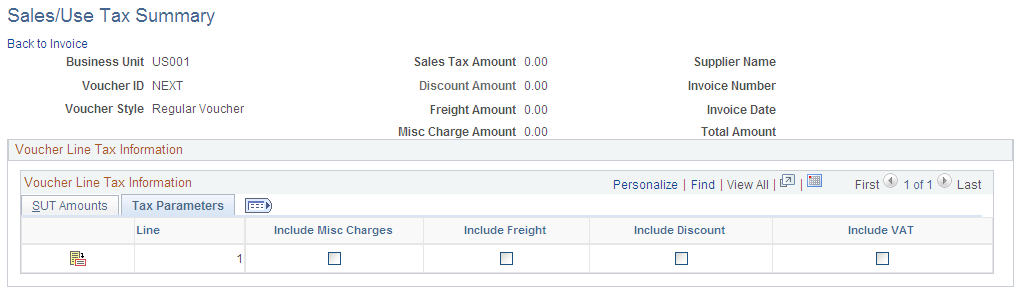

Use the Sales/Use Tax Summary page (AP_SUT_SUMM_PG) to review the sales and use tax information for all the voucher lines, and if applicable, modify tax information.

Navigation:

Click the Sales/Use Tax Summary link on the Invoice Information page.

This example illustrates the fields and controls on the Sales/Use Tax Summary page with Taxware. You can find definitions for the fields and controls later on this page.

Note: Only fields specific to Taxware and Vertex are discussed in this section. Other voucher fields are discussed in detail in "Entering and Processing Vouchers Online: General Voucher Entry Information."

Voucher Line Tax Information

Field or Control |

Description |

|---|---|

|

Click to access the Invoice Line Tax Information page to review detail tax information for this voucher line. |

Override Tax Location |

Click to access the GeoCodes and Addresses page, where you can define a new Taxware or Vertex tax location. |

Tax Destination |

Indicates the location for which a sales or use tax is applicable. This value is defined as a ship to location, but it does not have to be the same as the ship to location defined in the PeopleSoft Payables control hierarchy. |

Fields displayed when you select the More Information tab are discussed in detail in the following section.

Tax Details

These fields are display-only and represent information returned by Taxware or Vertex. These fields display the amounts that are due to each tax agency for each voucher line.

Note: For a single voucher line, up to four tax code types can be displayed: County, State, City, and District.

Use the Invoice Line Tax Information page (VCHR_LINE_TAX) to review and, if applicable, override tax settings for the voucher line.

Navigation:

Click the Sales/Use Tax link in the Invoice Lines group box on the Invoice Information page.

This example illustrates the fields and controls on the Invoice Line Tax Information page with Taxware. You can find definitions for the fields and controls later on this page.

The fields on this page display values that are passed to the voucher line through the PeopleSoft Payables default hierarchy. If the voucher was created by copying a purchase order, purchase order values override the PeopleSoft Payables default hierarchy, so the voucher inherits sales and uses tax data from the purchase order. However, the third-party tax application provides the tax rates used in the calculation. When you create a new voucher, all of the fields on this page can be overridden for the voucher line.

Note: Only fields specific to Taxware and Vertex are discussed in this section. Other voucher fields are discussed in detail in "Entering and Processing Vouchers Online: General Voucher Entry Information."

Fields Appearing For Third-Party Tax Applications Only

Additional fields appear on this page if you have installed and enabled a third-party tax application, like Taxware or Vertex.

Sales and Use Tax

Field or Control |

Description |

|---|---|

Title Passage |

Select Buyer Dest (buyer destination), Consignee, or Sell Origin (seller origin). These applications use this information to apply the appropriate tax calculation algorithms. |

Category |

Select a category that applies to the voucher line. This system populates this field by default from the purchase order. |

SUT Product Code, Tax User Area, Job Number, and SUT Freight Code |

Displays information that is copied from the purchase order if the voucher is created by copying a purchase order. These fields are information-only and appear on the third-party tax application register. |

Override Tax Location |

Click to access the GeoCodes and Addresses page, where you can define a new Taxware or Vertex tax location. You can enter an address for any one or all four addresses to determine the applicable tax; point of order, order acceptance (Taxware only), ship to, and ship from addresses. Note: If you enter a one-time address in PeopleSoft Purchasing, that address populates this field. |

Tax Details

These are display-only fields. After you return to the Invoice Information page and save the voucher, access the Voucher Line Tax Information page again. These fields will now display the amounts that are due to each tax agency for the voucher line.

Use the GeoCodes and Addresses page (VCHR_LINE_TXGEO) to define a new tax location for vouchers (Taxware or Vertex users only).

Navigation:

Click the Override Tax Location link on the Invoice Line Tax Information page

This page is used only by Taxware or Vertex, and the fields vary depending on which application you selected on the Installation Options - Overall page.

Field or Control |

Description |

|---|---|

Location Type |

Enter a location address option. For Taxware, the options are Order Acpt (order accepted), POO (point of order origin), Ship From, Ship To, Service Performed For Vertex, the options are Order Acpt (order accepted), Ship From, Ship To, Service Performed The system populates the Ship From geocode by default from the supplier. The system populates the Order Acpt and POO fields from the Ship From field unless you entered a one-time address on the PO or the voucher specifically for order accept or point of order origin. |

GeoCode |

Displays a value that is used by third-part tax applications to link a location to the tax calculation algorithms. If you did not select a geocode, this field displays a Lookup link. Clicking the geocode value or Lookup link accesses the Tax GeoCode Selection page, where you select a geocode value for the location. |