Understanding Pay Cycle Processing

The Pay Cycle process is a flexible tool. You can review payments after specific processing steps—such as after payment selection and before payment creation—and correct exceptions before proceeding to the next step. Or you can run the Payment Selection and Payment Creation processes together if you do not need to review the payments after selection. If you have a large payment run and only a very small percentage of exceptions, you do not have to delay payment processing—you can continue the current pay cycle, resolve exceptions, and then process the payments in a different pay cycle run.

The centerpiece of payment processing in PeopleSoft Payables is the Pay Cycle Application Engine process (AP_APY2015), which creates the payments. Various output processes then transform these payments to flat files that are sent to the financial institution for settlements.

Pay Cycle is also integrated with PeopleSoft Financial Gateway processing. PeopleSoft Financial Gateway handles electronic settlements between PeopleSoft Payables and financial institutions, formatting payments, and sending acknowledgement messages between the systems.

Setup for pay cycle processing comes in two stages:

Optionally, you tailor your Pay Cycle processing to your needs by defining processing steps that you can administer separately.

Although the delivered steps satisfy most users' needs, you can also configure and add your own user-defined steps to the Pay Cycle process.

You create reusable sets of payment selection criteria, called pay cycles.

Note: If you want the Pay Cycle process to process payment information from sources other than PeopleSoft Payables, you perform an additional setup step: configuring the PeopleSoft Payables payment interface to accept those outside payment sources.

If you want the Pay Cycle process to replace bank accounts automatically for payments that meet certain selection criteria, you must define bank replacement rules.

Positive Payment is not supported by the Pay Cycle Job process.

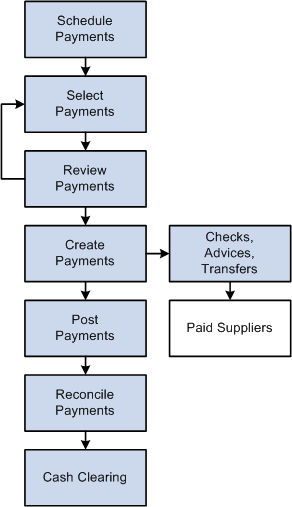

To understand how to set up the Pay Cycle process to meet your organization's needs, you should see how the Pay Cycle process fits in the larger PeopleSoft Payables payment process flow.

Payment Process Steps

To give you maximum control over which vouchers to pay and when, the payment process has several steps.

Scheduling payments.

You can configure the system to automatically select scheduled payments, or you can manually select them any time. You provide necessary information, such as supplier payment terms, due dates, and business calendar, as part of the control hierarchy or at voucher entry. If the voucher is to be paid in one payment, the system automatically schedules the payment. If you decide to pay the voucher in multiple payments, you can apply split payment terms to the voucher, and the system automatically creates multiple payment schedules. You can also schedule the payments manually using the Payments page.

Selecting payments.

You create, run, and update pay cycles that select vouchers for payment. Pay cycles are payment selection templates that store the criteria that the system uses to select vouchers for payment. These are some of the criteria:

Pay through date.

Supplier pay group.

Business unit.

Bank account.

Payment method.

Netting options.

Draft options.

If you want to schedule a pay cycle to run automatically, use the Payment Selection Criteria component (PYCYCL_DEFN) to set up the criteria and schedule the process. After you set up your standard pay cycles, you can run them repeatedly by manually or automatically updating the pay through and payment dates.

Reviewing payments.

You can review payments online on the Pay Cycle Manager page after payment selection before you create the actual checks and payment advice. During this review process, you evaluate whether any payments should be put on hold, determine how to deal with payments that require special handling, and schedule multiple payments for each invoice. You also analyze potential supplier issues by monitoring the payment statuses. PeopleSoft Payables alerts you to potential lost discounts if you leave a voucher payment schedule unpaid until the next payment run.

Creating payments.

After you define your pay cycle criteria, you run the Pay Cycle process from the Pay Cycle Manager to select eligible payments and generate the required payment records. This process enables you to flag vouchers as paid and then run the print job separately. In addition, if something does go wrong with your printer, you can elect to restart the check run at a specific number. If you are using preprinted check stock, void any numbered checks that were mangled and renumber the check run starting at the next available check. For system-numbered checks, select the Re-Print using the same reference radio button to reuse the check numbers.

Since vouchers can be combined during pay cycle processing into a single payment, the pay cycle also validates that the total payment amount does not exceed the defined Same Day ACH Amount Per Payment on the Federal Payment Schedule Restrictions page. All vouchers making up the payment will be set to an error status in pay cycle if they violate this validation.

The Pay Cycle process also checks the number of payments per schedule limitation on Payment Schedule Restrictions Page. Once the limit is reached, the pay cycle creates a new schedule. The pay cycle is then certified by the appropriate user and the payment file is created.

Posting payments.

You run the Payment Posting Application Engine process (AP_PSTPYMNT) on the Payment Posting Request page to create accounting entries based on your payments.

Reconciling payments.

Bank account reconciliation supports both manual and electronic entry of bank reconciliation data. Transactions can be automatically matched and reconciled, or you can manually match and force them to reconcile. Online inquiries and reports are available to review the results of the reconciliation process. You initiate the Bank Reconciliation Application Engine process (BNK_RECON) from the Process Reconciliation page.

Cash clearing.

Use cash clearing to track cleared and uncleared amounts in the banking system. The more often you reconcile payment information from your bank, the more accurate your cash account balances are. To use this feature, define a cash clearing account and a cash account for each bank account. Payment posting creates accounting entries that credit the cash clearing account. You run the Cash Clearing Application Engine process (AP_APCSHCLR) from the Cash Clearing Request page.